The market sentiment couldn't be contained the day after returning to work, making this task harder to write. The U.S. stock market was performing well before and during the opening, but $BTC was on a downward trend. This isn't just about poor liquidity; any minor disturbance in the market tends to first reflect in the cryptocurrency realm. The first event today was the rising risk of war between the U.S. and Iran, causing U.S. oil prices to surge by over 4%.

And that's not all; there are also the Federal Reserve's meeting minutes coming out in the early morning. To be honest, I think saying anything now is almost pointless; the key battle will still take place after June. However, the market will react to this report, which states that the U.S. economic outlook is better than predicted in the last meeting, showing signs of stability in the labor market, although consumer price inflation remains high.

The result was that apart from Miran and Waller, who advocated for a 25 basis point rate cut, the other ten members decided to hold steady. Given the current situation, if Trump wants to have control over the Federal Reserve after Powell's departure, he will need to fight for more positions on the board. However, it is evident from the meeting minutes that the board members agreed that if inflation continues to decline, then the Federal Reserve could continue to lower interest rates, but this process may not be quick.

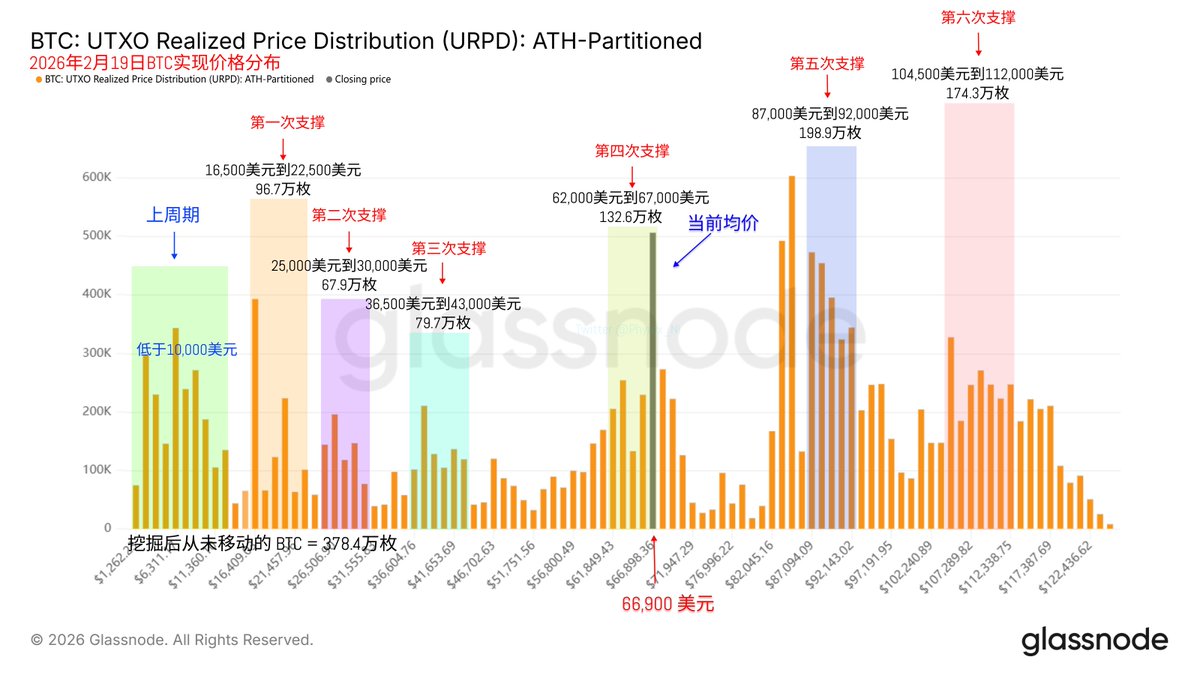

Looking back at Bitcoin's data, as the Asian holidays gradually come to an end, trading volume and turnover rate begin to increase, making it even harder to control price suppression, especially when negative market sentiment arises, which amplifies the decline. The cryptocurrency market is indeed feeling the pressure now.

Today, Coinbase's CEO Brian stated that the recent drop in $BTC is more driven by psychological factors rather than fundamentals. Brian indicated that this drop is likely temporary and pointed out that Coinbase is repurchasing shares and buying more Bitcoin at lower prices.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。