The same "explosive" non-farm employment report is seen by traders as definitive evidence for delaying interest rate cuts, but from Trump's perspective, it is a rallying cry of "America is strong, so interest rates must be at their lowest." Meanwhile, the Federal Reserve, caught in the middle, is performing a solitary opposition act from a soon-to-be-departing board member against colleagues.

On February 11, Washington time, the data for January showing an addition of 130,000 non-farm jobs and an unemployment rate dropping to 4.3% was released. Logically, an overheating economy should extinguish expectations for interest rate cuts. But the White House concluded the exact opposite: Because the data is good, interest rate cuts should accelerate.

This is not a divergence in economics; it is a reflection of the misalignment between power cycles and policy cycles. And across the ocean, in front of trading screens, Bitcoin provided a deeply meaningful reaction—first crashing, then rallying, completing a full bull-bear trap within 24 hours.

1. The "Two Faces" of Non-Farm: Traders See Hawks, White House Sees Doves

Looking at the headline number for January non-farm jobs, the 130,000 certainly exceeded expectations of 55,000. But when dissected, this report is not pristine:

● First, there is a serious structural imbalance. Healthcare and social assistance contributed 122,000 jobs, nearly encompassing all the gains; Federal government employees saw a net decrease of 34,000, as Trump's delayed resignation plan began to be factored into the statistics. The real demand for private sector employment is far from as robust as the headline suggests.

● Second, annual revisions have been selectively ignored. Employment for the entire year of 2025 was significantly revised down by 862,000, shrinking from 584,000 to 181,000—this implies that hiring was almost nonexistent last year. The January rebound resembles a gentle bounce from the bottom rather than a takeoff.

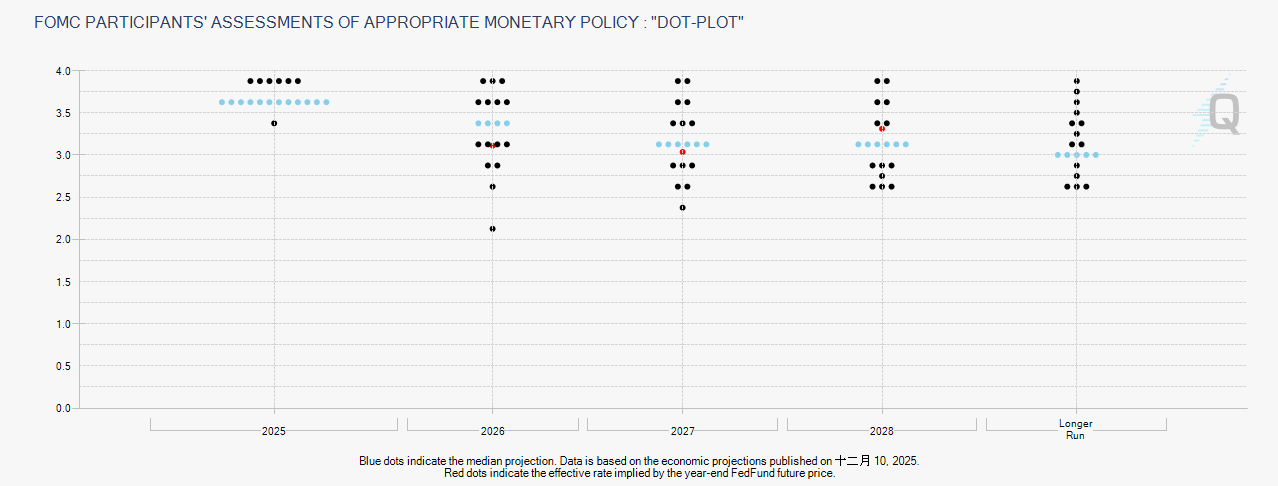

● Yet the market does not care about these details. CME FedWatch shows the probability of no change in March skyrocketing from 79.9% to 94.1%, and the probability of no interest rate cut in June jumping from 24.8% to 41.1%. Bets on Polymarket are even more extreme, with traders nearly erasing hopes for a June rate cut.

Strangely, the White House completely rejects this narrative.

● Trump's statement on Truth Social is quite intriguing. He did not mention "inflation is controllable," nor did he criticize Powell as usual; instead, he framed interest rate cuts as a privilege of a strong nation—"We are number one in the world, so we should be paying the lowest interest rates."

● This is a de-technicalized narrative. It simplifies the complex decision-making process for interest rates into "a strong country is qualified for low costs," bypassing the Federal Reserve's independence and the stubborn inflation in the service sector.

● But what truly caught the market's attention was the soon-to-be-departing Federal Reserve board member—Stephen Miran.

2. Miran's "Last Stand": A Rare Logic from Supply-Side Doves

Stephen Miran is a unique figure.

● Since joining the Federal Reserve Board in September 2025, he has consistently voted against all policy motions—not against interest rate cuts, but because he feels they are happening too slowly and too conservatively. During the January FOMC meeting, colleagues unanimously agreed to stay put, with only him and Waller (Christopher Waller) arguing for an additional 25 basis point cut.

● His term expired on January 31. According to the rules, he can stay until his successor is confirmed, but everyone knows that Trump nominated Kevin Warsh to take his seat.

But Miran did not remain silent.

In response to the question "Why cut rates when the non-farm data is so strong," his reply comes in three layers, each challenging the Federal Reserve's traditional framework:

● First Layer: Strong employment does not equal the need to brake. Miran believes that the U.S. economy still has the potential to absorb about 1 million new jobs without triggering inflation. The current labor market is not "overheated," but rather "just pulled back from the cliff." At this point, cutting interest rates is not adding fuel to the fire, but providing a safety net for the economy to prevent policy lag effects from causing unexpected contractions.

● Second Layer: Supply-side reforms are rewriting the lower limit of interest rates. This is the core and most controversial part of Miran's logic. He believes that the deregulation, early retirement plans, and reduction of government employees (which has decreased by 360,000) promoted by the Trump administration are enhancing total factor productivity. If production can run faster, the demand-side interest rates should not lag behind. In other words, the same economic growth rate now requires a lower nominal interest rate than in the past.

● Third Layer: Housing inflation will decrease, tariffs are not so scary. Miran's estimate of inflation is significantly more optimistic than his colleagues. He assesses the current core inflation rate to be around 2.3%, entering the error range of the 2% target, with the lagged effect of housing components about to be released. As for tariffs, he considers them to be "relatively weak" factors and sees no signs of widespread pass-through effects.

This "supply creates room for interest rate cuts" logic is an absolute minority within the Federal Reserve. Most decision-makers are unwilling to bet short-term policies on long-term productivity—what if productivity does not materialize and inflation returns first, how will it end?

However, what makes Miran's statements important is not because he can change the decisions in January or March, but because he represents a new narrative that the White House is trying to plant into the Federal Reserve. After Warsh takes over, this logic could transform from "individual dissent" to "the chair's tone."

3. The Market's Pricing "Split Personality": How Much Time is Left for the June Window?

Traders are honest; they do not follow political slogans.

● After the non-farm report was released, short-term interest rate futures faced selling pressure. The pricing for a June rate cut degraded from "nailed down" to "fifty-fifty," with the probability of action before April dropping below 20%. Research reports from JPMorgan and Wells Fargo shared a rare consensus: this data shrinks the likelihood of a rate cut in the first half of the year.

● However, the market's "hawkish pricing" is not absolute. The yield on 10-year U.S. Treasury bonds only rose by 2.77 basis points, closing at 4.17%. This modest increase indicates that no one is betting on the restart of the rate hike cycle. While the three major U.S. stock indices closed lower, the declines were all within 0.2%, with the S&P 500 nearly flat.

● This reflects a pricing posture of "late to cut but not absent." No one believes the Federal Reserve will shift to tightening; they are simply betting on whether the first cut will be in June or July, and whether there will be two cuts or one for the entire year. While the macro landscape appears somewhat muted, the crypto market provides a distinctly different intensity.

4. The Crypto Market's "Preempt Your Prediction": Bouncing Back from the Crash

● On the evening of February 11, within an hour of the non-farm data release, Bitcoin fell below $66,000, with a drop of over 5% at one point within 24 hours. This downward movement aligned with the trajectory of the U.S. stock market after opening, but the magnitude far exceeded the Nasdaq's 0.16%. Assets with lower liquidity are more sensitive to interest rate expectations—this rule still holds true.

● After midnight on the 12th in the East Eight Time Zone, Bitcoin rebounded sharply from a low of $65,984 and quickly surpassed $67,000, recovering more than half of the intraday drop. By the close in the early hours, it was reported at $67,035, up over $1,000 from the lowest point.

● This "first crash, then deep V" pattern is a classic entry of speculative buyers. Some are betting that the market over-interpreted the non-farm data, gambling that traders will reprice upon calm.

● Fairly speaking, this non-farm data is indeed insufficient to support a prolonged high level of real dollar interest rates. An unemployment rate of 4.3% remains historically low, but the total number of jobs is more than three million short of pre-pandemic levels, and the recovery of the labor participation rate is extremely slow. If we exclude the one-time shock from government cutbacks due to deregulation, the endogenous momentum is not strong.

● The crypto market has never followed macro data but has instead anticipated "the market's prediction of macro data." The crash reflects obedience to immediate emotions, while the rebound represents pricing for the Federal Reserve's forced shift to dovishness in the second half of the year.

5. Positions and Terms: The Hidden Variables Determining the 2026 Interest Rate Path

● You cannot avoid one person: Kevin Warsh. Trump has clearly nominated Warsh to replace Miran on the board and plans to formally appoint Warsh after Chairman Powell's term ends in May. The market characterizes Warsh as "hawkish"—he was known for his anti-inflation stance during his previous tenure at the Federal Reserve.

● However, a closer examination reveals that the macro environment surrounding Warsh has changed drastically. In 2018, he faced a period of tax increases and excess capacity; by 2026, he will face a period of deregulation and productivity pulses. He has acknowledged in private remarks that productivity increases may alter estimates of the long-term neutral interest rate.

● Warsh's real dilemma is not whether he should be left or right, but whether to adopt Miran's "supply-side interest rate cut logic." If he does not adopt it, it conflicts with the White House's expectations; if he fully embraces it, it means a significant shift in the Federal Reserve's policy framework.

● There is also a more subtle institutional issue: Powell's seat on the Federal Reserve Board does not expire until January 2028. If Powell retains his board member status after resigning as chairman in May, the Federal Reserve will face a rare situation of "a former chairman and a new chairman" coexisting. This is extremely rare in the Federal Reserve's century-long history.

● Miran's remark in an interview, "I am happy to stay, but it is not up to me," subtly expresses the uncertainty of this personnel transition. Even if he wants to stay and continue fighting for the doves, the physical vacancy of the seat does not depend on individual will.

When economic data does not support interest rate cuts but policymakers are determined to cut rates, who should the market listen to? The answer for the past fifteen years has been "listen to the Federal Reserve." But this year, the White House is attempting to change that answer.

Trump's policy pace in his second term is clearly accelerating. Deregulation, spending cuts, and capacity expansion— the quicker these supply-side measures are implemented, the more the Federal Reserve's rationale for maintaining high rates is eroded. Even if inflation remains persistent, real interest rates are already too high.

Bitcoin's rapid retracement after the crash is a tentative acknowledgment by risk assets of this logic. It may not be correct, but it reflects the urgency of capital seeking avenues.

As for Miran, this "short-lived" dove on the Federal Reserve has completed his last few solitary opposing votes as his term counts down. His policy suggestions did not win over colleagues, but his framework of thought is winning over the White House. May in Washington will be the true moment of reckoning.

Join our community, let's discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。