Author: Trading Strategy

Compiled by: Tim, PANews

Stream xUSD is a "tokenized hedge fund" disguised as a DeFi stablecoin, claiming to operate using a delta-neutral strategy. Currently, this project has fallen into a state of insolvency. Over the past five years, several projects have followed this model, attempting to drive the development of their tokens through profits generated from delta-neutral investments. Successful cases include: MakerDAO, Frax, Ohm, Aave, Ethena.

Unlike many purer DeFi competitors, Stream lacks transparency in its strategies and holdings. The portfolio tracking platform DeBank shows that only $150 million of its claimed $500 million total locked value is visible on-chain. The reality is that Stream has invested funds into off-chain trading strategies operated by proprietary traders, some of whom have faced liquidation, reportedly resulting in a $100 million loss hole.

- CCN reported

It should be noted that the $120 million hacking incident that Balancer DEX encountered this Monday is unrelated to this.

According to rumors (as Stream has not disclosed relevant information, we cannot verify), the incident allegedly involved off-chain trading strategies that "short volatility." In quantitative finance, "shorting volatility" refers to profiting by implementing specific trading strategies when market volatility decreases, remains stable, or when actual volatility is lower than the implied volatility priced into financial instruments. If the price of the underlying asset remains stable (i.e., in a low-volatility environment), options may expire worthless, allowing the seller to keep the premium as profit. However, this strategy carries significant risks, as a sudden spike in volatility can lead to massive losses, often described as "picking up coins in front of a steamroller."

- Detailed explanation of shorting volatility:

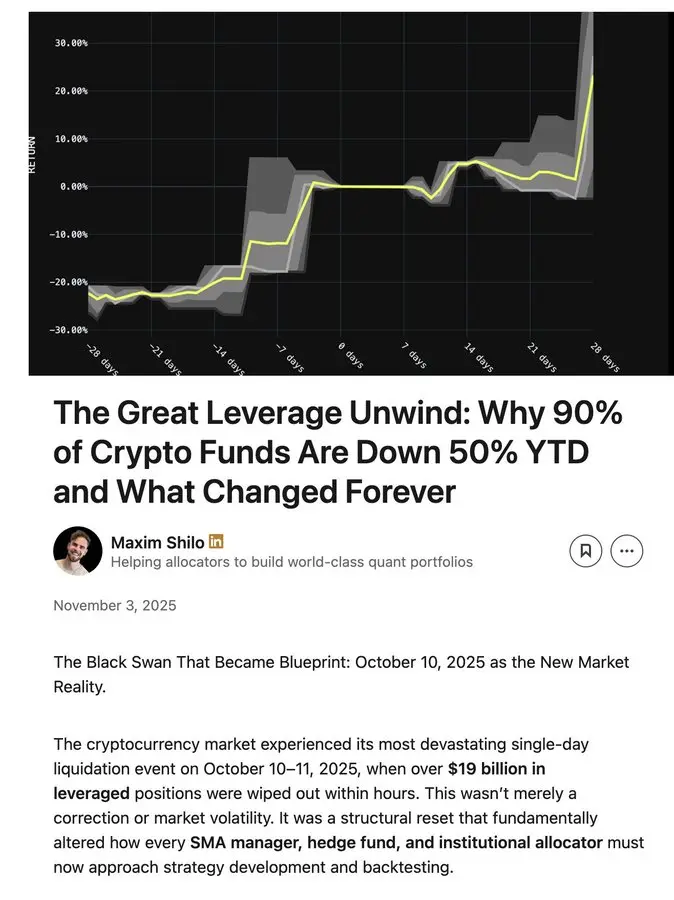

We experienced such a "volatility spike" on "Red Friday," October 10. As the market's fervor for Trump-related trends in 2025 continued to brew, the crypto market gradually accumulated systemic leverage risks. When Trump announced new tariff policies on the afternoon of October 10, all markets fell into panic, which quickly spread to the crypto market. In a panic, those who preemptively sold their liquid assets often gained the upper hand. This wave of selling ultimately triggered a chain liquidation.

Due to the long-term accumulation of leverage risks, systemic leverage had reached a high level, and the perpetual futures market lacked sufficient market depth to smoothly unwind and liquidate all leveraged positions. In this situation, the automatic deleveraging mechanism was activated, beginning to distribute losses to profitable traders. This further distorted an already crazed market.

- What is automatic deleveraging:

The market volatility triggered by this incident can be described as a once-in-a-decade event in the crypto market. Although not unprecedented, similar crashes occurred in the early crypto market in 2016, but due to the lack of reliable data during that period, most algorithmic traders built their strategies based on recent "stable volatility" data. Given that the market had not experienced such severe volatility for a long time, even moderately leveraged positions of about 2x were not spared and ultimately faced liquidation.

Regarding the impact of the "Red Friday" incident on algorithmic traders and the potential fundamental shift in crypto market trading patterns, Maxim Shilo has provided an in-depth analysis:

- Shilo discusses how October 10 changed algorithmic trading in the crypto market.

Now, the first victims' bodies are surfacing from the "Red Friday" incident, and Stream is one of them.

The fundamental definition of a delta-neutral fund is that it should not incur losses. If losses occur, by definition, it cannot be considered delta-neutral. Stream promised to adopt a delta-neutral strategy but secretly invested in proprietary, opaque, off-chain operational strategies. Delta-neutral strategies are not always black and white, and hindsight is always easy. Many experts may consider these strategies too risky to be regarded as truly delta-neutral, as they can backfire, and the facts have proven this to be the case.

When Stream lost principal in these failed trades, the platform found itself in a state of insolvency.

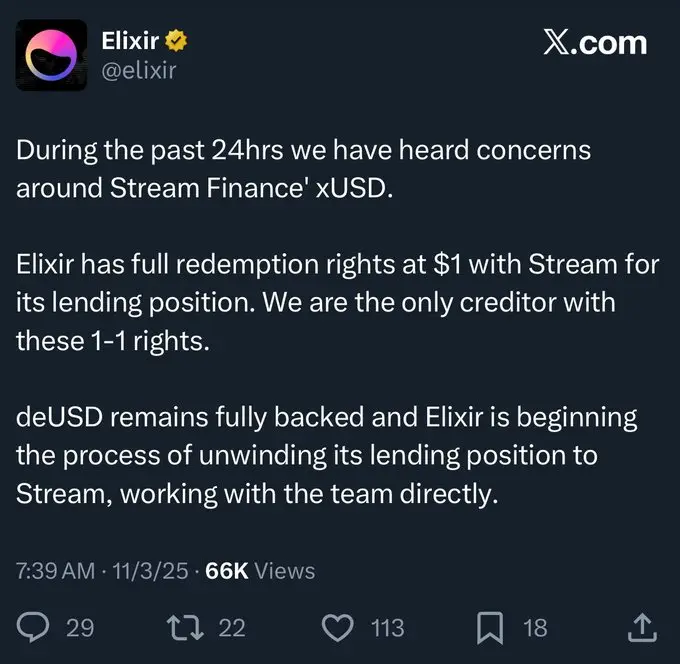

The DeFi space carries high risks, and some losses are acceptable. As long as the capital can eventually be recovered, and there is a 15% annual return, a 10% paper loss is not fatal. However, the problem is that Stream also leveraged its position to the extreme through a "recursive loop" lending strategy with another stablecoin, Elixir.

What is recursive looping?

How Stream increased leverage and its scale?

To make matters worse, Elixir, through an off-chain agreement, claims to have priority repayment rights to its principal in the event of Stream's bankruptcy. This means Elixir will recover more funds, while other DeFi investors in Stream will only recover less (or even lose everything).

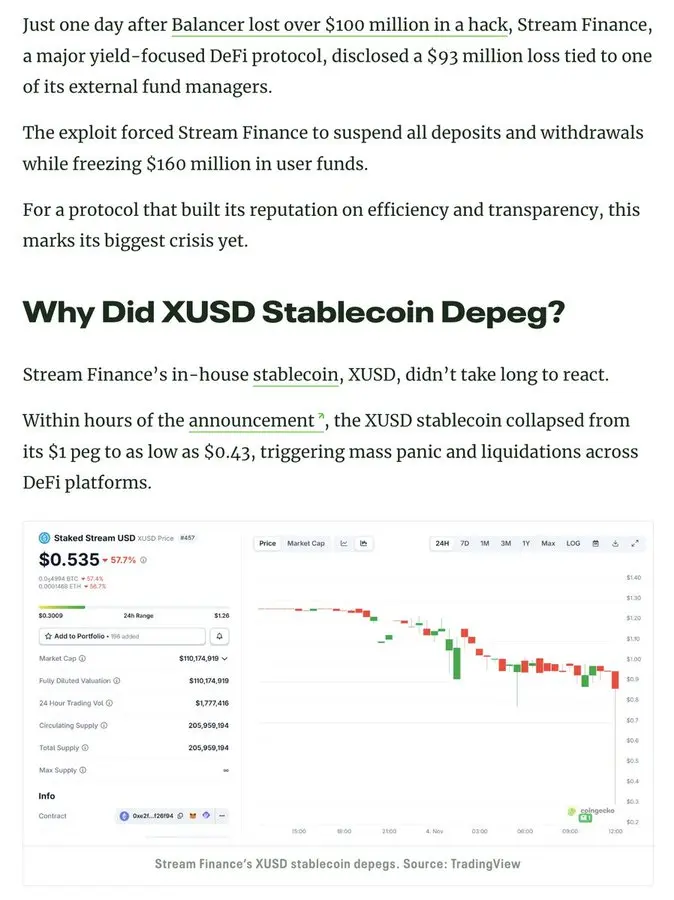

Due to the lack of transparency, the existence of recursive loops, and proprietary strategies, we cannot actually ascertain the scale of losses for Stream users. Currently, the price of Stream's xUSD stablecoin has dropped to $0.60 per unit.

As this matter was not disclosed to these DeFi users, many are now extremely outraged at Stream and Elixir: they not only suffered financial losses but also have to passively bear the burden of loss distribution to ensure that wealthy Americans with Wall Street backgrounds can preserve their profits.

This incident has also impacted lending protocols and their management:

"Everyone who thought they were taking out collateralized loans on Euler was actually participating in uncollateralized lending through proxies," said Rob from infiniFi.

Furthermore, since Stream has not disclosed its positions and profit and loss status transparently or provided on-chain data, users have begun to question whether Stream has engaged in fraudulent misappropriation of user profits by the management team in the context of this incident. Stream's xUSD stakers rely on the platform's self-reported "oracle" data to obtain returns, and third parties cannot verify whether the related calculations are accurate and fair.

How to respond?

Such incidents like Stream could have been avoided, especially in an emerging industry like DeFi. While "high risk, high reward" is an eternal rule, the key is to understand that risks are not homogeneous; some risks are indeed unnecessary. There are already several reputable liquidity mining, lending, and stablecoin (essentially tokenized hedge fund) protocols that maintain transparency in their risk exposure, investment strategies, and position statuses, which are worth the market's attention.

Stani, the founder of Aave, discusses the timing of when DeFi management and excessive risk-taking behaviors may occur, and he has released some insights regarding the recent visible risks in DeFi:

The foundation of the survival of DeFi lending lies in trust. One of the biggest misconceptions is to equate DeFi lending with AMM liquidity pools— the operational logic of the two is fundamentally different.

Only when people are confident that market mechanisms are sound, collateral assets are reliable, risk parameters are reasonable, and the overall system is stable can the lending model continue to operate.

Once this trust collapses, an on-chain bank run will unfold. This is precisely why the model that allows anyone to deploy vaults without permission and promote them on the same platform has inherent flaws. As most investment strategies have become highly homogeneous, strategy managers lack effective means to stand out, often having to push rates to the bottom line or take on higher risks to compete for capital from other pools.

One day, a significant blowup will destroy the entire market's confidence, causing the industry to regress comprehensively. The next Terra Luna-style collapse will inevitably stem from the reckless operations of some radical strategy manager on an open platform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。