Author: XinGPT

During the Spring Festival of 2026, I made a decision: to transform all of my business processes into Agents.

Today, a week later, this system has already completed nearly one-third of the process. Although the system is still being improved, my daily routine tasks have been reduced from 6 hours to just 2 hours, while business output has increased by 300%.

More importantly, I have validated a hypothesis: the transformation of personal business into Agents is feasible, and I believe everyone should build such an operating system.

Having an Agent system means a complete shift in thinking, from "How do I complete this task?" to "What kind of Agent should I build to complete this task?" The impact of this shift from passive to proactive thinking is immense.

In this article, I will not produce any AI-generated platitudes, nor will I deliberately create anxiety about AI replacement. Instead, I will thoroughly dissect how I accomplished this transformation step by step, and how you can replicate this method for free.

This is the first article on building an agent productivity system. Click now to bookmark it and follow future updates without getting lost.

Why Agentization is Mandatory, Not Optional

First, let's state a harsh fact:

If your business model is "exchanging time for income," then your income ceiling has been locked in by the laws of physics. There are only 24 hours in a day; even if you work year-round, the hourly billing limit is right there.

Fund manager annual salary ¥1.5 million ≈ ¥720 per hour (based on 2080 working hours)

Consulting partner annual salary ¥2 million ≈ ¥960 per hour

Top financial KOL earns ¥3 million annually ≈ ¥1440 per hour

Does it seem high? But this is already the limit of the human mode.

In contrast, the logic of Agentization is completely different: your income is no longer determined by the hours worked, but by the operational efficiency of the system.

A real turning point

On a Friday night at 11 PM in January 2026, I was still sitting in front of my computer sorting through the market data from the day.

That day the US stock market plummeted, and I needed to:

Read over 50 important news articles

Analyze the after-hours performance of 10 key companies

Update my investment strategy

Write a market interpretation article

I calculated that it would take at least another 3 hours. And the next morning at 8 AM, I would have to repeat the same process.

At that moment, I suddenly realized: my time was not being spent on investment analysis or decision-making; I was merely functioning as a data搬运工.

The real decisions requiring my judgment probably only took up 20% of my time, while the remaining 80% was repetitive information collection and organization.

This was the starting point for my decision to implement Agentization.

My investment research Agent system now automatically processes:

20,000+ global financial news articles

Updates on 50+ companies' financial reports

30+ macroeconomic data indicators

10+ industry research reports

If done manually, these tasks would require a team of 5 people. My cost is: $500 per month for API usage + 1 hour of review time daily.

This is the essence of Agentization: to replicate your judgment framework with algorithms and replace manpower costs with API costs.

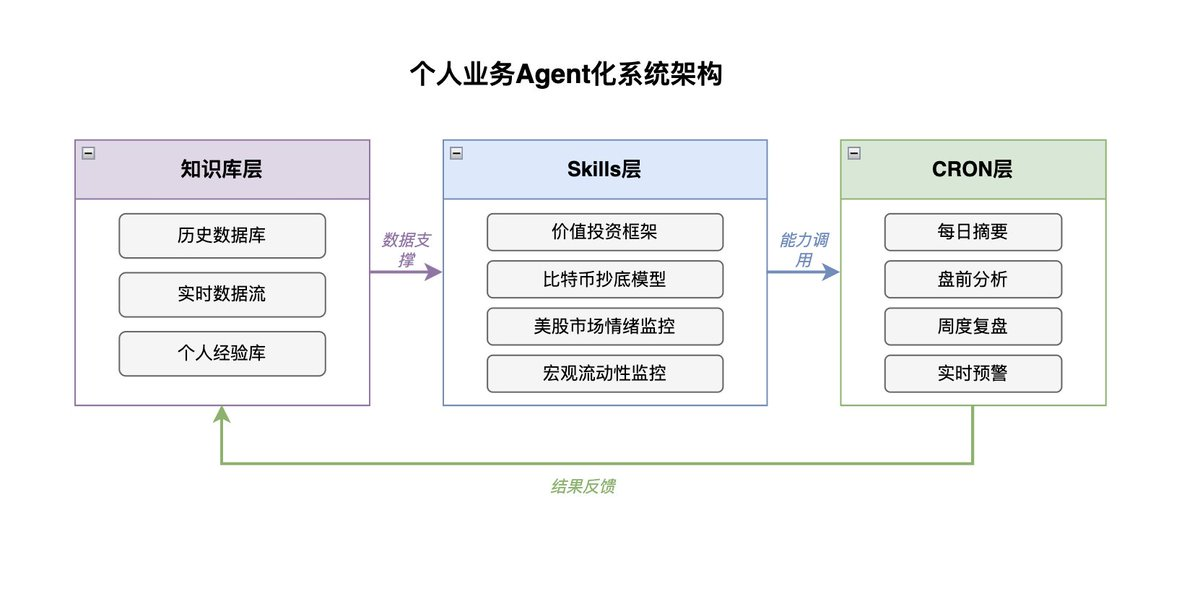

01 Deconstruct Your Business: Three-Tier Architecture from People to Systems

Any knowledge work can be deconstructed into three layers:

First Layer: Knowledge Base

This is the "memory system" of the Agent.

Taking investment research as an example, my approach was to establish a knowledge base that contains the information and data needed for my investments:

1. Historical Database

Macroeconomic data for the past 10 years (Federal Reserve, CPI, non-farm payrolls)

Financial report data for the top 50 companies on US stock markets

Notes from major market events (2008 financial crisis, 2020 pandemic, 2022 rate hike cycle)

2. Important Indicators and News

Key financial media and information channels that I follow

Federal Reserve policies and important company financial report release dates

50 Twitter accounts I follow (macro analysts, fund managers)

Important macro indicators

Key industry research and data tracking

3. Personal Experience Database

Records of my investment decisions over the past 5 years

Review of each decision's right or wrong

A specific case: The market crash in early February 2026

In early February, the market suddenly plummeted, gold and silver collapsed, cryptocurrency flooded, and US and Hong Kong stock markets dropped consecutively.

The interpretations in the market mainly included:

Anthropic's legal AI is too powerful, leading to software stocks collapsing

Google's capital expenditure guidance is too high

Incoming Federal Reserve Chair Warsh is hawkish

My Agent system issued a warning 48 hours before the crash because it detected:

Daily bond yields spiked, and the US2Y-JP2Y spread narrowed significantly

TGA account balances remain high, and the treasury is continuously withdrawing from the market

CME raised gold and silver futures margins six times in a row

These were clear signs of tightening liquidity. Moreover, my knowledge base included a complete review of the market fluctuations caused by the closing of yen arbitrage transactions in August 2022.

The Agent system automatically matched historical patterns and provided the recommendation of "tight liquidity + high valuations → reduce positions" before the crash.

This pre-warning helped me avoid at least a 30% drawdown.

This knowledge base contains over 500,000 structured data points and automatically updates 200+ entries daily. If done manually, it would require 2 full-time researchers.

Second Layer: Skills (Decision Framework)

This is the layer that is most easily overlooked but is the most critical.

Most people use AI as follows: open ChatGPT → input question → receive answer. The problem with this method is that AI does not know what your judgment criteria are.

My approach is to break down my decision-making logic into independent Skills. For instance, in investment decisions:

Skill 1: US Stock Value Investment Framework

The following Skills are for example only and do not represent my actual investment standards, which I also update in real-time:

markdown

Input: Company financial report data

Judgment Criteria:

- ROE > 15% (sustained for over 3 years)

- Debt ratio < 50%

- Free cash flow > 80% of net profit

- Moat assessment (brand/network effect/cost advantage)

Output: Investment rating (A/B/C/D) + Reason

Skill 2: Bitcoin Bottom Buying Model

markdown

Input: Bitcoin market data

Judgment Criteria:

- Candlestick technical indicators: RSI 30 and under, with weekly overselling

- Trading Volume: Shrinking volume after panic selling (below 30-day moving average)

- MVRV ratio: 1.0 (market cap below realized cap, overall holders in loss)

- Social media sentiment: Twitter/Reddit panic index > 75

- Miner shutdown price: Current price close to or below mainstream miner shutdown price (e.g., S19 Pro cost line)

- Long-term holder behavior: LTH supply ratio increases (bottom buying signal)

Trigger Conditions:

- Meet more than 4 criteria → Partial buying signal

- Meet more than 5 criteria → Heavy buying signal

Output: Bottom buying rating (strong/mid/weak) + Suggested position percentage

Skill 3: US Stock Market Sentiment Monitoring

markdown

Monitoring Indicators:

- NAAIM Exposure Index: Proportion of active investment managers' stock holdings

· Value > 80 and median hitting 100 → Institutions increasing positions warning

- Institutional stock allocation ratio: Data from large custodial institutions like State Street

· At historical extremes since 2007 → Contrarian warning signal

- Retail net buying amount: Daily retail fund flows tracked by JPMorgan

· Daily average buying amount > 85% of historical level → Overheated sentiment signal

- S&P 500 forward P/E ratio: Monitoring if approaching historical valuation peaks

· Approaching 2000 or 2021 levels → Fundamentals diverging from stock prices

- Hedge fund leverage: Crowded positions in high-leverage environments

· Leverage at historical high levels → Potential volatility amplifier

Trigger Conditions:

- More than 3 indicators warning simultaneously → Reduce positions signal

- All 5 indicators warning → Significant position reduction or hedging

Output: Sentiment rating (extreme greed/greed/neutral/panic) + Position suggestion

Skill 4: Macroeconomic Liquidity Monitoring

markdown

Monitoring Indicators:

- Net Liquidity = Federal Reserve's Total Assets - TGA - ON RRP

- SOFR (Overnight Financing Rate)

- MOVE Index (US Treasury Volatility)

- USDJPY + US2Y-JP2Y spread

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。