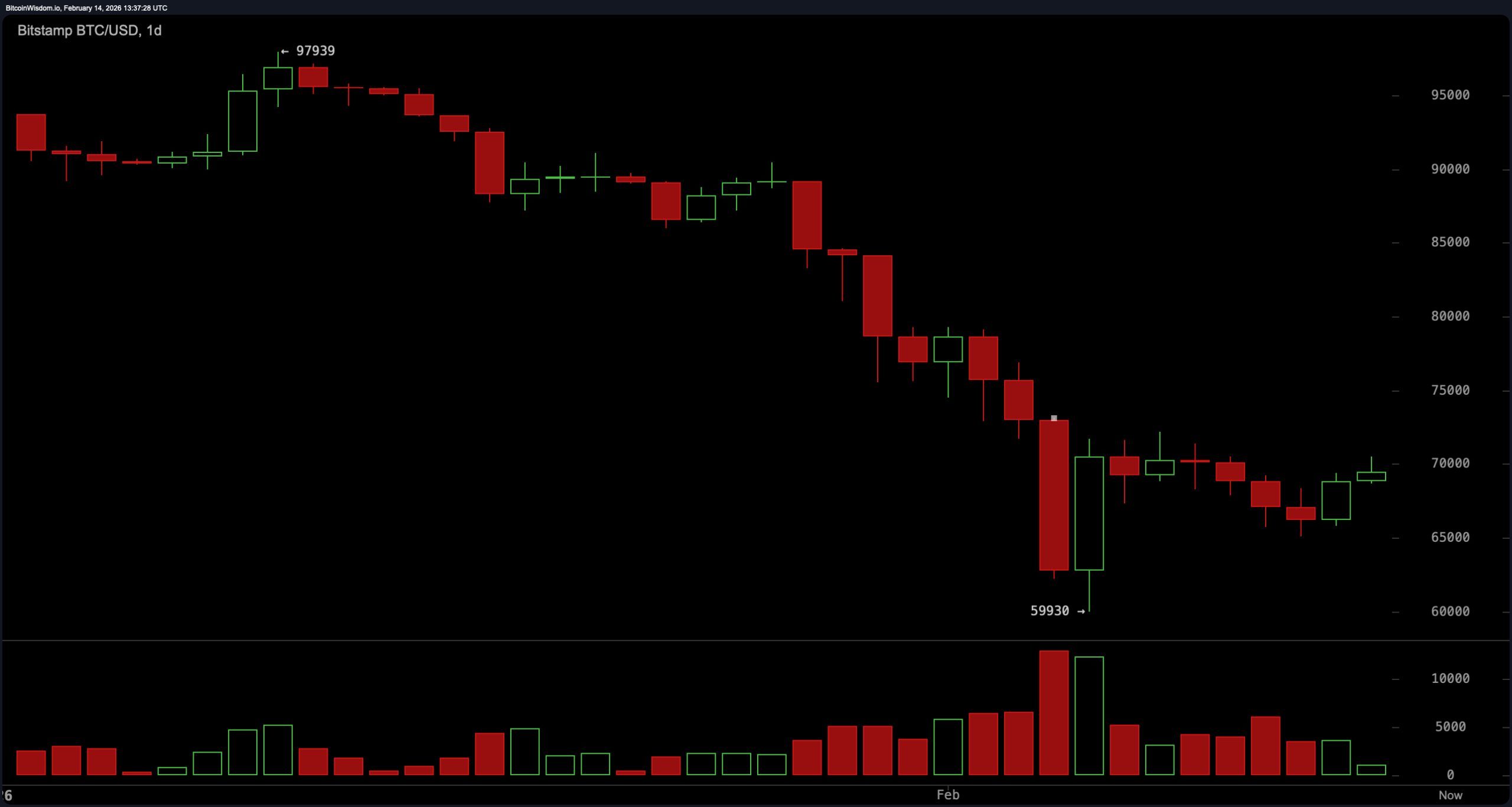

After tumbling more than 30% from the $97,900 region to the mid-$65,000s, bitcoin is attempting to stabilize — but the higher-timeframe charts continue to reflect a market digesting heavy distribution. Volatility has cooled slightly, yet structurally, the burden of proof still sits overhead.

On the daily chart, the corrective structure remains intact. The decline from $97,939 unfolded in a waterfall sequence, culminating in a decisive Feb. 12 breakdown on volume exceeding 10,000 units — roughly double the prior average — confirming distribution. Price is now hovering near $65,000, aligning with the 38.2% Fibonacci retracement level, while resistance layers are at $70,000 and $75,000. The formation resembles a descending triangle, and bitcoin continues to close beneath critical dynamic levels. Unless $72,000 is reclaimed with expanding volume, the daily timeframe bias remains tilted lower despite intermittent stabilization attempts.

BTC/USD 1-day chart via Bitstamp on Feb. 14, 2026.

The 4-hour chart reinforces this posture. Bitcoin declined approximately 9.5% from $72,174 to $65,800 before compressing into a tight $65,800-$66,500 range. Consecutive red marubozu candles and a shooting star near $69,500 preceded the acceleration lower. Volume expanded above 2,000 units during the Feb. 12-13 decline, well above the 800-1,200 unit norm, signaling capitulation. Subsequent rebounds have printed on sub-500 unit volume, suggesting a lack of sustained conviction. Support remains defined at $65,000-$65,800, while resistance stands at $67,000 and $70,000, with price still pressing against the lower boundary of a descending channel.

BTC/USD 4-hour chart via Bitstamp on Feb. 14, 2026.

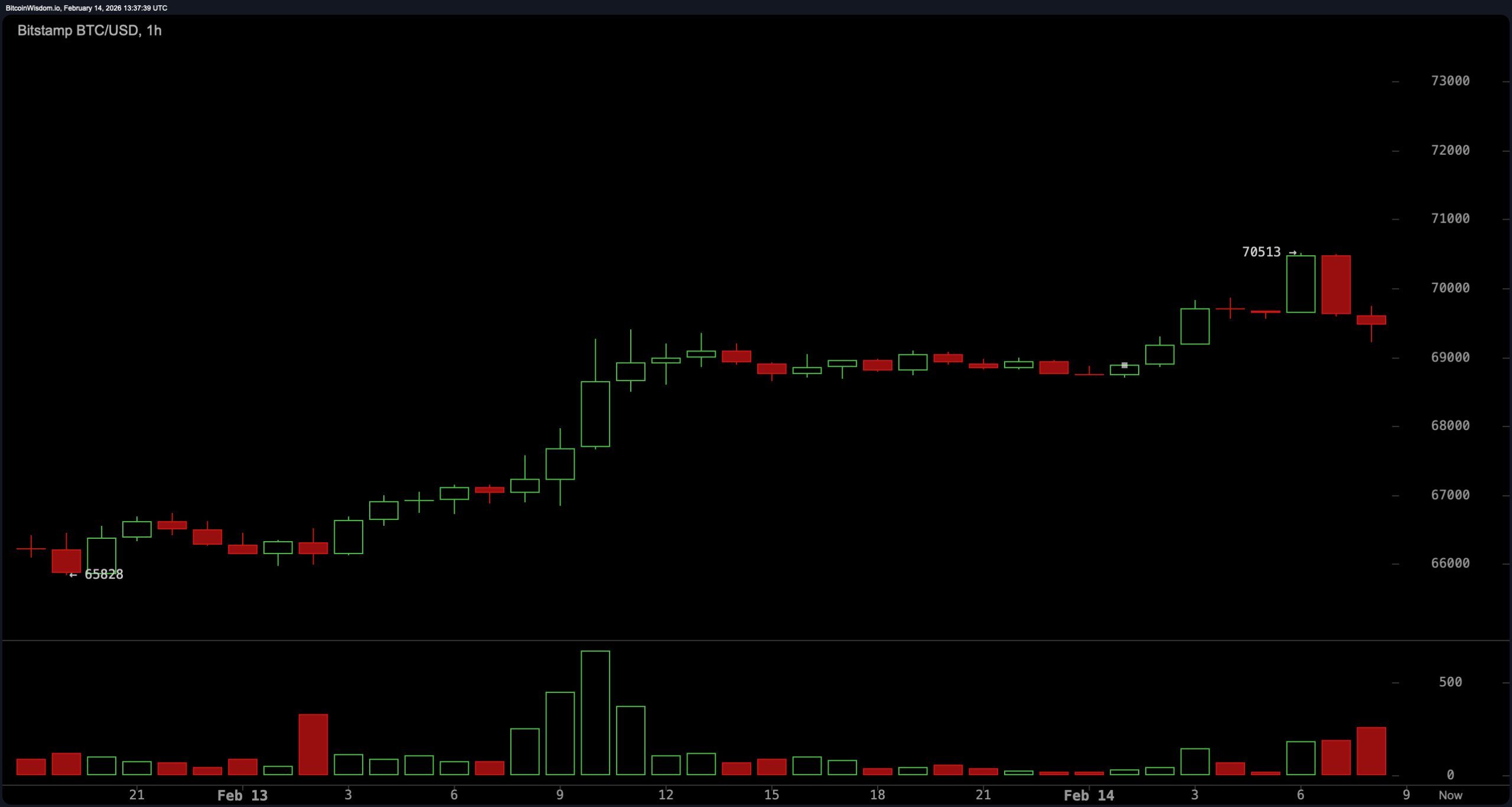

On the 1-hour timeframe, volatility has been pronounced but inconsistent. Bitcoin rebounded sharply from $65,628 to $70,513 before forming a double-top near $68,000 and rotating back toward $66,000. Upper wicks near $70,500 marked exhaustion, and late-session declines printed on diminishing volume below 100 units. Price remains beneath the daily volume-weighted average price (VWAP) near $67,500, and wedge compression signals an approaching directional expansion. Failed breakout attempts continue to reinforce resistance overhead, keeping short-term structure fragile.

BTC/USD 1-hour chart via Bitstamp on Feb. 14, 2026.

Oscillators reflect stabilization but stop short of confirming a reversal. The relative strength index ( RSI) at 37 is neutral, rebounding from oversold territory without strong upward expansion. The Stochastic at 37 mirrors this neutrality. The commodity channel index (CCI) at negative 54 indicates subdued momentum, while the average directional index (ADX) at 55 confirms the presence of a strong prevailing trend — notably to the downside.

The Awesome oscillator at negative 14,028 remains in negative territory, and the moving average convergence divergence ( MACD) level at negative 5,371 continues to reflect bearish momentum. Momentum at negative 3,555 suggests short-term upward pressure, pointing to possible relief within the broader corrective framework.

Moving averages (MAs) remain stacked in bearish alignment. The exponential moving average (EMA) and simple moving average (SMA) structures show price trading beneath nearly every major trend gauge. The EMA (10-day) sits at $70,055, while the SMA (10-day) rests at $68,326. The EMA (20) stands at $74,185, and the SMA (20) at $75,066. The EMA (30) is positioned at $77,404, and the SMA (30) at $80,348.

The EMA (50) reads $81,619, with the SMA (50) at $84,613. Longer-term markers remain elevated, including the EMA (100) at $88,191 and the SMA (100) at $88,023, followed by the EMA (200) at $94,360 and the SMA (200) at $100,806. In practical terms, bitcoin remains beneath short-, intermediate-, and long-term averages — a configuration that continues to cap rallies and reinforce structural overhead pressure.

Bull Verdict:

If $65,000-$65,800 continues to hold and price reclaims $67,000 with expanding volume, short-term momentum could build toward $70,000 and potentially challenge $72,000. Oversold recovery signals across shorter timeframes and contracting downside volume suggest that a relief rally remains technically plausible.

Bear Verdict:

As long as bitcoin trades below $70,000 and remains under the majority of key moving averages, the broader corrective trend remains dominant. A decisive break below $65,000 would expose downside risk toward $60,000, keeping the structural bias firmly in favor of continuation rather than reversal.

- What is bitcoin’s price on Feb. 14, 2026? Bitcoin is trading at $69,383 with a 24-hour range between $67,098 and $70,434.

- Is bitcoin in a bullish or bearish trend right now? Bitcoin remains in a short-term corrective trend below key resistance levels and major moving averages.

- What are the key support and resistance levels for bitcoin? Immediate support sits at $65,000-$65,800, while resistance is layered at $67,000, $70,000 and $75,000.

- What do bitcoin’s technical indicators signal? Oscillators show neutral-to- bearish momentum, with the moving average convergence divergence ( MACD) and multiple exponential moving averages indicating continued downside pressure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。