Original authors / Tiago Souza, Mario Stefanidis

Translation / Odaily Planet Daily Golem (@web3_golem)

Editor's note: On February 13, Coinbase released its fourth quarter and full year financial report for 2025.The financial report showed that while Coinbase performed strongly throughout the year, doubling its trading volume and market share, with platform assets and USDC balances hitting all-time highs, it reported a net loss of $667 million for the fourth quarter of 2025, a loss per share of $2.49, with total revenue of $1.78 billion, far short of analysts' expectations.

As a result, several Wall Street investment banks, including JPMorgan and Canaccord, haverevised down their target prices on Coinbase stocks. However, on February 14, after the US stock market closed, COIN still surged by 16.46%, showing no sign of the impact from the fourth quarter financial report falling short of expectations, which proves that the market remains optimistic about Coinbase's various business developments in 2026 in the short term.

However, analysts from Artemis believe that in investment domains, timing is crucial; while Coinbase's market prospects are promising in the long term, its current earnings are not enough to offset the risks. Coinbase still has significant cyclicality, and given the ongoing pressure on the fundamentals of its brokerage business and the lagging effects of the current market retreat, market expectations for Coinbase in 2026 remain too high. Therefore, it is not advisable to buy its stock right now.

Analysts systematically elaborate on the composition of Coinbase's business revenue, its current advantages, and the challenges it faces in the future. Odaily Planet Daily summarizes the key points as follows for investor reference.

First, the conclusion: Currently, we do not recommend investing in Coinbase

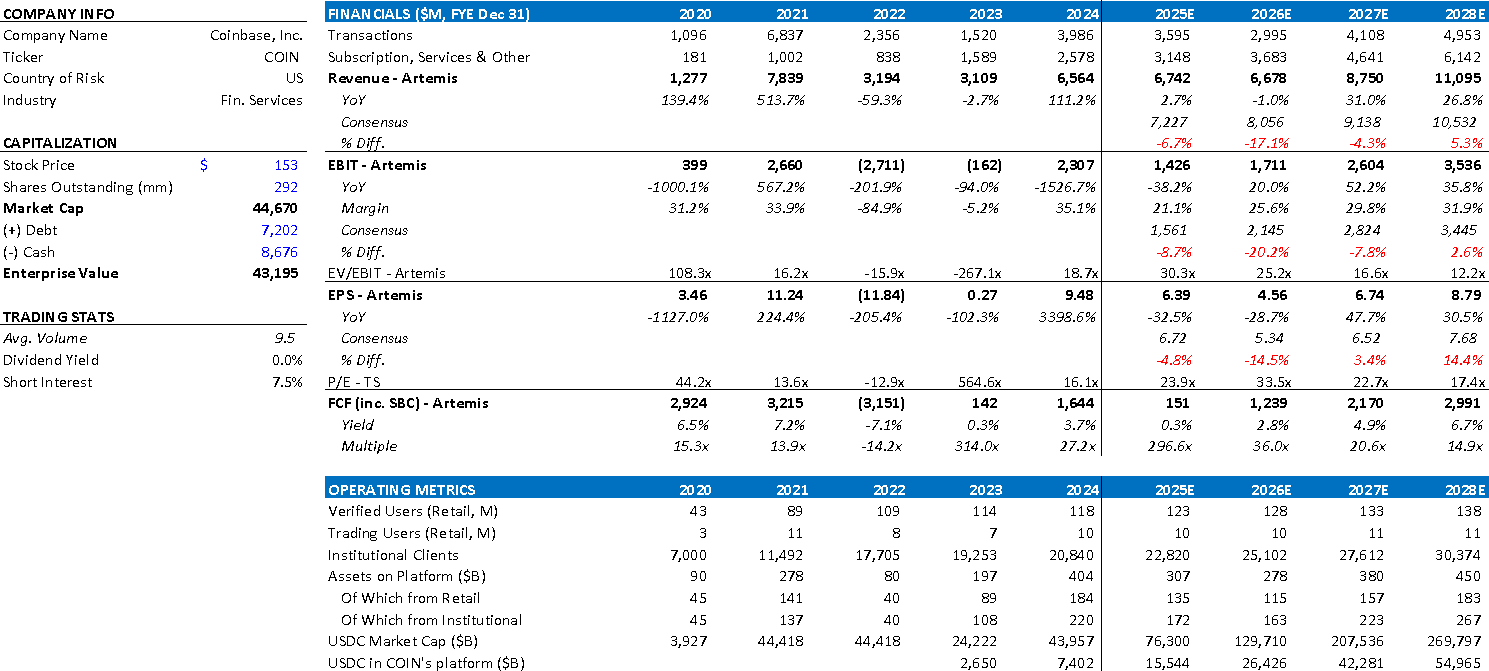

Coinbase's historical core financial data

We currently do not recommend investing in Coinbase because we believe its current earnings are insufficient to offset the risks. Although Coinbase still holds an absolute leading position in the US market, with a strong base of institutional clients, a good regulatory status, and solid domestic competitive advantages, the timing for investors to enter is crucial.

Reviewing past cryptocurrency sell-offs, downgrading profit expectations and compressing price-to-earnings ratios usually persist for a period after the initial price correction, as the decline in account asset sizes and weakened trading activities lag behind financial performance. We expect a similar situation will occur in the current cycle.

Given the ongoing pressure on Coinbase's brokerage business fundamentals and the high likelihood of underperforming profits in fiscal years 2025 and 2026, the downside risks remain significant. While Coinbase's long-term franchise value still exists, short-term volatility and profit expectations falling short lead us to conclude: In the current cycle stage, the expected returns are insufficient to offset the risks.

Overview of Coinbase's Revenue Proportions

Coinbase is a centralized cryptocurrency platform whose main revenue source is brokerage services, providing digital asset trading intermediary services for retail and institutional clients. The platform matches customer trades with liquidity providers, using public blockchains to record and settle asset ownership, and integrates with traditional banking systems for fiat deposits and withdrawals.

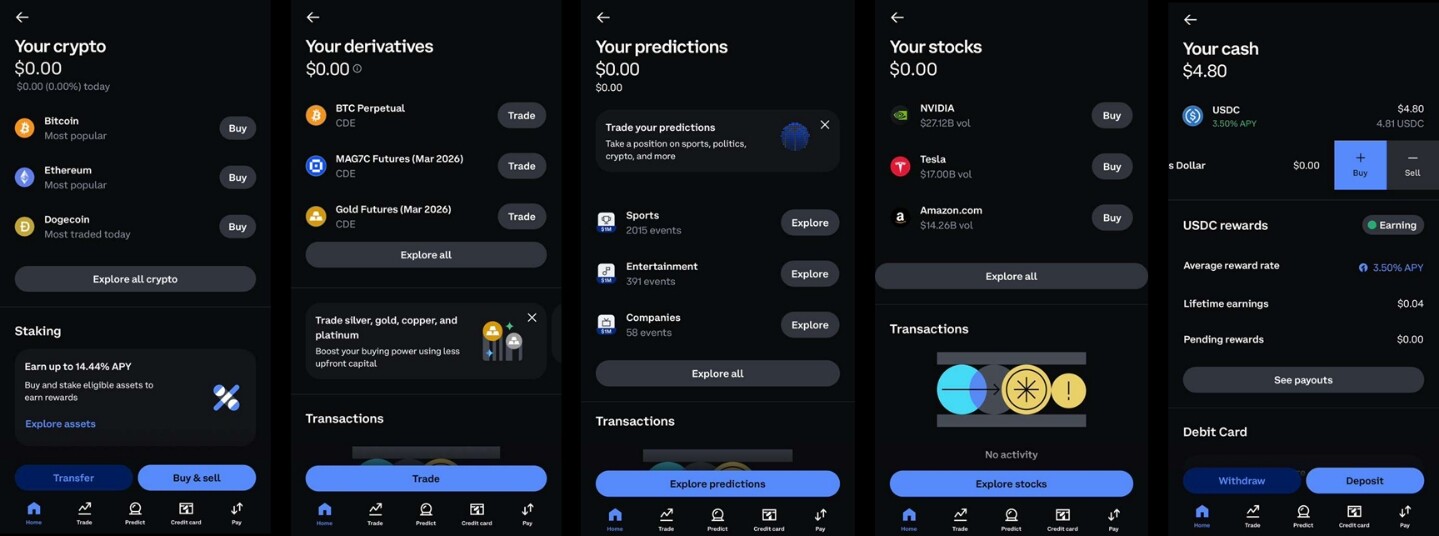

Despite intense competition and cyclical fluctuations in the trading market, Coinbase is actively expanding its range of services, going beyond a purely trading economic model towards a broader cryptocurrency financial infrastructure, and has embedded several initiatives directly into its core application. These initiatives include:

- Coinbase One, a subscription product that offers zero-fee trading and enhanced services, aimed at increasing recurring revenue and customer retention;

- Prediction markets (in collaboration with Kalshi), expanding Coinbase’s derivatives and event-driven trading capabilities;

- Tokenized stocks, allowing users to access traditional financial assets through the blockchain.

In addition to existing businesses like institutional custody and prime brokerage services, staking and on-chain yield, stablecoin distribution, and payments, Coinbase is also building applications and settlement infrastructure through its open-source, permissionless Ethereum Layer-2 network, Base.

These initiatives aim to enhance customer engagement and retention, especially at the institutional level, diversify revenue, shift towards more recurring income and infrastructure-related revenue, and transform Coinbase from a trading-oriented broker into a platform and gateway connecting traditional finance and on-chain markets.

Trading Business Revenue

56% of total revenue | Six-year compound annual growth rate of 36% | Market size: $27 billion (2024)

Trading revenue is Coinbase's core brokerage business, in which the company holds about 14% market share. Revenue comes from transaction fees and spreads charged on platform trading volume.

Trading volume is primarily driven by total platform assets, which are approximately $516 billion, with retail making up 42% and institutional clients 58%. While institutional clients contribute most of the asset growth, retail remains the main source of profitability due to their significantly higher trading spreads.

- Retail spread: approximately 154 basis points

- Institutional client spread: approximately 6 basis points

Institutional clients trade through Coinbase Prime, a suite of standalone products that offer advanced execution algorithms, smart order routing, and over-the-counter (OTC) block trading services. These clients require more complex infrastructure but generate lower earnings per dollar, highlighting the importance of retail participation to Coinbase's overall profit margin.

Subscription and Service Revenue

44% of total revenue | Six-year compound annual growth rate of 232%

This segment aggregates Coinbase's non-trading revenue sources, reflecting the company's strategic shift towards a recurring, infrastructure-driven profit model. It includes the following components:

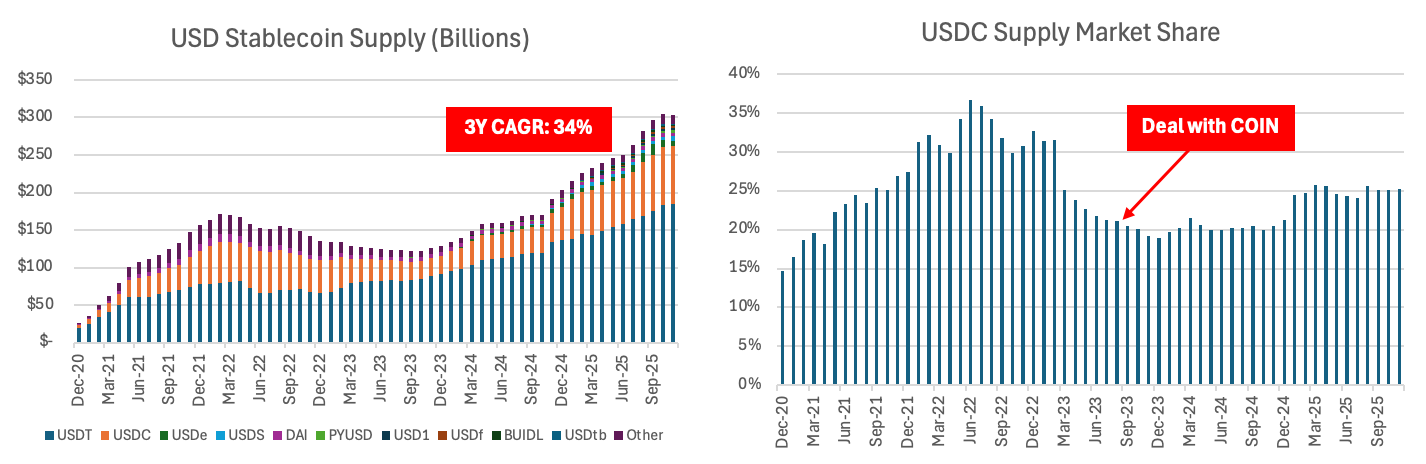

- Stablecoins (30% of revenue)

Stablecoin revenue is primarily influenced by the adoption rate of USDC and the federal funds rate. Coinbase earns interest income from USDC reserves through a revenue-sharing agreement with the issuer Circle.

Under the agreement from August 2023, Coinbase receives all interest income generated from USDC on its platform, while off-platform USDC interest income is split 50/50 between Coinbase and Circle.

This structure makes USDC Coinbase's most important non-trading revenue source, creating a scalable yet interest rate-sensitive income stream that helps reduce the company's dependence on fluctuating trading volumes (trading revenue still accounted for 86% of total revenue in 2020).

Notably, most of the economic value generated by the Circle partnership belongs to Coinbase, reflecting Coinbase's control over distribution and user access. Data shows that USDC's market share stabilized and then began to recover after a period of decline following the distribution agreement with Circle, highlighting the central role large, trustworthy platforms play in the adoption of stablecoins and strengthening the strategic value of Coinbase's distribution advantage.

- Staking services (10% of revenue)

Clients stake their cryptocurrency assets through Coinbase, and the company earns commissions from staking rewards. In proof-of-stake (PoS) networks like Ethereum and Solana, staking involves locking up assets to support network validation. Validators earn rewards akin to yield; Coinbase provides these rewards and takes a portion as fees.

The main revenue drivers for this segment include the prices of crypto assets and overall blockchain activity.

- Other services (4% of revenue)

This category includes several monetization initiatives launched post-IPO, which are currently scaling up:

- Coinbase One, a subscription service offering lower trading fees, higher rewards, and priority customer support;

- Base, Coinbase's L2 blockchain, enabling developers to build applications and services on-chain;

- Payments, including a prepaid debit card launched in collaboration with Visa, allowing customers to shop with fiat and earn cryptocurrency rewards. Transactions are settled in fiat, but the user experience is similar to native cryptocurrency payments.

Long and Short Arguments Surrounding Coinbase's Core Issues

Will Coinbase be able to significantly reduce its cyclicality, or will its stock remain a leveraged proxy for cryptocurrency prices (primarily Bitcoin)?

Historically, COIN's stock price has been highly correlated with Bitcoin and broader cryptocurrency prices, reflecting its revenues driven by spot trading volume.

- Bullish: Management's ventures into subscription, stablecoins, derivatives, custody, and Base will diversify revenues and reduce cyclicality over time.

- Bearish: Despite these initiatives, spot trading continues to dominate its economics, meaning that declines in Bitcoin and major cryptocurrency prices will affect its stock price.

Sustained weaknesses in crypto assets lead to declines in trading volumes, margins, and earnings.

Can stablecoins significantly improve the company's profitability?

- Bullish: USDC-related income is a scalable, high-margin business closely tied to on-chain payments, treasury uses, and tokenized cash, which can partially hedge trading volatility.

- Bearish: Stablecoin income is highly sensitive to interest rates, portfolio shifts, and competitive dynamics, meaning that changes in rates or custodial balances can significantly compress earnings. If stablecoin profits are proven to be cyclical rather than structural, the perceived downside protection in Coinbase's profit model may diminish.

How will regulatory changes over the next 12-24 months impact the company's profitability?

- Bullish: Clearer rules will facilitate institutional participation and position Coinbase as the most compliant platform in the US, strengthening its status as the default entry point into the cryptocurrency market.

- Bearish: Regulation may also attract traditional brokers and financial institutions to enter the cryptocurrency space, accelerating fee compression and intensifying competition, especially in the retail market. Higher legitimacy may expand trading volumes but could also come at the expense of long-term pricing power.

Centralized Exchange Crisis and Coinbase's Unique Advantages

DEX Rising in Global Trading Market

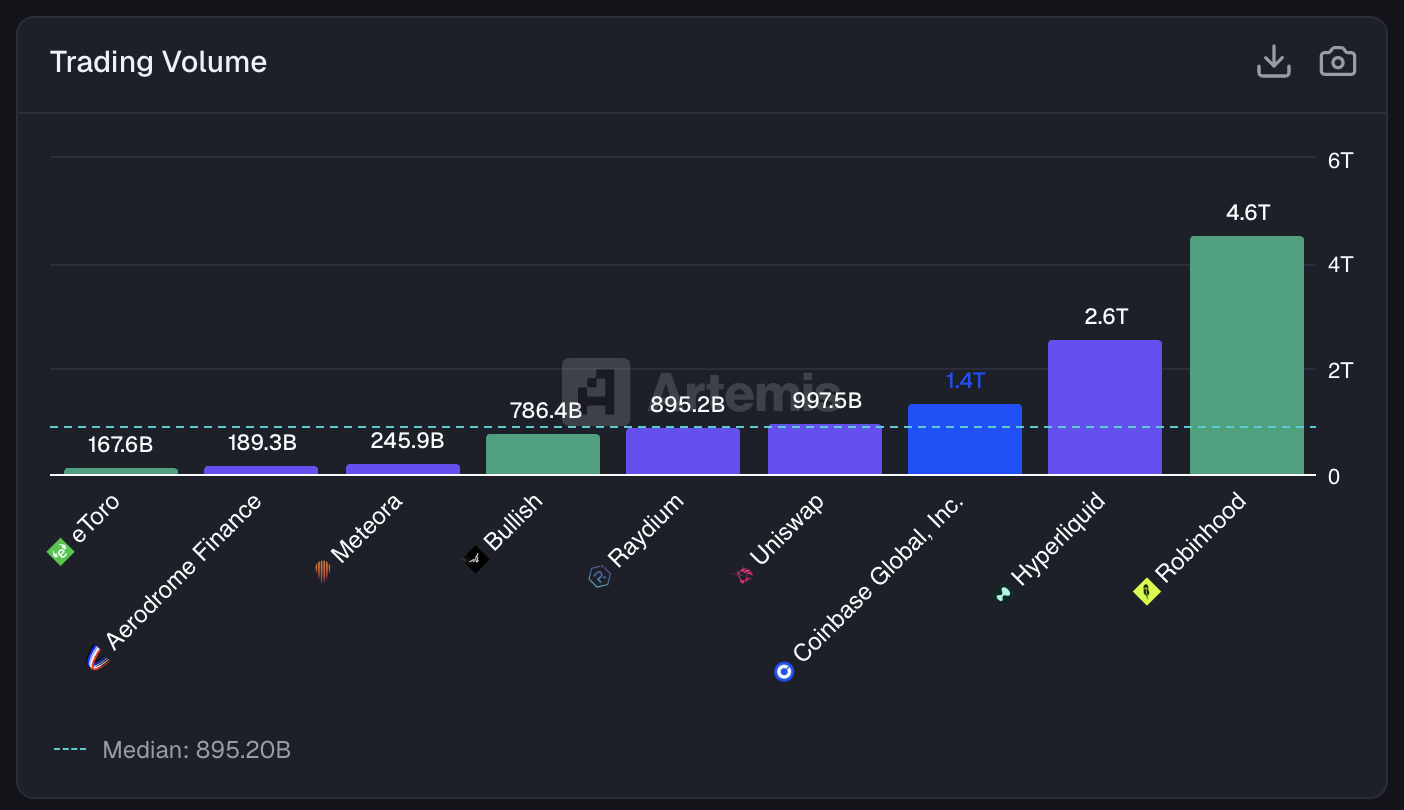

Globally, the total addressable market (TAM) for centralized exchanges (CEX) and decentralized exchanges (DEX) is the same foundational capital pool: encompassing trading activities of cryptocurrencies across spot, derivatives, and on-chain asset swaps, with nominal annual trading volumes currently reaching trillions of dollars.

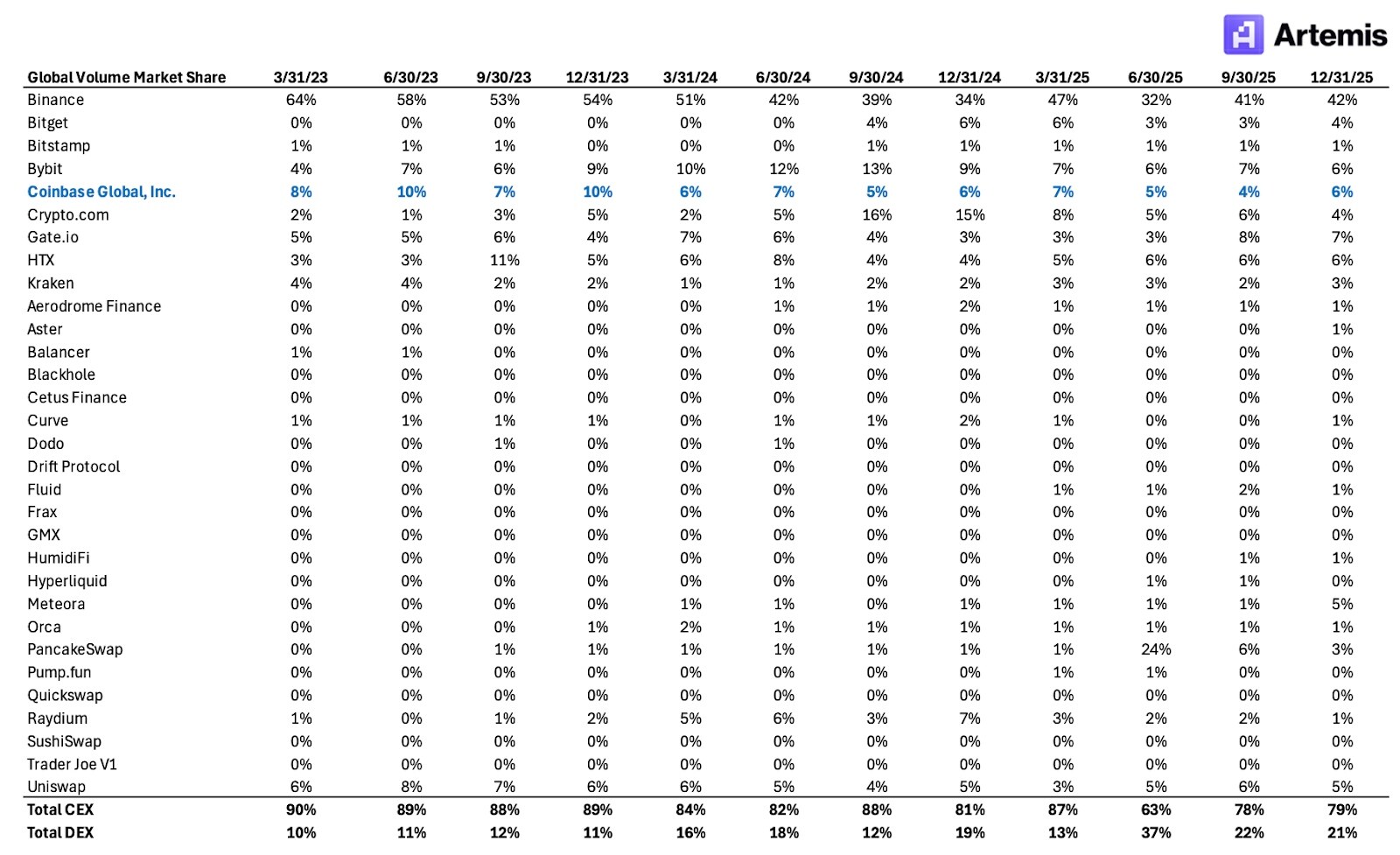

For spot trading alone, industry data indicates that global CEX spot trading volume exceeded $18 trillion in 2024, while derivatives trading volume is much larger. In the US, the spot TAM is smaller but still substantial, with dollar-denominated spot trading volume estimated around $1.5 trillion annually, reflecting the US's significance in fiat liquidity and price discovery. Historically, CEX has dominated this market share due to its robust liquidity, convenient fiat deposit channels, and superior user experience (especially for retail and institutional participants).

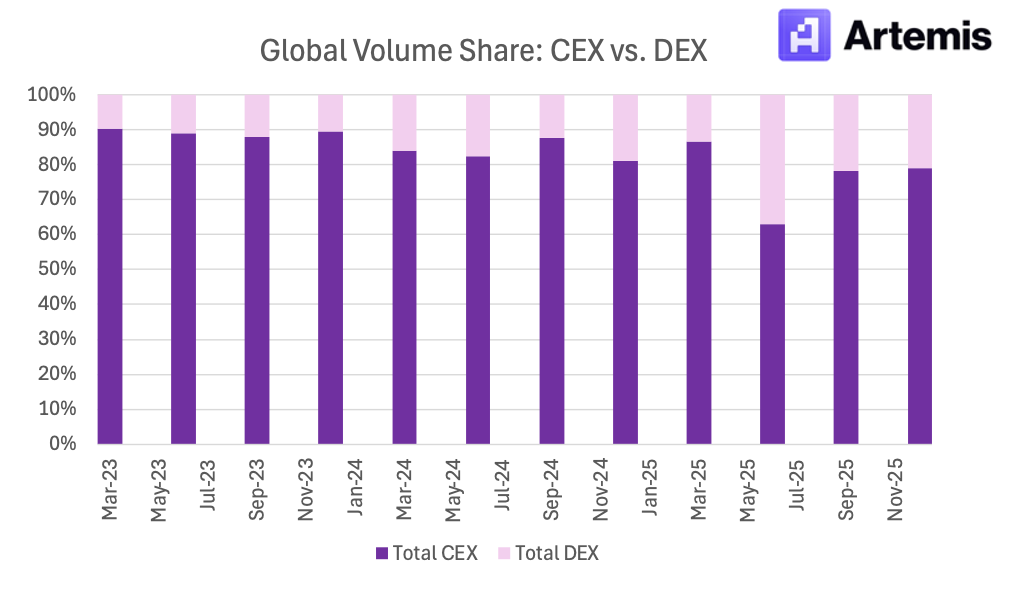

However, over time, DEX has steadily increased its share of global trading volume, growing from single-digit lows a few years ago to over twenty percent today. This shift is more pronounced outside the US, where DEX usage benefits from permissionless access, while the market share in the US remains notably low due to fiat dependencies and regulatory frictions.

The fundamental driver of this evolution is structural: L2 networks reduce transaction costs, improve execution quality and liquidity depth, and the rapid development of on-chain ecosystems has led to increasingly native implementations of functions like trading, lending, and yield generation.

At the same time, increasing regulatory and compliance burdens constrain the product flexibility of multiple CEXs across various jurisdictions, while DEX retains its global accessibility by design. Additionally, it is worth mentioning that in the US, the heightened regulatory and compliance burdens similarly limit the product flexibility of multiple CEXs, while DEX can be accessed globally without permission.

Thus, although CEX continues to dominate total trading volumes and institutional flows, especially in the US, DEX is carving out an increasingly large share of the global trading market (TAM), reflecting a gradual but persistent redistribution of trading activities.

Coinbase's Advantages in the US Market

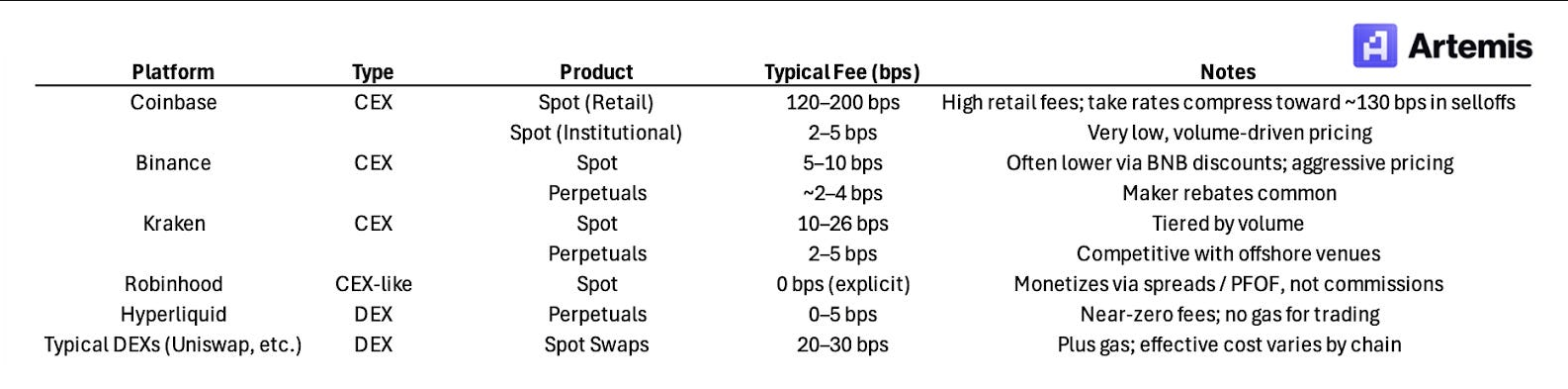

In the global cryptocurrency market, the differences in trading fees among various platforms are significant, reflecting disparities in regulatory frameworks, cost structures, and competitive intensity. Against this backdrop, Coinbase has historically charged fees much higher than most global peers, primarily due to its US-centric operating model.

Operating fully within the US regulatory framework means higher costs (covering compliance and custody standards, reporting, and capital requirements), but it also provides users with legal clarity and security unmatched by offshore trading platforms. For retail investors in the US, especially during strong market growth periods, this trade-off encourages them to be willing to pay for convenience, trust, and regulatory certainty.

Proportion of fees charged by different exchanges

In the US, Coinbase, as the largest and oldest regulated cryptocurrency exchange, especially in dollar-denominated spot trading, occupies a unique advantageous position.

Coinbase accounts for about 40% to 50% of US spot cryptocurrency trading volume, with its share being higher during market pressure periods when trading counterparts prioritize balance sheet safety and regulatory clarity. Coinbase's core customer base includes US retail investors who value usability and reliable fiat deposit channels, as well as institutional clients (including asset management firms, ETFs, corporates, and market makers) who prioritize convenience and regulatory certainty.

This bilateral franchise model benefits from deep banking relationships, integrated custody services, and long-term cooperation with US regulatory bodies.

However, the competitive landscape in the US contrasts sharply with the global market. Coinbase's main competitors include Robinhood (which actively competes to lower prices in the retail market but offers fewer cryptocurrency product varieties), Kraken (which attracts more active traders with lower fees), and Binance.US (whose scale and product breadth remain limited compared to its global parent company).

Unlike offshore trading platforms, these competitors operate under similar regulatory constraints, limiting fee arbitrage and product differentiation. Thus, the focus of competition in the US is not on who can offer the lowest fees globally, but rather on trust, compliance, and dollar liquidity. Coinbase’s regulatory reputation, institutional penetration rate, and dominant position in dollar entry reinforce its leadership in the US cryptocurrency market, even as competitive pressures gradually increase at the margins.

Three Arguments Expecting Coinbase's Future Business to be Poor

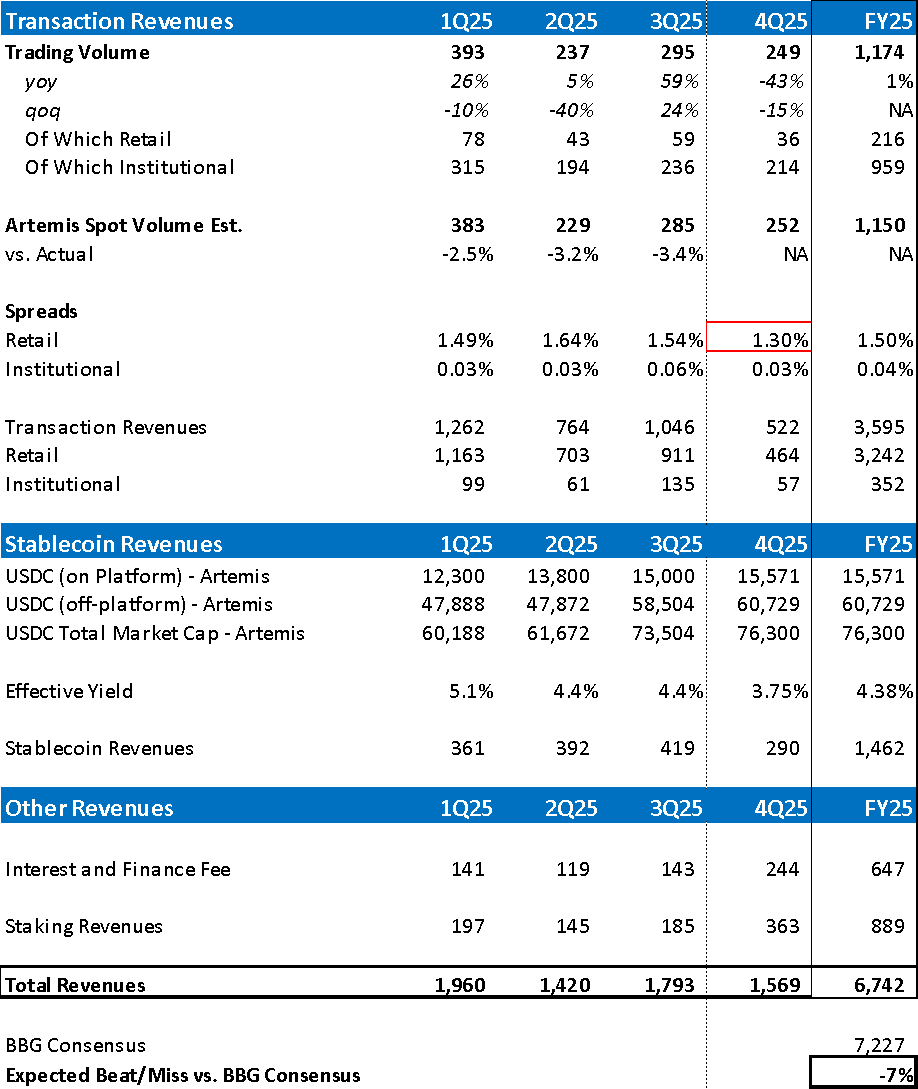

Argument One: Coinbase's brokerage business is expected to face pressure in the fourth quarter of 2025, which may result in its fiscal year 2025 revenue falling about 7% below market expectations

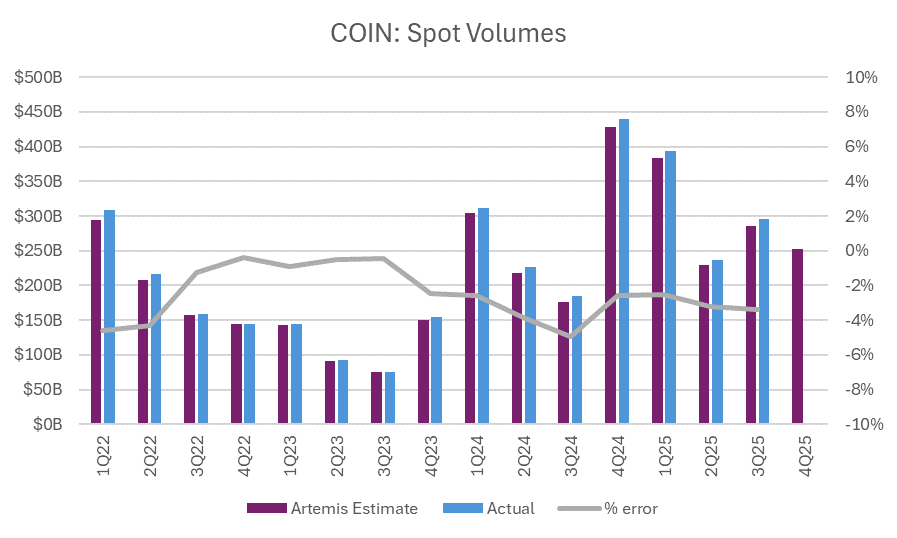

Although Coinbase is expanding other services on its platform, its profitability still heavily relies on two business segments: brokerage services and stablecoin-related revenue. The expected performance decline primarily stems from the ongoing pressure on its brokerage business in the fourth quarter of 2025. We estimate Coinbase's spot trading volume using the Artemis terminal, which has historically had an average estimation error of about 2.5% for quarter-end trading volume.

Current data indicates that trading activity has slowed this quarter, with an estimated trading volume of approximately $249 billion in the fourth quarter of 2025. We anticipate a slight decline in retail trading fees, consistent with past cryptocurrency sell-off periods, when retail trading fees fell to about 130 basis points due to reduced volatility and heightened competition. Institutional trading fees, already structurally low, are expected to remain below 5 basis points, consistent with patterns during historical downturns.

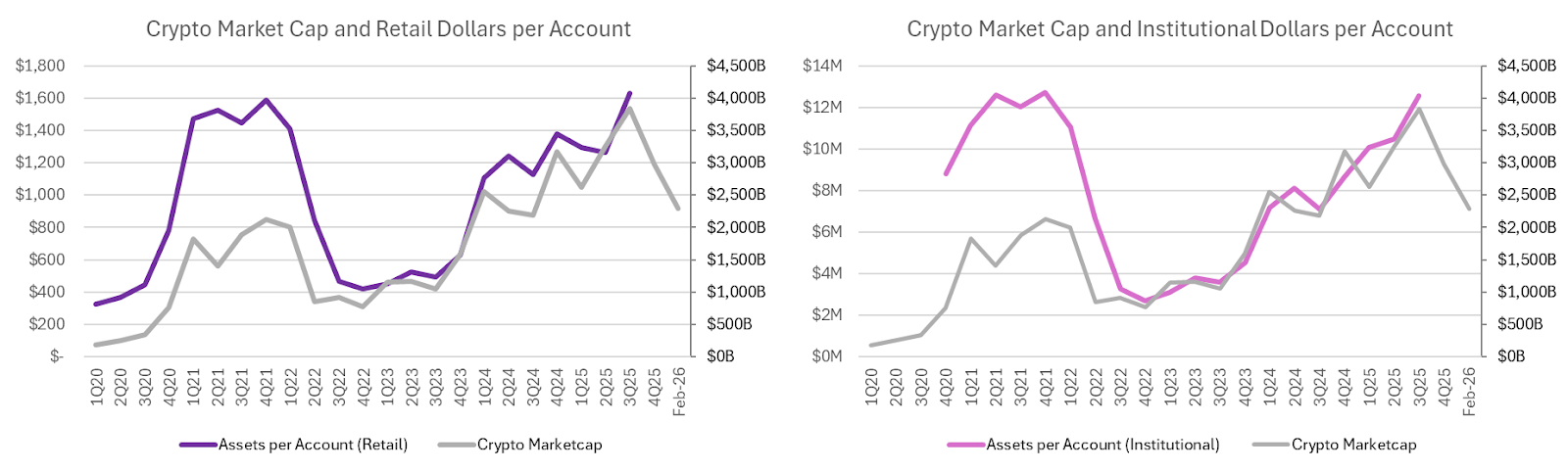

Argument Two: Headwinds for the brokerage business are expected to continue into 2026, but the downside pressure will be less severe than during the 2022/2023 cryptocurrency winter, with earnings per share in 2026 expected to be 14% lower than expected

We expect earnings pressure in 2026 to endure, primarily influenced by the cryptocurrency sell-off that began in 2025 and extends into early 2026. The core variable of the brokerage business revenue model is assets per account (the average dollar value held by clients), which has historically been highly correlated with total cryptocurrency market value (approximately 0.8 for retail accounts and approximately 0.6 for institutional accounts). This dynamic relationship is especially important, given that retail customers are more sensitive to market fluctuations and generally incur higher fees.

As of February 2026, the total cryptocurrency market value has declined around 20% compared to the end of 2025, after having already fallen 22% in the fourth quarter of 2025, indicating continued pressure on customer asset balances. In our baseline forecast, we anticipate a nearly 10% compression in retail account assets and a similar 10% compression in institutional account balances by 2026.

We assume a recovery model in 2027 consistent with past cycles, where market value rebounds to 2024 levels and then maintains an annual growth rate of around 15%, allowing for substantial upward movement beyond general market expectations in the following years.

For stablecoins, we continue to expect strong growth, estimating approximately 40% growth in 2026, primarily due to a nearly 70% growth in USDC's market capitalization compared to 2025, despite a slowdown from around 110% growth from 2024 to 2025. This growth partially offsets the weakness in brokerage business.

However, overall, we expect total revenue in 2026 to decrease by about 1%, which implies that revenue will be approximately 17% lower than general market expectations, and earnings per share will drop by about 15% due to operating leverage amplifying the impact of weak trading fundamentals.

Argument Three: Regulatory progress in 2026 has structural positive significance, but the pace is too slow to offset short-term profitability pressure

We anticipate that regulatory transparency in the US cryptocurrency market will improve in 2026, which may be achieved through partial market structure legislation, thereby reducing legal uncertainty and strengthening the standing of compliant existing companies like Coinbase. In principle, clearer rules could serve as an essential catalyst for wider cryptocurrency adoption, particularly among institutional investors, thereby unlocking new pools of capital and expanding the potential market.

A member of the SEC's cryptocurrency task force previously stated, "Regulatory agencies are expected to issue guidance clarifying the distinction between securities and non-securities in the cryptocurrency space, potentially providing innovative exemptions for tokenized securities and new on-chain market structure pilot projects, and expanding the use of no-action letters to indicate that certain activities are not enforcement priorities."

However, the legislative process remains slow, and the implementation speed indicates that any substantive benefits from widespread adoption will gradually emerge over time rather than being immediate. In the short term, Coinbase's financial performance continues to be primarily driven by cryptocurrency prices, retail trading volumes, and fees (these factors are currently undergoing long-term adjustment periods, facing pressure). While the adoption of institutional investors is supported by regulatory progress, it tends to be gradual, and trading profit margins are structurally low.

Furthermore, after the approval of ETFs and the recent signals from policymakers, the optimism surrounding regulation has largely been reflected in market sentiment. Therefore, even though regulatory improvements do represent long-term structural positives, their slow progress renders these benefits unable to offset short-term profitability headwinds, leading to downside risks for market expectations in 2026 and 2027.

Valuation Forecasts Under Different Scenarios

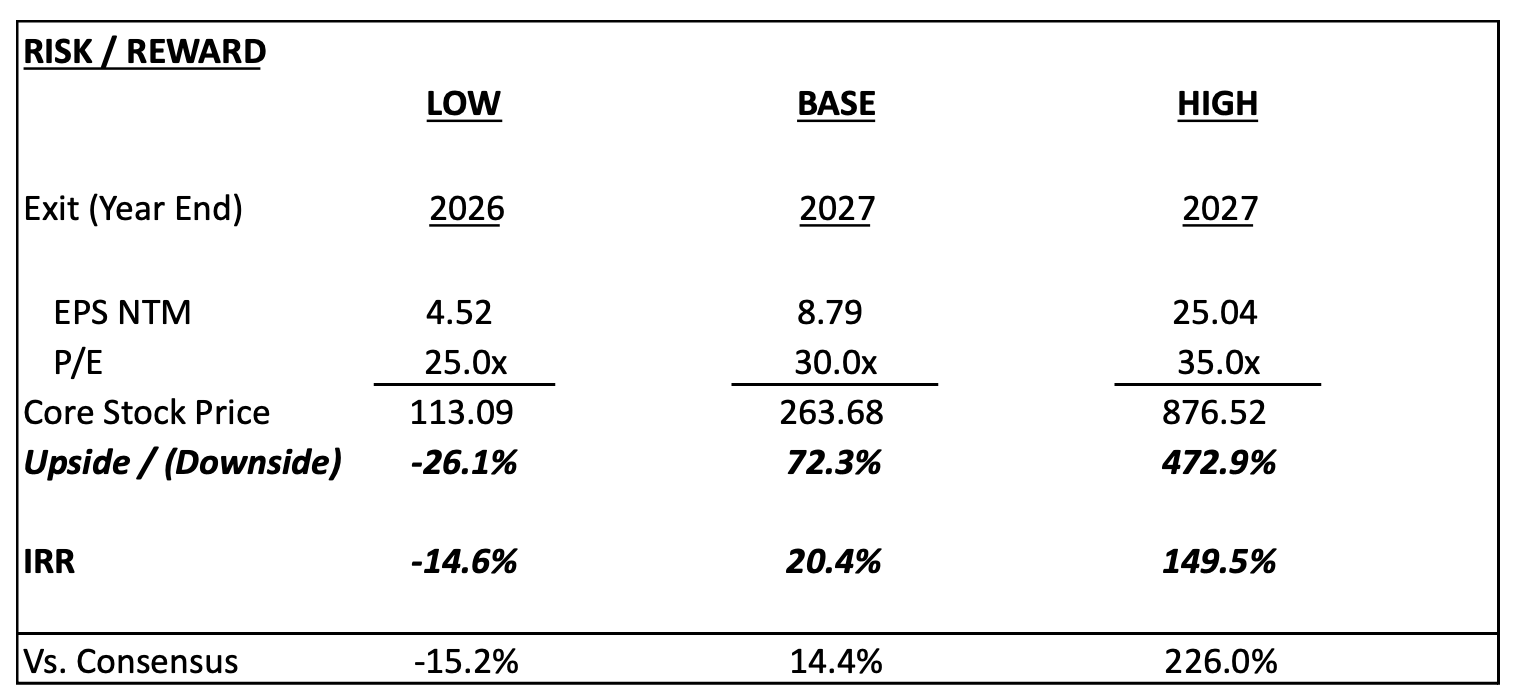

Low Valuation Scenario

We assume that the market will experience a prolonged downturn similar to that of the 2022-2023 cycle, with an estimated 50% decline in assets per account in 2026, stabilizing in 2027, reflecting ongoing weakness in user engagement and asset balances. We assume a slowdown in the annual growth rate of USDC to around 25%, as on-chain activity and risk appetite remain subdued.

In this scenario, pressure on Coinbase's brokerage business persists, operating leverage remains constrained, and visibility into profit sustainability diminishes. Therefore, we adopt a more conservative 25x NTM price-to-earnings ratio as the exit multiple for the end of 2026, which aligns with Coinbase's valuation as a highly cyclical brokerage business. This scenario implies approximately a 15% negative internal rate of return (IRR), highlighting potential downside risks if adjustments exceed expectations and the duration is prolonged.

Benchmark Scenario

We assume a more moderate adjustment, with retail account assets decreasing nearly 10% in 2026 and institutional client account assets also dropping nearly 10%, followed by a rebound to 2024 levels as cryptocurrency market capitalization recovers in 2027.

In terms of stablecoins, we model an approximately 40% annual growth rate, achieving stronger growth in 2026 and 2027 (approximately 70% and 60%, respectively), reflecting the continued adoption of USDC. The continuous growth of stablecoin revenue will partially offset the weakness in the brokerage business and gradually improve the overall revenue structure.

We apply a 30x NTM price-to-earnings ratio as the exit multiple for the end of 2027, which means the internal rate of return (IRR) over three years will reach approximately 20%, making it quite attractive. However, we acknowledge the critical importance of path dependence: although the final profits predicted by the model are considerable, the expected earnings shortfall in 2026 and potential future fluctuations reduce the attractiveness of the risk-adjusted development trajectory.

Optimistic Scenario

We assume that the initial adjustment is similar to the benchmark scenario, with retail account assets declining nearly 10% in 2026 and institutional client assets decreasing around 14%, followed by a stronger rebound starting in 2027. In this scenario, account assets in 2027 and 2028 are expected to grow approximately 80%, aligning with the growth rates experienced during the 2023-2024 recovery period, after which growth will continue at nearly double-digit rates.

In terms of stablecoins, we predict that USDC's market capitalization will maintain an average annual growth rate of about 56% through 2030, with approximately 80% growth in 2026 and about 50% growth in 2027, reflecting the accelerated adoption of USDC and the ongoing expansion of on-chain applications.

Under these assumptions, Coinbase's revenue structure would significantly reduce cyclicality, thereby enhancing operating leverage and supporting its valuation to reach an expected price-to-earnings ratio (NTM P/E) of 35x by the end of 2027, which implies an internal rate of return (IRR) of approximately 226% over three years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。