Author: DWF Ventures

Translator: Glendon, Techub News

Summary

- Tokens: Overvaluation and declining liquidity have undermined investor confidence, as funding flows are shifting towards the stock market.

- Tokens and stocks have similar upside potential, but their risk characteristics are distinctly different: tokens peak faster (in less than 30 days) and are more volatile, whereas stocks tend to maintain more stable returns over a longer time frame.

- Stocks enjoy a higher valuation premium compared to tokens: this premium can be attributed to institutional access requirements, inclusion in indices, and enhanced trading strategies supported by stocks.

- The price-to-sales (P/S) ratio is a useful benchmark for assessing companies, but valuation discrepancies reflect the significance of other factors: these include regulatory barriers, revenue diversification, shareholder value, and industry sentiment.

- M&A activity has reached its highest level in five years, with industry consolidation accelerating: acquiring capabilities has proven faster than building them in-house, and regulatory compliance requirements are driving strategic acquisitions.

Current Status of Token Issuance

The cryptocurrency industry has reached a turning point. Billions of dollars are pouring in, institutional interest has peaked, and the regulatory environment is becoming increasingly favorable. However, the situation is gloomier for builders and users than ever before. The gap between institutional funding and the crypto-native community is widening, reflecting a larger issue, as centralized entities enter and exert significant influence, the original spirit of decentralization and cypherpunk experiments seems to be gradually fading.

The cryptocurrency industry has long relied on a high-risk, casino-like environment, but as token performance sharply declines, this environment is gradually disappearing. Additionally, certain "harvesting" events that significantly impact retail investors have also caused market liquidity to evaporate.

According to a report by Memento Research, over 80% of tokens issued in 2025 are currently priced below their Token Generation Event (TGE) price. Due to overvaluation and difficulty in rationalizing and maintaining valuations, projects have been heavily impacted by high volatility and a general lack of demand for tokens. Moreover, most tokens face immense sell-off pressure starting from the TGE, making upward movements rare—stemming from early profit-taking, a lack of confidence in the products, or poorly architected token economics (airdrops, centralized exchange listings, etc.). This has dampened interest among investors and retail, and events like "10.11" have further exacerbated the outflow of funds from the crypto industry, raising doubts about the core infrastructure of the sector.

The Rise of Initial Public Offerings (IPOs)

Meanwhile, in traditional finance, crypto companies are actively seeking IPOs, with several well-known cryptocurrency firms set to go public in 2025 and more companies filing for IPOs. Data shows that the amount of funds raised by crypto company IPOs has increased 48 times since 2024, raising over $14.6 billion in 2025. M&A transactions are also showing similar growth speeds, as existing core companies seek to diversify, which will be discussed further below. Overall, the outstanding performance of these companies indicates a substantial demand for exposure to digital assets—a trend likely to accelerate in 2026.

Where is Liquidity Heading?

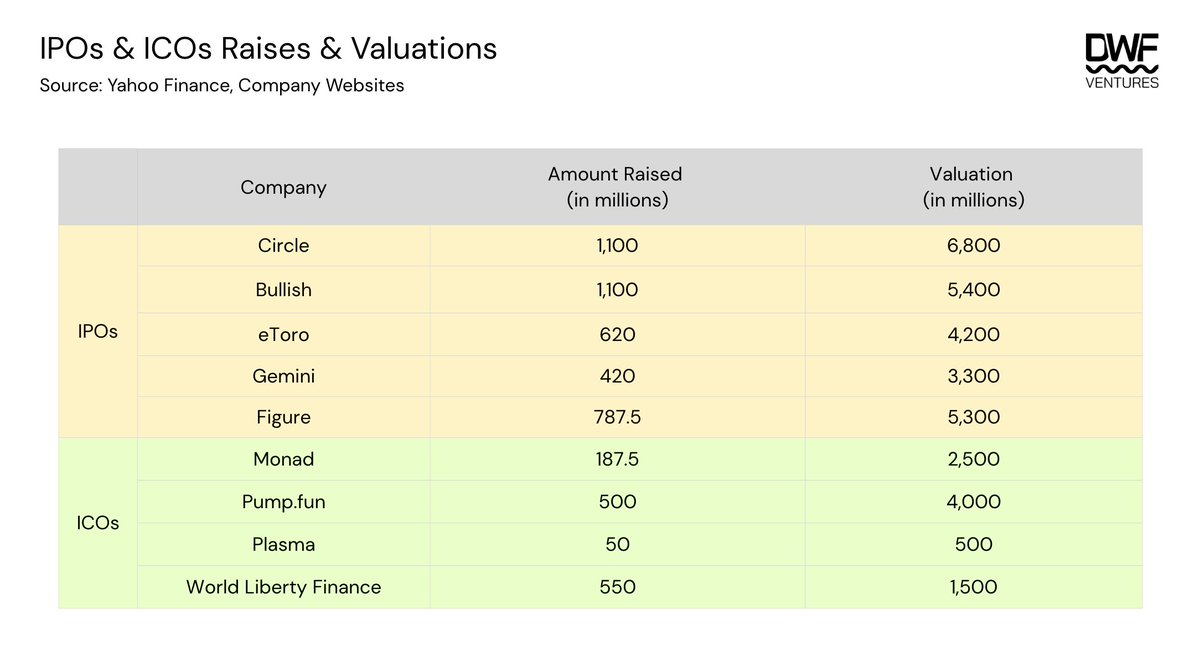

Over the past year, we have seen numerous high-profile IPOs and ICOs successfully raising substantial amounts of capital. The table below shows the amounts raised by each company and their initial valuations.

From this, we observe that the valuations of IPOs and ICOs are relatively close. Certain ICO projects (such as Plasma) are deliberately priced below institutional investors' valuations to provide greater upside and participation opportunities for retail investors. On average, the percentage of shares publicly offered in IPOs ranges from 12% to 20%, whereas ICOs range from 7% to 12%. The Trump family project World Liberty Finance (WLFI) is a notable exception, with publicly sold tokens exceeding 35% of the total supply.

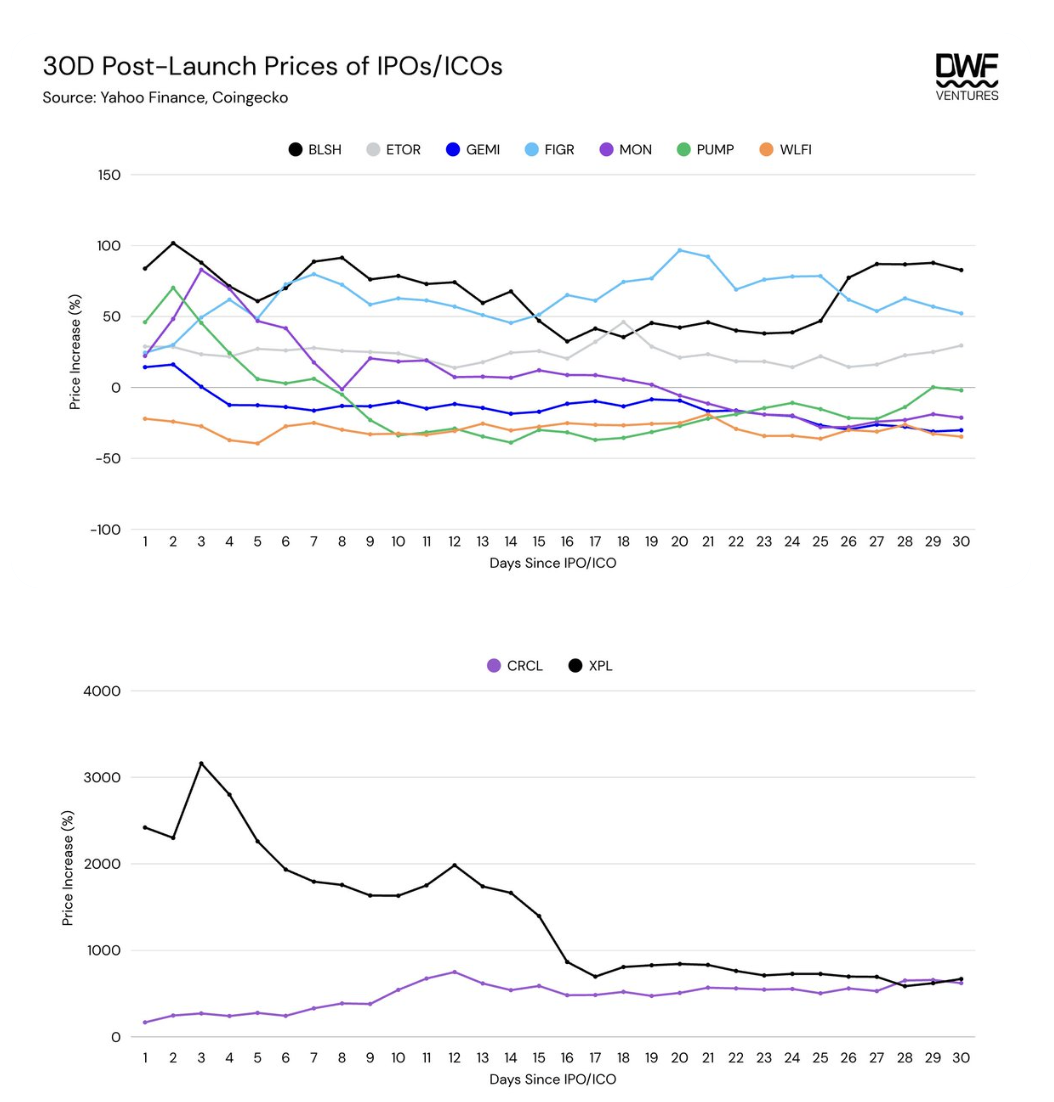

Analyzing the performance of IPOs versus ICOs reveals that tokens tend to exhibit more extreme short-term volatility and shorter peak times (less than 30 days). On the other hand, stocks tend to maintain stable growth over a longer time frame. Notably, despite these differences, both show considerable similarity regarding upside potential.

CRCL and XPL are exceptions to this rule, achieving significant gains initially, yielding returns of 10-25 times for investors. However, their performance also followed the above trends—XPL retraced 65% within two weeks of reaching its peak, while CRCL continued a steady rise over the same period.

Revenue: Assessing Stock Premiums

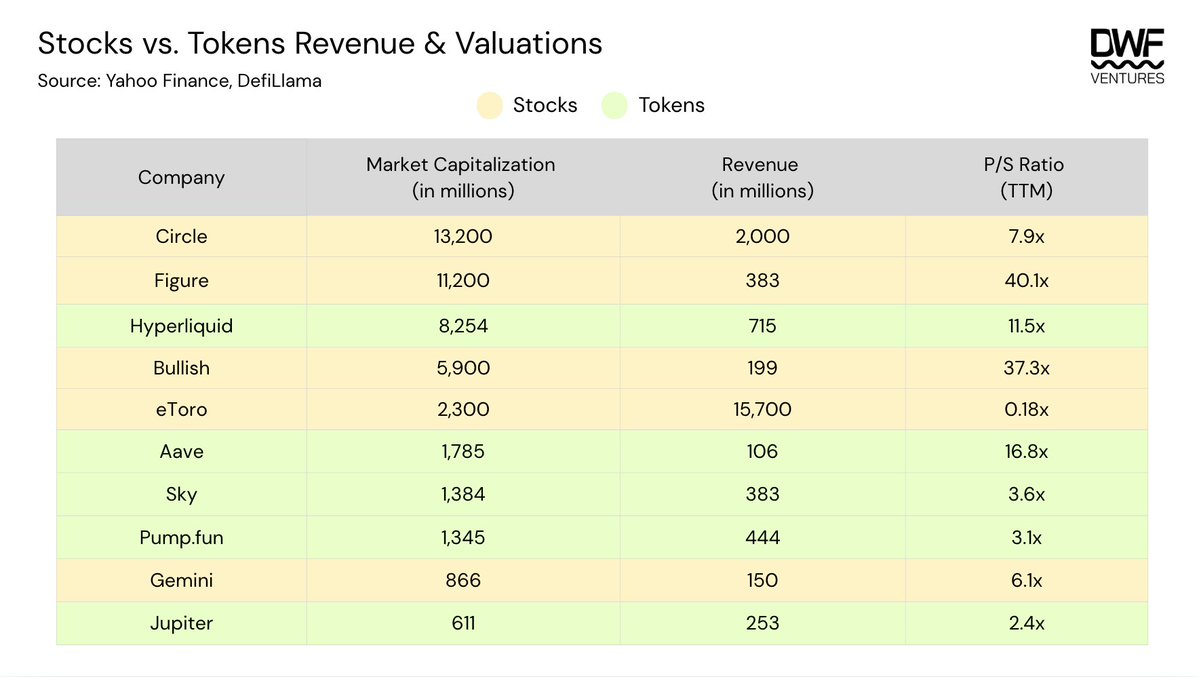

A further analysis of revenue data indicates that the trading prices of stocks are typically many times higher than those of tokens, with specific multiples ranging from 7 to 40 times and 2 to 16 times, respectively. This is mainly due to enhanced liquidity brought by various factors:

- Institutional Access: While there is a growing positive attitude towards holding digital assets on balance sheets, this access is still typically limited to funds restricted to securities-related investment mandates (especially pension or endowment funds). Going public (IPO) enables companies to tap into this pool of institutional capital.

- Index Inclusion: Growth drivers in the public sector far exceed those in on-chain growth. In May 2025, Coinbase became the first crypto company to be included in the S&P 500 index. This may prompt index-tracking funds/ETFs to accumulate and hold, creating upward buying pressure.

Overall, the price-to-sales ratio (P/S ratio) reflects how companies are valued based on revenue from the past 12 months, helping to determine if a company is undervalued or overvalued when comparing with competitors. However, those factors that cannot be quantified directly but can reflect investor sentiment have not been accounted for. Some considerations in evaluating stocks/tokens include:

Moat and Diversification

This is crucial in the fast-changing digital asset industry. Companies need to pay additional costs for licenses and regulatory compliance, while a diversified business portfolio can enhance the value proposition of core businesses, making it more than just revenue numbers.

For example, Figure has launched an RWA lending pool targeting retail and institutional investors and is the first to receive approval from the SEC to issue yield-bearing stablecoins (YLDS). Bullish is a regulated exchange that also owns other businesses like CoinDesk, adding value beyond mere trading services. All these factors can lead to a higher premium.

In contrast, eToro's P/S ratio is extremely low, appearing "undervalued," but a deeper analysis reveals that its revenue growth matches its cost growth, indicating that it is not in the best situation. Additionally, the company focuses solely on trading services, with low product differentiation and margins. Thus, this indicates that building a defensible moat and achieving business diversification are also key factors of interest for investors.

Shareholder Value

Returning capital to investors through share buybacks is common in both stocks and tokens, especially for high-revenue companies.

For instance, Hyperliquid's stock buyback program is the most aggressive, allocating 97% of its revenue for buybacks. Since its inception, the fund has repurchased over 40.5 million HYPE tokens, accounting for over 4% of the total supply. As long as revenue remains stable and the industry still has growth potential, this aggressive buyback move will undoubtedly impact prices and boost investor confidence. This helps raise the P/S ratio, and considering the strong backing provided by the team itself, it does not necessarily imply that the token is "overvalued."

Industry Sentiment

Industries that achieve high growth due to institutional or regulatory events naturally command a premium, as investors seek related investment opportunities.

For example, shortly after Circle went public in June 2025, its stock price soared, peaking with a P/S ratio of about 27 times. This may be attributed to the passage of the GENIUS Act—an act aimed at promoting the adoption and legitimization of stablecoins. The act was passed soon after Circle's IPO, and given Circle's leading position in stablecoin infrastructure, it makes them a major beneficiary.

M&A: A Wave of Large-Scale Consolidation

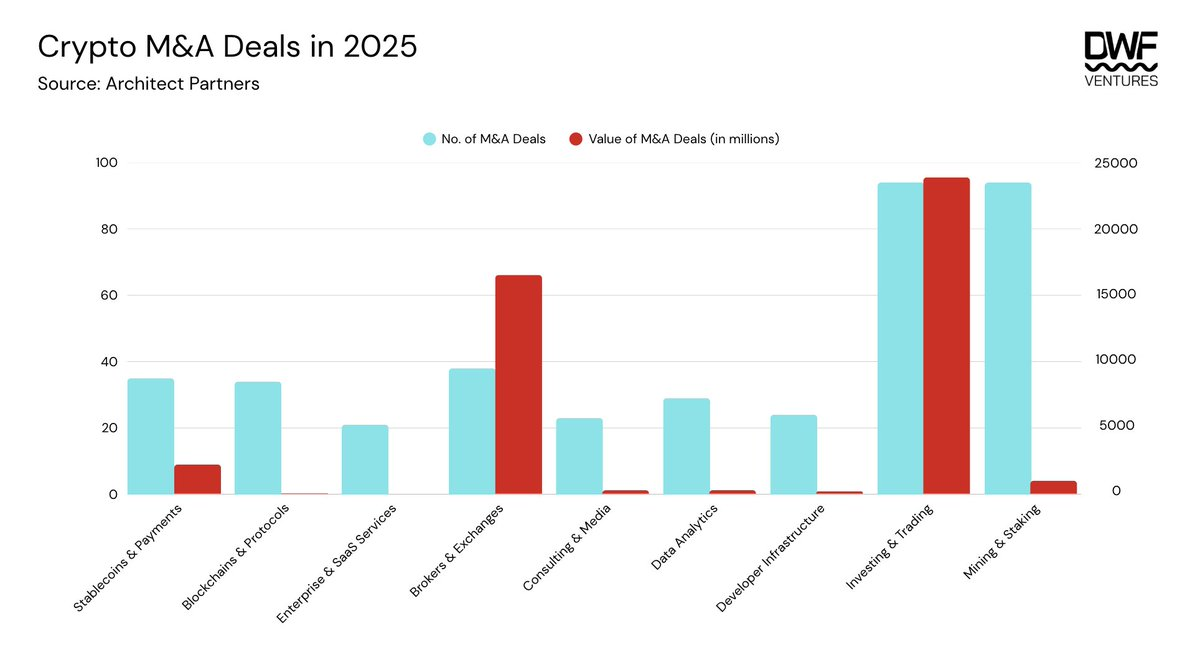

According to an Architect Partners report, in 2025, driven by traditional finance (TradFi) companies' vigorous efforts and an increasingly friendly regulatory outlook, M&A activity in the cryptocurrency space reached its highest level in five years. Following the Trump administration's introduction of a series of cryptocurrency-friendly policies, digital asset treasury (DATs) have experienced booming growth, as holding digital assets on balance sheets is no longer so controversial. Additionally, companies are focusing on acquisitions as a more efficient way to obtain certain licenses and enhance compliance. Overall, the introduction of an appropriate regulatory framework has paved the way for the accelerated expansion of M&A activities.

Looking back over the past year, we find that the number of trades across all categories has increased significantly. The following three categories have become the focal points for institutional investors:

- Investment and Trading: This includes trading settlement, tokenization, derivatives, lending, and DAT infrastructure.

- Brokers and Exchanges: Regulated platforms focused on digital assets.

- Stablecoins and Payments: Including inflow and outflow channels, infrastructure, and applications.

By 2025, these three categories accounted for over 96% of total transactions, exceeding $42.5 billion.

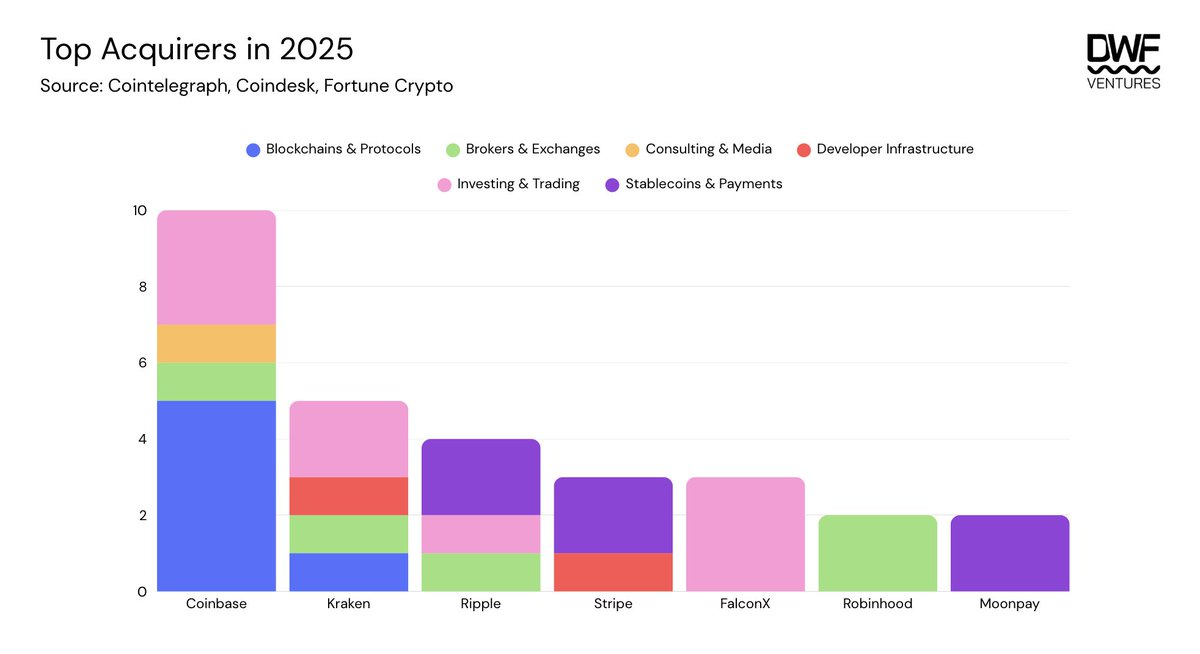

Major acquirers include Coinbase, Kraken, and Ripple, which are involved in multiple sectors. In particular, Coinbase has consolidated its ambition to become a "universal application" by acquiring both traditional and innovative decentralized applications (DApps), focusing on bringing on-chain technology to the masses. This may be attributed to increased competition among exchanges and their desire to be one-stop applications to attract their own user bases and capital flows.

Other companies, such as FalconX and Moonpay, are making significant investments in their respective fields, enabling them to provide comprehensive services through complementary acquisitions.

How Will "Token" Issuance Develop Next?

Despite the current unsatisfactory market environment and sentiment, we believe that the digital asset space will still see many positive factors in 2026. We anticipate an increase in the number of public companies, which will undoubtedly be good news for the entire industry. This will enhance the industry's accessibility to capital and investors, thereby expanding the scale of the entire industry.

Upcoming IPOs include:

- Kraken: filed its S-1 registration statement with the SEC in November 2025, with strong expectations to go public in early 2026.

- Consensys: is collaborating with Goldman Sachs and JPMorgan, planning to go public in mid-2026.

- Ledger: is working with Goldman Sachs, Jefferies, and Barclays to plan a $4 billion IPO.

- Animoca: plans to go public on NASDAQ in 2026 via a reverse merger with Currenc Group Inc.

- Bithumb: plans to go public on KOSDAQ in 2026, with a valuation of $1 billion, underwritten by Samsung Securities.

It can be seen that the future path is not about choosing between traditional financial validation and crypto-native innovation, but rather moving towards integration. For developers and investors, this means prioritizing fundamentals and creating practical products that can generate genuinely sustainable revenue. This shift towards long-term thinking may bring some turbulence, but those who can adapt will be able to seize the next wave of value creation.

Cryptocurrency is dead, but cryptocurrency will also be reborn.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。