Written by: Mah, Foresight News

One of the most successful public chains, Solana, is also facing a winter period.

Since the market crash on February 5, the Solana token SOL temporarily dropped to $67, hitting a new low since December 2023. As of now, the latest price for SOL is $80, with a 24-hour decline of 3.57%. On a monthly basis, SOL has continuously declined for five months since its peak of $10 in October 2025, during which the maximum drop exceeded 71%. The most famous NFT in this ecosystem, Mad Lads, saw its floor price drop to 22 SOL, approximately $1760, while at its peak, this NFT was worth over $40,000.

Looking back at this bull market, SOL rose from a low of $8 to $295, performing remarkably among public chains. Coupled with the explosion of the meme sector, even former President Trump chose to launch tokens on the Solana network, resulting in countless wealth stories during this period.

However, as the market turns bearish, with falling prices, TVL halved, on-chain transaction volumes sharply decreased, and the growth engine stalled, Solana is also facing various issues.

End of the Meme Craze

In this cycle, the meme craze originated in Solana. From late 2024 to early 2025, Solana, through the Pump.fun platform, initiated a "Meme Summer," where the daily issuance of new tokens surpassed ten thousand, with peak trading volumes exceeding $6 billion. Meme coins like Dogwifhat and Bonk saw their market cap soar, driving Solana’s overall activity to a peak. It reached its zenith when Trump issued TRUMP, creating a historic high of $295. However, with various frauds and the loss of wealth effects, starting from mid-2025, the meme craze began to cool down, with many projects having a graduation rate of less than 2%, and funds started to flow out.

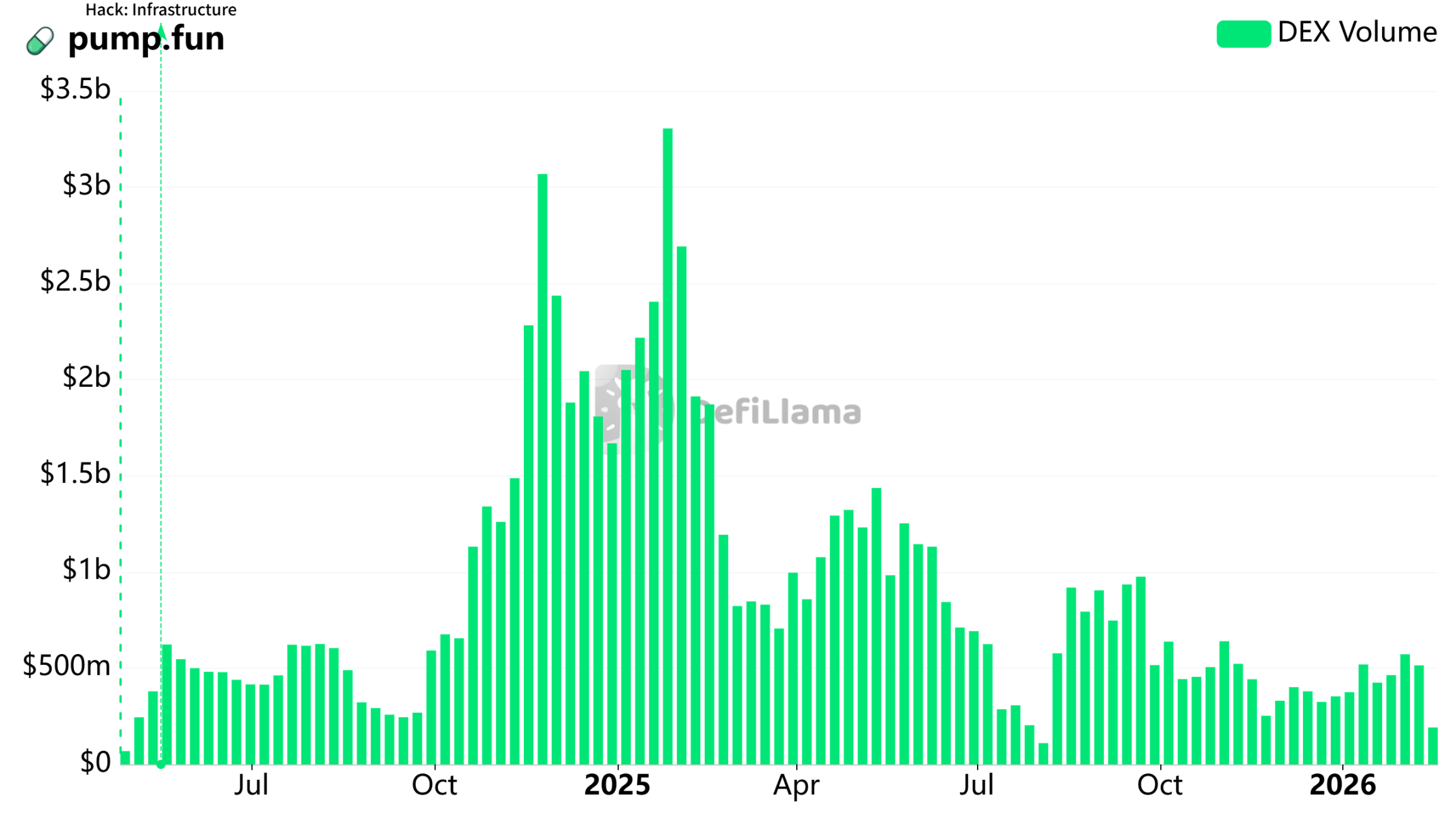

Data from Defilama shows that the meme platform pump.fun achieved historical highs in trading volume around 2025. Weekly trading volume exceeded $3 billion twice, and it subsequently began to decline. By early 2026, its trading volume hovered around $500 million, just 1/6 of its peak.

Meanwhile, part of the meme traffic has shifted to BNB Chain. BNB Chain rapidly rose through the Four.Meme platform in the second half of 2025, where Chinese-themed memes like "Binance Life" and "I Am Coming" triggered FOMO, causing the meme market cap on BNB Chain to rise from almost zero to hundreds of millions of dollars, with 24-hour trading volume reaching $460 million. In contrast, although Solana's meme market cap still stands at several billion dollars, growth has stagnated, with many projects dropping over 95% from their peak.

In October 2025, BNB Chain once replaced Solana on the trending meme rankings, with fund rotations being evident: when BNB Chain memes surged, Solana’s funds contracted; after BNB Chain receded, while some funds flowed back, the momentum was diminished. Additionally, influenced by prominent figures like CZ and He Yi, BNB Chain saw short-term growth, while Solana's Pump.fun, despite its first-mover advantage, became weak due to narrative exhaustion and a lack of incremental funds.

The end of the meme wave signifies a simultaneous decrease in demand for public chain tokens.

Cooling Public Chain Narrative

Furthermore, the overall cooling of the public chain narrative has further weakened Solana’s ecological expansion plans. Between 2025 and 2026, the crypto market retreated from early-stage high leverage and narrative over-expansion, with many weak narratives, such as celebrity tokens and meme crazes, rapidly fading, shifting focus to areas with greater practicality and institutional support. Solana, with its "high-speed public chain" narrative, once attracted developers, but as the market entered a "value deep water zone," investors gravitated toward mainstream assets like Bitcoin and Ethereum as "digital gold" or "settlement layers," exacerbating the overall bear market and increasing capital outflow from Solana.

This narrative weakness reflects a shift in public chain competition from simple TPS comparisons to ecological maturity and regulatory adaptability, diluting Solana’s previous TPS and ecological advantages. Whether in memes or airdrop incentives, Solana's attractiveness to new users has significantly weakened.

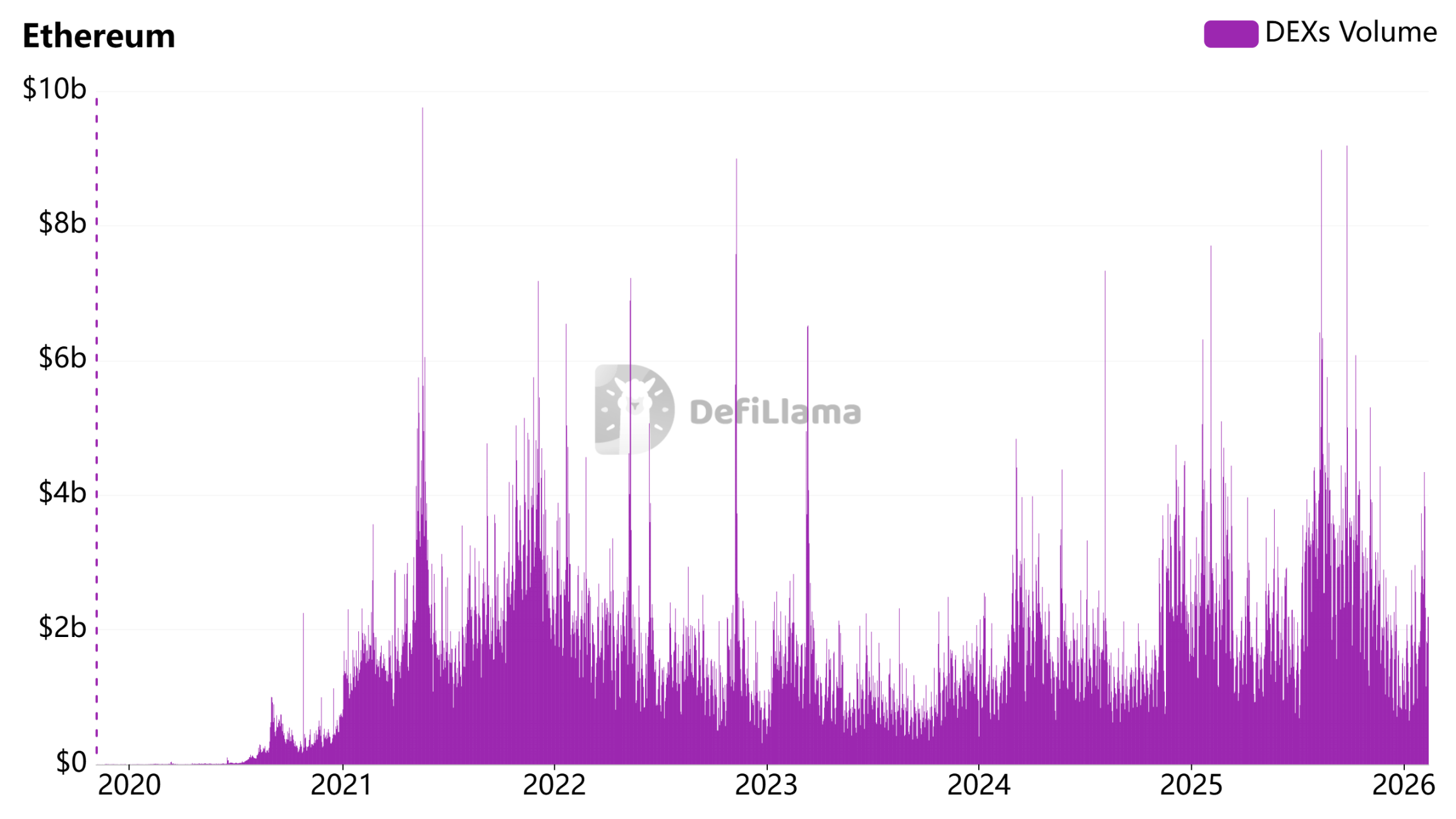

Meanwhile, Ethereum’s mainnet speed has significantly improved, further undermining Solana's core advantages. Through the Fusaka upgrade in 2025, Ethereum increased its data blob capacity from 3 to 6-9 and introduced the PeerDAS mechanism, greatly reducing transaction fees and increasing throughput, leading to a rebound in transaction volume and active addresses.

Data shows that DEX trading volume on Ethereum rose significantly towards the end of 2025. Entering 2026, the Glamsterdam upgrade will achieve nearly perfect parallel processing, further accelerating block validation and reducing costs, making the mainnet closer to an "operating system" level. These improvements bring the TPS and costs of Ethereum’s mainnet closer to Solana’s levels while retaining higher security and decentralization, reducing the necessity for users to switch to Solana.

Another rising competitor, Base, is also growing rapidly, especially attracting numerous users with AI tokens. According to DefiLlama data, its TVL currently remains at a high level of $4 billion.

The tokenization craze is occurring more on Ethereum, further marginalizing Solana's ecosystem. As of February 12, 2026, rwa.xyz data shows that RWA assets on Ethereum's mainnet totaled $14.9 billion, while Solana only had $1.7 billion, indicating a significant gap. The tokenization trend of RWA emphasizes stability and compliance, making it difficult for Solana to gain a foothold due to Ethereum’s leading position.

Digital Asset Treasury Buying Power Failed to Offset Overall Bear Market Pressure

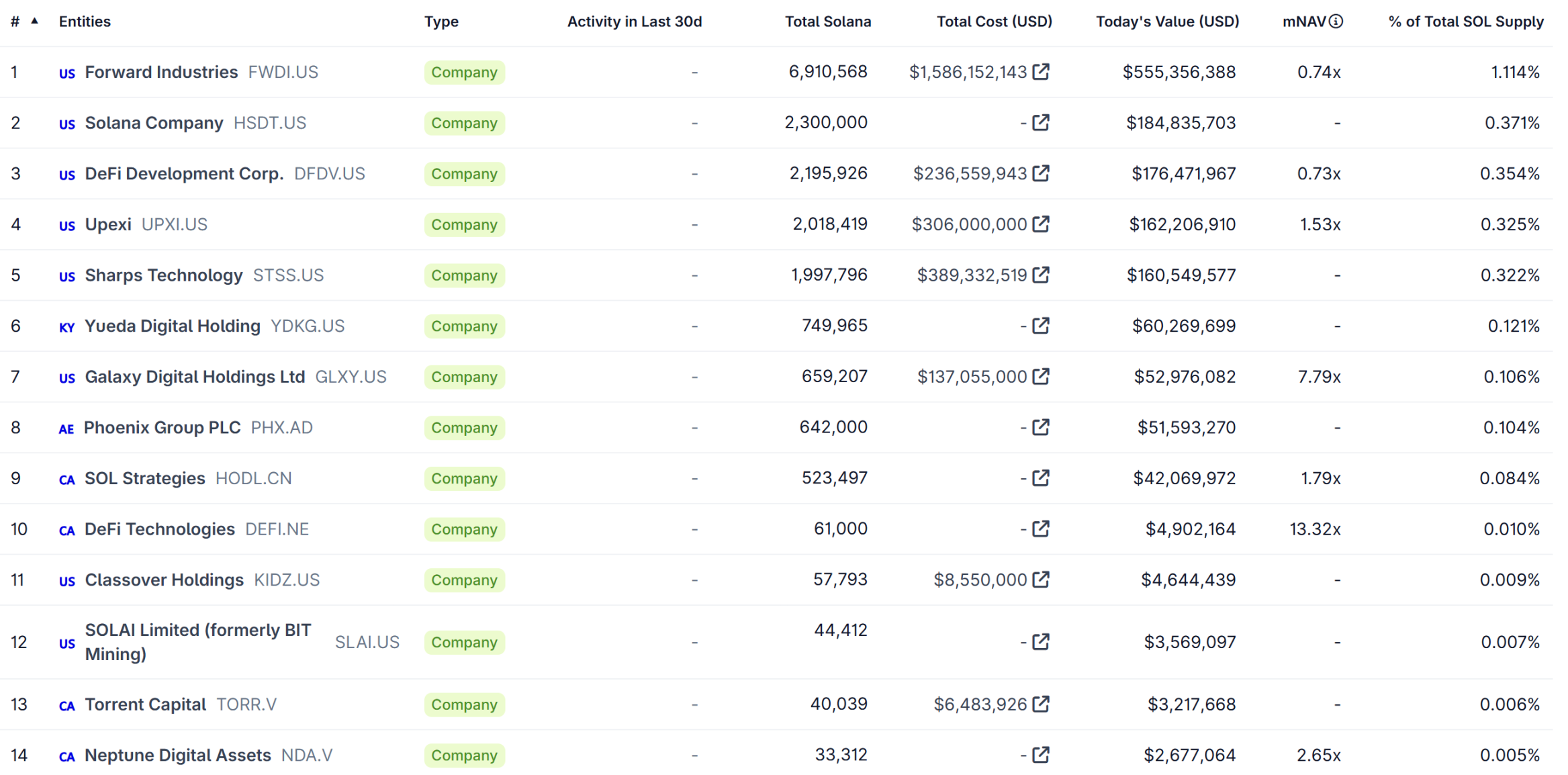

From the perspective of Digital Asset Treasury (DAT), in 2025, the DAT model was quite popular, with many publicly traded companies like Forward Industries, Upexi, and Sharps Technology raising funds through private placements or debt issuance to purchase large amounts of SOL as treasury assets.

Entering 2026, as SOL price dropped from its 2025 peak of $200 to around $80, the market cap of these DAT companies dramatically shrank, for example, Forward Industries spent $1.58 billion to purchase SOL, which is now worth only $555 million, causing some investors to lose confidence.

Additionally, the DAT buying frenzy has weakened, with new companies joining the market at a slower pace. Although the locked-up SOL from early purchases reduced circulating supply, it failed to offset overall bear market pressures.

Bitcoin and Ethereum prices also suffered significant losses in the recent months of the bear market. BTC dropped from $126,000 to now $67,000, and ETH fell from $4,900 to the current $2,000.

In January 2026, Solana's founder Toly posted in Chinese on X, asking: What do you think is Solana's biggest challenge now? The comments section received a wide range of feedback and answers, including: no direct exchanges, and users having little perception of other products in the ecosystem aside from memes.

Perhaps Solana will find its own solutions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。