Original authors: David Puell, Matthew Mena

Original translation: Luffy, Foresight News

In 2025, Bitcoin continues to integrate into the global financial system. The launch and expansion of spot Bitcoin ETFs, the inclusion of digital asset-related listed companies in mainstream stock indices, and the continuous clarification of the regulatory environment are pushing Bitcoin from the margins of the crypto industry to a new asset class worthy of institutional allocation.

We believe the core theme of the current cycle is Bitcoin's transition from a "discretionary" new monetary technology to a strategic allocation asset for an increasing number of investors. The following four major trends are strengthening Bitcoin's value proposition:

- The macroeconomic and policy environment is driving demand for scarce digital assets;

- Trends are changing the holding structures of ETFs, corporations, and sovereign institutions;

- The relationship between Bitcoin and gold, as well as the broader value storage system;

- Compared to previous cycles, Bitcoin's drawdowns and volatility are decreasing.

This article will systematically review these trends.

Macro Background in 2026

Monetary Environment and Liquidity

After prolonged monetary policy tightening, the macroeconomic landscape is changing: the U.S. quantitative tightening (QT) ended in December last year, and the Fed's rate cut cycle is still in its early stages, with over $10 trillion in low-yield money market funds and fixed income ETFs potentially turning toward risk assets.

Policy and Regulatory Normalization

Clarification of regulations remains a constraint for institutional adoption while also serving as a potential catalyst. U.S. and global policymakers are advancing frameworks that define the regulation of digital assets, standardize custody, trading, and information disclosure, and provide more guidance for institutional investors.

Taking the U.S. CLARITY Act as an example, the act will have the Commodity Futures Trading Commission (CFTC) regulate digital commodities and the Securities and Exchange Commission (SEC) regulate digital securities, which is expected to reduce compliance uncertainty for relevant companies and institutions. The act provides a compliance path for the entire lifecycle of digital assets and allows tokens to shift from SEC regulation to CFTC regulation through standardized "maturity testing" after decentralization. At the same time, the broker dual registration system has also reduced the legal gray areas that have long forced digital asset companies to move overseas.

The U.S. government has also taken actions specifically targeting Bitcoin from multiple levels:

- Discussions among legislators and industry leaders to include Bitcoin in national reserves;

- Regulating the handling of Bitcoin confiscated by the federal government;

- States such as Texas are taking the lead in adopting Bitcoin as a reserve asset.

Structural Demand: ETFs and Digital Asset Treasuries

ETFs as New Structural Buyers

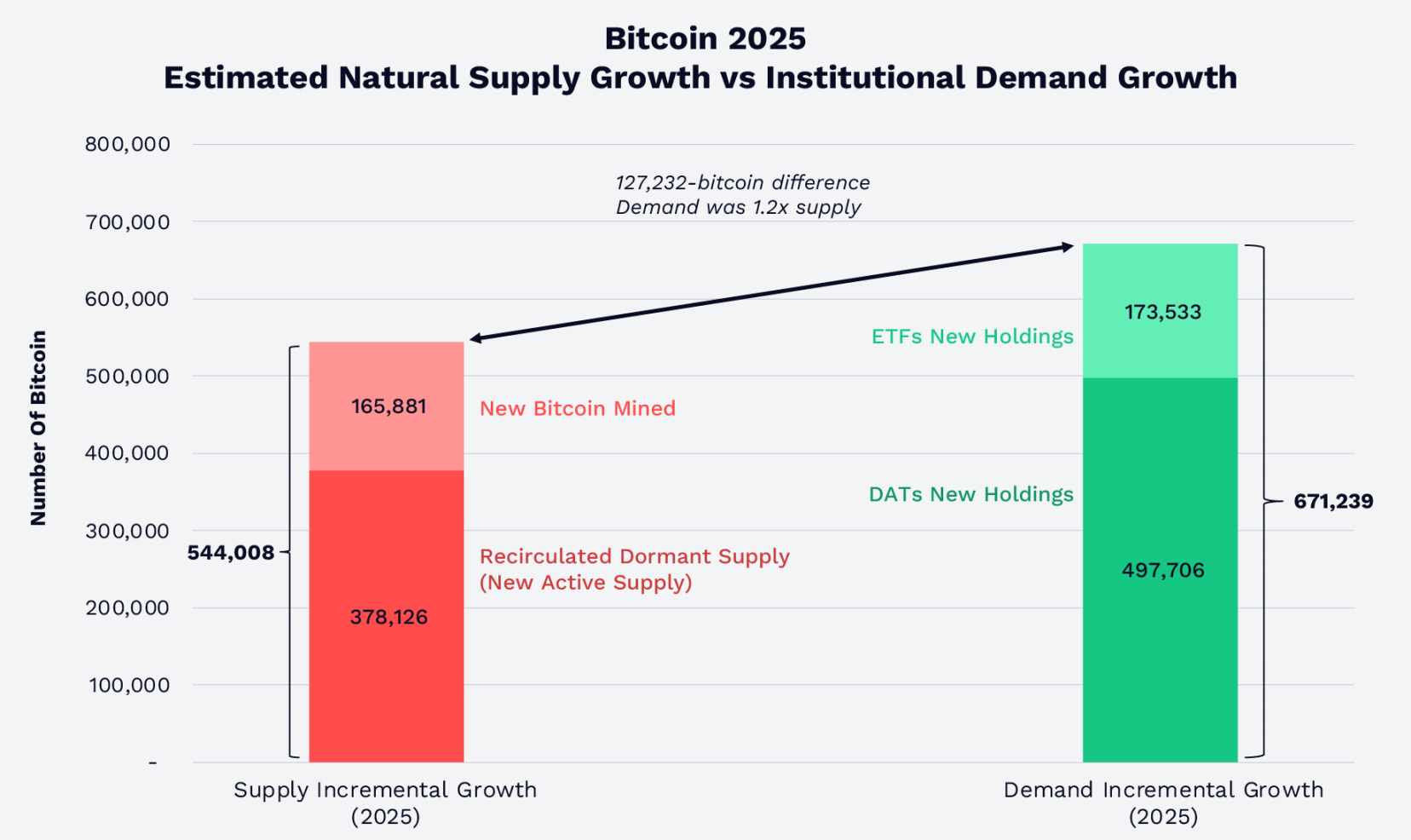

The scalability of spot Bitcoin ETFs has fundamentally changed the supply-demand structure of the market. In 2025, the amount of Bitcoin absorbed by U.S. spot Bitcoin ETFs and digital asset treasuries (DAT) reached 1.2 times the total amount of newly mined Bitcoin plus the re-circulation of dormant coins. By the end of 2025, the holdings of ETFs and DAT accounted for over 12% of Bitcoin's total circulation.

Despite demand growth exceeding supply, Bitcoin prices still experienced declines, primarily influenced by external factors: large-scale liquidations on October 10 last year, concerns about Bitcoin's four-year cycle peak, and negative sentiment regarding quantum computing's threat to Bitcoin's cryptography.

Comparison of Bitcoin's new circulating supply and institutional demand in 2025, source: ARK Investment Management LLC and 21Shares

In the fourth quarter, Morgan Stanley and Vanguard successively incorporated Bitcoin into their investment platforms:

- Morgan Stanley opened compliant Bitcoin products to clients, including spot ETFs;

- Vanguard, which had long rejected cryptocurrencies and commodities, has now also accessed third-party Bitcoin ETFs.

As ETFs mature, they will increasingly serve as a structural bridge between the Bitcoin market and traditional capital.

Corporate Treasury Accumulation

Corporate adoption of Bitcoin has expanded from a few early participants to a broader range. The S&P 500 and Nasdaq 100 have included stocks from companies like Coinbase and Block, allowing mainstream portfolios to indirectly allocate Bitcoin.

Strategy (formerly MicroStrategy), as a representative of digital asset treasuries, has built a substantial Bitcoin holding that accounts for 3.5% of the total supply. By the end of January 2026, various Bitcoin DAT companies collectively held over 1.1 million BTC, accounting for 5.7% of the total supply, worth approximately $89.9 billion, with a focus on long-term holders.

Sovereign Institutions and Strategic Holdings

In 2025, after El Salvador, the Trump administration established the United States Strategic Bitcoin Reserve (SBR) using confiscated Bitcoins. Currently, this reserve holds about 325,437 BTC, accounting for 1.6% of the total supply, valued at $25.6 billion.

Bitcoin vs. Gold: Comparison of Value Storage Assets

Gold Leads, Bitcoin Follows?

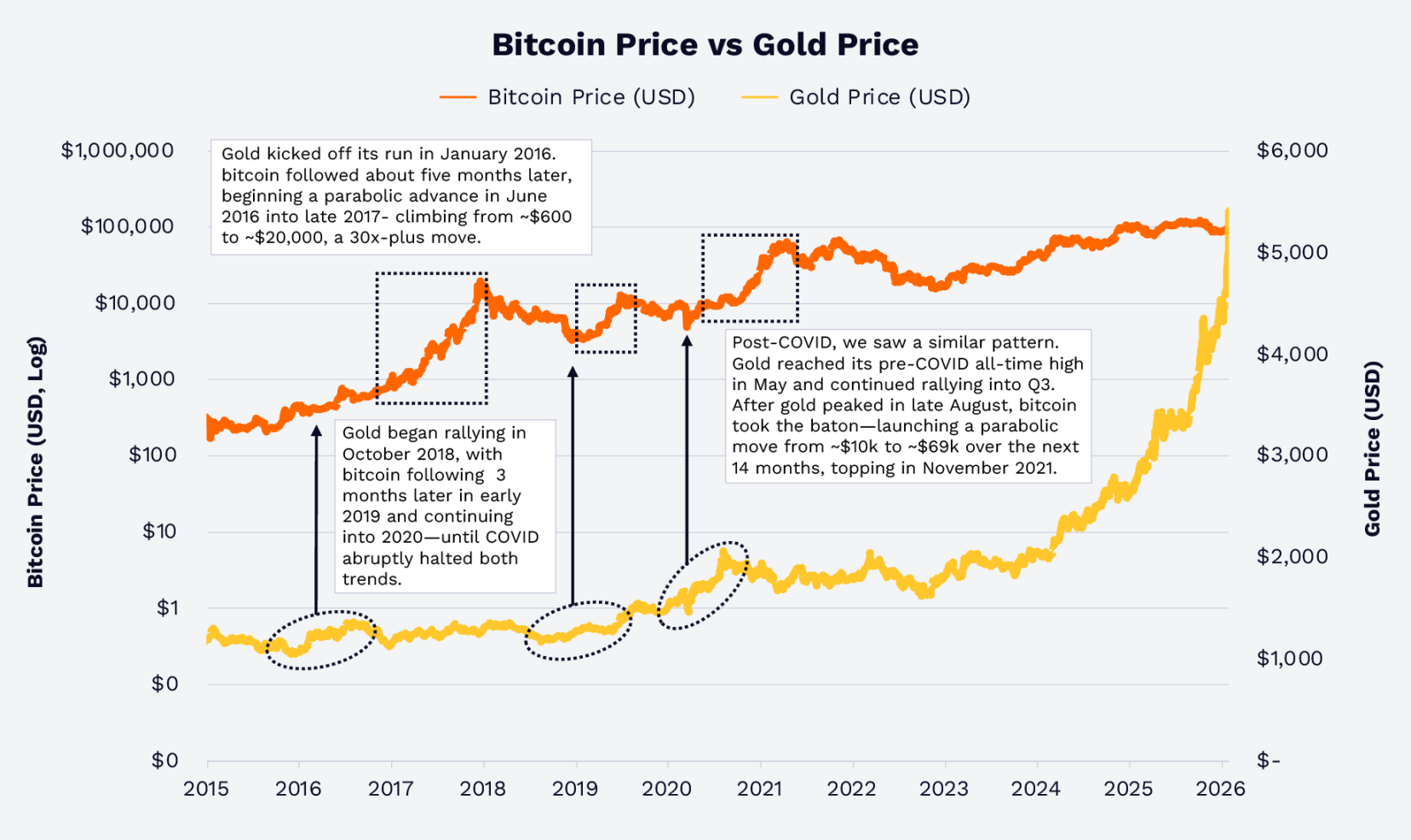

In recent years, gold and Bitcoin have reacted differently to macro narratives such as currency depreciation, real negative interest rates, and geopolitical risks. In 2025, driven by concerns over inflation, fiat currency depreciation, and geopolitical risks, gold prices surged by 64.7%, while Bitcoin prices instead fell by 6.2%, showing a significant divergence.

This is not the first time in history:

- In 2016 and 2019, gold prices rose ahead of Bitcoin;

- After the initial pandemic shock in early 2020, gold prices rebounded first, followed by a significant rise in Bitcoin amidst explosive fiscal and monetary liquidity.

Historically, Bitcoin is a high beta, native digital macro asset similar to gold.

Comparison of Bitcoin and gold prices, source: ARK Investment Management LLC and 21Shares

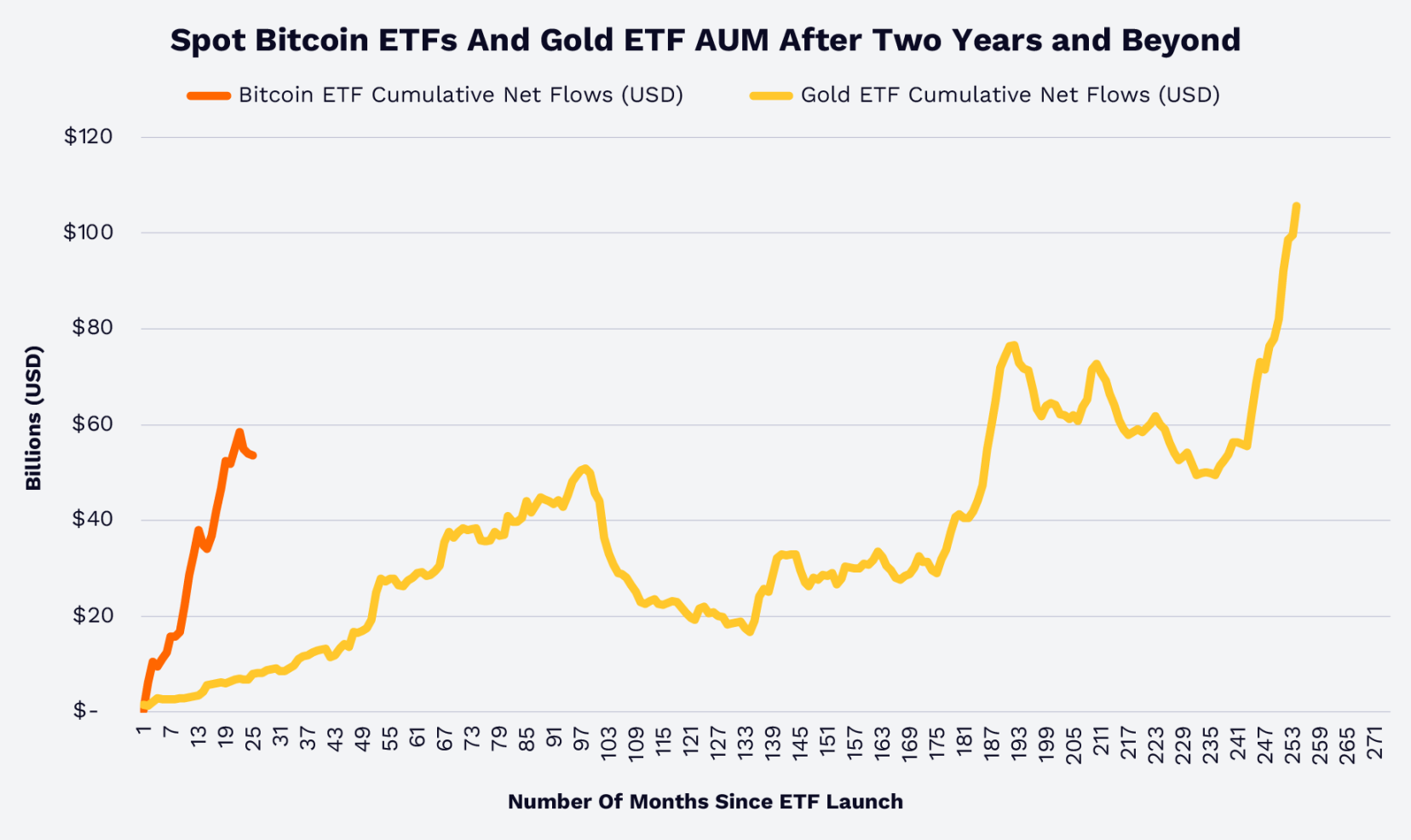

ETF Scale: Bitcoin Growth Far Exceeds Gold

Looking at cumulative ETF fund flows, spot Bitcoin ETFs have completed a journey in less than two years that took gold ETFs over 15 years. This indicates that financial advisors, institutions, and retail investors seem to recognize Bitcoin's role as a means of value storage, diversification investment tool, and a new asset class.

Changes in asset management scale of spot Bitcoin ETFs and gold ETFs, source: ARK Investment Management LLC and 21Shares

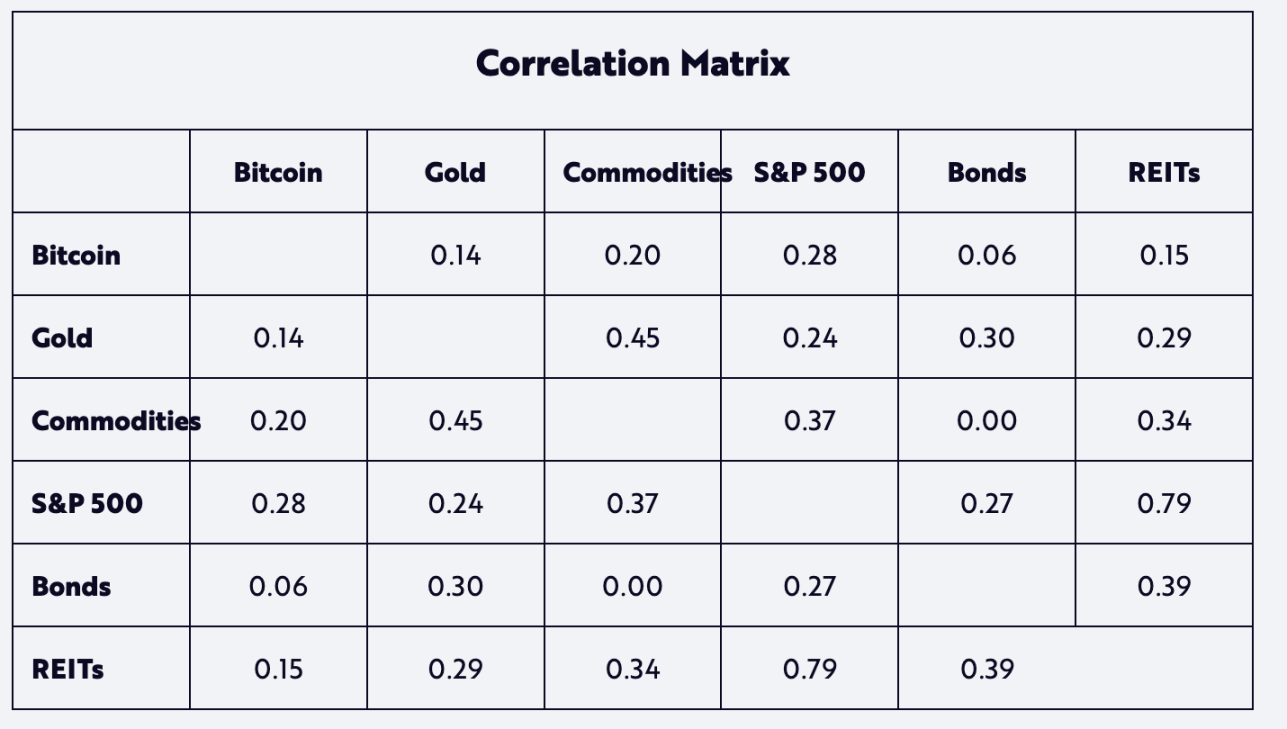

It is noteworthy that the correlation of returns between Bitcoin and gold remains very low in the market cycle from 2020 to the present. However, gold may still serve as a leading indicator for Bitcoin.

Correlation matrix of mainstream assets

Market Structure and Investor Behavior

Drawdowns, Volatility, and Market Maturity

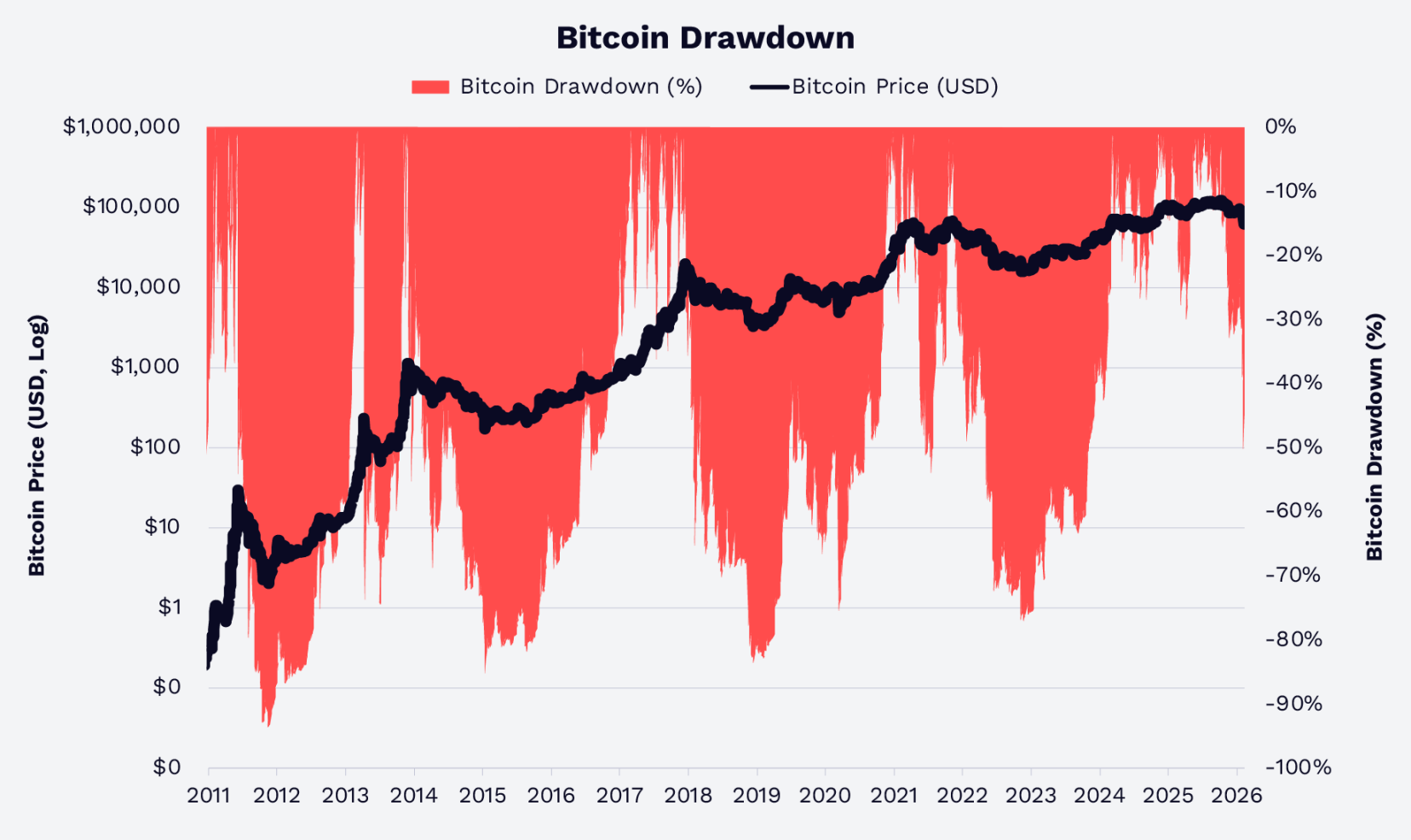

Bitcoin is highly volatile, yet its drawdown magnitude is gradually narrowing. In previous cycles, the decline from peak to trough often exceeded 70% to 80%. However, in the current cycle since 2022, as of February 8, 2026, the Bitcoin price has never dropped more than approximately 50% from its historical high (as shown in the figure below), indicating increasing market participation and more abundant liquidity.

Long-term Holding Over Timing

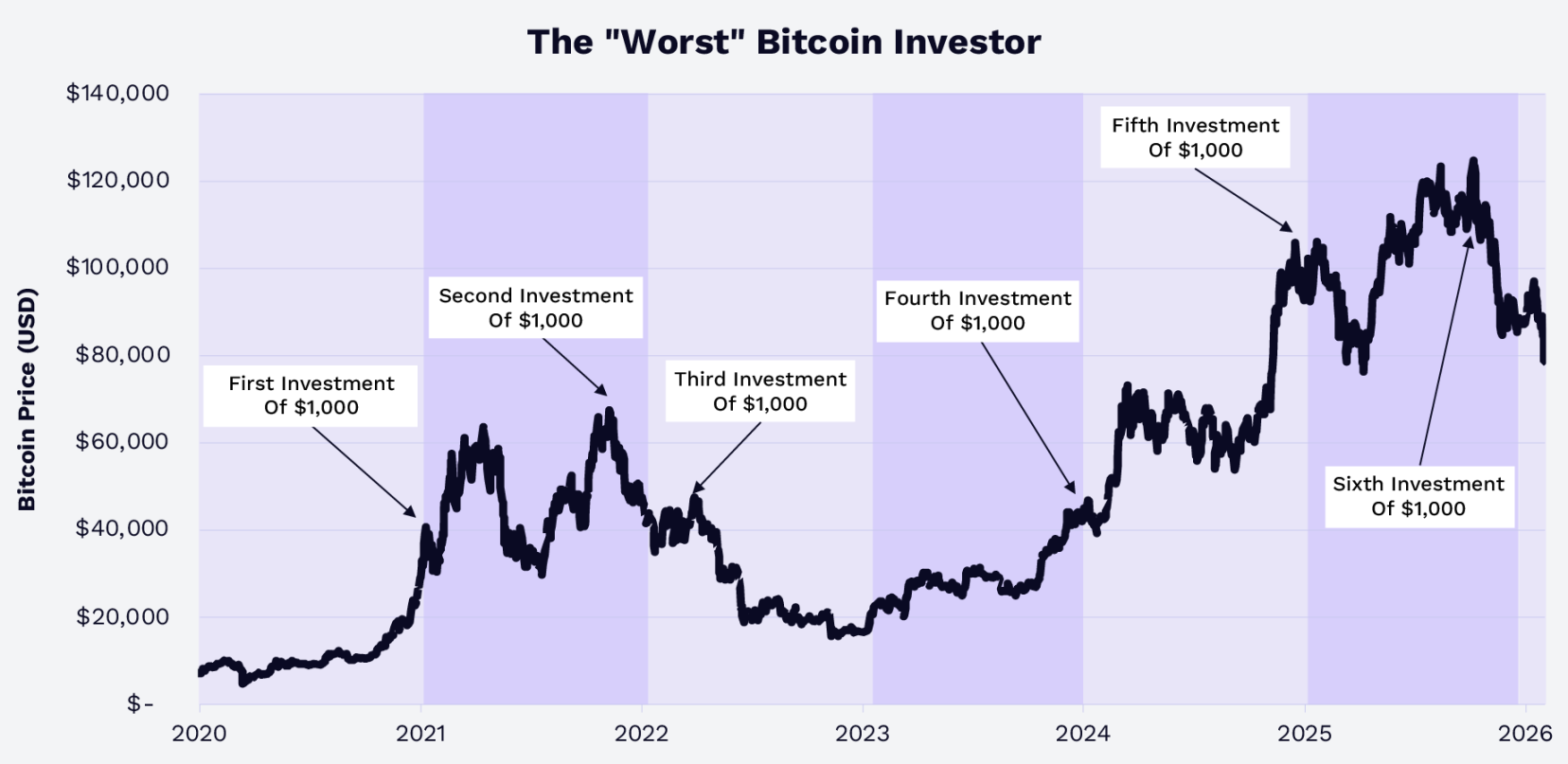

Data from Glassnode shows that from 2020 to 2025, even the "worst investors," who buy $1,000 at the peak each year, will see their $6,000 principal grow to approximately $9,660 by the end of 2025, with a return of about 61%; by the end of January 2026, there is still about a 45% return; even after experiencing an adjustment in early February, there is still about a 29% return by February 8.

The conclusion is clear: since 2020, holding period and position management are far more important than timing.

Bitcoin's Current Strategic Proposition

By 2026, Bitcoin's core narrative is no longer "Can it survive?" but rather "What role does it play in a diversified portfolio?" Bitcoin is:

- A scarce non-sovereign asset in the global monetary policy, fiscal deficit, and trade friction environment;

- A high beta extension of traditional value storage assets such as gold;

- A globally liquid macro asset that can be accessed through compliant instruments.

Long-term holders such as ETFs, corporate treasuries, and sovereign institutions have absorbed a significant amount of new Bitcoin, and the improvement of regulation and infrastructure has further opened participation channels. Historical data shows that Bitcoin has low correlation with other assets like gold, combined with the current cycle's decreasing volatility and drawdown, allocating Bitcoin is expected to enhance the risk-adjusted returns of investment portfolios.

We believe that the question facing investors in 2026 is no longer "Should we allocate?" but rather "How much to allocate, and through what tools to allocate?"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。