Original authors: Bao Yilong, Zhang Yaqi, Li Jia

Original source: Wall Street Insights

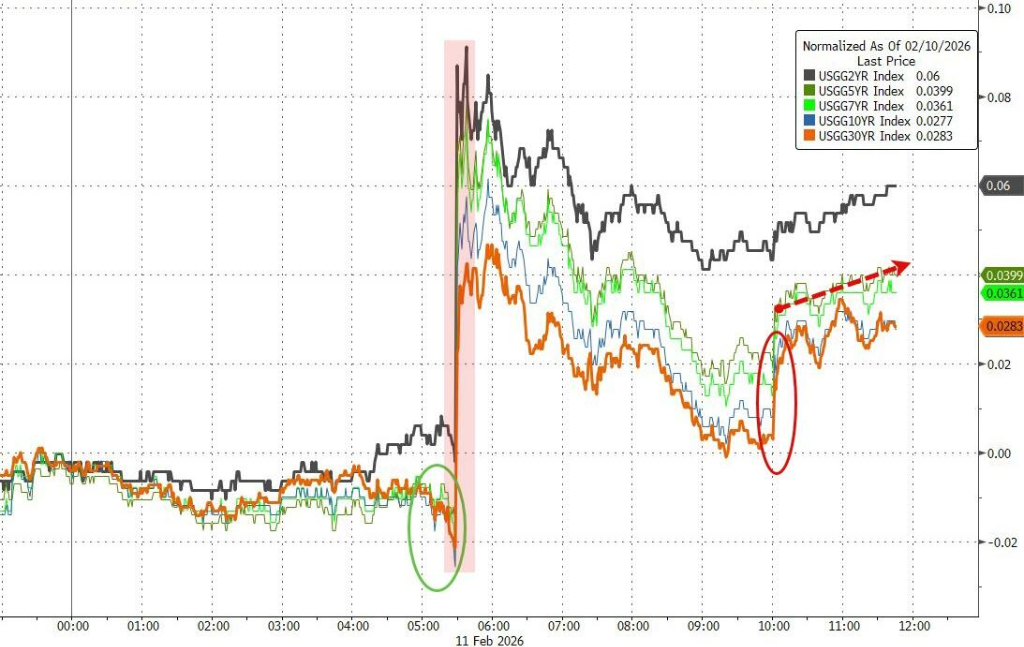

The better-than-expected U.S. January employment report quickly extinguished the market's hopes for the Federal Reserve to cut interest rates early, leading traders to delay expectations for the first rate cut from June to July, putting pressure on U.S. Treasury prices. U.S. stock indices initially spiked after the data was released but later retraced gains due to weakness in technology stocks.

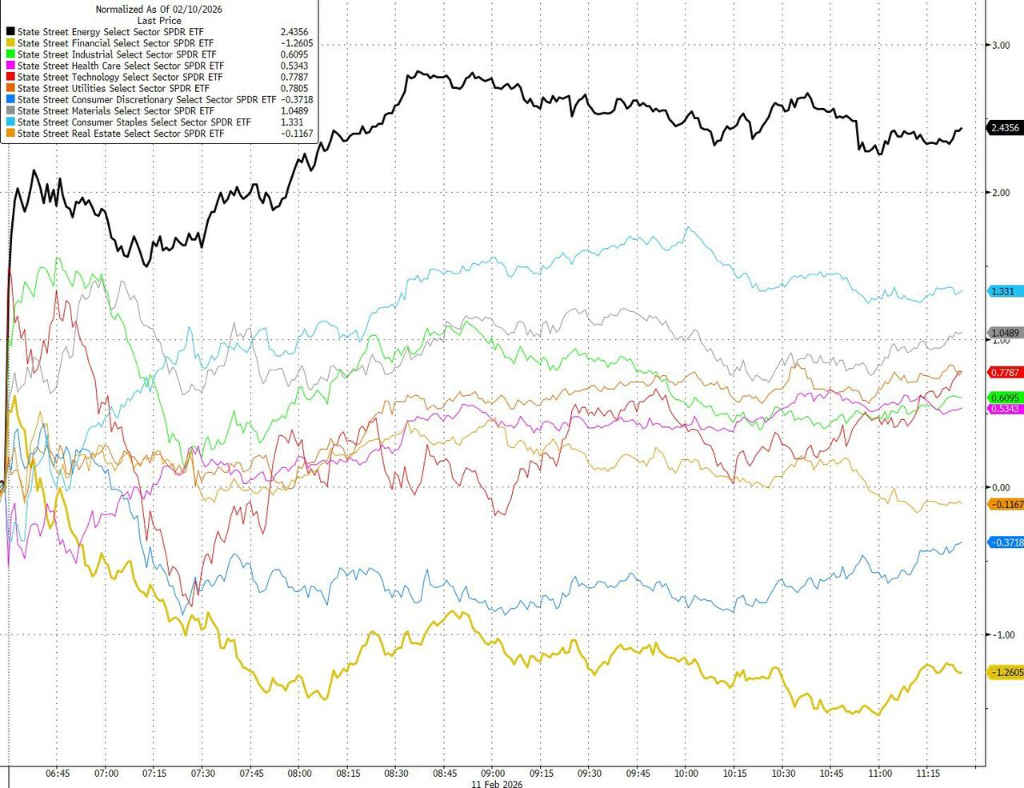

On Wednesday, the S&P was basically flat, and the Dow and Nasdaq closed slightly lower. Notably, the equal-weighted S&P index rose by 0.2%, with nearly 300 stocks advancing. The "old economy" sectors such as energy, materials, and consumer staples performed relatively well. Funds continue to shift from high-valuation growth stocks to the "real economy" and hard assets.

According to Wall Street Insights, the U.S. added 130,000 non-farm jobs in January, far exceeding the market expectation of 65,000, and the unemployment rate unexpectedly dropped to 4.3%. Although employment data from the previous year was significantly revised downward, the rebound in January was enough to break the narrative that "the labor market is quickly weakening."

After the data was released, expectations for rate cuts significantly decreased. The swap market pushed back the timing of the next rate cut from June to July, with the probability of a rate cut in March almost completely eliminated. CME data shows the probability of the Federal Reserve staying put in March rose to over 94%.

Weakness in large technology stocks dragged down the overall performance of U.S. stocks. Traditional economic sectors, including energy, consumer staples, and materials, outperformed other sectors.

Kevin O'Neil of Brandywine Global stated:

While job growth remains concentrated in the healthcare sector, the manufacturing sector has returned to positive growth, showing encouraging signs of improvement.

Mike Reid of Royal Bank of Canada Capital Markets remarked:

The January employment report shows the U.S. labor market continues to improve. Looking ahead, this report reinforces our previous view that the Federal Reserve will pause rate hikes long-term until 2026.

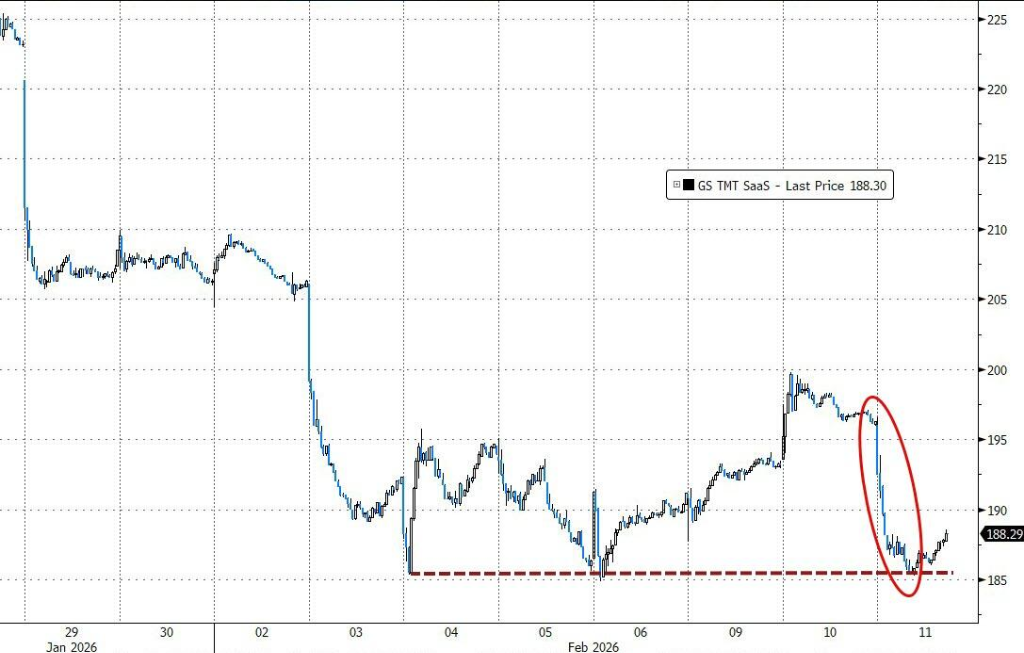

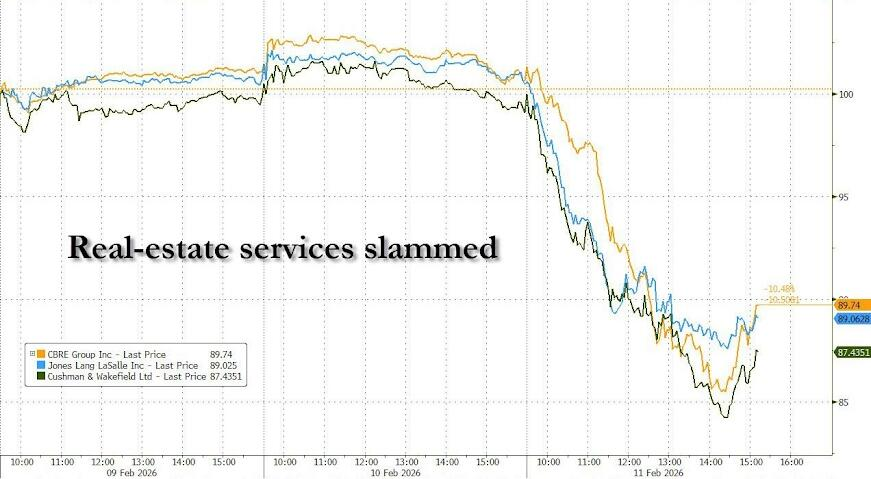

Concerns about AI disruption continue to brew, first hitting software, then private credit, insurance brokerage, and brokerage firms, and now spreading to real estate services and financial intermediaries. Software stock ETFs fell by 2.6%.

(SaaS stocks fell, analysts believe the rebound in software stocks has ended)

(SaaS stocks fell, analysts believe the rebound in software stocks has ended)

Real estate service stocks were sold off, with CBRE Group and Jones Lang LaSalle dropping 12%.

(Real estate service stocks plunged)

(Real estate service stocks plunged)

The Philadelphia Semiconductor Index rose by 2.3%, continuing to attract investor interest. Micron surged nearly 10% on expectations of HBM4 capacity release, and the market placed bets again on the certainty of the AI infrastructure chain. Robinhood fell nearly 9% as its results fell short of expectations, reflecting a cooling off in retail trading enthusiasm.

(The semiconductor sector rose)

(The semiconductor sector rose)

Bond market fluctuations were also significant. Before the non-farm report was released, long-term U.S. Treasury yields fell but quickly rebounded following the data. The 2-year Treasury yield, sensitive to policy changes, rose by 6.4 basis points, while the 10-year yield increased by about 3 basis points.

(U.S. stock benchmark indices intraday movements)

(U.S. stock benchmark indices intraday movements)

Amid strong employment data and hawkish expectations for the Federal Reserve, the dollar index fluctuated significantly during the day and slightly rose by 0.08% at the close. The yen rose for the third consecutive day, appreciating over 1% at one point. Under the pressure of "higher for longer" interest rate expectations, cryptocurrencies remained weak.

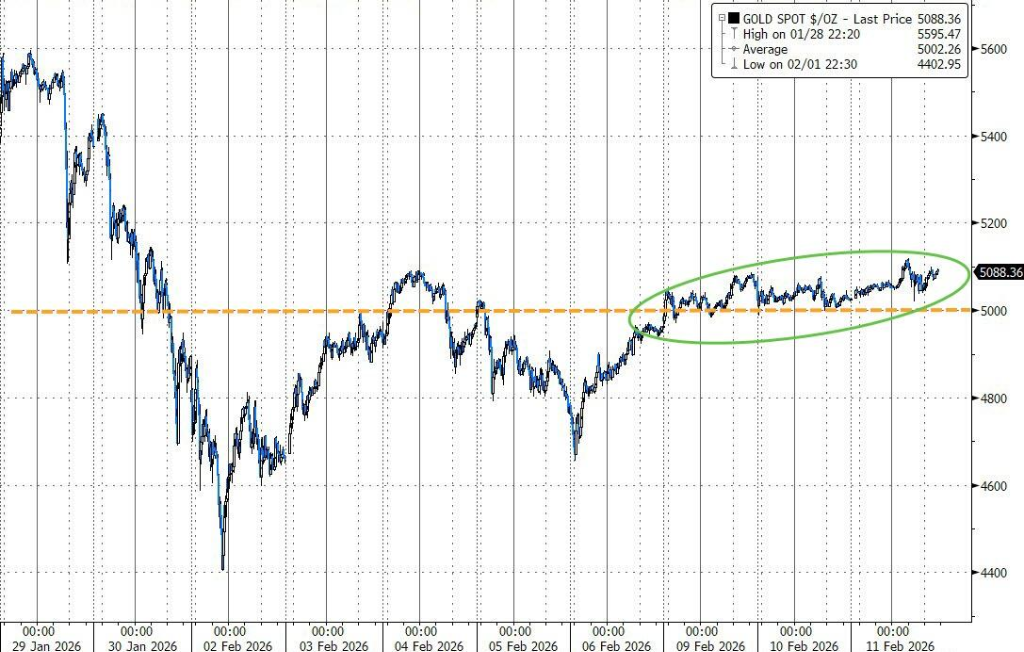

Spot gold rose 1.3%, remaining above $5080. Silver edged higher before falling back, still up over 4%.

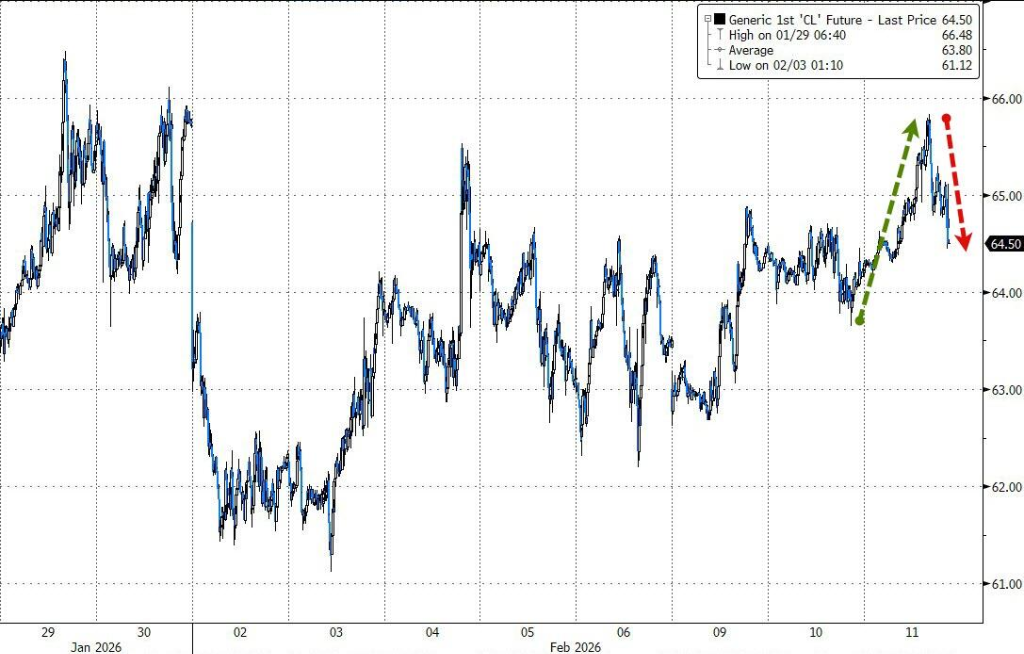

Wall Street Insights mentioned that reports suggest Trump is privately considering withdrawing from the USMCA, leading to a rise of over 2% in oil prices during the day. However, a significant increase in oil inventory and a rebound in U.S. production caused the oil price increase to narrow to 1%.

On Wednesday, the three major U.S. stock indices spiked and then fell back, the S&P remained basically flat, and the Dow and Nasdaq closed slightly lower. Concerns about AI disruption continue to brew, with software stock ETFs falling 2.6%, and real estate service stocks also sold off due to AI concerns, with CBRE Group and Jones Lang LaSalle plummeting 12%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。