I know many friends have been confused. Now that the price of $BTC is so low, is it the whales selling off?

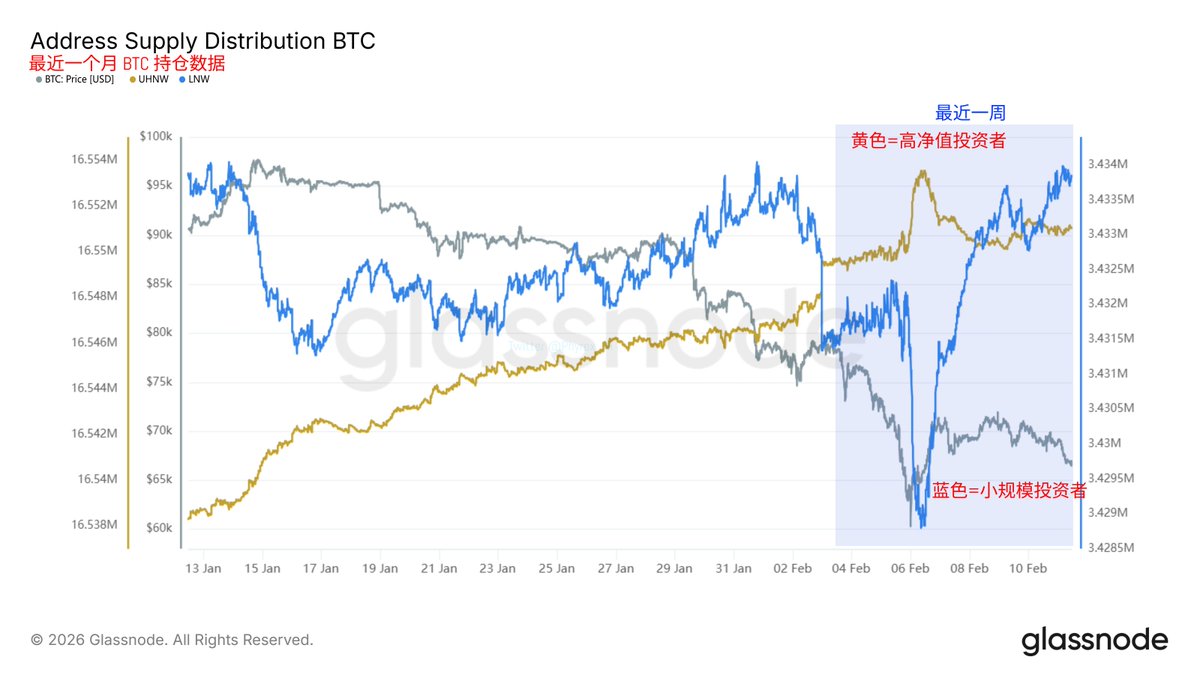

In fact, from the data I see, whether it’s high-net-worth investors holding more than 10 Bitcoin or small-scale investors holding less than 10, they have been trending towards buying recently, especially the small-scale investors who are currently the most active in bottom-fishing.

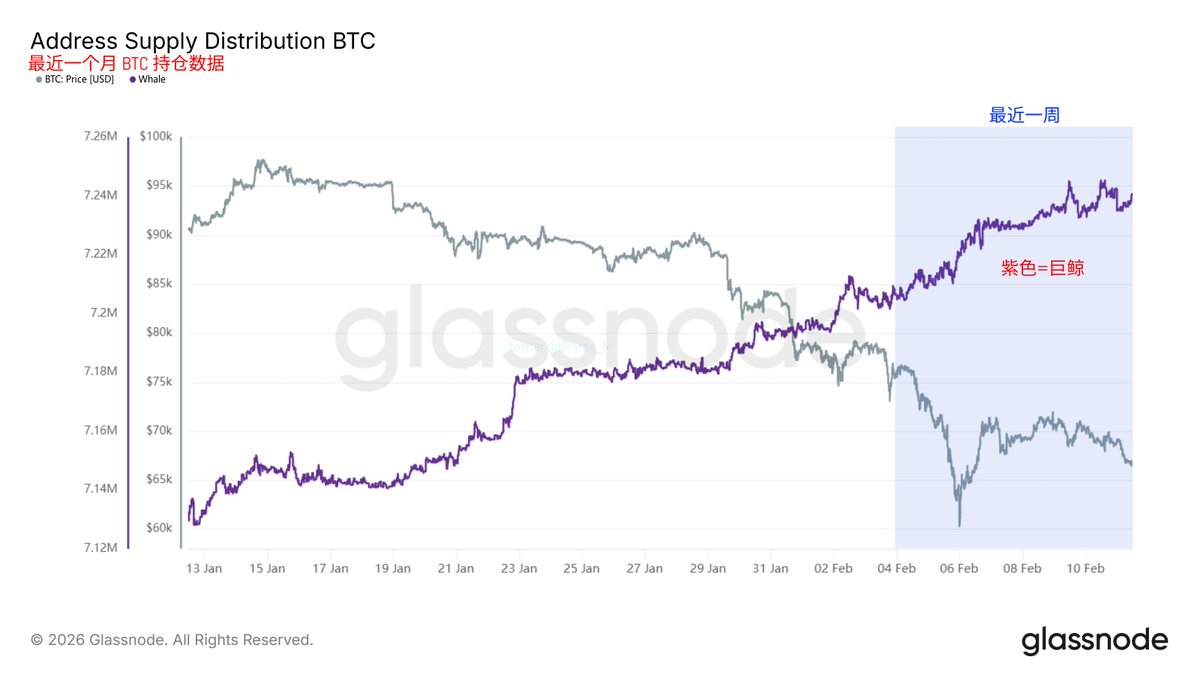

As for the whales, those holding more than 1,000 BTC, their holdings have not only remained stable over the past month but have actually increased. Moreover, the overall amounts held on exchanges have also decreased recently, indicating that the increase in whales is not due to wallets on exchanges accumulating more incoming Bitcoin.

I can understand that friends may have doubts. Since everyone is buying, why is the price of BTC still falling?

My view is:

1. The increase in on-chain holdings only indicates a transfer of chips and does not represent a net buying in the current moment. At the same time, there are still sell orders in the market, which do not need to be very large; they only need to appear during times of low liquidity to push the price down.

2. The price is often determined not by spot trades but by the passive liquidation of derivatives. During a downturn, what is most common in the market is not that short sellers actively sell off but rather that position structures force people to sell.

For example, high-leverage longs are forced to reduce positions, futures basis arbitrage positions are closed, or negative Gamma from market makers or structured products triggers further selling as prices drop. These all belong to non-opinion-based sell orders.

3. What we see as high-net-worth individuals, whales, or even retail investors accumulating positions often involves distributed purchasing, whereas the sell pressure in the market may be concentrated and released within a single day. When depth is insufficient, this can easily break through support.

In simpler terms, buying is very dispersed, while selling is concentrated, resulting in everyone buying yet the price still falling.

Therefore, I prefer to understand the current decline not as whales selling off, but as the market rotating through deleveraging, risk reduction, and liquidity replacement. Bitcoin is transitioning to more committed investors, but before this rotation is completed, the price will be dominated by derivatives and liquidity, rather than by faith.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。