Recently, the daily homework has been difficult to write. Today's sharp decline in the market shows that some information predicts that Friday's CPI data will be very poor, exceeding the previous value and expectations. Even JPMorgan has made a prediction, believing that the monthly inflation rate will rise by 0.4%. Given the favorable non-farm data for the economy, inflation should be the data that everyone is most concerned about, and a monthly increase of 0.4% likely means that the broad CPI will also rise. Therefore, today's decline may be an act of risk aversion by investors.

This means that if next Friday's CPI data is indeed very poor, the decline may continue, and after Friday, it will be the Chinese New Year (the stock markets in China, South Korea, Vietnam, Taiwan, and Hong Kong will be closed), which is also a three-day long weekend in the United States. The market's liquidity will definitely be extremely low, and if something unusual occurs at that time, we would really need to call for help.

However, I believe short-term data is not sufficient to determine the Federal Reserve's monetary policy going forward. Trump does not need another Powell; the long-chosen Waller could surprise us or give Trump a shock, but we won't know until June. Before that, it may be very difficult, and yes, there is also Trump's tariffs in between.

Looking at the data for Bitcoin, the turnover rate continues to rise, and investor sentiment is still being tested. However, from the data of $BTC moving to exchanges, the new selling pressure isn't significant, but the exchange inventory is increasing, indicating that purchasing power is declining. From sentiment to capital flow, it really shows characteristics of entering a bear market.

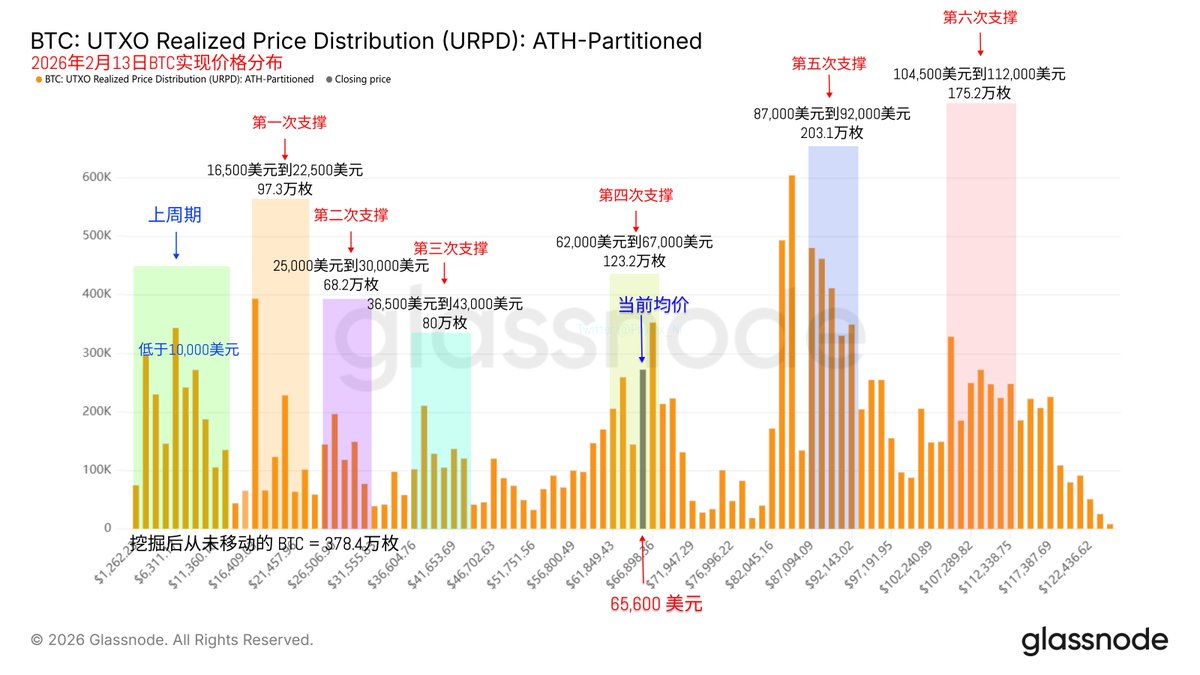

However, URPD data shows that the chip structure is still quite healthy, with early investors and those who are at a loss at high levels not experiencing significant changes. The sentiment of most investors remains stable, but due to a shortage of purchasing power and gaps in liquidity, even a small amount of selling cannot be absorbed by the market.

Let's see Friday's CPI.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。