Written by: Deep Tide TechFlow

On February 10, LayerZero launched Zero in New York.

This is a self-developed Layer 1 public blockchain aimed at carrying transactions and settlements for institutional-level financial markets.

LayerZero calls it a "decentralized multi-core world computer." Let me translate that for you: a chain specifically for Wall Street.

At the same time, various institutions on Wall Street have started publicly backing it, with some responding by directly investing money.

Among them, Citadel Securities strategically invested in the ZRO token.

This company handles about one-third of retail stock orders in the United States; CoinDesk specifically pointed out in its report on this matter that directly buying crypto tokens is not a routine operation for traditional financial institutions like Citadel.

ARK Invest also purchased equity and tokens in LayerZero, with Cathie Wood directly joining the project's advisory committee; Tether announced a strategic investment in LayerZero Labs on the same day, but the amount was not disclosed.

Apart from buying tokens and investing in equity, there is a quieter signal underneath.

DTCC (the central clearinghouse for U.S. stock trading), ICE (the parent company of the New York Stock Exchange), and Google Cloud have also signed a joint exploration agreement with LayerZero.

So, a project that is transitioning from a cross-chain bridge to a platform has simultaneously secured endorsements from a collective across the entire industrial chain of clearing, exchanges, market making, asset management, stablecoins, and cloud computing.

Traditional institutions are expanding their foothold in on-chain financial pipelines.

After the news was announced, ZRO increased by more than 20% on the same day and is currently around $2.3.

No longer a bridge, but a pipeline?

What LayerZero has been doing for the past three years is not complicated:

Moving tokens from one chain to another. Its cross-chain protocol currently connects more than 165 blockchains, and USDt0 (the cross-chain version of the Tether stablecoin) has processed more than $70 billion in cross-chain transfers in less than a year since its launch.

This is a mature business, but the ceiling is visible.

Cross-chain bridges are essentially tools; users will use whichever is cheaper and faster. However, with the contraction of the entire crypto market and the decline in trading volume, the cross-chain essentially has become a pseudo-demand, making LayerZero's choice to change tracks understandable.

Moreover, it has the capital to change. a16z and Sequoia have invested in the project, with total funding exceeding $300 million, and it was once valued at $3 billion.

The list of these two capitals' investments is essentially Wall Street's contact list. The fact that Citadel and DTCC are now willing to sit at the table and support LayerZero may be largely related to who is standing behind it.

Returning to the new L1 launched by LayerZero, Zero, it seems not to be prepared for DeFi players or meme traders.

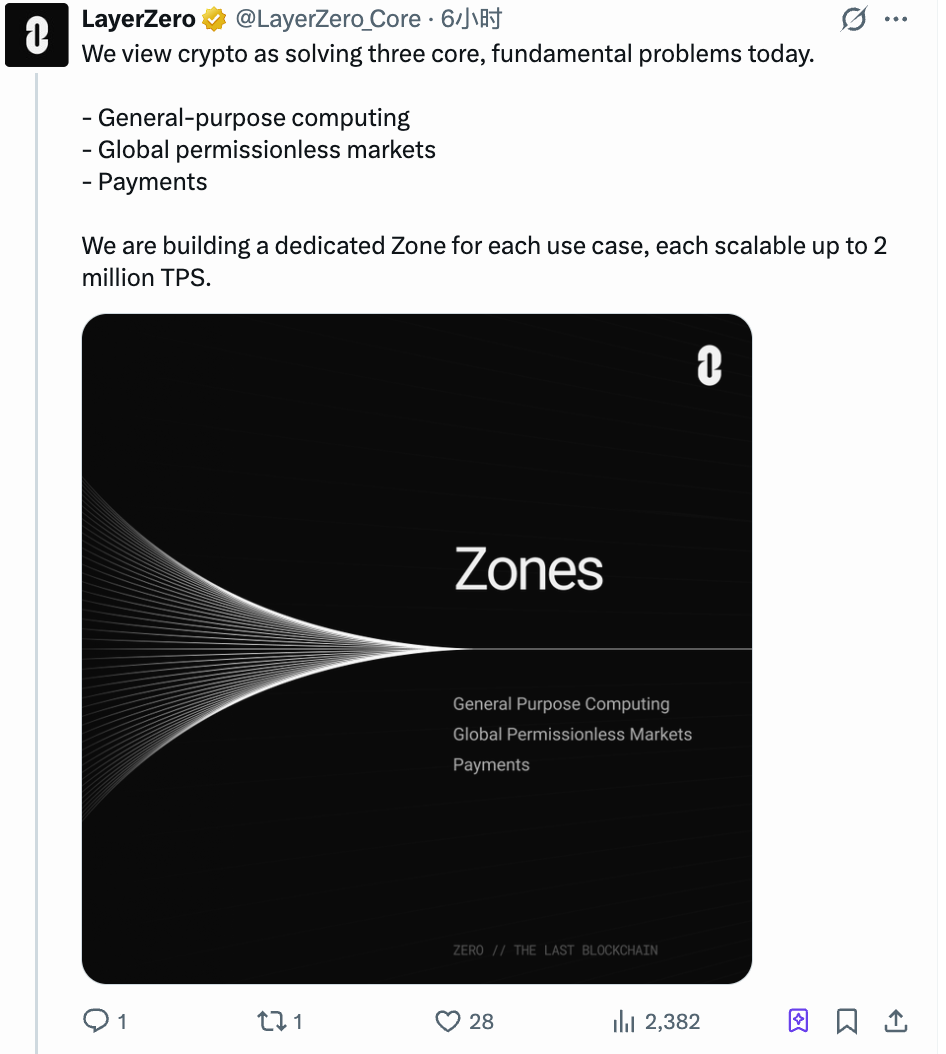

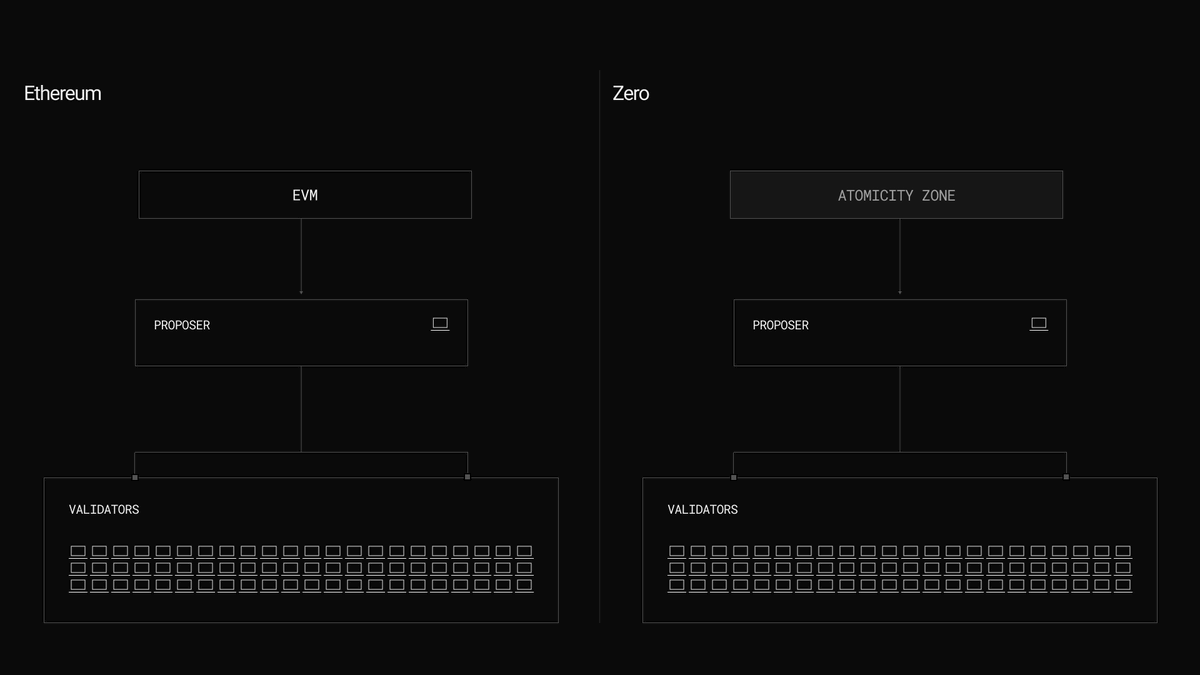

The architecture of Zero is somewhat different from existing public chains. Most chains run all vehicles on one road, but Zero has broken the chain into multiple independently operating zones, which LayerZero calls Zones.

Each Zone can be individually optimized for different scenarios without interfering with each other.

Three Zones were launched at the outset: a general environment compatible with Ethereum smart contracts, a privacy payment system, and a dedicated trading matching environment.

These three Zones cater to three types of clients.

The general EVM environment retains existing crypto developers, with low migration costs. The privacy payment addresses longstanding institutional issues: trading on Ethereum allows counterparties to see your positions and strategies, making large funds reluctant to expose themselves.

The trading-specific Zone has a more direct target, responsible for solving matching and settlement after the tokenization of securities.

Looking back at the client list helps to understand this. DTCC clears securities trading worth hundreds of trillions of dollars annually, and it wants to know if clearing can be faster. ICE operates the NYSE, which only opens during weekdays, and it wants to test 24/7 trading. Citadel handles massive order flows, and every step faster in the post-trade process translates to money.

So when viewed together, these are not demands of the crypto industry; they are the pain points of Wall Street itself.

LayerZero CEO, Bryan Pellegrino, stated quite straightforwardly in a public interview:

"It's not that existing things aren't good enough; it’s that there are scenarios that truly require 2 million transactions per second, belonging to the future global economy."

By the way, the new chain Zero claims it can achieve 2 million TPS in the testing environment, and it can indeed meet the production-level needs of traditional finance. However, the performance narrative of public chains has long been played out, and whatever high performance one might achieve, the author feels it is not surprising.

The story can remain unchanged, but the audience for the narrative can change once, and this time it's the old money.

Wall Street wants to move trading on-chain, but Ethereum can't handle it

The influx of institutions into LayerZero isn't driven by a crypto bull market; it's Wall Street pushing for tokenization.

BlackRock's BUIDL fund issued over $500 million on Ethereum last year. JPMorgan's Onyx platform runs on Ethereum technology and has already handled trillion-level repurchase transactions.

Wall Street has done proof of concept using Ethereum and demonstrated the feasibility of tokenization. The next step is to find a place that can handle production loads.

The three Zones of Zero are aimed at this gap. EVM compatibility means assets and contracts from Ethereum can migrate over.

This may represent the true schism between LayerZero and Ethereum.

Ethereum is currently using standards like ERC-8004 to vie for defining rights, issuing on-chain identities for AI agents and establishing rules for the future on-chain economy...

LayerZero's current move is to disregard definitions, directly build pipelines, and tell institutions that their trades can operate here.

One is writing the rulebook; the other is laying water pipes. The bets are different.

Ethereum is betting on its irreplaceability as the layer of trust, with a strong TVL scale, security audit ecosystem, and institutional recognition as its foundation. LayerZero is betting on the demand for an execution layer's replacement: Wall Street needs speed, privacy, and throughput, and whoever provides it first will be used.

Whether these two paths will intersect in the end is currently uncertain. However, the flow of capital has already provided directional signals.

What does it mean for $ZRO?

The previous positioning of ZRO was straightforward: the governance token of the LayerZero cross-chain protocol. The total supply is 1 billion, used for voting and staking, and nothing more.

After the launch of Zero, the narrative for this token has changed.

ZRO is the native token of the Zero chain, anchoring network governance and security. If Zero truly becomes institutional-level financial infrastructure, the valuation logic for ZRO will no longer be "how much transaction volume the cross-chain bridge has," but rather "how many assets are running on this chain."

These two valuation anchors are well understood; the ceiling differs by several orders of magnitude. However, despite the narrative, several hard variables will determine ZRO’s future movements.

Supply side: 80% of tokens are still locked.

Currently, about 200 million ZRO are in circulation, making up just over 20% of the total supply. According to CoinGecko data, approximately 25.71 million ZRO will unlock on February 20, valued at around $50 million, accounting for 2.6% of the total supply, allocated to core contributors and strategic partners. The entire unlocking period extends until 2027.

The unlocking batch on February 20 will be the first supply shock after the announcement; whether the market can absorb it will be a litmus test for short-term sentiment.

Demand side: the fee switch hasn't been turned on yet.

Currently, ZRO has no direct value capture mechanism. There was one governance vote last December proposing to charge a fee for each cross-chain message, with revenue used to buy back and burn ZRO, but it failed due to insufficient voting turnout. The next vote is set for this June.

If it passes, ZRO will have a burning mechanism similar to ETH, with each transaction reducing circulation. If it fails again, the token's "governance power" will only consist of voting rights, without cash flow support.

Considering all the factors, players interested in ZRO can keep an eye on three time points:

1. June, the second vote on the fee switch. Whether it passes will directly determine if there is internal demand for ZRO.

2. This fall, the mainnet of Zero will launch.

3. Until 2027, the ZRO token will not be fully unlocked. Before then, each round of unlocking will be a pressure, combined with the current bear market in crypto; favorable news may not necessarily lift ZRO's price.

Lastly, LayerZero refers to Zero as a "decentralized multi-core world computer," which clearly draws a comparison with Ethereum’s world computer concept, attempting to play a more significant role at the settlement layer, particularly in financial settlements, while transitioning and cutting away from the thin narrative of cross-chain bridges.

However, the official statements from several partners are worth pondering.

Citadel describes its involvement as "evaluating how the architecture supports high-throughput workflows"; DTCC talks about "exploring scalability in tokenization and collateral management."

To translate that: we think this thing might be useful, but we haven't decided yet.

Wall Street's money is smart, so smart that they will simultaneously place many small bets to see which one comes through first. Therefore, when a project attracts a consolidation of various star institutions, it does not necessarily mean a complete strong binding; it resembles more of a short-term favorable catalyst.

What LayerZero has obtained may be a ticket to enter, or it may just be an interview opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。