Source: Jin Shi Data

On Wall Street, the growing fear of artificial intelligence is heavily impacting the stock prices of companies that could become its targets for disruption, affecting both small software firms and large wealth management companies alike.

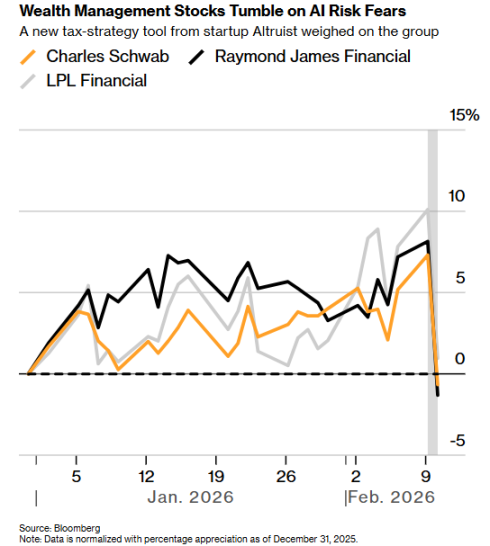

The latest round of sell-offs erupted on Tuesday when a little-known startup, Altruist Corp., launched a tax strategy tool that led to a drop of 7% or more in the stock prices of Charles Schwab Corp., Raymond James Financial Inc., and LPL Financial Holdings Inc.

This is one of the most severe declines for some of these stocks since the market crash triggered by the trade war last April. But this is just the latest example of the "sell first, ask questions later" mentality—one that is rapidly gaining dominance as hundreds of billions invested in AI start to convert into commercial products, raising concerns about AI potentially disrupting entire industries.

"Any company that poses a potential disruption risk is being indiscriminately sold off," said John Belton, a fund manager at Gabelli Funds.

For the past few years, advances in AI technology have been at the forefront of Wall Street, with tech stocks leading the charge. As this rally pushed stock prices to record highs, questions have lingered over whether this represents an impending bubble or whether it could usher in a productivity boom that reshapes American businesses.

However, since the beginning of last week, the release of a series of AI products has triggered a noticeable market shift. Investors are no longer focused on picking winners but are quickly trying to avoid holding any companies that face even the slightest risk of being replaced.

"I don’t know what’s going to happen next," said Will Rhind, CEO of Graniteshares Advisors.

"Last year’s narrative was that we all believed in AI—but we were looking for use cases, and now as we continually discover seemingly stronger and more compelling use cases, it’s leading to disruption."

For some time, the software industry has been troubled by concerns over AI. Last week, when a new tool from Anthropic PBC caused significant drops in stocks across industries such as software, financial services, asset management, and legal services, these concerns began to spread more broadly to other sectors.

The same fears heavily impacted U.S. insurance broker stocks on Monday, following the launch of a new app from online insurance marketplace Insurify that uses ChatGPT to compare auto insurance rates. On Tuesday, wealth management stocks became the next victims, with Altruist’s product Hazel (which helps financial advisors create personalized strategies for clients) dragging down these stocks.

Wealth management stocks plummet due to AI risk concerns

Altruist CEO Jason Wenk said he was surprised by the scale of the market reaction, which wiped billions off the valuations of several investment firms. But he noted that this sent a strong signal about the competitive threat posed by his company.

"People are starting to realize—the architecture we used to build Hazel can replace any job in wealth management," he said in an interview. "These jobs are typically done by entire teams. Now, AI can effectively do this work for just $100 a month."

AI companies like OpenAI and Anthropic have made solid progress in the software engineering space by helping developers streamline and debug coding processes and are entering other industries.

However, many questions remain about how this technology will be adopted. Take the banking sector, for example—it has faced periodic challenges from electronic services and other technologies, but these technologies have ultimately failed to undermine its dominance.

Gabelli's fund manager Belton is one of those skeptical about how Wall Street's fears of an AI bubble have shifted to fears of its impending disruption of most economic sectors.

"Every industry will have winners and losers," Belton said. But he added: "A rule of thumb is that technological disruption often takes longer to play out than expected."

This pullback may also reflect a broader anxiety about the market's significant rise over the past few years, driven by a boom in AI spending and the unusual resilience of the U.S. economy. It's made valuations seem excessive and made investors more sensitive to the prospect of reversals.

"As long as they emit any signals the market considers slightly negative, stocks will drop 10%, something that would never happen in a market that hasn't reached current trading levels," Graniteshares' Rhind said.

For Ross Gerber, CEO of Gerber Kawasaki, the anxiety over AI losers hitting parts of the market over the past week is premature. He said it's too early to pinpoint exactly what the impact will be.

"We can try to infer how AI will change the world in five years, but we just don’t know," he said. "While we are still at the beginning of this infancy stage, the market is trying to make judgments about it."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。