Kyle Samani deleted the tweet that revealed his inner thoughts, but the assertion that "blockchain is essentially just an asset ledger" has left cracks in the hearts of the crypto world. Multicoin Capital co-founder Kyle Samani announced his departure from the company he co-founded against the snowy backdrop of Hokkaido, Japan, marking the end of the most influential narrative era in the crypto industry.

He quietly deleted a tweet: "I once believed in the Web3 vision and dApps, but I no longer believe. Blockchain is essentially just an asset ledger."

1. Exit Declaration: The Collapse of a Narrative Master’s Belief

● Kyle Samani's exit was not sudden but rather a reflection of the gradual fading of idealism in the crypto industry. In early February 2026, Multicoin Capital co-founder Samani posted a brief statement on social media announcing his departure from the top crypto venture capital firm that he co-founded and managed over $5.9 billion in assets.

● In a lengthy article, Samani explained that this was a "bittersweet moment," and he needed time to "explore new technological frontiers." His partner Tushar Jain revealed to limited partners that Samani's interests have expanded from cryptocurrency to emerging technology fields such as AI, longevity technology, and robotics.

● Before announcing his departure, Samani made a shocking statement on social media, which was quickly deleted but captured by keen observers: "Cryptocurrency is not as interesting as many once imagined. I once believed in the Web3 vision and dApps, but I no longer believe. Blockchain is essentially just an asset ledger."

This statement was particularly surprising coming from Samani, as he has been one of the most powerful evangelists in the crypto industry.

● Even more confusing was his contradictory stance. Shortly after announcing his departure, Samani claimed: "I am still super bullish on SOL, super bullish on cryptocurrency." He plans to continue holding a large position in SOL through Forward Industries.

2. Narrative Factory: How Multicoin Defined the Crypto Era

Multicoin Capital is not a traditional venture capital firm but a "thesis-driven investment firm." This unique positioning has made it the most influential narrative factory in the crypto world.

● From its inception, the company clearly articulated three "mega theses," systematically defining concepts such as Web3, DePIN, and data sovereignty, providing the entire industry with a cognitive framework. The most successful narrative among these is undoubtedly DePIN. In 2019, Multicoin began exploring a fundamental question: "Why can blockchain only serve finance? Can it directly transform the infrastructure of the real world?"

● Their proposed solution was to incentivize the construction of physical networks through tokens, converting real-world assets into on-chain production materials. This narrative quickly gained market recognition. The Helium project deployed over 600,000 hotspot nodes within 30 months, directly competing with traditional telecom networks; Hivemapper redefined mapping systems through crowdsourced devices.

By 2025-2026, DePIN had become a standard track for institutions, with a market size estimated to reach tens of billions of dollars.

● Another proposition that Multicoin has long emphasized is data sovereignty. They believe that if Web3 is meaningful, it must manifest at the data layer—individuals must regain control over their identity, privacy, behavioral data, and credit information. Around this direction, Multicoin has invested in numerous privacy computing and encryption protocol projects, including the highly regarded Zama.

3. Golden Era: The Rise of Solana and the FTX Myth

The rise of Multicoin is closely tied to the development of Solana, and both have formed a complex symbiotic relationship with the now-bankrupt cryptocurrency exchange FTX. However, few know that Multicoin's earliest heavy bet was not on Solana, but on EOS.

● In 2017-2018, Multicoin viewed EOS as a "performance killer" and "Ethereum killer," believing its high TPS and low latency characteristics would bring about a new generation of public chain revolution. However, EOS ultimately failed due to governance issues and an empty ecosystem.

● This "faith-level defeat" forced Multicoin to begin cautiously searching for "the next chain that can truly run a financial system." At this time, they turned their attention to Solana.

● A call between Samani and FTX founder SBF is seen as a key turning point in Solana's fate. During a late-night call, they discussed whether Solana could handle transactions at a real scale. SBF did not take Samani's word for it but chose a Wall Street-style verification method—initiating a large number of spam transactions on Solana as a stress test.

● When Solana successfully passed the test, FTX fully entered the market, purchasing large amounts of SOL, investing in Solana ecosystem projects, and providing liquidity. Meanwhile, Multicoin continued to increase its holdings, endorse publicly, and promote research. Almost all early core projects in the Solana ecosystem were closely tied to FTX/Alameda and Multicoin, forming a de facto strategic alliance.

● During this period, Multicoin's investments in Solana yielded astonishing returns. By purchasing SOL at $0.04, $0.20, and $0.23 through three rounds of private placements, this meant a return rate of at least 39,000%.

4. Idealism Retreat: The Confidence Crisis in the Crypto Industry

● Samani's departure is not an isolated event but a concentrated reflection of the confidence crisis in the crypto industry. Just before he announced his resignation, a16z Crypto general partner Arianna Simpson also announced her departure, planning to establish a new fund that is not limited to the crypto field.

● More pointed criticism came from Ken Chan, former co-founder and CTO of Aevo. In November 2025, he published an article bluntly stating that he "wasted 8 years of his life on cryptocurrency" and described the crypto industry as "the largest and most participatory super casino in the world."

● Industry data is equally grim. According to RootData, Multicoin Capital has participated in only 4 investment rounds since the second half of 2025, and only 10 since October 2024. This number not only represents a significant slowdown compared to previous investment frequencies but also lags behind other well-known VCs during the same period.

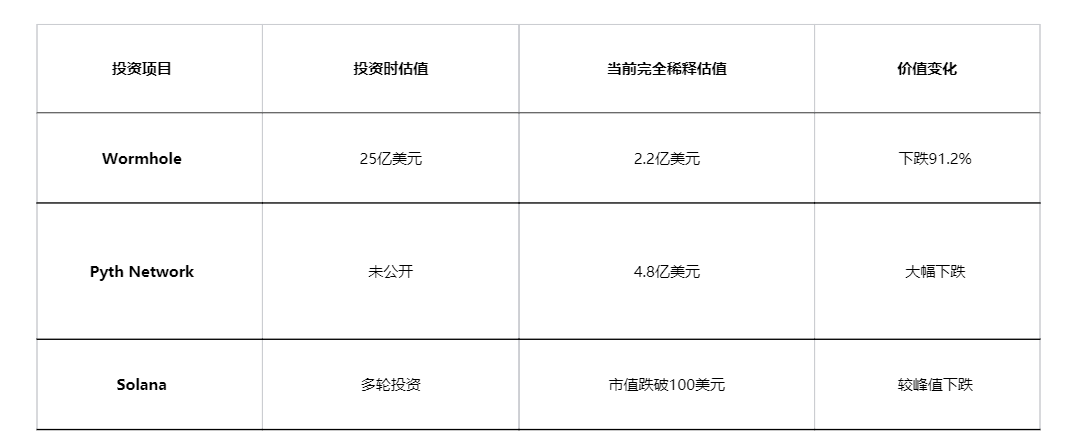

From a market performance perspective, the valuations of several projects that Multicoin heavily invested in over the past few years have significantly shrunk:

5. Value Reassessment: What is Blockchain Really?

● The most jarring point in Samani's exit statement is: "Blockchain is essentially just an asset ledger. It will reshape finance, but that's about it; it won't be much more." This viewpoint has sparked a rethink of the essence of blockchain in the industry.

● Ethereum co-founder Vitalik Buterin also expressed similar self-reflection around the same time: "The progress of L2 entering Stage 2 is much slower and harder than we expected. Meanwhile, L1 itself continues to scale."

● This reassessment is, in fact, a periodic summary of the crypto industry's ten-year development. From the initial vision of a "world computer" to the exploration of various applications such as DeFi, NFT, GameFi, and SocialFi, and now returning to the basic positioning of "asset ledger," the industry seems to be undergoing a cognitive cycle.

● However, even under this basic positioning, blockchain still shows strong potential. Asset tokenization is becoming a new focus for traditional financial institutions, with BlackRock CEO Larry Fink pointing out that tokenization is the future of the financial system.

● Meanwhile, improvements in privacy computing, verifiable computing, and compliance frameworks are driving the crypto industry from mere trading speculation to building decentralized networks with lasting value. Samani himself acknowledged: "DePIN is another noteworthy area." At the same time, he remains confident that the privacy computing project Zama will win in the on-chain privacy/confidentiality space.

6. The Road Ahead: Who is Holding On and the New Directions in the Industry

● Despite facing a confidence crisis, industry leaders hold differing views on the future of Web3. a16z, in its annual report, proposed 17 most exciting ideas for the Web3 industry in 2026, emphasizing that stablecoins will become the infrastructure of internet finance, and AI agents will gain on-chain identity and payment capabilities.

● A report released by HashKey in collaboration with the Hong Kong University of Science and Technology's Digital Finance Lab pointed out that by 2026, AI agents are expected to evolve into on-chain execution entities with autonomous decision-making capabilities, asset tokenization will accelerate, and the infrastructure for stablecoin inflows and outflows will be fully upgraded.

● The signals from the 2026 Davos Forum are also positive: as the U.S. regulatory environment clarifies and global sovereign funds make substantial entries, Web3 is being absorbed as a new generation of global financial infrastructure. More first-line VCs, including Coinbase Ventures, a16z, YZi Labs, and Pantera Capital, remain active, with over 30 investments in the past year.

● For the crypto industry, which is currently in a period of adjustment, the support from these VCs may not immediately bring about new prosperity, but it at least signifies that this round of reassessment has not evolved into a complete exit. Samani's departure marks the end of a narrative-driven era, but it may also open a new phase that is more pragmatic and oriented towards practical application value.

In the conference room of Multicoin Capital's Austin headquarters, the remaining team members are discussing the next investment theme. Outside, the crypto market is as unpredictable as the weather in Texas.

They have a report on their table titled "2026: From Narrative to Practicality." The report begins with: "When the bubble of idealism bursts, the foundation of pragmatism begins to emerge."

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。