The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and reject any market smokescreens!

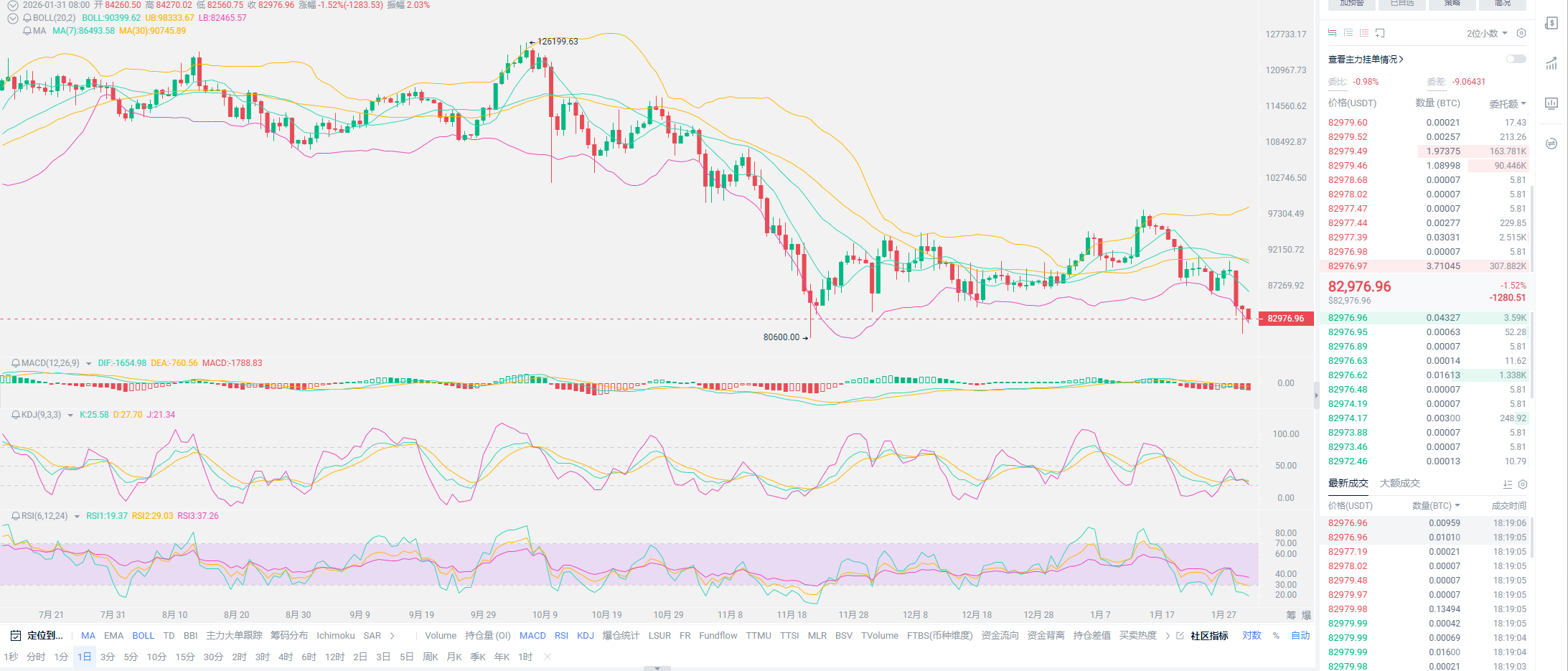

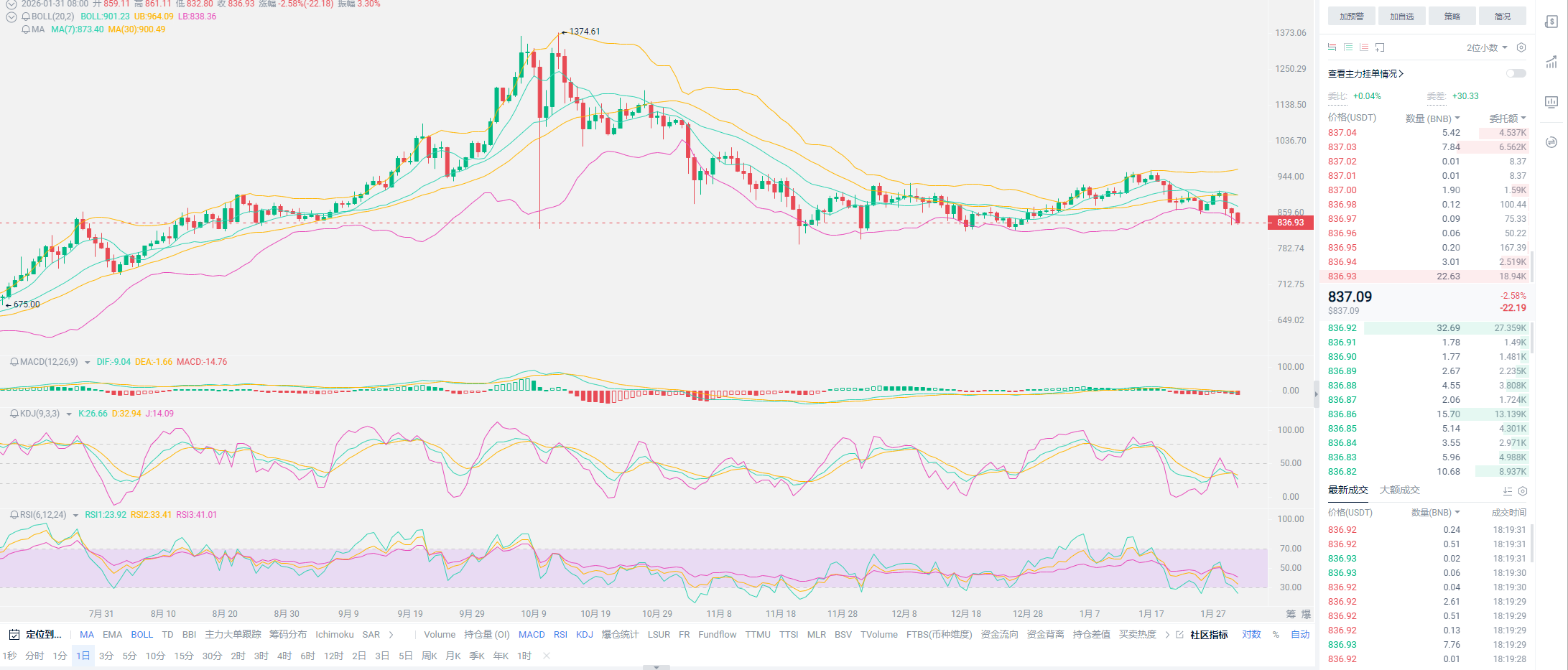

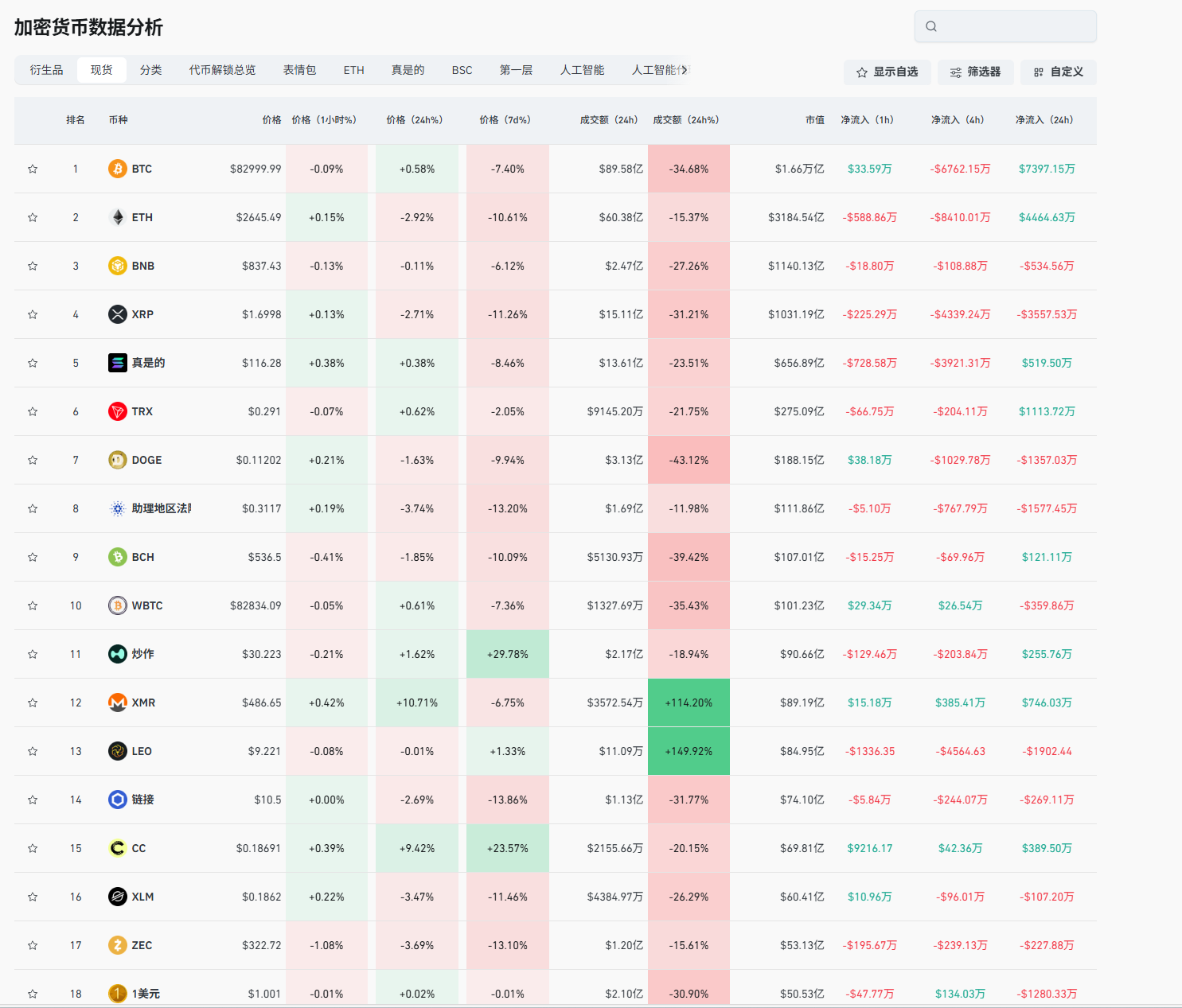

As the year-end approaches, things are getting busier. As long as the market remains within our estimated range and no reversal signals occur, Lao Cui's updates will become increasingly sluggish, focusing more on the real users at hand. Returning to the market, the last time I published an article, Bitcoin was still above 87,000, and this round has directly dropped to around the lowest point of 81,000. The predicted support above 80,000 is still relatively solid. From the recent trends and data, breaking below seems to be just a matter of time. However, Lao Cui no longer supports a bearish outlook. In the estimates, there may still be downward spikes, but substantial breakdowns are unlikely to occur. This round of decline is more inclined to be a problem with gold. Lao Cui's view is that it is not primarily a gold issue, but more from internal factors. Whether it's Binance or other major holders, there are signs of offloading, with a significant push coming from clearing over 4,000 Bitcoins.

The issues with gold and silver are common problems. Lao Cui has previously reminded everyone that a subsequent decline may only require a butterfly flapping its wings to complete the transition between bulls and bears, but the intensity of this transition was unexpected. The profits from the rise have clouded the minds of most investors; such rising behavior itself contradicts the logic of financial markets. Now that the decline has occurred, Lao Cui feels that we have finally returned to the market itself. At least this wave of decline has likely reduced the possibility of future conflicts. Many analysts in the gold market are searching for the main reasons behind the decline, with most practitioners believing it is due to the unexpected choice of the Federal Reserve Chair, causing fluctuations in the stable market. But do you really think that a single choice can dominate the market factors to such a large extent? A single day's drop directly accounts for the entire cryptocurrency market's value, exceeding 50 trillion; this is not something that can be explained by a financial indicator.

For the cryptocurrency market, many users are starting to feel confused. When gold rises, the crypto market falls; when gold falls, the crypto market falls even harder. It seems that all reference indicators have deviated from their original intentions. Which market is the crypto market synchronized with? Users who continuously follow Lao Cui can clearly perceive that since the end of 2025, Lao Cui has already stated that the crypto market will develop an independent trend in the future, and at this stage, it will not be part of the bear market (according to the timeline). This cycle of decline will not exceed one year, and the timing of the outbreak is very important. Perhaps the next round of outbreaks will only exist in a main upward wave lasting one to two weeks, after which it will be difficult to reach higher positions again. Looking at the crypto market, you can only watch whether Trump's expectations for the crypto market are being realized. Currently, through the crypto market, some investments in the US stock market can already be made, and the future slogan is also to make the crypto market the pipeline of the financial market, allowing direct segmentation of stocks, but the actual implementation is still in a hesitant stage.

Sister can also simply understand that for stock rules, many listed companies, due to SEC regulations or their own reasons, will adopt a multi-share system. This means that if a share is 100 dollars, you must purchase more than 100 shares at once. This system makes it difficult for retail investors to invest. If blockchain technology is applied, the concept of segmentation can be implemented. At that time, you could also purchase 0.01 shares, which would not require such a large capital proportion. This is extremely good news for many listed companies and retail investors, and even South Korea has lifted the ban on companies trading cryptocurrencies. The opening of Japan and South Korea is also a very important point; only if they can keep up will we see the true intentions of Europe. The actual technical application of the crypto market is becoming a grounded strategy. Lao Cui is more focused on the market's acceptance level. Only when more people can participate will there be frequent capital inflows. As long as we grasp the main reasons behind the events, our understanding of the trends will be deeper.

The emergence of another event further strengthens Lao Cui's bullish outlook, which is that Iran has officially announced that it can purchase military weapons through cryptocurrencies. Secondly, Binance and Tesla have reached an agreement, and in the future, Tesla's stock tokens will be issued on Binance. This is a positive development that you need to think about carefully: which cryptocurrencies will benefit? These positive news will not center around altcoins, which is the key issue. Many friends, after reading Lao Cui's article, still choose to invest in some unknown cryptocurrencies. Last year, it was already mentioned that the process of compliance is to eliminate these air coins; how could they still be given opportunities? Last year, in order to cater to the American market, whether it was Binance or other platforms, they were crazily listing some cryptocurrencies, and this year, the delisting of these cryptocurrencies has become mainstream. The possibility of new cryptocurrencies replacing those in the top ten by market value is becoming smaller and smaller. If you want to profit, it is best to give up these unrealistic fantasies.

Here, I would like to clarify that in this round, Lao Cui will indeed stand on the bullish side, but Lao Cui does not support the arrival of the altcoin season. Looking at this year's cryptocurrency market, valuable cryptocurrencies will still have bull markets and may even reach historically high levels, while worthless cryptocurrencies will have no future. Especially after this round of gold's sharp decline, it remains to be seen whether the crypto market can seize this wave of traffic. After February, Lao Cui will no longer maintain a bearish outlook, as previously theorized; January will maintain a decline, and February will see a rebound, but this year's new highs will definitely not be shown in the near term. If the cryptocurrency market can maintain fluctuations within a certain range in the first half of the year, it will be a healthy cycle for the entire market. Similarly, Lao Cui will not look for new lows; the current position is already infinitely close to this year's low, and the bottom position will not be too deep. I want to emphasize again, as mentioned above, there will be spikes, which are not real; after the spikes appear, it will be your opportunity to act.

Lao Cui summarizes: Recently, I have also noticed some news from abroad. Many friends want to hear Lao Cui's views on the CZ incident on October 11. Lao Cui actually doesn't have much to say. He is someone who started from a capital pool, and such methods are within his understanding; Lao Cui has also suffered from it, and there is nothing to do but say that personal understanding is insufficient, which is a destined event. Excessive discussion is not very meaningful, and CZ will not make any compromises because of this. Lao Cui is not trying to whitewash; there is no interest relationship with Binance. This is of no benefit to Lao Cui either. I still hope everyone can focus on the trends, prioritizing personal gains. Currently, apart from Bitcoin, almost all cryptocurrencies have reached new lows. This shadow hanging over us requires you to see the future clearly. Lao Cui has always said that the future is still there, but the actual trends also bring you great psychological pressure. Therefore, I have previously advised all spot users, especially those who have fully invested, to withdraw a portion and open short positions to hedge against spot losses. In the short term, we will still move around the bearish side. For contract users, you can still open short positions. This 80,000 has become a key position. Users who are not very confident can take profits above 80,000, while ambitious users can adopt profit-taking strategies when spikes occur. If you have practical questions, you can directly ask Lao Cui. Although there may be a time lag in seeing them, I will reply later. I have been a bit busy recently, so I appreciate your understanding.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess. Experts can see five, seven, or even ten steps ahead, while those with lower skills can only see two or three steps. The skilled consider the overall situation and the big trend, not focusing on a single piece or territory, aiming for the final victory. The less skilled, however, fight for every inch, frequently switching between bulls and bears, only competing for short-term gains, and often find themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。