Original author: David, Deep Tide TechFlow

In 2020, MicroStrategy founder Michael Saylor finished reading a book and decided to buy $425 million worth of Bitcoin.

The book is called "The Bitcoin Standard," published in 2018, translated into 39 languages, with sales exceeding one million copies, revered by Bitcoin advocates as the "Bible."

The author, Saifedean Ammous, holds a PhD in economics from Columbia University, and the core argument is simple:

Bitcoin is a harder "hard currency" than gold.

At the same time, on the book's promotional page, Michael Saylor's recommendation reads:

"This book is a genius work. After reading it, I decided to buy $425 million worth of Bitcoin. It has had the greatest impact on MicroStrategy's way of thinking, leading us to pivot our balance sheet to a Bitcoin standard."

However, there is a chapter in this book that does not discuss Bitcoin. It talks about why silver can never become a hard currency.

Eight years later, silver has just surged to a historical high of $117, and the investment frenzy in precious metals continues, with even Hyperliquid and various CEXs starting to launch precious metal contract trading in different forms.

Often at such times, there are always whistleblowers and contrarians reminding us of the risks, especially in an environment where everything is rising except Bitcoin.

For example, a widely circulated post on Crypto Twitter today features a screenshot of page 23 from this book, highlighting a paragraph that states:

Every silver bubble will burst, and the next one will be no exception.

The History of Silver Speculation

Don't rush to criticize; let's take a look at what this core argument really is.

The core argument in this book is actually called stock-to-flow, the ratio of stock to flow. BTC OGs should have heard of this theory.

In simpler terms, for something to become a "hard currency," the key is how difficult it is to increase its supply.

Gold is hard to mine. The global stock of gold is about 200,000 tons, with annual new production of less than 3,500 tons. Even if the price of gold doubles, miners cannot suddenly extract twice as much gold. This is called "supply rigidity."

Bitcoin is even more extreme. The total supply is capped at 21 million coins, halving every four years, and no one can change the code. This is scarcity created by algorithms.

What about silver?

The highlighted passage in the book essentially states: Silver bubbles have burst before, and they will burst again. Because once a large amount of capital flows into silver, miners can easily increase supply, driving prices down, and the wealth of savers evaporates.

The author also gives an example: the Hunt brothers.

In the late 1970s, Texas oil tycoons the Hunt brothers decided to hoard silver, attempting to corner the market. They bought billions of dollars worth of silver and futures contracts, driving the price from $6 to $50, setting a historical high for silver prices at the time.

And then? Miners flooded the market with silver, exchanges raised margin requirements, and silver prices collapsed. The Hunt brothers lost over $1 billion and ultimately went bankrupt.

Thus, the author's conclusion is:

The supply elasticity of silver is too high, making it impossible to become a store of value. Every time someone tries to hoard it as a "hard currency," the market teaches them a lesson through increased production.

This logic was written in 2018 when silver was $15 an ounce. No one cared.

Is This Round of Silver Different?

For the above logic about silver to hold, there is a premise: when silver prices rise, supply can keep up.

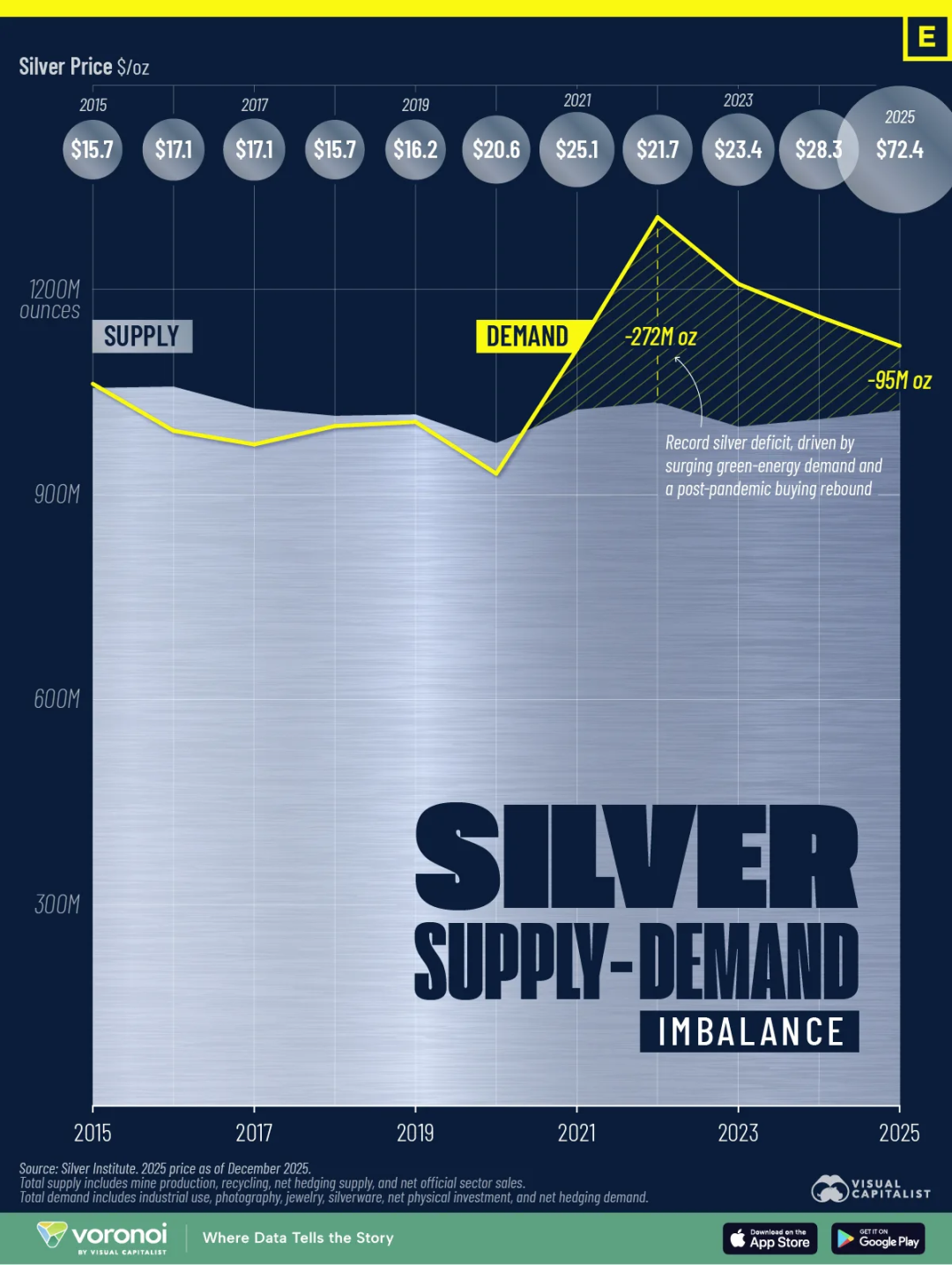

However, 25 years of data tells a different story.

Global silver production peaked in 2016 at about 900 million ounces. By 2025, this number is expected to drop to 835 million ounces. Prices have risen sevenfold, but production has shrunk by 7%.

Why has the logic of "rising prices lead to increased production" failed?

One structural reason is that about 75% of silver is produced as a byproduct of mining copper, zinc, and lead. Miners' production decisions depend on the prices of base metals, not on silver. If silver prices double but copper prices do not rise, mining will not increase.

Another reason may be time. New mining projects take 8 to 12 years from exploration to production. Even if work starts immediately, no new supply will be seen before 2030.

The result is a continuous supply gap. According to the Silver Institute, from 2021 to 2025, the global cumulative silver deficit is expected to approach 820 million ounces, nearly equivalent to a full year of global production.

At the same time, silver inventories are also nearing depletion. The London Bullion Market Association's deliverable silver inventory has dropped to just 155 million ounces. The silver borrowing rate has skyrocketed from a normal range of 0.3%-0.5% to 8%, indicating that someone is willing to pay an annualized cost of 8% just to ensure they can obtain physical silver.

There is also a new variable. Starting January 1, 2026, China will implement export restrictions on refined silver, allowing only state-owned enterprises with an annual production capacity of over 80 tons to obtain export licenses. Small and medium-sized exporters are effectively shut out.

In the era of the Hunt brothers, miners and holders could use increased production and selling to crash the market.

This time, the supply side may not have enough ammunition left.

Speculation and Genuine Demand

When the Hunt brothers hoarded silver, it was a speculative commodity. Buyers thought: prices will rise, hoard it and wait to sell.

The driving force behind the silver surge in 2025 is completely different.

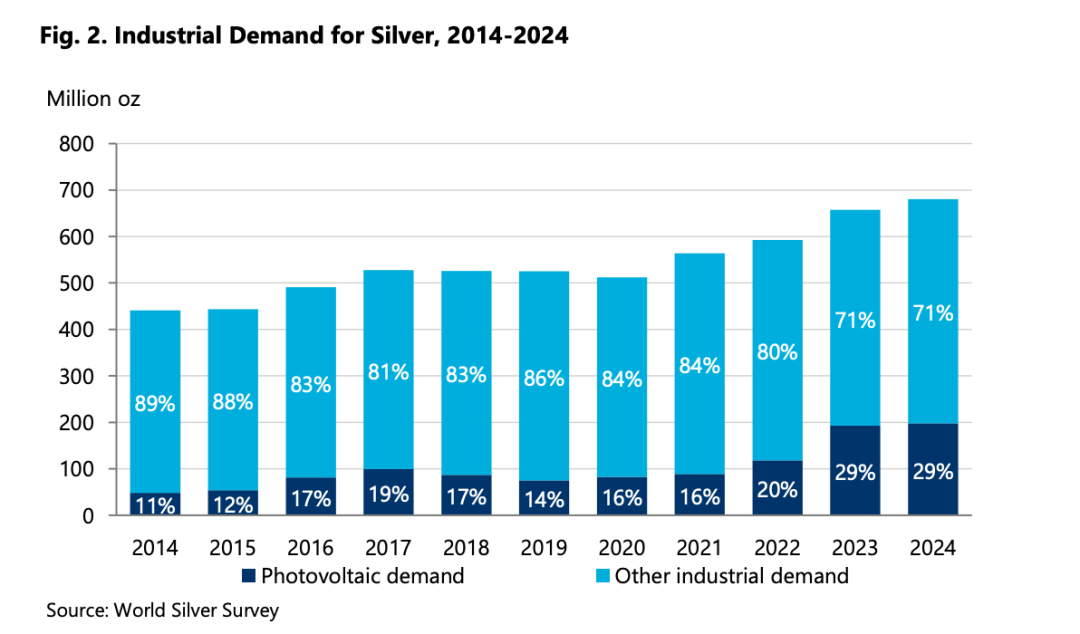

First, let's look at a set of data. According to the World Silver Survey 2025 report, industrial demand for silver is expected to reach 680.5 million ounces in 2024, a historical high. This figure accounts for over 60% of total global demand.

What is driving industrial demand?

Photovoltaics. Every solar panel requires silver paste for its conductive layer. The International Energy Agency predicts that global photovoltaic installed capacity will quadruple by 2030. The photovoltaic industry has become the largest single industrial buyer of silver.

Electric vehicles. A traditional gasoline car uses about 15-28 grams of silver. An electric vehicle uses 25-50 grams, with high-end models using even more. Silver is needed everywhere, from battery management systems to motor controllers to charging interfaces.

AI and data centers. Servers, chip packaging, high-frequency connectors—silver's conductivity and thermal conductivity are irreplaceable. This demand is expected to accelerate starting in 2024, with the Silver Institute specifically listing "AI-related applications" in its report.

In 2025, the U.S. Department of the Interior will include silver on its list of "critical minerals." The last time this list was updated, lithium and rare earths were added.

Of course, maintaining high silver prices will lead to a "silver-saving" effect, as some photovoltaic manufacturers have already begun to reduce the amount of silver paste used in each solar panel. However, the Silver Institute predicts that even considering the silver-saving effect, industrial demand will remain close to record levels in the next 1-2 years.

This is essentially rigid demand, a variable that Saifedean may not have foreseen when writing "The Bitcoin Standard."

A Book Can Also Provide Psychological Comfort

The narrative of Bitcoin as "digital gold" has recently been muted in the face of real gold and silver.

The market has dubbed this year the "Debasement Trade": the dollar weakens, inflation expectations rise, and geopolitical tensions increase, leading funds to flow into hard assets for safety. However, this wave of safe-haven funds has chosen gold and silver, not Bitcoin.

For Bitcoin extremists, this requires an explanation.

Thus, the aforementioned book has become a cited answer and a defense of their position, claiming that silver's current rise is due to a bubble, and when it bursts, you will know who was right.

This feels more like a narrative self-rescue.

When the assets you hold underperform the market for an entire year, you need a framework to explain "why I am still right."

Short-term prices are unimportant; long-term logic is what matters. The logic of silver is wrong, and the logic of Bitcoin is right, so Bitcoin will inevitably outperform; it's just a matter of time.

Is this logic self-consistent? Yes. Can it be falsified? Very difficult.

Because you can always say, "the time isn't long enough yet."

The problem is, the real world doesn't wait. Those holding Bitcoin and altcoins, still clinging to the crypto circle, are genuinely anxious.

The Bitcoin theory written eight years ago cannot automatically cover the reality of not rising eight years later.

Silver is still surging, and we sincerely wish Bitcoin good luck.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。