Author: Nancy, PANews

Gold has gone crazy. Less than a month into the new year, various funds are frantically scrambling to buy, and gold prices are frequently hitting historical highs.

In this carnival of precious metals, an "invisible big player" has unexpectedly entered the scene: the stablecoin giant Tether has quietly amassed a gold reserve of 140 tons.

Holding 140 Tons of Gold, Aiming to Become the World's Largest Gold Central Bank

Tether, which "has a mine at home," is becoming a major player in the gold market.

"We will soon be one of the largest 'gold central banks' in the world," Tether CEO Paolo Ardoino recently stated in an interview with Bloomberg, unabashedly revealing his ambitions.

This is not mere talk. As of now, Tether has accumulated approximately 140 tons of physical gold, valued at about $23 billion at current prices. Typically, Tether purchases directly from Swiss refineries and leading global financial institutions, with large metal orders often taking months to deliver. The gold, once received, is stored in a Cold War-era nuclear bunker in Switzerland, protected by multiple heavy steel doors, and Switzerland boasts one of the world's top confidentiality systems.

In terms of scale, Tether has become the largest known holder of physical gold outside of the banking system and nation-states, ranking among the top 30 gold holders globally, with holdings exceeding those of several countries, including Greece, Qatar, and Australia.

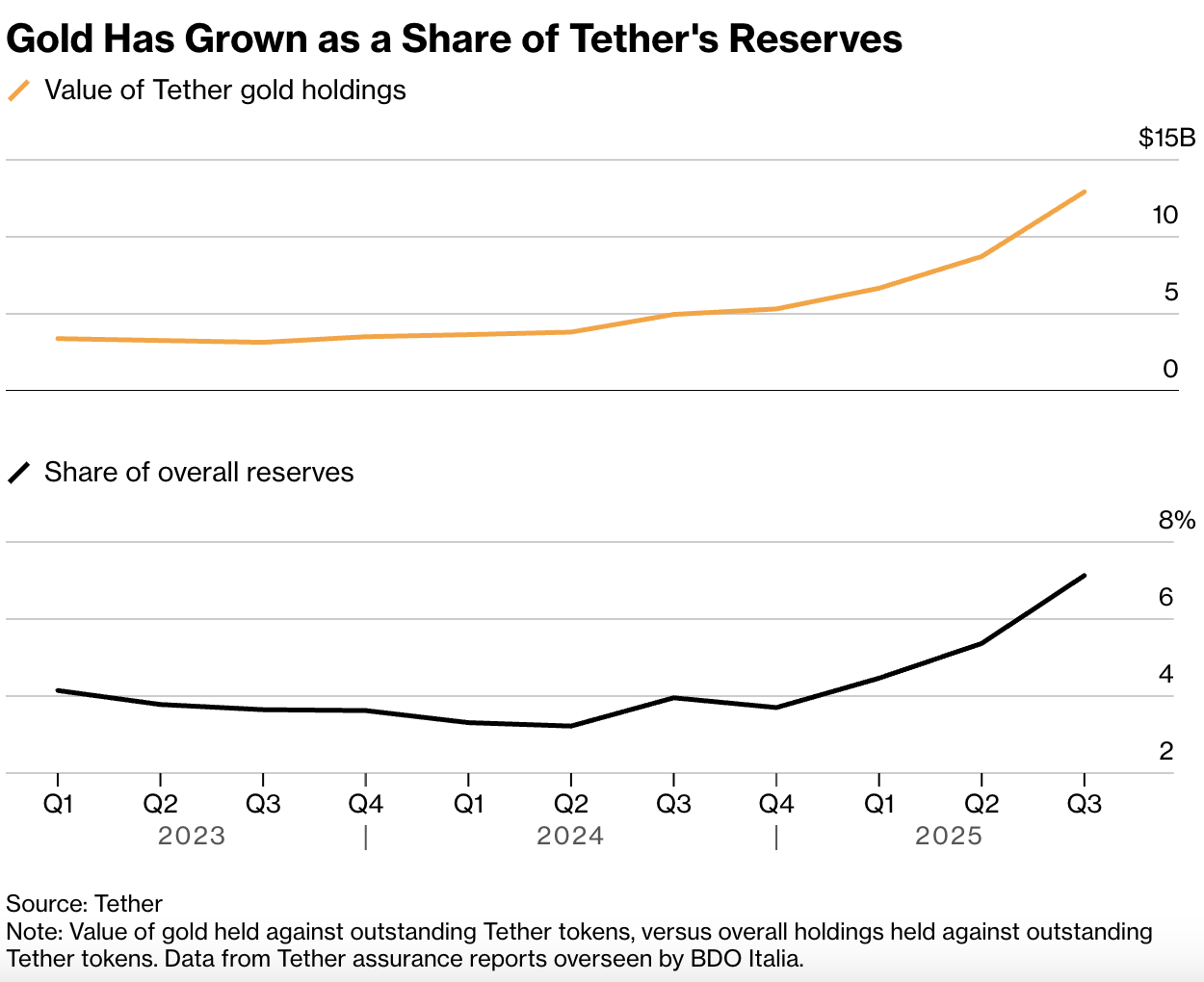

Although Tether began laying the groundwork for gold assets years ago, the real large-scale entry occurred in 2025. Just last year, Tether purchased over 70 tons of gold, becoming one of the top three buyers of gold globally this year. The scale of procurement not only surpassed almost all single central banks except for the Polish central bank but also exceeded many large gold ETFs.

It can be said that Tether is also an important driver of this year's rise in gold prices.

According to Ardoino, Tether's gold procurement speed is currently about 1 to 2 tons per week, and they plan to maintain this pace in the coming months, "it may slow down, but we will assess gold demand quarterly."

However, Tether's ambitions do not stop at hoarding gold. In the Bloomberg interview, Ardoino stated that Tether is evaluating market and potential trading strategies, planning to capture arbitrage opportunities through active trading of gold reserves. At the same time, the company is working to create "the best gold trading hall in the world," aiming to establish stable, long-term channels for gold acquisition and compete with major banks like JPMorgan and HSBC that dominate the global precious metals market.

To this end, Tether made headlines last year by bringing in two heavyweight trading veterans: former HSBC global metals trading head Vincent Domien and Mathew O’Neill, the former head of precious metals procurement for Europe, the Middle East, and Africa, specifically to expand its gold business footprint. (Related reading: Tether's Gold Empire: The Ambitions and Fractures of a "Stateless Central Bank")

At the upstream of the industry chain, Tether has also begun to position itself with cash capabilities. Tether has invested in several Canadian mid-sized gold mining companies, including Elemental Royalty, Metalla Royalty & Streaming, Versamet Royalties, and Gold Royalty, locking in future production capacity and revenue through equity investments.

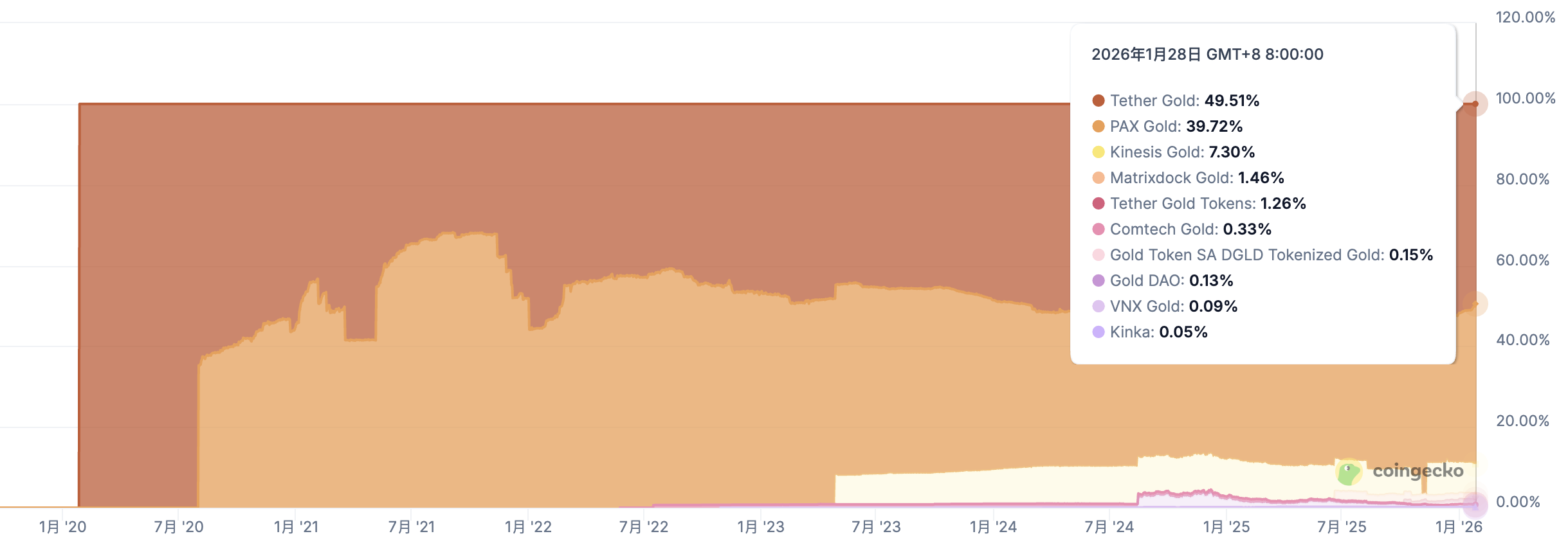

In terms of financial products, Tether launched the gold-backed stablecoin Tether Gold (XAU₮) back in 2020. By the end of last year, this token was backed by 16.2 tons of physical gold. Recently, Tether also introduced a new pricing unit for XAU₮ called Scudo, where 1 Scudo represents one-thousandth of a troy ounce of gold, aimed at making gold a more user-friendly payment method.

According to CoinGecko data, as of January 28, the circulating market value of XAU₮ has reached $2.7 billion, growing approximately 91.3% over the past year, capturing 49.5% of the market share in the tokenized gold sector, firmly holding the top position.

From physical gold hoarding to industry chain layout and financial product innovation, this gold enthusiast's substantial investments have even left traditional commodity circles baffled, with some describing Tether as "the strangest company encountered."

But now, as gold prices continue to hit historical highs, Tether's bet is yielding astonishing returns.

Earning $15 Billion a Year, Building a Capital Arsenal

Tether's confidence in hoarding gold comes from a high-speed "money printing machine."

According to Fortune, Tether generated approximately $15 billion in net profit in 2025, a significant increase from the previous year's $13 billion. The global workforce supporting this multi-billion profit is only about 200 people. Rough calculations show a per capita profit of $75 million, such high efficiency puts traditional financial giants to shame.

The core of this profitability comes from the capital pool accumulated through its stablecoin business.

Today, Tether's US dollar stablecoin USDT is the most widely used stablecoin globally, with over 500 million users. CoinGecko data shows that as of January 28, 2026, the circulating supply of Tether's US dollar stablecoin USDT is close to $187 billion, firmly holding the top position in the stablecoin sector. Trading activity is also leading, with Artemis Analytics data indicating that total trading volume of stablecoins grew by 72% to $33 trillion in 2025, with USDT contributing $13.3 trillion, accounting for over 33%.

On this basis, Tether is further expanding its capital accumulation scale through compliance.

On January 27, Tether officially launched the federally regulated stablecoin USAT, issued by Anchorage Digital Bank, the first federally regulated stablecoin issuer in the U.S., with Cantor Fitzgerald serving as the designated reserve custodian and preferred primary dealer, and former White House advisor Bo Hines appointed as CEO. This is seen as a key step for Tether's full entry into the U.S. domestic market.

At the same time, Tether is leveraging investments in content platforms like Rumble to integrate USAT business into the traffic ecosystem, aiming to quickly reach 100 million U.S. users and setting a goal of a $1 trillion market value within five years. If successful, USAT could become the first true competitor to USDC in the U.S. market.

With almost zero-cost liabilities, Tether easily captures interest spreads by allocating high liquidity, low-risk assets.

Among these, U.S. Treasury interest is Tether's core source of income. During a high-interest rate period, U.S. Treasury interest directly amplifies Tether's profitability. Currently, Tether holds approximately $135 billion in U.S. Treasury bonds, surpassing sovereign nations like South Korea, becoming the 17th largest holder of U.S. Treasury bonds globally.

At the same time, Tether is also a super player in Bitcoin. Since 2023, Tether has allocated up to 15% of its monthly net profit to dollar-cost averaging into Bitcoin. Currently, its holdings exceed 96,000 BTC, making it one of the largest institutional holders of Bitcoin globally, with an average cost of about $51,000, far below the current market price. Surrounding the Bitcoin ecosystem, Tether has also built its own mining facilities, invested in mining companies, and laid out DAT (crypto treasury), continuously expanding its industry influence, and there have even been overseas conspiracy theories about Tether being the "invisible operator" of BTC. (Related reading: Caught in the BTC Invisible Operator Conspiracy? Unveiling Tether's Bitcoin Strategic Landscape)

Additionally, to leverage more potential returns, Tether has initiated a large-scale investment strategy in recent years, extending its investment reach into satellite communications, AI data centers, agriculture, telecommunications, and media.

Thus, an arbitrage machine spanning traditional finance and the crypto world has gradually taken shape, continuously supplying Tether with capital ammunition, becoming the chips for its large-scale bets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。