A sudden announcement has left the crypto market breathless, as Tether, the "offshore giant," announced the launch of the fully federally compliant stablecoin USAT, directly confronting Circle's main battlefield.

Just yesterday, Tether officially announced the launch of USAT—a dollar stablecoin issued by Anchorage Digital Bank, compliant with the U.S. "GENIUS Act" framework. USAT will first be available on platforms such as Bybit, Kraken, OKX, and Moonpay, specifically designed for the U.S. market and digital payment infrastructure.

The issuer chosen by Tether, Anchorage Digital Bank, is the first federally regulated stablecoin issuer in the U.S., while Cantor Fitzgerald serves as the designated reserve custodian and preferred primary dealer.

1. Market Landscape

● Tether and Circle currently dominate the global stablecoin market, together controlling about 87% of the supply.

● According to the latest data from January 2026, USDT holds about 62% of the market share, while USDC accounts for approximately 25%. This duopoly has persisted for quite some time, and any significant strategic adjustments by either party could trigger a market restructuring.

● Tether Group is currently the 17th largest holder of U.S. Treasury bonds globally, surpassing sovereign nations such as Germany, South Korea, and Australia. This indicates that it has ample reserve assets to support the value of its stablecoin.

2. Regulatory Background and Strategic Intent of USAT

● The U.S. "Guidance and Establishment of a National Innovation Act for Stablecoins" (referred to as the "GENIUS Act") was passed by Congress in July 2025, establishing a clear regulatory framework for stablecoins. The act requires that stablecoins must be backed by liquid assets such as U.S. dollars or short-term U.S. Treasury bonds, and issuers must disclose reserve details monthly. USAT is a product launched under this legal framework.

● Tether CEO Paolo Ardoino stated: “USA₮ provides institutions with an additional option: a dollar-backed token made in the U.S.”

● This marks a strategic transformation for Tether—from offshore operations to embracing U.S. regulation. Through USAT, Tether aims to penetrate the U.S. institutional market while retaining USDT to maintain its global offshore business, achieving risk isolation and market expansion.

3. Short-term Impact and Direct Competition

● The launch of USAT will undoubtedly create direct competition with USDC in the U.S. market. Both are compliant stablecoins that adhere to the requirements of the "GENIUS Act," and their target users overlap significantly—U.S. institutions and users seeking compliant products.

● From a financial perspective, Tether has significant scale and cost advantages. In the third quarter of 2025, Tether's net profit was approximately $4.3 billion, with a profit margin close to 99%. This high efficiency primarily stems from its nearly zero distribution cost model.

● In contrast, Circle's profitability is more moderate. In the third quarter of 2025, Circle's net profit was $214 million, with a profit margin of about 29%. However, Circle is reducing its reliance on reserve income through business diversification.

4. Circle's Long-term Strategic Moat

● Despite facing competition from USAT, Circle's ecosystem moat remains robust. Circle has transformed from a mere "stablecoin issuer" to a "payment and blockchain infrastructure provider." A key development is Circle's cross-chain transfer protocol, which allows USDC to be securely transferred across chains with zero slippage and very low gas costs.

● In 2025, Circle successfully went public on the NYSE, becoming the first stablecoin company to list on the U.S. stock market. This brought it access to traditional capital market financing channels and brand credibility.

● Circle's payment network currently connects with 29 institutions, with another 55 under review, achieving an annual transaction volume exceeding $3.4 billion. This network addresses the traditional cross-border payment delays of T+2 to T+5, as well as the pain points of fees as high as 3%-5%.

5. Technical Route: The Layer 1 Battle

Stablecoin issuers are actively building their own Layer 1 blockchains to capture more value, strengthen control, and comply with regulations.

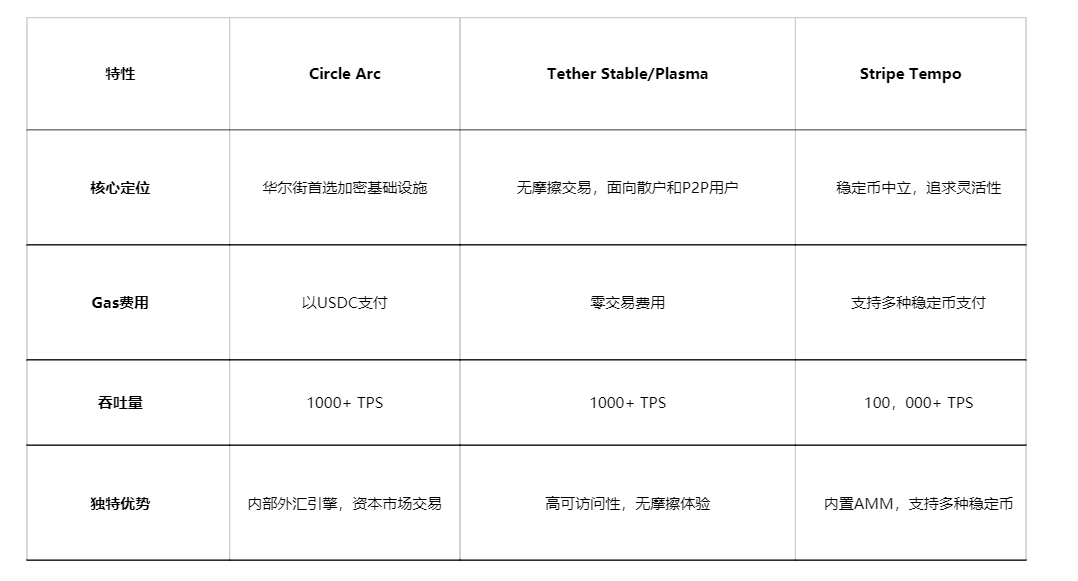

● Circle's Arc is designed for both retail and institutional users, with its internal foreign exchange engine making it highly attractive in capital market trading and payment sectors. Tether, on the other hand, focuses on accessibility, offering zero transaction fees to facilitate frictionless trading for retail and P2P users.

● Meanwhile, Stripe has launched the stablecoin-neutral Tempo, which supports multiple stablecoins for gas and payments through built-in AMM. This neutrality may attract developers and merchants seeking flexibility without being locked in.

The table below compares the Layer 1 strategies of the three major participants:

6. Risks and Opportunities of Market Fragmentation

● As the stablecoin market develops, the risk of ecosystem fragmentation is increasing. Merchants may encounter a confusing situation with "USD" from different chains that cannot be easily exchanged.

● Circle's cross-chain transfer protocol attempts to address this issue by creating a single liquid version of USDC across multiple chains, but its coverage is limited to Circle's tokens.

● Meanwhile, new entrants in the stablecoin space are encroaching on Tether and Circle's market share through "white-label issuance" strategies. Platforms like Hyperliquid and Ethena Labs are starting to launch their own stablecoins, keeping profits within the ecosystem rather than flowing to traditional issuers.

Analysts warn that proposed U.S. regulations prohibiting stablecoins from offering yield to users may push yield-seeking capital toward offshore or less transparent synthetic dollar products.

7. Divergence in Business Models of the Duopoly

Observing the capital redistribution strategies of the two companies reveals that they have chosen different paths.

● Tether is executing a diversification investment strategy, establishing business units such as Tether Evo, Tether Power, and Tether Data, investing substantial profits into cutting-edge fields like sustainable energy production, Bitcoin mining, and AI computing infrastructure.

● In contrast, Circle has chosen a "platformization" route, deeply engaging with institutions and traditional finance, attempting to transform into a fintech SaaS company.

● In terms of interest rate cycles, as the Federal Reserve begins a rate-cutting cycle, the ceiling on reserve income has become apparent. Tether maintains about a 15% exposure to alternative assets, while Circle strictly locks its asset side in high liquidity, low-risk cash equivalents to meet compliance requirements.

On the first day of USAT's launch, market trading volume reached $12 million, while USDC's daily trading volume remained stable at $11 billion. A new account for a compliant stablecoin wrote on social media: "We need more choices, not fewer."

Far away at Circle's headquarters in Boston, engineers continue to optimize the final code for the cross-chain transfer protocol. In Tether's New York office, the team is preparing the next phase of USAT's promotional plan. In Stripe's San Francisco office, developers are discussing how to integrate more stablecoins into Tempo.

When representatives from the three companies meet again at a regulatory hearing in Washington, they are no longer just stablecoin issuers; they are competitors reshaping the way global value flows.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。