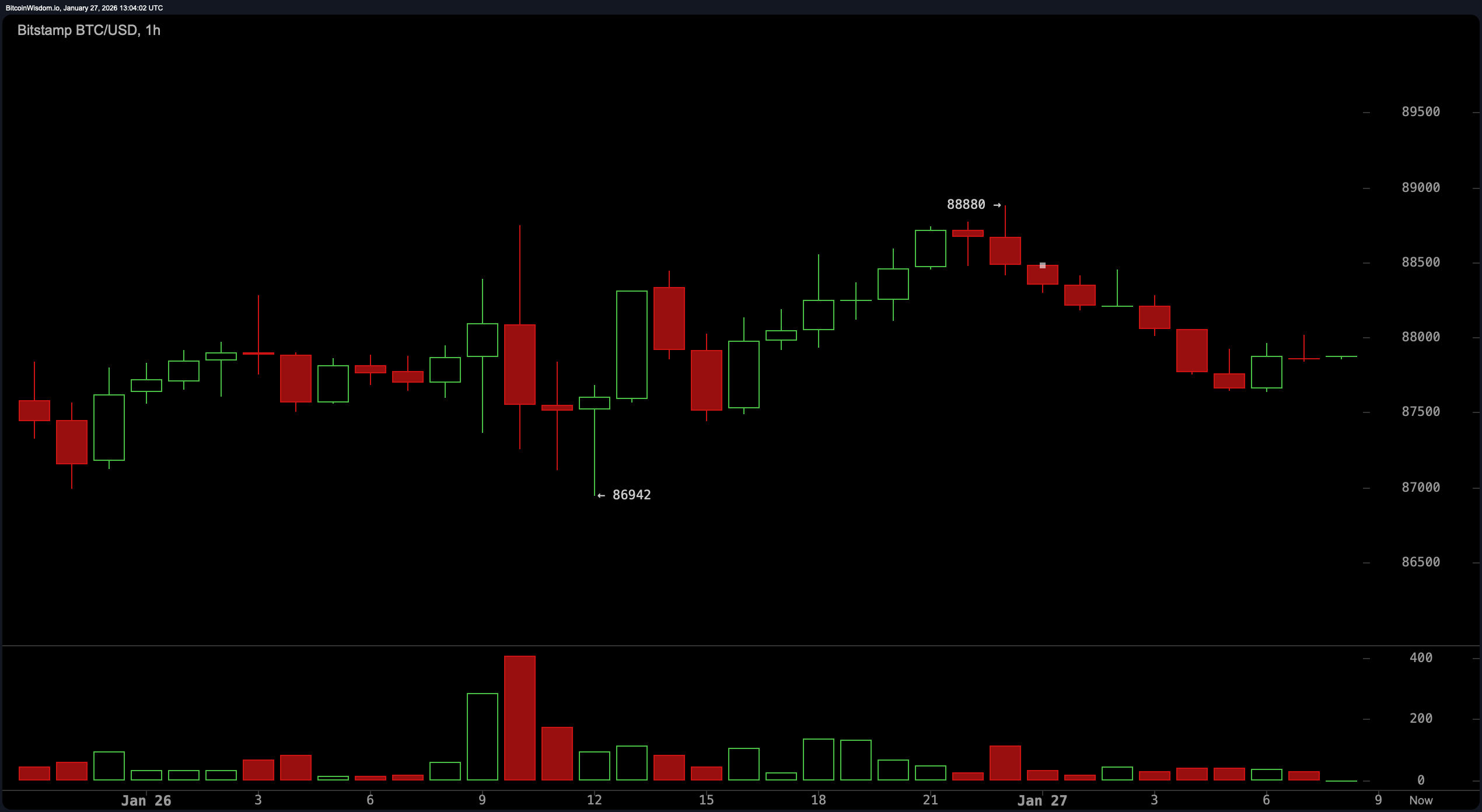

Bitcoin‘s hourly chart signals are tapping the brakes after a brisk bounce from a local bottom at $86,942 to a modest high of $88,880. The momentum has since waned, with small-bodied candles and lower volume pointing to indecision.

The technical cliff notes? It’s a delicate dance near $88,800—any bullish break above that level might send prices flirting with $89,500, while a stumble below $87,800 threatens a retreat back to the $86,000 neighborhood. The micro-trend has slid into a shallow downtrend, hinting at exhaustion among short-term bulls.

BTC/USD 1-hour chart via Bitstamp on Jan. 27, 2026.

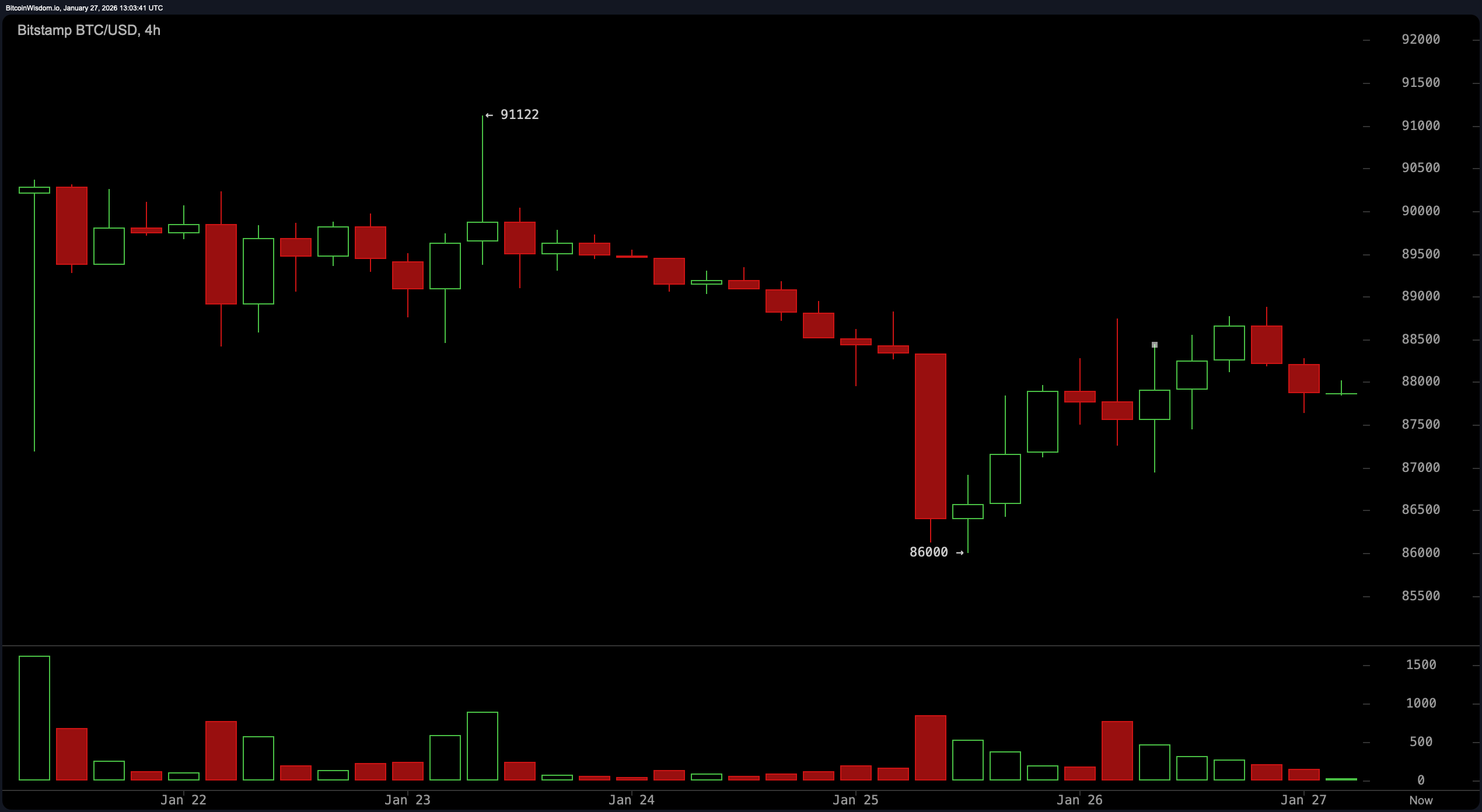

Over on the 4-hour chart, the mood is sideways-to-optimistic, though the optimism feels a bit like a forced smile. A fierce selloff down to $86,000 was quickly met with a rebound, yet lower highs are still the reigning fashion—suggesting the uptrend may be more wishful thinking than reality. The price now loiters between $87,500 and $88,800, tightening like a spring. Should bitcoin breach $89,000 with conviction (and volume to match), there’s room to revisit the $91,000 region. Conversely, any clean break under $87,500 and we’re heading back toward $86,000 territory—perhaps with a dramatic flair.

BTC/USD 4-hour chart via Bitstamp on Jan. 27, 2026.

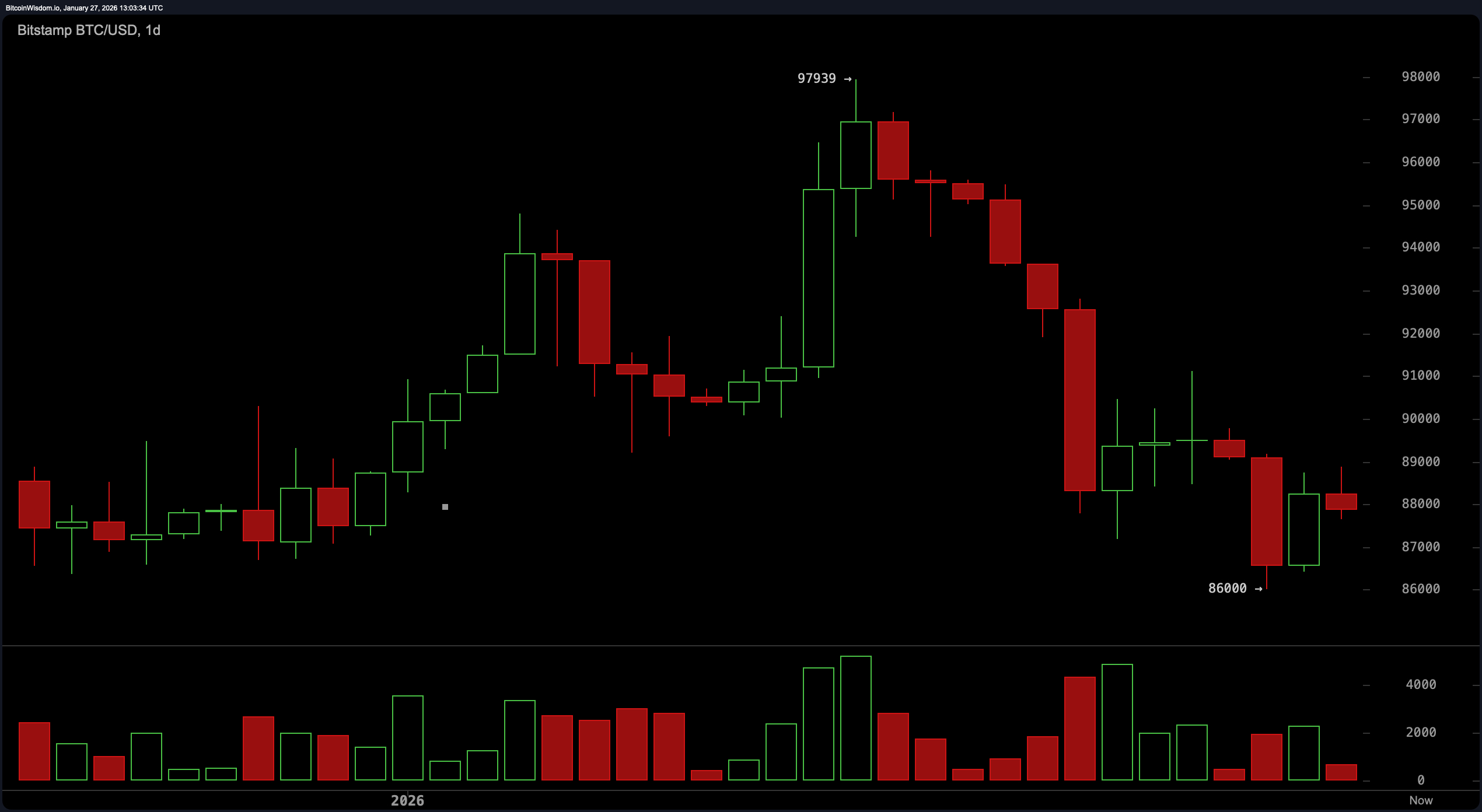

The daily chart paints a broader picture of discontent. After tagging a local high near $97,939, bitcoin faced a cascade of red, heavy- volume candles, signaling distribution and potential capitulation. The price now huddles around the $87,000–$89,000 zone, struggling to reclaim any meaningful ground. The structure is shaping into a textbook bearish pattern—lower highs, lower lows, and enough downward pressure to make a chartist wince. Short of a convincing rally above $90,000, any enthusiasm should be tempered with a hefty dose of realism.

BTC/USD daily chart via Bitstamp on Jan. 27, 2026.

Now for the real diva: the indicators. Oscillators are in full neutral mode, except for momentum, which is throwing a lone signal toward upward pressure—though likely just a tease. The relative strength index ( RSI) is lounging at 41, still shy of any real conviction. The Stochastic oscillator is near a nap at 13, and the commodity channel index (CCI) drags in at –90. Meanwhile, the moving average convergence divergence ( MACD) level sits at –762, spelling bearish sentiment more boldly than a Wall Street headline.

Moving averages? A sea of red flags. All major exponential moving averages (EMAs) and simple moving averages (SMAs) from the 10-period to the 200-period are showing bearish tendencies. The 10-period EMA at $89,379 and the 10-period SMA at $89,462 are both positioned well above the current price, confirming downward momentum. The longer-term 200-period simple moving average casts a shadow all the way from $104,835. Translation: until bitcoin musters the strength to claw back above these averages, it’s stuck playing defense in its own half of the field.

Bull Verdict:

Should bitcoin break above $89,000 with rising volume and confirm strength above the $90,000 mark, a push toward $91,000 and beyond remains plausible. Momentum is subtly shifting, and if buyers step up, this could mark the beginning of a short-term recovery leg within the broader downtrend.

Bear Verdict:

With all key moving averages towering above the current price and bearish structures dominating across timeframes, bitcoin remains under significant downward pressure. A breakdown below $87,500, especially on volume, risks dragging price action back to the $86,000 zone or lower, extending the bearish trajectory.

- Where is bitcoin trading now?

Bitcoin is currently priced at $87,867, hovering in a narrow range between $87,180 and $88,763. - Is bitcoin showing bullish or bearish signals today?

Technical charts show a bearish bias with fading momentum and resistance across key moving averages. - What levels should traders watch near-term?

Watch $89,000 for a potential breakout and $87,500 for signs of further downside. - How is bitcoin’s volume trending today?

The 24-hour volume sits at $40.97 billion, with lower timeframes showing decreasing participation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。