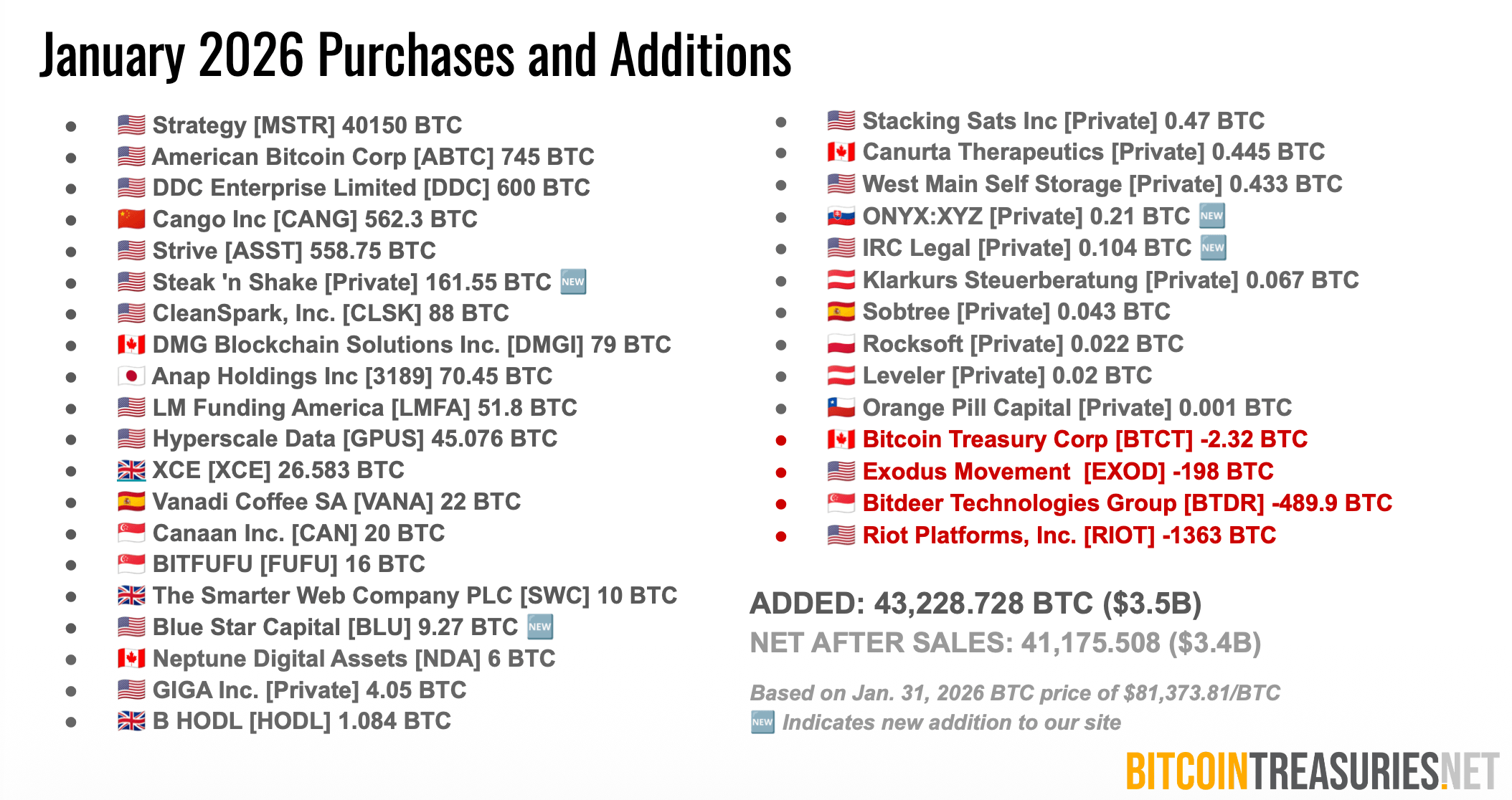

The January 2026 Corporate Adoption Report from bitcointreasuries.net shows that public and private entities added 43,228 BTC during the month, valued at roughly $3.5 billion based on Jan. 31 pricing. After sales and reductions, net additions totaled 41,175 BTC.

The report’s data highlights one clear driver: Strategy purchased 40,150 BTC in January and ended the month holding 712,647 BTC. That accounted for up to 97.5% of public-company buying after sales, marking the third consecutive month in which the firm dominated additions.

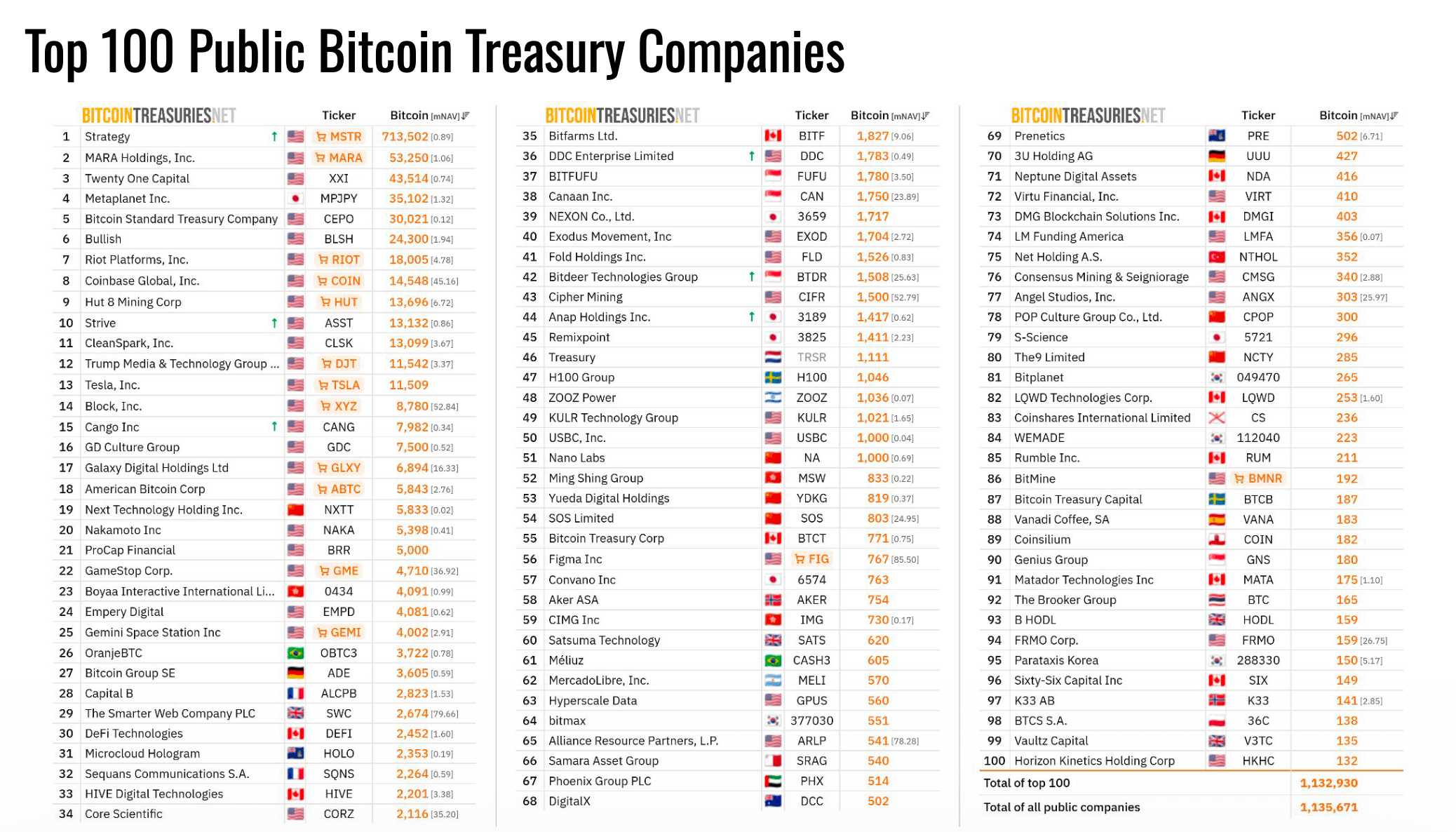

While total monthly buying approached levels seen last summer, bitcointreasuries.net researchers note that this rebound reflects concentrated accumulation rather than broad-based participation. Public treasuries now hold approximately 1.13 million BTC, while all tracked entities — including ETFs and governments — hold about 4.08 million BTC.

The analysis also points to Strategy’s long-range projections. Under its most aggressive model, the company’s Q4 2025 report outlines potential 2.5x growth in bitcoin per share by 2032, targeting 492,000 BPS under a 14% assumed annual bitcoin yield.

Beyond spot purchases, bitcointreasuries.net’s new digital credit dashboard tracks $26.8 billion in cumulative trading volume tied to preferred-share products and related instruments. Strategy’s offerings account for nearly all of that activity, with yield dispersion and pricing differences shaping investor appetite.

The research further identifies a committed cohort of repeat buyers. Of 194 public companies with bitcoin holdings, roughly one-third have added at least 1 BTC per day on average since launching treasury strategies, and 20 firms average at least 10 BTC per day.

Adoption continues to broaden. Since October, 21 new treasuries have been added to the bitcointreasuries.net coverage universe, contributing about 3% of non-Strategy buying over the past four months.

Still, concentration is rising. The report cites data showing increased inequality in corporate bitcoin holdings over the past two to three months, even when excluding the largest holder.

Mining firms remain influential, accounting for roughly 11% of public company balances, though January featured notable miner sales that weighed on net additions.

In short, the January report shows a sector that is expanding in headcount and product complexity — digital credit included — but still overwhelmingly shaped by one balance sheet that continues to set the pace.

- How much bitcoin did companies add in January 2026?

Bitcointreasuries.net reports 43,228 BTC added, with 41,175 BTC net after sales. - How much bitcoin does Strategy hold?

Strategy ended January with 712,647 BTC, according to bitcointreasuries.net. - What is the size of the digital credit market?

Bitcointreasuries.net estimates cumulative digital credit trading volume at $26.8 billion. - Is corporate bitcoin ownership becoming more concentrated?

Yes, bitcointreasuries.net data shows rising holdings concentration over recent months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。