The Japanese yen’s sharp advance against the U.S. dollar was largely fueled by two pivotal developments tied to major central banks. The first was a tactical step by the New York Federal Reserve, which carried out a “rate check” with major banks on behalf of the U.S. Treasury.

In practice, this maneuver involves officials contacting leading banks to request their buy and sell quotes for the yen, offering a direct window into market liquidity. During periods of abrupt currency moves, traders and analysts widely view such outreach as an early signal that foreign exchange intervention is being considered.

The prevailing view in markets is that close monitoring by authorities, coupled with a readiness to intervene, acts as a deterrent to speculative positions against the yen—at least for now. The second critical factor centers on the Bank of Japan’s (BOJ) latest policy stance. While the BOJ held its benchmark lending rate steady at 0.75%, the central bank’s forward guidance signaled that accommodative financial conditions would remain in place “for the time being.”

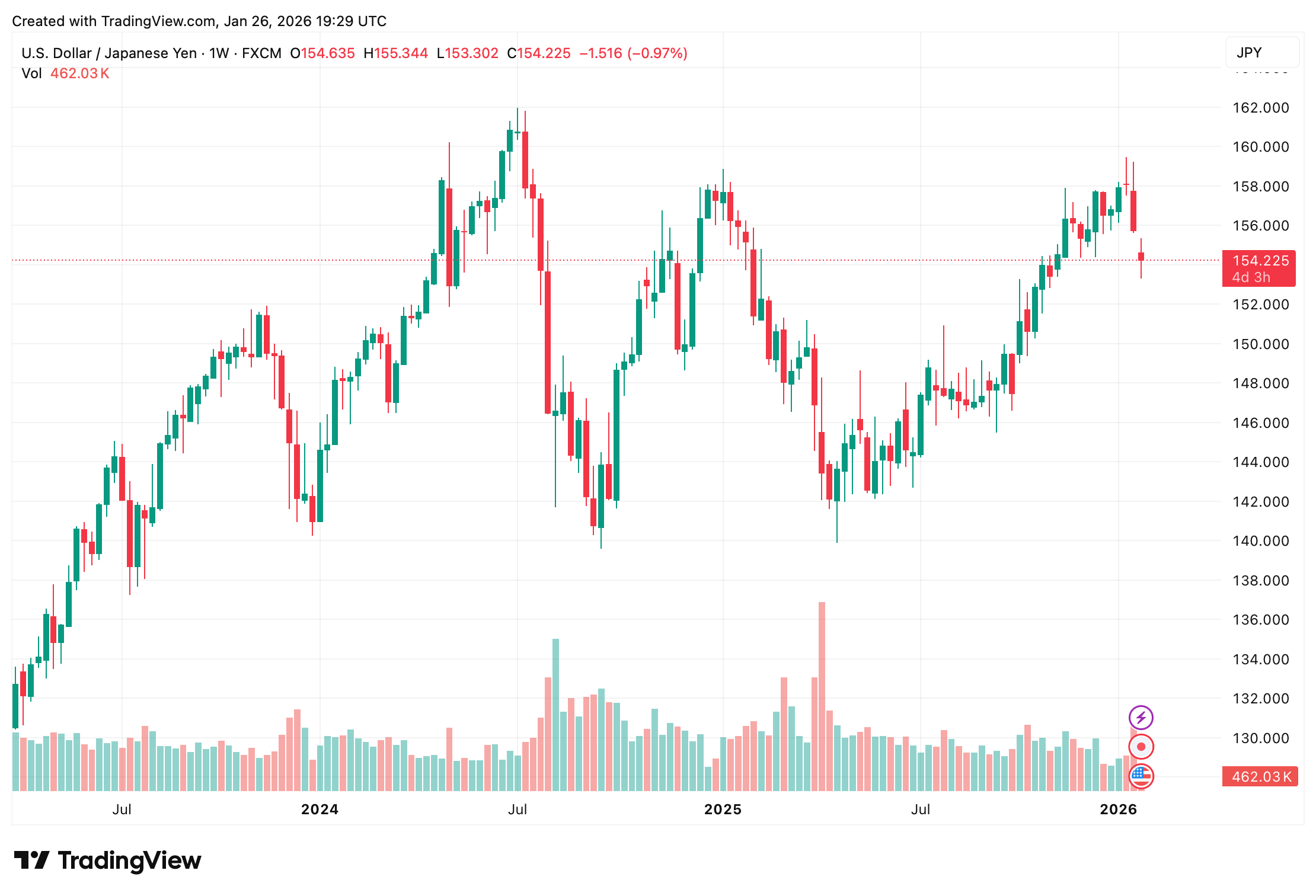

USD/JPY on Jan. 26, 2026.

Taken together, the credible prospect of direct currency intervention and expectations of a narrowing interest rate gap with the United States formed a potent tailwind that pushed the yen to a two-month high. At the same time, the Japanese government bond (JGB) market registered a notable and nuanced reaction, with prices climbing and yields easing on the day.

The near-term mechanics behind this move were straightforward: yields fell across a range of maturities. That rebound followed a broader and choppy week for JGBs, which had earlier been rattled by a steep sell-off, described as one of the worst on record for 30-year bonds. Many now argue the BOJ is being pressured to walk away from decades of yield curve control. Metals and Miners YT podcast founder and host Gary Bohm contends the BOJ will need to rethink its approach to defend the yen.

“To defend the yen and prevent a complete collapse of their own bond market, Japanese financial institutions will be forced to repatriate capital,” Bohm explained on X. “They need to sell their foreign assets and bring the money home to buy JGBs, creating a domestic bid to replace the waning influence of the BoJ.”

He added:

“And what is the largest and most liquid foreign asset held by Japanese institutions? The United States Treasury bond. Japan is the largest foreign holder of U.S. government debt, with over $1.1 trillion in its coffers.”

Also read: Polymarket Traders Weigh Silver’s Ceiling and Gold’s Staying Power Into 2026

As of today, the yen’s climb reflects more than short-term positioning, combining policy signaling, credible intervention risk, and shifting bond dynamics. With the BOJ under growing pressure to adapt and global rate differentials in flux, currency and bond markets appear tightly linked. For now, vigilance from central banks remains the defining force shaping Japan’s financial outlook.

- Why did the Japanese yen strengthen against the U.S. dollar?

The yen firmed as markets reacted to intervention signals from U.S. and Japanese authorities and shifting expectations around interest rate policy. - What role did the New York Federal Reserve play?

The New York Fed conducted a yen “rate check,” widely viewed as a preliminary step toward possible foreign exchange intervention. - How did the Bank of Japan influence markets?

The BOJ held rates at 0.75% while signaling that accommodative conditions would continue for the time being. - Why are Japanese government bonds part of the story?

JGB prices rose as yields fell, reflecting bond market stress and expectations that domestic capital may be redirected back into Japan.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。