According to coinglass.com metrics, total bitcoin futures open interest across exchanges stands at 639,780 BTC, or $43.81 billion. Over the past 24 hours, aggregate OI slipped 2.32%, even as the one-hour change rose 0.16%, signaling short-term repositioning rather than a broad exodus from leveraged bets.

The Chicago Mercantile Exchange (CME) leads the pack with 118,450 BTC in open interest, valued at $8.11 billion, giving it an 18.5% market share. Binance follows with 110,770 BTC, or $7.58 billion, accounting for 17.3%. OKX holds 45,340 BTC worth $3.10 billion. Elsewhere, BingX stood out with a 20.56% increase in OI over 24 hours, a sharp contrast to the wider pullback.

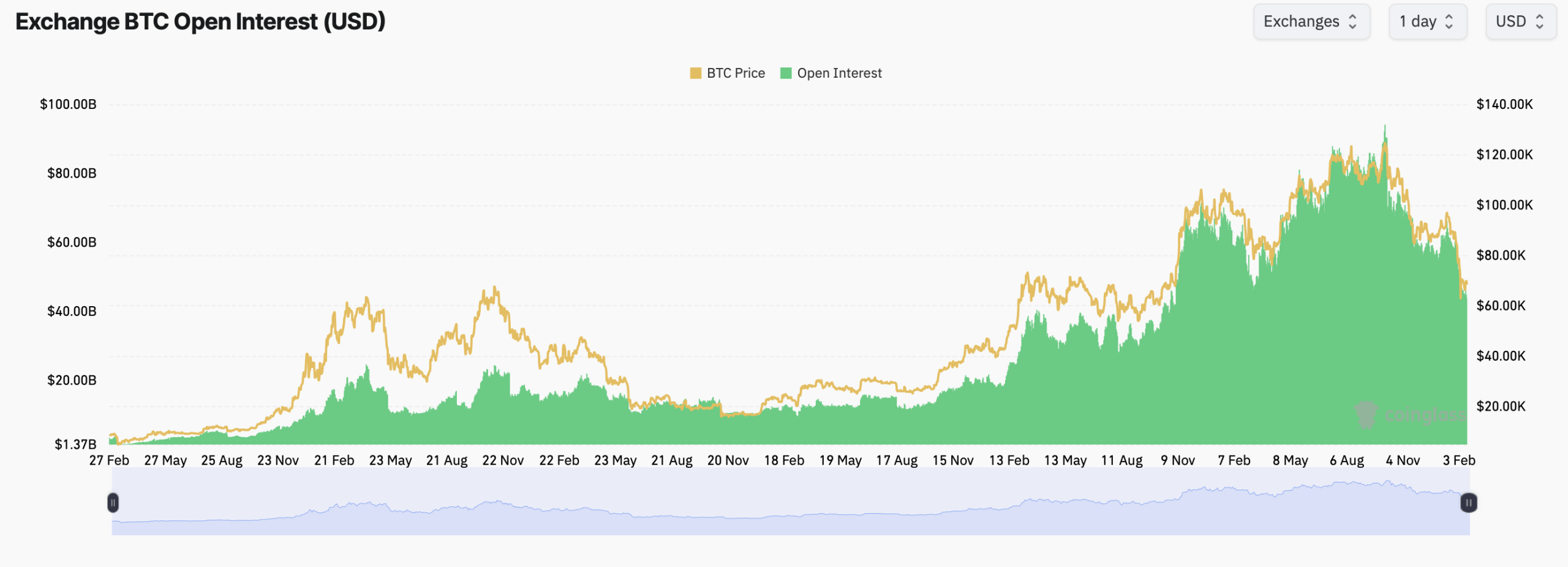

Bitcoin futures open interest on Sunday, Feb. 15, 2026, according to coinglass.com stats.

Zooming out, futures open interest surged to nearly $90 billion in late 2025 before cooling alongside price. Even after the recent retracement, positioning remains elevated compared to earlier phases of the cycle, showing that traders are still deeply engaged in directional trades and hedges.

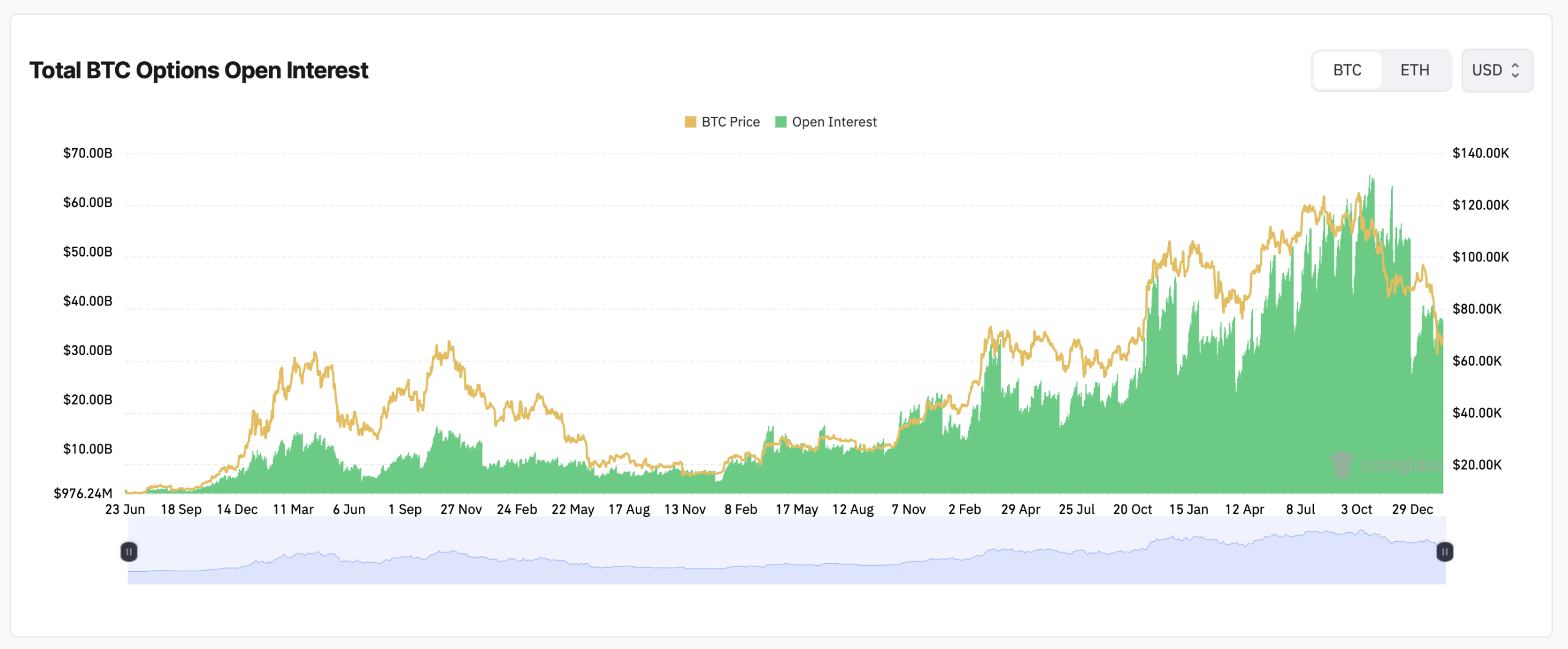

In options markets, the tilt favors the bulls — at least on paper. Total bitcoin options open interest shows 56.21% in calls versus 43.79% in puts, translating to 276,172 BTC in calls against 215,135 BTC in puts. Over the past 24 hours, volume skews even more heavily toward calls at 60.07%, or 14,603 BTC, compared to 9,707 BTC in puts.

Deribit dominates the options board, and the biggest positions tell a story in plain English. The single largest contract is a put option expiring Feb. 27, 2026, with a $40,000 strike price, covering 7,409 BTC. That contract pays off if bitcoin falls below $40,000 — more than $28,000 beneath today’s $68,429 price — effectively serving as crash insurance.

Bitcoin options open interest on Sunday, Feb. 15, 2026, according to coinglass.com stats.

On the opposite end, traders are stacking aggressive upside bets. The second-largest position is a Dec. 25, 2026, call at a $120,000 strike, totaling 5,930 BTC. That wager only gains real value if bitcoin climbs more than $50,000 from current levels. Close behind is a March 27, 2026, call at $90,000, representing 5,665 BTC — a bet that bitcoin could rally roughly $21,500 from here.

Together, these positions reveal a layered strategy: hedge the fall to $40,000 while keeping exposure to a run toward $90,000 or even $120,000. Max pain levels — the price at which the largest number of options expire worthless — add another dimension. On Binance, near-term expirations cluster in the $70,000 to $80,000 range, slightly above spot.

OKX shows a similar gravity point near $70,000 for February contracts, rising toward $82,000 for March and around $85,000 for later dates. Deribit’s curve stretches higher, with March near $85,000 and September peaking close to $90,000 before easing toward roughly $85,000 into December 2026.

In practical terms, many options writers would benefit most if bitcoin drifts modestly higher from the current $68,729 range, but remains below the upper strike clusters. That does not guarantee price direction, but it highlights where incentives are stacked.

Currently, the derivatives data reflects a market that is still cautious yet ambitious at certain junctions. Futures open interest remains substantial despite a short-term dip, calls outpace puts, and major strike concentrations sit both far below and well above spot. Bitcoin may be trading just under $70,000, but the derivatives crowd is clearly mapping out scenarios that stretch from $40,000 all the way to $120,000.

- What is bitcoin futures open interest right now?

Total bitcoin futures open interest stands at 639,780 BTC, valued at $43.81 billion. - Are calls or puts dominating bitcoin options markets?

Calls lead with 56.21% of total open interest and 60.07% of 24-hour volume. - What are the largest bitcoin options positions on Deribit?

The biggest contracts are a $40,000 put for Feb. 27, 2026, a $120,000 call for Dec. 25, 2026, and a $90,000 call for March 27, 2026. - Where are current max pain levels for bitcoin options?

Max pain levels cluster between roughly $70,000 and $90,000 across Binance, OKX, and Deribit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。