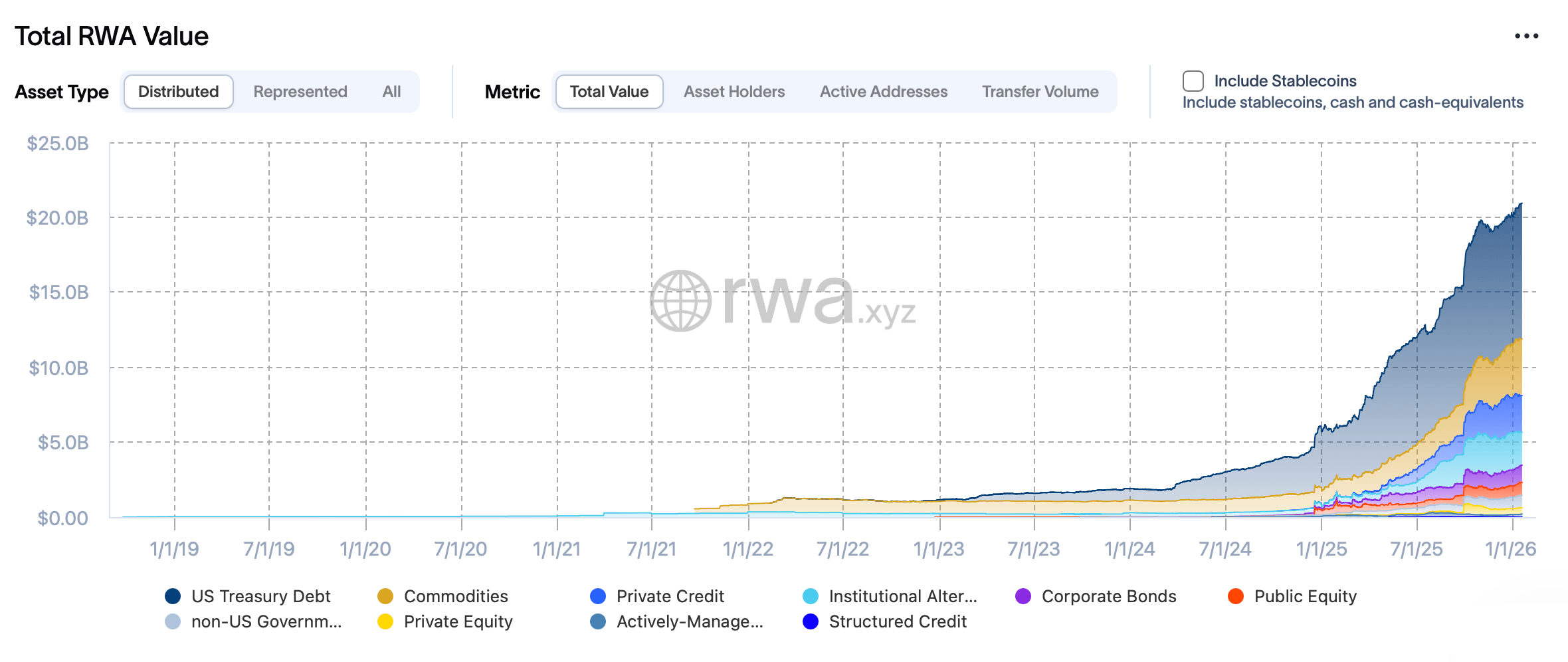

Tokenization and the RWA space are widely expected to expand sharply in 2026, and early signs suggest the year is already getting off on the right foot. Figures compiled by rwa.xyz show that at the start of the year, distributed asset value across the space climbed 5%, rising from $20.33 billion to the current $21.35 billion.

At its core, tokenization is the act of turning ownership rights to assets like commodities, bonds, or art into digital tokens on a blockchain, unlocking fractional ownership, quicker transfers, and programmable perks such as automated payments. RWAs, meanwhile, are those tokenized takes on tangible or traditional financial assets that migrate onto blockchain networks, linking off-chain value with onchain liquidity and decentralized finance (DeFi) applications.

Total RWA value according to rwa.xyz stats on Jan. 19, 2026.

Metrics gathered on Monday indicate that the RWA sector counts roughly 636,898 holders, with that figure up 8.94% over the past 30 days since Dec. 19. On the chain front, in terms of value locked, Ethereum lays claim to $12.8 billion of that total, while BNB Chain locks in $2 billion, with both Solana and the Liquid Network hovering near $1.1 billion apiece and Stellar rounding it out with $1 billion in RWA value.

Of the $21.35 billion total, U.S. Treasury debt does the heavy lifting at about $9.05 billion. Commodities come next with $3.77 billion, followed by private credit at $2.44 billion and institutional alternative funds at roughly $2.19 billion. Corporate bonds check in at $1.15 billion, public equity at $867.2 million, and non-U.S. government debt close behind at $816.7 million.

The rest of the RWA pie is sliced thinner, with private equity at $425.5 million, actively managed strategies at $198.2 million, and structured credit barely registering at just under $4 million. The RWA sector hit a modest dip toward the end of October 2025, but it has since added $2.13 billion from the $19.22 billion logged on Nov. 19, 2025. Right now, the crown jewel of RWA assets is Tether’s XAUT coin, a token backed by gold.

Also read: ‘Sell America’ Trade Roars Back as US Dollar Slides and Markets Brace for Turbulence

XAUT currently carries a market cap of $1.93 billion. Trailing close behind is Paxos’ gold-backed token PAXG at $1.76 billion, followed by the U.S. Treasury fund managed by Blackrock and issued by Securitize, BUIDL, which ranks third at $1.71 billion. XAUT and PAXG have enjoyed an extra tailwind this week as gold’s sharp climb against the U.S. dollar padded the value of both tokens.

All told, RWAs have entered 2026 with momentum and money to match. Value has recovered, holders are multiplying, and capital is clustering in familiar corners like Treasurys and gold. Whether this pace holds will hinge on liquidity and execution, but the opening chapters of the year make one thing clear: tokenization has moved well beyond the realm of a niche experiment.

- What are real-world assets ( RWAs) in crypto?

RWAs are traditional assets like Treasurys, commodities, and bonds that are tokenized on blockchain networks for easier trading and settlement. - How big is the RWA market in January 2026?

Total value locked in the RWA sector stands at about $21.35 billion after adding more than $1 billion early in Jan. 2026. - Which blockchain leads RWA value today?

Ethereum dominates the RWA market with roughly $12.8 billion in value locked, far ahead of BNB Chain, Solana, and others. - What are the largest RWA tokens right now?

Tether’s gold-backed XAUT leads by market cap, followed by Paxos’ PAXG and Blackrock’s tokenized Treasury fund, BUIDL.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。