Crypto ETFs delivered a broadly constructive week as strong mid-week inflows outweighed late selling pressure. Bitcoin and ether ETFs led the charge, while XRP and solana quietly extended their positive momentum.

Exchange-traded fund (ETF) flows told a familiar January story this week: sharp rotations, heavy conviction, and resilience beneath the surface. Despite a volatile finish, institutional appetite remained intact across the crypto ETF market.

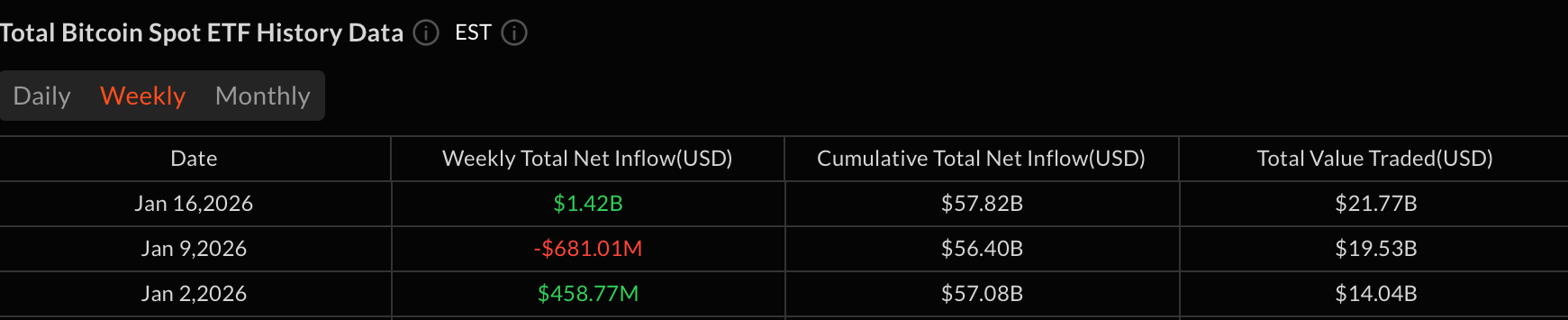

Bitcoin ETFs posted a net inflow of $1.42 billion on $21.77 billion in trading volume, driven by explosive mid-week demand. Blackrock’s IBIT was the clear anchor, finishing the week with $1.03 billion in net inflows, powered by massive entries on Jan. 14 and 15 that easily absorbed late-week selling.

Fidelity’s FBTC closed firmly positive with $194.40 million in net inflows, even after heavy redemptions on Friday. Grayscale’s GBTC was largely flat on the week as inflows earlier were offset by late exits, while Ark & 21Shares’ ARKB ($42.50 million) and Bitwise’s BITB ($79.64 million) both ended marginally positive after Friday’s sharp risk-off move trimmed earlier gains.

First billion dollar week for bitcoin ETFs in 2026

Ether ETFs recorded a $479.04 million weekly net inflow with $7.74 billion traded, marking their strongest week of the year. Blackrock’s ETHA dominated activity, delivering the bulk of inflows with $219.05 million and setting the tone for the category.

Grayscale’s Ether Mini Trust and ETHE added steady demand throughout the week with inflows of $123.38 million and $76.74 million, while Fidelity’s FETH saw mixed flows but ultimately finished slightly positive with $20.27 million as strong mid-week accumulation offset Friday profit-taking.

XRP ETFs continued to build momentum, posting $56.83 million in net inflows on $144.53 million in volume. Grayscale’s GXRP was the primary driver with $23.75 million, with additions from Bitwise’s XRP ($18.39 million) and Franklin’s XRPZ ($11.30 million), adding incremental support despite mild volatility late in the week.

Read more: ETFs Reshaped Crypto Liquidity Flows in 2025

Solana ETFs quietly extended their advance with $46.88 million in net inflows and $209.13 million traded. Bitwise’s BSOL once again led demand with $32.23 million, supported by steady contributions from Fidelity’s FSOL ($10.97 million) and Grayscale’s GSOL ($3.94 million), even as Friday saw light profit-taking.

The week reinforced a key January theme which shows that short-term volatility hasn’t shaken institutional conviction. Dip-buying behavior remains intact, especially in bitcoin and ether, keeping the broader ETF structure constructive heading into late January.

- Why did crypto ETF flows remain positive despite late-week selling?

Heavy mid-week inflows, especially from institutions, more than offset Friday’s profit-taking. - Which crypto ETFs led inflows this week?

Bitcoin and Ether ETFs dominated, driven by strong demand for BlackRock’s IBIT and ETHA. - How did XRP and Solana ETFs perform during the week?

Both quietly extended their momentum, posting steady net inflows despite late volatility. - What does this signal for crypto ETF sentiment in January?

The data points to sustained institutional conviction and ongoing dip-buying across major crypto assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。