China’s CBDC is steadily finding its footing, with adoption reportedly driven in part by the mBridge platform—a multi- CBDC bridge engineered to facilitate real-time cross-border payments and foreign exchange transactions using the digital currencies of participating nations.

Reuters reporter Marc Jones wrote that transfers conducted through the mBridge protocol have climbed past $55 billion, citing findings from a study by the Atlantic Council. The platform primarily relies on the digital yuan and reportedly settles transactions within seconds at near-zero cost by sidestepping traditional systems such as SWIFT, removing intermediaries, and employing smart contracts for compliance, fixed exchange rates, and cryptographic security.

Of the $55 billion total, 95% was settled in e-CNY. The mBridge platform is used by the People’s Bank of China, the Hong Kong Monetary Authority, the Bank of Thailand, the Central Bank of the UAE, and the Bank of Saudi Arabia, with an additional 20 commercial banks participating through the technology. Data from the Atlantic Council and Jones’ report via Reuters shows the protocol has handled more than 4,000 transfers.

“Taken together, these developments point to a gradual expansion of the yuan’s internationalization through digital infrastructure,” the Atlantic Council’s Alisha Chhangani told Jones. “Project mBridge is unlikely to challenge dollar dominance directly, but it may incrementally erode it,” she further remarked.

Atlantic Council data indicates that, as of the end of 2025, alongside China’s global leadership in CBDCs, 136 other nations are in development, pilot, or launch stages. Beyond China, which is still in pilot mode, three countries have fully rolled out retail CBDCs: the Bahamas (Sand Dollar), Jamaica (JAM- DEX), and Nigeria (eNaira). Venezuela’s PETRO is not classified as a fully realized CBDC, as it operated more like a state-backed cryptocurrency token without genuine central bank issuance on a sovereign ledger.

Also read: Groundbreaking: China to Pay Interest on Digital Yuan Deposits in Adoption Push

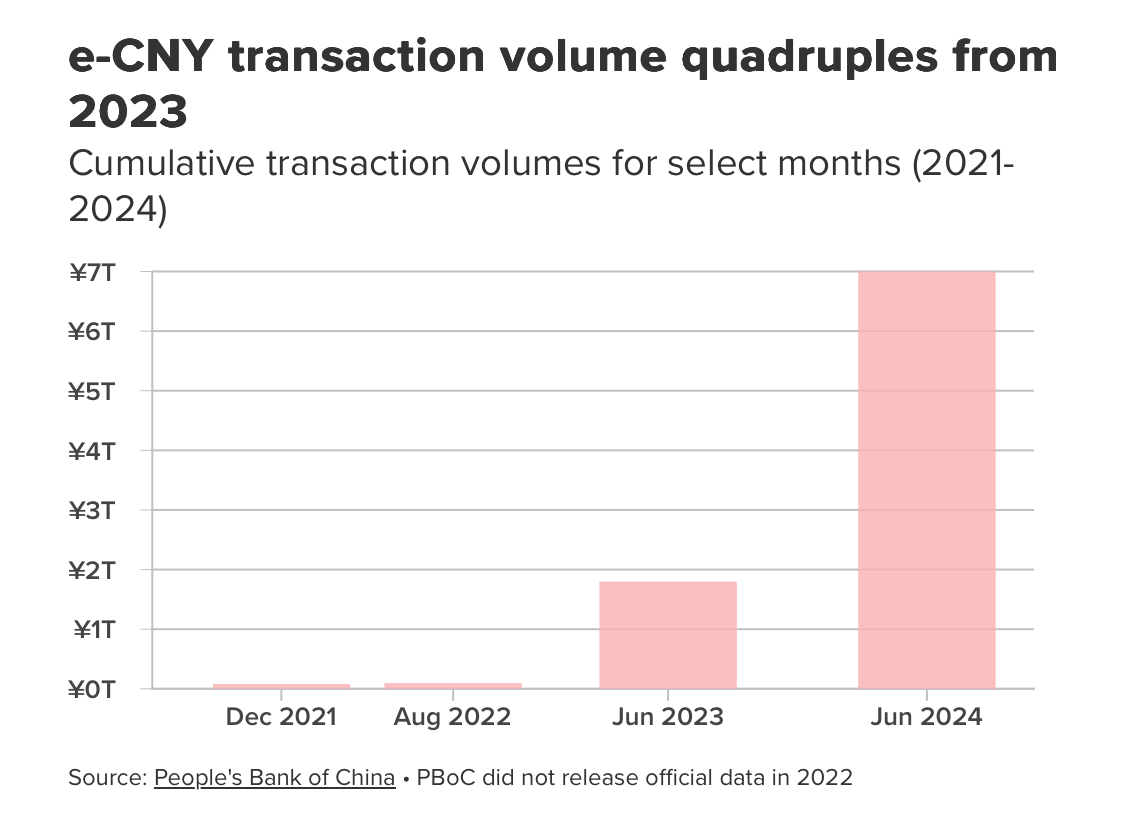

The Reuters report says data from the PBOC shows e-CNY has settled around “3.4 billion transactions worth roughly 16.7 trillion yuan ($2.4 trillion).” While adoption was limited in its early days, the digital yuan now appears to be gaining practical usage and recording measurable increases in real-world use.

Screenshot source: Atlantic Council Central Bank Digital Currency Tracker.

The figures suggest China’s digital yuan is moving beyond pilot-stage optics and into functional deployment, outpacing every other nation, particularly in cross-border settlement.

While e-CNY is unlikely to upend the dollar-based system outright, its growing transaction volume, institutional backing, and expanding international rails via mBridge point to a slow but deliberate recalibration of how global payments infrastructure may evolve in the coming years ahead.

- What is China’s e-CNY? China’s e-CNY is a central bank digital currency issued by the People’s Bank of China for domestic and cross-border payments.

- What is the mBridge platform? mBridge is a multi- CBDC payment network that enables real-time cross-border transactions and foreign exchange using digital currencies.

- How much value has e-CNY processed via mBridge? According to Reuters and Atlantic Council data, mBridge has processed about $55 billion, with 95% settled in e-CNY.

- Does e-CNY threaten the U.S. dollar? Analysts say the digital yuan is not poised to replace the dollar but may gradually reduce reliance on traditional payment systems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。