At the beginning of the new year, 3,500 institutional investors in South Korea are waiting for entry instructions. In a few weeks, a new era dominated by institutional funds will begin in the South Korean crypto market.

On January 12, 2026, the South Korean Financial Services Commission officially finalized guidelines allowing listed companies and professional investors to trade crypto assets.

This move reverses the ban on corporate crypto investments that has been in place since 2017. According to the regulations, eligible institutions can invest up to 5% of their equity each year in the most liquid cryptocurrencies traded on major exchanges in South Korea.

The final details are expected to be announced in a few weeks, and if the legislative timeline proceeds smoothly, corporate trading teams are expected to be active in the crypto market before the end of 2026.

1. Breaking the Ice

● The South Korean Financial Services Commission has officially announced the end of the nine-year ban on corporate cryptocurrency investments. Starting from 2026, listed companies and professional investors will be allowed to enter this market, which has long been dominated by retail investors.

● Regulators have set clear barriers for corporate entry. Only listed companies and licensed professional investors will be eligible to trade, with an annual exposure limit set at a small percentage of their balance sheets. Purchases must focus on the most liquid and fundamentally sound cryptocurrencies traded on major exchanges in South Korea.

● Execution rules will also be tightened. Exchanges will be required to adjust large orders to reduce market volatility and sudden price changes. According to data from the Bank of Korea, in just the first quarter of 2025, the trading volume of USDT, USDC, and USDS stablecoins on South Korea's five major exchanges reached 57 trillion won. By the end of 2024, the total market capitalization of the South Korean crypto market had surpassed 100 trillion won.

2. Deep Logic

The South Korean government's policy shift is driven by multiple deep-seated reasons. The first is the real economic structural pressure.

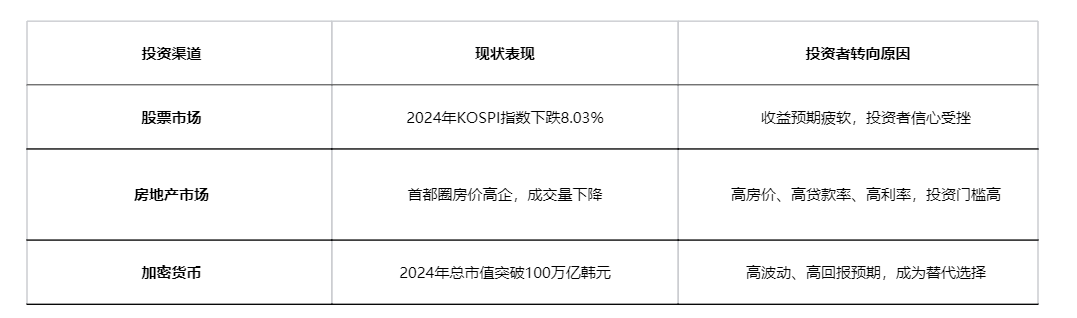

● Traditional investment channels in South Korea are facing difficulties, with both the stock market and real estate showing weak performance. The KOSPI index fell by 8.03% in 2024, far below the performance of the Shanghai Composite Index and the Nikkei 225 during the same period. The real estate market is characterized by "three highs and one low": high housing prices, high loan rates, high interest rates, and low transaction volumes.

Table: Dilemma of Traditional Investment Channels in South Korea

● The social psychology in South Korea is also an important driving factor. In this country where the "빨리빨리" (quickly) culture prevails, young people's anxiety about wealth has intensified, and cryptocurrencies are seen as a "fast track" to class ascension.

● According to surveys, 69.1% of South Koreans aged 20-39 list "financial freedom" as their primary life goal. More than one-third of South Koreans (about 18 million people) are active in the digital asset market.

● The newly elected President Lee Jae-myung promised during his campaign to actively promote the legalization of spot cryptocurrency ETFs and allow institutional investors to legally enter the crypto asset market. These policies are now gradually being realized.

3. Chain Reaction

The unique ecology of the South Korean crypto market will change with the entry of institutional funds. The most direct impact will be increased liquidity and a narrowing of the "kimchi premium."

● The "kimchi premium" phenomenon has long existed in the South Korean market, where cryptocurrency prices on South Korean exchanges are significantly higher than those on other major global exchanges. In March 2024, this premium reached 8.5%, and in November, it surged to 10%.

● With about 3,500 eligible institutional investors entering the market, a large influx of new funds will improve liquidity in the South Korean market. The rational pricing and cross-market arbitrage behavior of institutional investors are expected to gradually narrow this premium.

● The exchange landscape may face reshuffling. The South Korean market is highly concentrated, with Upbit and Bithumb monopolizing 98% of the market share. If the government implements a "tiered licensing" or "licensing mechanism," Upbit is likely to further consolidate its position due to its resource and technological advantages. Smaller exchanges may face compliance pressures and funding threshold challenges.

● Capital flows are also expected to show a trend of centralization. Analysts predict that even if policies allow investment in the top 20 cryptocurrencies by market capitalization, funds will still be concentrated in Bitcoin, and possibly Ethereum, with limited spillover effects on other altcoins.

4. Global Comparison

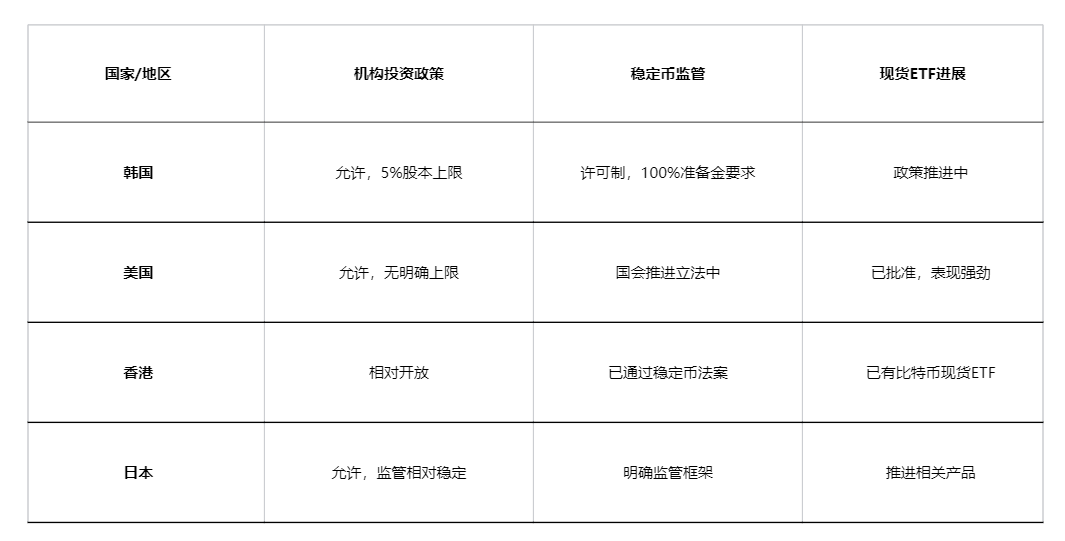

South Korea's policy adjustment is not an isolated case but part of the global trend towards the mainstreaming of crypto finance, though specific measures reflect distinct South Korean characteristics.

● The 5% allocation limit for institutional investors in South Korea is considered relatively conservative, stricter than the practices in the United States, Japan, Hong Kong, and the European Union. Some market participants have indicated that this strict limit may restrict financial strategies centered on crypto assets.

● South Korean regulators are also assessing how to incorporate dollar-pegged stablecoins while exploring the groundwork for launching won-denominated stablecoins. This aligns with President Lee Jae-myung's policy stance of "preventing the outflow of national wealth overseas."

● The proposed Digital Asset Basic Law stipulates that South Korean companies with a capital of 500 million won or more can issue stablecoins, provided they ensure a redemption mechanism through reserves. This news previously caused KakaoPay Corp's stock price to surge by 18%.

5. Future Outlook

● The South Korean crypto market is at a critical turning point. The final details to be announced in the coming weeks will provide clear operational guidelines for corporate crypto investments. Meanwhile, a more comprehensive Digital Asset Basic Law is also in the legislative process.

● South Korea has explicitly included the promotion of the approval process for Bitcoin spot ETFs in its 2026 economic growth strategy. If this development proceeds in parallel with the new corporate trading framework, it is expected to further normalize crypto assets within the South Korean financial system.

● South Korean exchanges have stated that their trading and settlement systems have the technical conditions to support institutional crypto products. This indicates that technical barriers are not an issue; institutional design is key.

● The status of venture capital may be granted to crypto companies. South Korea is considering allowing virtual asset trading platforms and brokerage services to obtain venture capital company certification, enjoying tax incentives, financing plans, and business development support. This will fundamentally change the policy that categorized digital asset companies alongside nightclubs and casinos in 2018.

● More broadly, South Korea is seeking to become a digital financial hub in Asia. As Singapore tightens its regulatory policies, if South Korea can quickly implement institutional designs and effectively execute them, it is expected to reshape the regional landscape.

The South Korean fintech company Toss has stated that it is ready to issue a stablecoin pegged to the won once the regulatory framework is in place. On the day the news was announced, KakaoPay Corp's stock price surged by 18%, marking the highest increase in over a year.

With the final details about to be announced and the advancement of the Digital Asset Basic Law, about 3,500 institutional investors are waiting at the entrance of the crypto market. The retail-dominated market structure in South Korea is about to undergo a fundamental change, and the landscape of crypto finance in Asia will be redrawn as a result.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。