The market holds its breath for the release of the U.S. December CPI data at 21:30 tonight. This economic report will reveal whether inflation is a technical rebound or a resurgence of structural issues.

Tonight, the U.S. will announce the December Consumer Price Index, with the market generally expecting a slight increase in this data. This figure will not only influence the market's judgment on the Federal Reserve's policy path but will also provide crucial guidance against the backdrop of exceptionally high uncertainty regarding the economic outlook.

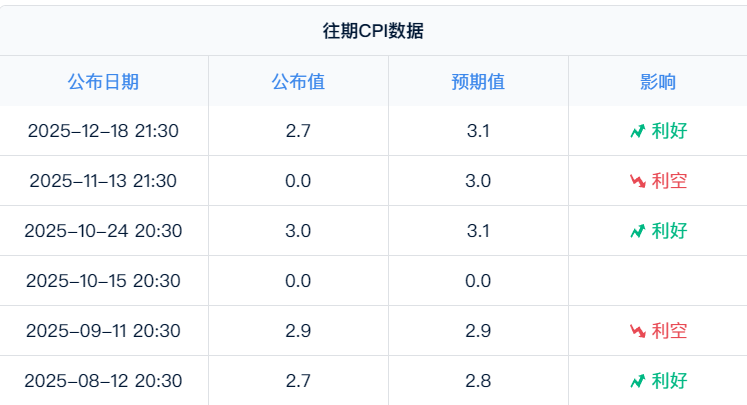

According to market forecasts, the December CPI is expected to rise by 0.3% month-on-month and 2.7% year-on-year; the core CPI is also expected to rise by 0.3% month-on-month and 2.7% year-on-year.

1. Market Expectations and Data Forecasts

The U.S. December CPI data to be released tonight has become the market focus. After a 43-day government shutdown that interrupted data releases, the publication of key economic data in the U.S. is gradually returning to normal.

● The market generally expects this inflation data to show a slight warming trend. According to the latest survey, economists expect the December CPI to rise by 0.3% month-on-month and 2.7% year-on-year. The core CPI is also expected to rise by 0.3% month-on-month and 2.7% year-on-year.

● This data will be one of the last key references before the Federal Reserve's monetary policy meeting on January 27-28. The market generally expects that this meeting will keep interest rates unchanged, but after three consecutive rate cuts in 2025, investors are betting on at least two more 25 basis point cuts in 2026.

● CICC analysis points out that the overall CPI month-on-month and core CPI month-on-month in December may be in the range of 35-45 basis points, higher than the market consensus expectation of 30 basis points.

2. Technical Factors and Statistical Distortion

It is worth noting that the recent fluctuations in CPI data have been significantly influenced by statistical method issues caused by the government shutdown. This issue may lead to a severe underestimation of the November inflation data, while the December data may show a compensatory increase.

● Due to the "government shutdown," the U.S. Bureau of Labor Statistics did not collect inflation data from October 1 to November 13, thus using the "carry forward" method to fill in the October inflation readings, effectively assuming that the month-on-month change in October CPI was zero. This led to a severe underestimation of the November inflation data on at least three levels.

● Specifically, the underestimation effect of the rent sample rotation is one of the key factors. U.S. rent inflation uses six sample rotations to calculate inflation growth, with the monthly inflation month-on-month approximately equal to the cumulative change of the current month's sample relative to the sample from six months ago divided by six.

● Because the statistical bureau directly used April data to fill in October data, the calculated month-on-month inflation for October was zero. The month-on-month growth rate compounded to yield the year-on-year inflation for November, which missed the month-on-month change in October inflation, resulting in a severe underestimation.

● The alternating month sample rotation also produced a similar effect. For inflation items with about 40% weight, the statistical bureau does not conduct sampling every month but adopts a combination of alternating month statistics and single month statistics. These technical issues are expected to be gradually corrected in the coming months, but they also increase the complexity of data interpretation.

3. Structural Factors and Tariff Impact

● In addition to technical factors, structural factors, especially tariff policies, cannot be ignored in their impact on U.S. inflation. The minutes from the Federal Reserve's May meeting clearly pointed out that the uncertainty regarding the economic outlook is exceptionally high, mainly due to the potential impact of tariff increases.

● New York Fed President Williams has stated that he expects tariffs to have a greater impact on inflation in the coming months, making the Fed's current restrictive policy stance "entirely appropriate." The impact of tariffs may lead to an increase of about 1 percentage point in U.S. inflation from the second half of this year to the first half of 2026.

● An analysis report from the U.S. Congressional Budget Office shows that Trump's tariff policy will reduce the deficit by $2.8 trillion over ten years, but will also lead to economic contraction, rising inflation rates, and a decrease in the overall purchasing power of American households.

● The report estimates that the tariff policy will cause the average annual inflation rate in the U.S. to rise by 0.4 percentage points in 2025 and 2026. The Fed's meeting minutes also noted that tariffs are expected to significantly push up inflation this year, with the upward effect expected to weaken in 2026.

4. Policy Path and Market Impact

Currently, the market's focus is on how the CPI data will affect the Fed's policy path. The Fed's policy in 2026 may exhibit characteristics of "moderate easing in the first half and differentiation in the second half with the change of administration."

● CITIC Securities analysis believes that the Fed's policy will continue to be moderately accommodative in the first half of 2026. Powell has repeatedly stated in the December meeting that the current "policy rate is in a good position to observe changes in the economic situation," and clearly pointed out that no FOMC member views interest rate hikes as the baseline scenario.

● The controlled state of inflationary pressure provides conditions for continued easing. Powell has stated that "if there are no new tariffs, commodity inflation may peak in the first quarter of 2026." At the same time, the Fed's confidence in a decline in inflation is increasing, having lowered its overall PCE inflation forecast for 2025 from 3% to 2.9%.

● Goldman Sachs' forecast is more specific, expecting the Fed to cut rates by 25 basis points in June and September 2026. This forecast is based on an optimistic outlook for economic growth, with Goldman Sachs expecting the U.S. GDP growth rate to reach 2.8% in 2026, more optimistic than economists surveyed by Bloomberg.

5. Asset Allocation and Investment Insights

In the face of potential volatility brought by inflation data, investors need to adjust their asset allocation strategies. CICC recommends that in an environment where inflation is temporarily strong, investors should increase commodity allocations, adding to positions in gold, U.S. Treasuries, and Chinese and U.S. stocks on dips.

Specifically, the rise in U.S. inflation at the beginning of 2026, combined with improving growth, may lead the Fed to slow down the pace of rate cuts. During this period, global liquidity is expected to tighten marginally, which objectively favors the dollar and is bearish for gold.

● On the other hand, as inflation rises, Trump's continued pressure on the Fed further undermines the credibility of the Fed and the dollar, which may also lead to a depreciation of the dollar and an increase in gold prices. During this period, the uncertainty between gold and the dollar increases, and overseas high-valuation growth stocks and U.S. Treasuries may face pressure.

● For Chinese assets, if U.S. inflation strengthens in the short term and overseas liquidity tightens marginally, it may temporarily increase market uncertainty. However, considering that recent domestic risk appetite remains high and market liquidity is abundant, the "spring market" is thriving, and stock market performance may be "dominated by domestic factors," with overseas influences unlikely to last long.

As the data release time approaches, the market holds its breath. Regardless of how the numbers fluctuate tonight, the complexity of the inflation path has already become apparent: on one side are the technical fluctuations caused by statistical distortions, and on the other side are the structural pressures induced by tariff policies.

Wall Street traders have adjusted their positions, economists have updated their forecasting models, and Fed officials are prepared with a series of policy responses. The outcome of this numerical game will directly impact the flow of trillions of dollars in global capital in 2026.

The true test of inflation may not lie in one or two months of readings, but in whether the U.S. economy can find a realistic path to stable prices amid the multiple pressures of policy intervention, statistical anomalies, and global trade restructuring.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。