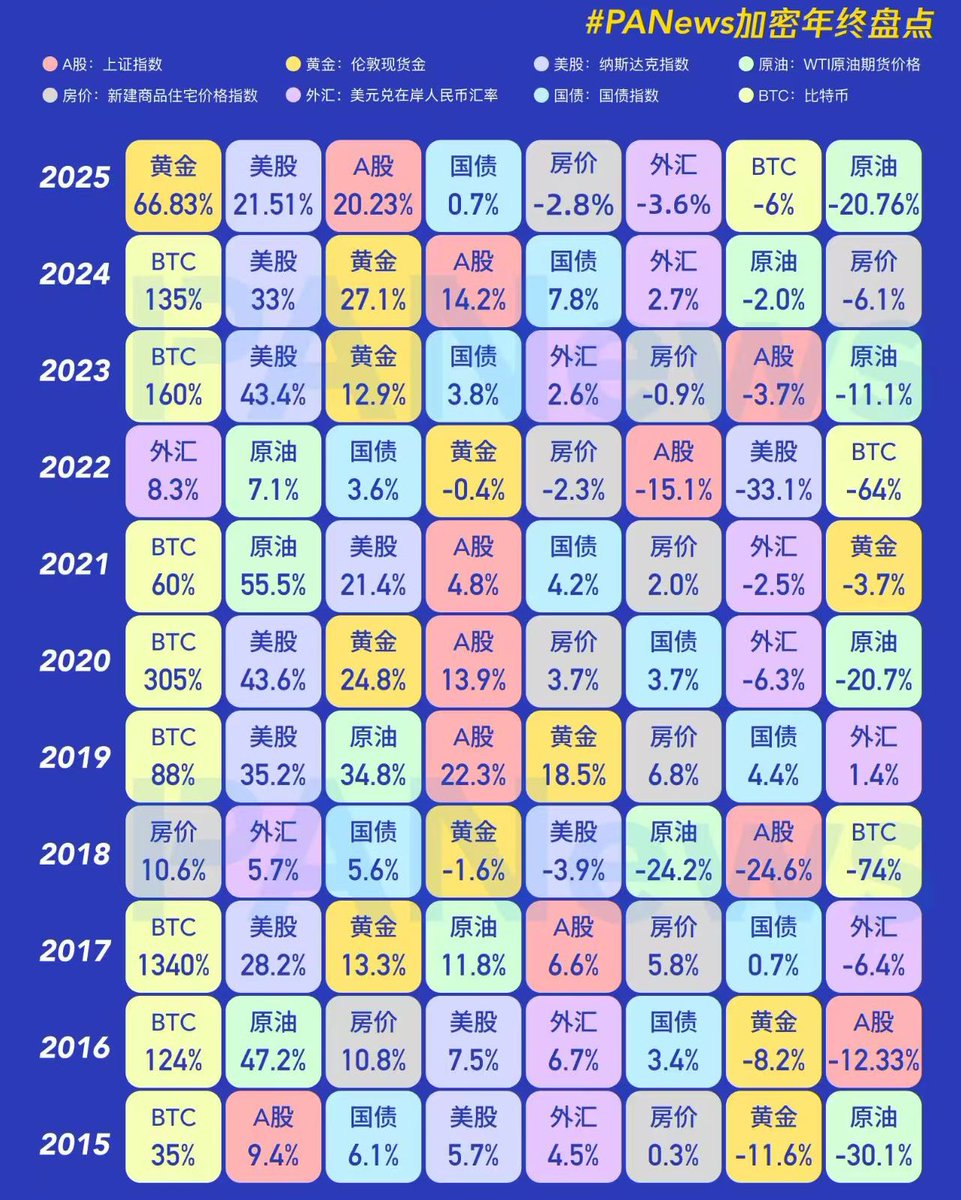

This image is more intuitive:

You can see that:

1️⃣ Bitcoin has been an asset with extreme volatility and extreme long-term returns in the first ten years.

2️⃣ The US stock market is the "most stable long-term winner." I believe it is a long-term compounding machine and the optimal default option.

3️⃣ The A-share market is a typical case of "high participation + low long-term returns." I admire the friends who are still fighting in it.

4️⃣ I don't want to talk about housing prices; basically, globally, they are transitioning from "faith-based assets" to "low-volatility assets," losing their allure.

5️⃣ It is necessary to hold some gold because it performs very well during "periods of systemic distrust" and is relatively stable in allocation.

So you see, the biggest dividend for ordinary people in their lifetime is not operational ability and short-term profitability, but whether they are on the "correct asset track."

This image proves that:

For some assets, working hard for ten years is in vain,

For some assets, as long as you don't self-sabotage, you can win.

Choosing is more important than effort by more than ten times.

This image is from @PANews, thanks for the compilation!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。