The trillion-dollar valuation myth of SpaceX reveals the cruel "class barriers" of traditional finance—most profits are often divided up before the IPO. However, the private equity tokenization platform represented by @JarsyInc is attempting to bridge the gap between retail investors and top unicorns through technological and business model innovation.

1️⃣ Crazy Valuations and "Locked-in" Excess Returns

According to the latest report from Bloomberg, SpaceX plans to go public in 2026 with a target valuation of up to $1.5 trillion.

What does this mean? Looking back in history, in 2015, Google and Fidelity jointly invested $1 billion in SpaceX, with Google contributing about $900 million for a 7.4% stake. At that time, SpaceX was valued at only $12 billion. Fast forward ten years, if we calculate based on a $1.5 trillion valuation, Google's investment from back then would skyrocket to $111 billion. The return on investment (ROI) for this single investment would be as high as 123 times.

This potential paper profit even exceeds the market value of an entire company like Adobe, and is more than Google's revenue for a single quarter.

Why is SpaceX worth this much? Many people think it just builds rockets, but in the eyes of professional investors, it has evolved into a "monopoly-level infrastructure giant."

Dominant Launch Capacity: In 2024, SpaceX completed 134 launches, capturing 90% of the global orbital payload mass. In this field, its competitor is not Boeing, but gravity itself.

Cash Cow Starlink: From a PowerPoint presentation to 8 million users (as of November 2025), annual revenue is expected to exceed $11.8 billion. It is no longer just a space company but the world's largest satellite telecom operator with its own launch capabilities.

Defense Moat: Holding $22 billion in government contracts, from NASA to the Pentagon, it is the sole core supplier of the U.S. space strategy.

However, faced with such a certain high-growth target, retail investors in the secondary market find themselves awkwardly "locked out." In the traditional private equity (PE) market, entry tickets are reserved for institutions like Google and Fidelity, which have billions in capital and top-tier connections. Ordinary people, even with a million in cash, are turned away due to the accredited investor threshold and high minimum investment amounts for single projects.

2️⃣ #Jarsy's #RWA Breakthrough Logic: Financial Equality

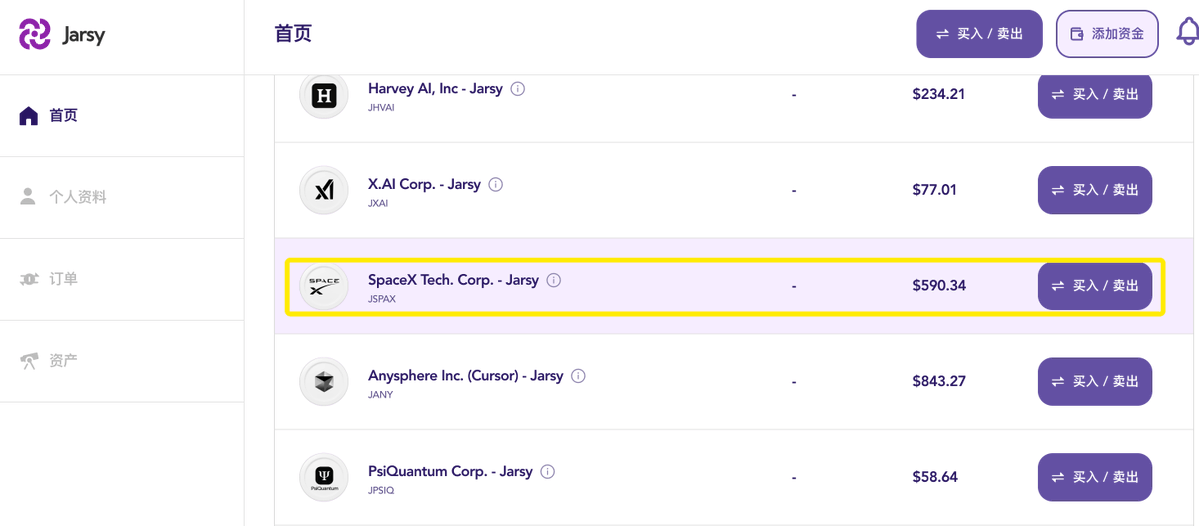

Recently, both the SEC and DTCC have been vigorously promoting RWA, which has become the most explosive core narrative for 2026, moving real assets onto the blockchain. What @JarsyInc is doing is fragmenting assets like SpaceX, the "crown jewel," through technological means.

This is not just about "issuing a token"; the financial engineering logic behind it addresses three core pain points:

- Regulatory arbitrage and compliance structure: Jarsy is not simply issuing tokens but has established a rigorous SPV (Special Purpose Vehicle) structure. It achieves a 1:1 mapping, where every token held by users is backed by real SpaceX equity held by a Delaware-registered SPV. Jarsy's registration and headquarters are also in the U.S., providing better protection for investors.

Bankruptcy Isolation: Even if the Jarsy platform itself faces operational risks, users' assets remain safely held in independent SPVs, still enjoying economic rights such as dividends, stock splits, and redemptions.

Extremely low entry barriers: In the traditional private equity primary market, the typical ticket size usually starts at $200,000 to $500,000. #Jarsy has violently reduced this threshold to $10. It connects the Web2 account system (Google login) and fiat deposit channels (USDC/fiat), allowing ordinary investors to allocate assets that were previously only accessible to firms like Sequoia and a16z, just like buying and selling stocks.

Solving the "liquidity discount" problem of private assets: The biggest risk in primary market investments is "liquidity lock-up." Your money may be locked for 5-8 years until the company goes public or is acquired. Jarsy introduces a "Name Your Price" mechanism, effectively establishing an OTC market on the blockchain. If you urgently need cash, you can transfer your tokens to others who are optimistic before the IPO. This grants unprecedented liquidity to private equity, turning what was once "dead money" into "live money."

Jarsy's selection strategy is also very restrained, focusing on leading projects in hard tech sectors like AI, aerospace, and fintech, such as the well-known SpaceX, Xai, and the recently popular prediction markets Polymarket, Kalshi, as well as financial unicorns like Stripe, Kraken, and Ripple. These companies undergo due diligence through Silicon Valley executive networks, which helps filter out junk projects for retail investors.

If investing in new coins is a gamble on "narratives," Jarsy bets on "the future of industries." Saying goodbye to the thrills of air coins, Jarsy opens the door for us to access the pre-IPO shares of the world's top unicorns, locking in the original stock dividends of giants like SpaceX and OpenAI in advance. Unlike the zero-risk of counterfeit projects in the coin circle, Jarsy's targets are all mature companies with real cash flow and moats, solid fundamentals, and strong resistance to downturns. Moreover, backed by a trillion-dollar global equity market, it accommodates large capital inflows and outflows, making it the best place to seek a safe harbor for assets, evolving investment from "high-risk gambling" to "steady growth following giants." Such opportunities were once unimaginable for retail investors, but now #Jarsy, through RWA equity tokenization, has made it a reality worth trying.

👉 Participation link: https://app.jarsy.com/?invite_code=4i7tqt

In summary, if Google's investment in SpaceX in 2015 was a carnival for top capital, then investing in #SpaceX through #Jarsy in 2025 represents a dimensional reduction attack by Web3 technology on traditional financial privileges. It does not promise instant wealth, but it does something more important: it tears down that wall. For retail investors, being able to hold shares in a great company before it rings the bell for its IPO, even if it's just a few hundred dollars, is an unprecedented financial experience. This may be the best annotation of blockchain technology empowering the real economy. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。