Author: angelilu, Foresight News

The cryptocurrency market in 2025 resembles a high-speed express train. Looking back from the platform, people can only see the survivors inside the train celebrating with raised glasses, while few notice the passengers who have been thrown off the tracks.

This year, we not only witnessed the madness of gamblers in the contract market but also observed the cruel infiltration of the Web3 dark forest rule into the physical world. The stories of sudden wealth are similar, but the ways of going to zero are varied. We have restored the money-losing records of several typical individuals in 2025—among them are billionaires, tech geeks, legendary gamblers, and even ordinary people just trying to save money.

Trading Section

Machi Big Brother Becomes the On-Chain "Liquidation Champion"

- Identity: Famous singer, entrepreneur, NFT whale

- Loss: Liquidated 71 times in just 19 days; single-day loss of $21.28 million

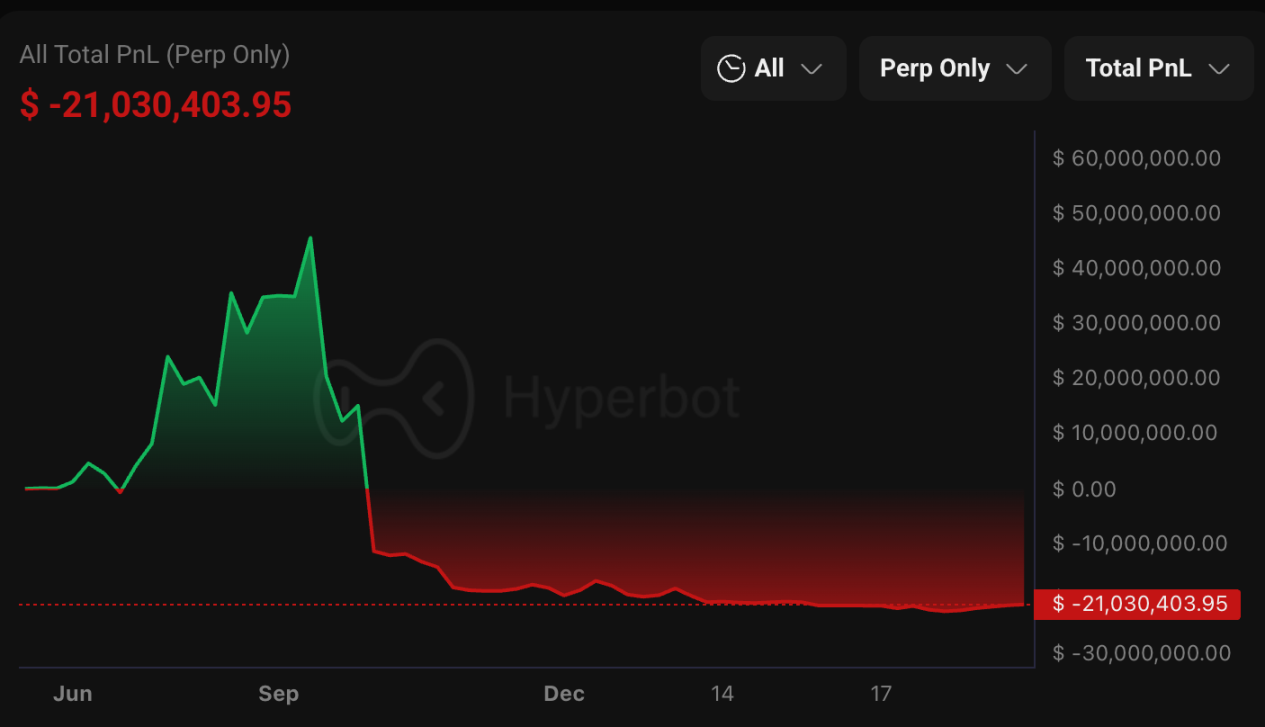

Huang Licheng's PnL profit and loss curve, source: Hyperbot

Rewind the clock three months, and Machi Big Brother was a winner in the Hyperliquid ecosystem, with heavy investments in HYPE, XPL, and ETH, at one point showing a paper profit exceeding $44 million. By the end of September and early October, the price of XPL collapsed (with a maximum drawdown of 46%), and HYPE also saw a significant correction. He failed to take profits in time, leading to a rapid expansion of his single-coin floating loss to over $8.7 million.

With the market crash on "10·11," Machi Big Brother officially turned to losses. However, this shift was not the end for him but the starting point for his unlimited opening of positions. He attempted to recover his losses by going long on ETH with high leverage. He held approximately 7,000 to 30,000 ETH long positions (with leverage often at 20x to 25x), but each time ETH experienced a sharp drop, it triggered his liquidation line.

In just 19 days from November 1 to 19, Machi Big Brother was forcibly liquidated 71 times. This means that over nearly three weeks, he averaged nearly four liquidations per day, earning him the title of "Liquidation Champion" on-chain. Yet, he kept recharging, getting liquidated, recharging again, and getting liquidated again. As of the writing, his total loss on perpetual contracts on Hyperliquid had reached $21.2 million. From a profit of $45.66 million to a loss of $21.2 million, he experienced an asset drawdown of over $66 million in less than three months. Despite a brief recovery, he remains in a state of deep losses and frequent margin calls.

Unlike ordinary people, Machi Big Brother Huang Licheng also carries the halo of a superstar. In the 1990s, he was the soul of Taiwan's L.A. Boyz, a pioneer idol who brought authentic American hip-hop into the Chinese music scene. This is not the first time Machi Big Brother has played the role of "retail savior." Everyone surely remembers the NFT battlefield of 2023. To compete for BLUR's airdrop points, he once crazily boosted trading volume in this bottomless pit. The outcome was tragic: he did receive airdrop tokens worth $1.9 million, but at the cost of losing 12,000 ETH (then valued at $25 million).

James Wynn's Billion-Dollar Gamble

- Identity: James Wynn

- Loss: Opened a $1.25 billion Bitcoin long position, lost $100 million in a week

If Machi Big Brother is a "rich person's pastime," then James Wynn's story is like a mortal who flew too high and ultimately had his wings melted by the sun.

Also engaged in contract trading, James Wynn's myth began with PEPE but exploded on the battlefield of Hyperliquid contracts. In March 2025, James Wynn entered Hyperliquid with a massive $25 million earned from PEPE. This $25 million was made from a mere $7,600 principal bet on the meme coin PEPE in 2023, but the gains from spot trading did not satisfy him. During March to April, he aggressively went long on PEPE and ETH, earning another $25 million, turning him into a super whale with $50 million in hand.

In May 2025, James Wynn turned his attention to Bitcoin, which was surging towards an all-time high of $110,000. At that time, James Wynn did something significant on-chain: he leveraged 40 times near the historical high of Bitcoin at around $108,000, opening a massive long position with a nominal value of $1.25 billion. What does this number mean? His on-chain position even exceeded the treasury reserves of many small countries. He attempted to use this $1.25 billion leverage to pry open the door to becoming the "world's richest person."

However, a sharp correction in Bitcoin soon pierced through the $105,000 mark, becoming James Wynn's nightmare. In just one week, his valuable contract melted away like an iceberg in the sun. Ultimately, he had to cut losses and exit, losing nearly $100 million. Overnight, the astronomical figure earned from PEPE was almost entirely returned to the market. After the collapse, he left a nihilistic quote on Twitter: "Money isn't real."

Unwilling to accept defeat, James Wynn attempted to "recover" in November, but he misjudged the direction—betting that Bitcoin would drop below $92,000, he shorted all his remaining funds. Data recorded his final madness: in just two months, he was forcibly liquidated 45 times; on the worst day, he was liquidated 12 times in 12 hours. Once the "meme coin prophet," he had now become a gambler screaming at the K-line. He vowed on social media: "I will sell all my stablecoins to short. Either I make hundreds of millions, or I go completely bankrupt."

Spot Whale Loses $125 Million and "Cuts Losses" to Exit

- Identity: Whale who shorted 66,000 ETH using borrowed coins

- Loss: Single position floating loss of $125 million; transferred $140 million to Binance to crash the market within 8 hours

In addition to contracts, whales holding spot assets also face massive losses. The "whale who shorted 66,000 ETH using borrowed coins" was once a hunter in the market, skilled at using lending protocols for large-scale short arbitrage. But this time, the hunter became the prey.

Earning $24 million through shorting with borrowed coins did not satisfy him; he wanted more—he wanted to "eat both long and short." On November 5, after closing his short position, he immediately reversed course and began frantically bottom-fishing. In just 9 days, by November 14, he transferred a staggering $1.187 billion to Binance and withdrew 422,000 ETH, raising his average holding price to $3,413. For this gamble, he even used up to $485 million in on-chain leveraged loans.

The market gave this greedy individual a harsh slap in the face. As the price of ETH continued to decline, breaking below the $3,000 mark, his "bottom-fishing" turned into a "deep trap." On-chain data recorded his most desperate moment: during the worst phase in November, his massive long position had a floating loss that once reached $133 million. The $24.48 million profit he painstakingly earned from shorting was instantly swallowed by this massive loss, and he lost a full $100 million of his principal. Once the "shorting god," he became a "leveraged gambler" burdened with $480 million in debt.

On November 16, the whale began a major retreat, redeeming 177,000 ETH from Aave and starting to transfer 44,000 ETH (worth $140 million) to Binance in batches, with an actual loss of $125 million.

Whale Collapsing in "Chinese Meme"

- Identity: Whale heavily invested in Chinese Meme at the peak

- Loss: Cumulative loss of $3.598 million (single coin loss of $2.49 million)

In addition to stubbornly holding ETH, many have also suffered losses by stubbornly holding memes.

In October 2025, when market hotspots rotated between AI and mainstream coins, this whale fell into the narrative maze of "Chinese Meme."

He was like a dedicated stamp collector, spending $4.49 million to crazily build a position in a series of Chinese Meme tokens on the BSC chain: "Binance Life," "Customer Service Xiao He," "Haqimi." He heavily bought "Binance Life" at an average price of $0.3485, increasing his position to $4.08 million, becoming the seventh-largest individual holder of that token. The market gave him countless opportunities to escape, but he chose to be a "diamond hand."

Eight days after his initial position, the value of his Meme assets shrank by 56.5%, with floating losses exceeding $3 million, and all but "Haqimi" collapsed. Yet he did not liquidate, still chasing the price higher when it rose. Ultimately, in early November, faith collapsed under the gravity of the K-line going to zero, and he liquidated all his tokens in one go within 50 minutes. The outcome was tragic: a cumulative loss of $3.598 million. Among them, just the token "Binance Life" alone cost him $2.49 million.

This whale learned a lesson worth $3.6 million: in the world of memes, liquidity exhaustion is scarier than contracts; once the trend turns bad, every second is a window for escape, and stubbornness only leads to zero.

A "Notorious Hacker's" "Karma"

- Identity: On-chain hacker / top "contrarian indicator"

- Loss: Losses from trading in October alone reached $8.88 million

This may be the most "refreshing" loss story of 2025. We usually think of hackers as cold, rational predators, but this "notorious hacker" proved through his actions that he only understands code, not K-lines.

In March and August of this year, he used technical means to steal a large amount of funds and should have vanished to enjoy his wealth. However, he made a fatal mistake—attempting to use the stolen money to trade coins. It turned out that the market manipulators in the crypto space are harsher than hackers.

In October, he precisely "bought high and sold low" on ETH, heavily investing in 8,637 ETH at an average price of $4,400 (total value of about $38.01 million). Just 10 days later, he encountered the flash crash on "10·11." In a panic, he not only failed to hold on but also liquidated at a floor price of $3,778, incurring a loss of $5.37 million.

In mid-October, he panicked and cut losses during the downturn, losing another $3.24 million. The most ridiculous scene occurred an hour after his liquidation—seeing the market rebound, he couldn't resist and bought back over 2,000 ETH at a higher price. As a result, the market declined again, forcing him to cut losses once more. By October 18, due to frequent chasing and selling, he had accumulated losses of $8.88 million in just half a month.

This hacker's experience tells us: stealing money requires skill, but preserving wealth requires character. In the face of volatile K-lines, even hackers are just tender green chives.

Attack Section

User Babur, Failed "Multisig" and Expensive "Double Click"

- Identity: On-chain whale

- Loss: Approximately $27 million (some funds laundered into Tornado Cash)

If some losses are due to overly complex technology, then Babur's $27 million loss is due to "bad habits."

At the end of December 2025, SlowMist founder Yu Xian and CertiK disclosed this case. Whale Babur's Solana and Ethereum addresses were raided, resulting in losses of up to $27 million. Ironically, Babur actually had a certain level of security awareness—he used an industry-standard Safe multisig wallet to store his assets.

In theory, a multisig wallet requires multiple private key signatures to transfer funds, making it highly secure. However, the investigation revealed a fatal low-level mistake: Babur had stored the two private keys required for the multisig on the same computer. This is akin to buying the world's most secure safe (multisig) that requires two keys to open, but hanging both keys on the doorknob of the safe.

When he double-clicked a malicious file (a "poisoning" attack) on his computer, the virus easily took all his private keys. Yu Xian commented, "Real poisoning attacks are probably very simple, with no advanced techniques; many threats are also old news."

Subsequently, CertiK monitored that the hacker had transferred 4,250 ETH (about $14 million) into Tornado Cash for mixing. Babur learned a simple lesson worth $27 million: if private keys are not physically isolated, even the most advanced multisig is just a layer of window paper.

Suji Yan, the "11 Minutes" that Disappeared at the Birthday Party

- Identity: Founder of Mask Network

- Loss: $4 million (a nightmare on his 29th birthday)

February 27, 2025, should have been a joyous moment for Suji Yan, the founder of Mask Network, celebrating his 29th birthday, but it turned into a nightmarish scenario reminiscent of Rashomon. This was not a high-level code attack from the dark web but a terrifying "insider" crisis. According to Suji's account, he was celebrating his birthday with a dozen friends at a private gathering. Just because he went to the restroom and his phone was out of sight for a few minutes, the wheels of fate began to turn.

On-chain data shows that in the following 11 minutes, a hacker calmly transferred over $4 million in assets from his public wallet through manual operation. SlowMist founder Yu Xian confirmed that these funds were quickly exchanged for ETH and dispersed to seven addresses.

"The operation was manual and lasted over 11 minutes." This means that behind the laughter and clinking glasses, someone (or lurking malware) took advantage of this brief window to carry out the heist right under his nose. Suji admitted, "I trust my friends, but this is a nightmare for anyone." This incident became one of the most chilling lessons in Web3 in 2025: never store the private keys of hot wallets containing large assets on your phone, which you carry for socializing and taking photos.

Sam Altman's Ex-Boyfriend's Terrifying Night

- Identity: Well-known tech investor, Sam Altman's ex-boyfriend

- Loss: $11 million + personal injury

If being robbed on-chain is "losing money to avoid disaster," then Lachy Groom's experience completely shattered the illusion that "decentralized assets are safer." On a Saturday in November, a robber disguised as a delivery person tricked his way into his mansion in San Francisco. Lachy not only faced armed kidnapping but was also bound with tape and beaten. For 90 minutes, the robber forced him to reveal his passwords, emptying his account of $11 million in crypto assets. This case represents a "dimensionality reduction attack" in the increasingly criminal Web3: hackers no longer need to break code; they just need to break down your front door.

Recommended reading: "Setting Aside 'Altman's Ex,' How Crazy is Lachy Groom's Life?"

Moreover, according to Bloomberg, in the past three years, there has been a surge in "wrench attacks" targeting cryptocurrency holders. According to a database maintained by Jameson Lopp, co-founder of the cryptocurrency security company Casa, about 60 such attacks have been recorded globally this year, resulting in tens of millions of dollars in losses.

TikTok Buyer, Cold Wallet "Poisoned" by Supply Chain

- Identity: Ordinary investor

- Loss: 50 million RMB (about $7.08 million)

This is a typical case of "cognitive harvesting." An investor, in pursuit of so-called absolute security, decided to use a hardware cold wallet to store assets. However, he made a fatal mistake: he purchased a "discounted" cold wallet on TikTok.

What he didn't know was that this wallet had been tampered with before leaving the factory, and the private keys had already been leaked. When he confidently deposited 50 million RMB, he was essentially sending money directly to the hacker. A few hours later, the assets were laundered clean through Huione. This expensive lesson teaches us: the biggest security vulnerability often lies in the human tendency to seek bargains.

Whale Trusting "Official Customer Service" Loses $91.4 Million

- Identity: "Obedient" whale with $300 million in Bitcoin

- Loss: 783 BTC (worth about $91.4 million at the time)

On August 19, 2025, a whale fell victim to a "social engineering attack." He didn't click on random links or download viruses; he simply answered a phone call. On the other end was a calm, professional "senior engineer from the hardware wallet," informing him that his device had a critical vulnerability and needed immediate cooperation for a "firmware upgrade." During an hour-long "guidance" call, this whale completely let down his guard and willingly handed over 783 BTC worth about $91.4 million. After the malicious transfer occurred, the funds began to undergo a typical money laundering process, being deposited multiple times into Wasabi Wallet (a privacy tool commonly used to obfuscate tracking).

A similar case had already occurred in 2024, with an even larger amount, where the victim lost approximately $300 million in Bitcoin.

Survivorship Bias

These ten names, with hundreds of millions of dollars in tuition, show us the full picture of the dark forest of Web3: there are no absolute winners here; hackers may steal code but lose to market makers in the secondary market; there is no absolute security—Babur's technical defenses cannot withstand the "poisoning" of the physical world; there are also no absolute fortresses—Lachy's mansion cannot stop the barrel of a robber's gun, and the whale trusting "official customer service" cannot resist the blind obedience deep within human nature.

Each person on this list was once a standout or lucky individual in their respective fields. If there is a survival rule to remember in 2025, it may not be "how to get rich," but rather "how to survive."

In the crypto market, staying alive is far more important than how much you earn. After all, only those who survive have the right to tell the story of next year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。