Original | Odaily Planet Daily (@OdailyChina)

On December 22, a development regarding the leading prediction market Polymarket attracted widespread attention in the market — Polymarket team member Mustafa confirmed in the Discord community that Polymarket plans to migrate from Polygon and launch an Ethereum Layer 2 network called POLY, which is currently the project's top priority.

An Unexpected "Breakup"

Polymarket's decision to leave Polygon is not surprising; one is a hot application layer representative, while the other is a gradually declining old layer, and there has always been a mismatch in market heat and value expectations between the two. As Polymarket gradually grows into a new giant, Polygon's unstable network performance (the latest failure occurred on December 18) and relatively weak ecosystem have objectively limited the former.

For Polymarket, building its own portal means a win-win choice in both product and economic dimensions.

In terms of product, besides seeking a more stable operating environment, building its own Layer 2 network allows Polymarket to customize underlying features according to its platform needs, thus adapting more flexibly to future upgrades and iterations of the platform.

The more significant meaning lies in the economic aspect. Building its own network means Polymarket can consolidate the economic activities and surrounding services derived from its platform into its own system, preventing related value from spilling over to external networks and instead gradually solidifying into its systemic advantages.

Explicit and Implicit Economic Contributions

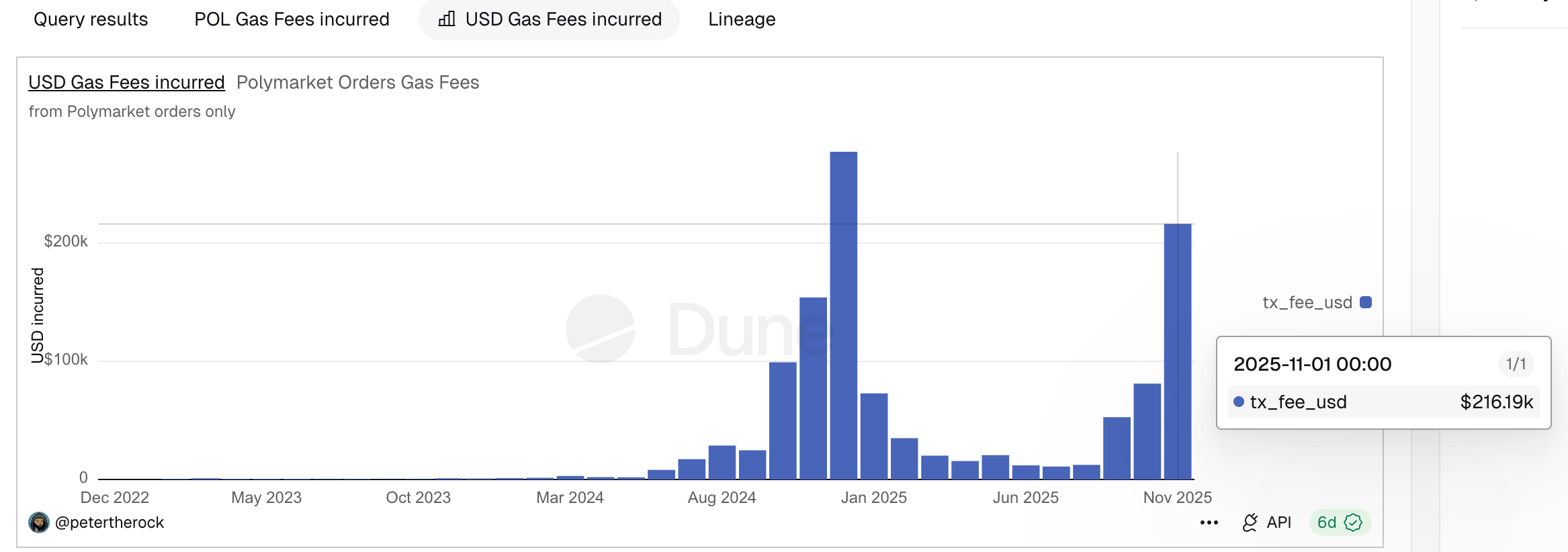

As an application layer, Polymarket's explosive growth has brought objective direct economic contributions to Polygon. Data analyst dash compiled historical data on Dune showing:

- Polymarket's active users this month are 419,309, with a total historical user count of 1,766,193;

- The total number of transactions this month is 19.63 million, with a total historical transaction count of 115 million;

- The total transaction volume this month is $1.538 billion, with a total historical transaction volume of $14.3 billion.

As for how to assess Polymarket's contribution to the economic ecosystem of Polygon, Odaily Planet Daily found a rather coincidental ratio while compiling data for both.

- First, in terms of locked funds, Defillama** data shows that the total value of positions across the Polymarket platform is approximately $326 million, accounting for about a quarter of Polygon's total locked value of $1.19 billion**;

- Secondly, regarding gas consumption, Coin Metrics reported last October that transactions related to Polymarket were expected to consume 25% of the gas on the entire Polygon network;

- Considering that this data is somewhat outdated, we checked recent changes, and data analyst petertherock** on Dune showed that transactions related to Polymarket consumed about $216,000 in gas in November, while Token Terminal reported that the total gas consumption for the entire Polygon network that month was about $939,000, with a similar proportion of nearly a quarter (about 23%).**

While there may be coincidences due to statistical criteria and time windows, the cross-dimensional similar results can serve as a reference for estimating Polymarket's economic significance to Polygon.

In addition to quantifiable indicators such as active users, locked funds, transaction volume, and gas contributions, Polymarket's economic significance to Polygon also lies in a series of more difficult-to-measure yet equally real implicit contributions.

First is the activation of stablecoin liquidity. All transactions on Polymarket are settled in USDC, and its high-frequency, continuous trading behavior has objectively significantly increased the demand for and use cases of USDC on the Polygon network; second is the ancillary behavioral value of retained users, aside from the prediction market itself, these users may also turn to use other products in the Polygon ecosystem, such as DeFi, for convenience, thereby enhancing the overall ecological value of the Polygon network. These contributions are difficult to quantify with specific data but constitute the "real demand" that the underlying network values most and is most scarce.

Why Now? The Answer is Not Hard to Guess

In fact, based solely on user scale, data performance, and market volume, Polymarket has fully established the confidence to stand on its own. This is no longer a question of "whether to leave," but rather "when to leave."

The reason for choosing to migrate at this moment is likely due to the approaching Polymarket TGE. On one hand, once Polymarket completes its token issuance, its governance structure, incentive system, and economic model will become relatively fixed, making subsequent underlying migrations significantly more costly and complex; on the other hand, upgrading from a "single application" to a "full-stack system of application + underlying" inherently means a change in valuation logic, and building its own Layer 2 undoubtedly opens a higher ceiling for Polymarket in terms of narrative and capital.

In summary, Polymarket's departure from Polygon is essentially not just a simple underlying migration but a reflection of structural changes in the crypto industry. When top applications begin to possess the ability to independently carry users, traffic, and economic activities, if the underlying network cannot provide additional value, it will inevitably be "backstabbed."

Nothing more, just profit-seeking.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。