Bitcoin broke through $120,000 in January, Zcash surged 241% in October alone, and a hacker attack caused the market to evaporate $300 billion in a single day. The story of ice and fire in the crypto market of 2025 is fiercely played out on the same candlestick chart.

2025 is the year when the crypto world was officially "pacified." The heavy boot of regulation has landed, and the torrent of institutional investment has surged in, while the market's narrative is no longer solely about Bitcoin.

From Capitol Hill in the United States to the Hong Kong Securities and Futures Commission, from BlackRock's boardroom to anonymous decentralized autonomous organizations, every decision is reshaping this digital jungle worth trillions of dollars.

1. New Macroeconomic Landscape: Three Forces Reshaping Market DNA

The underlying operational logic of the cryptocurrency market in 2025 has been completely rewritten. The market, once driven by retail sentiment and Twitter narratives, is now taken over by three more powerful forces: national regulatory will, traditional capital pathways, and sustainable technological narratives.

● The shift in the Trump administration's stance is the most critical macro variable of the year.

From quickly pardoning key figures in the industry after taking office in January to signing the landmark GENIUS Act in July, the U.S. made a rapid turnaround from vague resistance to actively constructing a regulatory framework within a year.

This is not an isolated case; the full implementation of the EU's MiCA regulations and Hong Kong's Stablecoin Regulations together outline a clear picture of major global economies incorporating crypto assets into mainstream financial regulatory systems.

● At the same time, the way capital enters the market has fundamentally changed.

Bitcoin and Ethereum spot ETFs are no longer novelties but have become standard allocation tools like stocks and bonds.

Just BlackRock's Bitcoin ETF alone saw weekly net inflows exceeding $1 billion multiple times in the fourth quarter.

The institutional nature of capital has led to market volatility becoming closely linked to macro indicators such as Federal Reserve interest rate decisions and Treasury yields, rather than being solely influenced by Musk's tweets.

● The technological narrative has undergone a deflationary baptism.

The "Zoo Meme Coin" craze that thrived last year has quickly receded, replaced by serious discussions on the substantive integration of AI and blockchain, the tokenization of RWA (real-world assets), and privacy computing infrastructure.

Market funds are voting with their feet, shifting from pure speculation to seeking protocols that can generate actual cash flow or solve real problems.

2. Regulatory Turning Point: From Gray Areas to Rule Jungle

If the market was still speculating when the regulatory knife would fall in 2024, by 2025, that knife has fallen and carved out a brand new set of game rules. The signing of the U.S. GENIUS Act is a "watershed moment" in the history of global crypto regulation.

● The essence of this act lies in "pacification" and "incorporation." It establishes a federal-level issuance and regulatory framework for USD stablecoins, mandating 100% high-quality liquid asset reserves and transparent audits.

Its deeper intention is clear: In the era of digital currency, to extend and consolidate the global hegemony of the dollar through privately issued, fully regulated USD stablecoins. Overnight, compliant stablecoins like USDC upgraded from a financial tool to an extension of national strategy.

● The "double-edged sword" effect of regulation is extremely evident. On one hand, it clears the largest uncertainties in the market, removing compliance barriers for traditional funds at the trillion-dollar level. On the other hand, the rules it establishes effectively declare the end of the "wild growth" era.

Privacy protocols that do not meet KYC/AML (Know Your Customer/Anti-Money Laundering) requirements and algorithmic stablecoin projects that cannot satisfy reserve audits are explicitly isolated from the mainstream financial system and even face existential crises.

● A new regulatory landscape has formed globally, characterized by U.S. dominance, EU norms, and Asian competition. This landscape is not monolithic but is filled with regulatory arbitrage opportunities. Some projects have begun relocating their headquarters to more regulatory-friendly jurisdictions, while multinational giants must learn to navigate the complex "rule jungle."

3. Capital Revolution: How Wall Street Shorted Bitcoin

The most spectacular market scene in 2025 is not the hundredfold surge of some altcoin, but how traditional capital systematically and mechanically "devours" Bitcoin through new channels. The story of institutional entry has evolved from a prelude in 2024 to the grand theme of 2025.

● Spot ETFs are the lifeblood of this revolution. They perfectly solve the custody, compliance, and tax issues faced by traditional institutions, making purchasing Bitcoin as simple as buying Apple stock.

Data on capital flows reveals a self-reinforcing cycle: The rise in Bitcoin prices attracts ETF inflows, large purchases further drive up prices and strengthen the upward trend, which in turn attracts more funds. The brand endorsement from giants like BlackRock and Fidelity has opened the floodgates for conservative capital such as pensions and endowment funds.

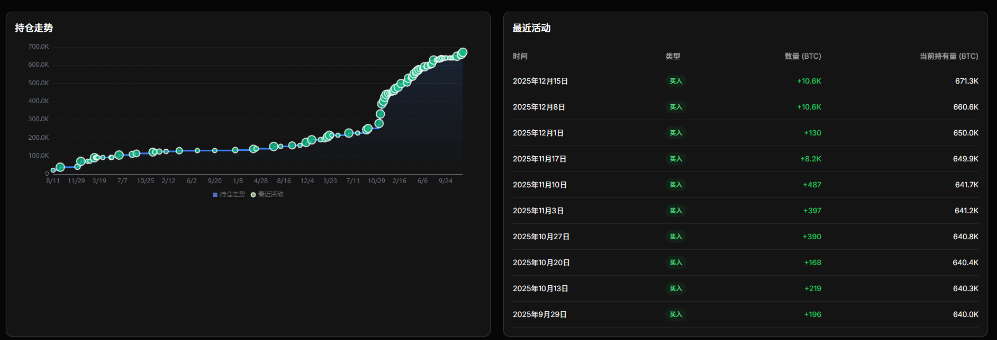

● Another silent revolution is occurring on corporate balance sheets. Strategy increased its Bitcoin holdings from about 446,000 coins at the beginning of the year to 671,000 coins in 2025, with its stock price's correlation to Bitcoin prices even exceeding that of its core business.

This "corporate hoarding of Bitcoin" trend has spread from publicly traded companies to private tech firms, forming a new corporate financial paradigm that treats Bitcoin as an "anti-inflation strategic reserve."

● The evolution of capital has profoundly changed market behavior. The funding rate fluctuations of perpetual contracts in the futures market have become more stable, as the strong support from spot buying has weakened the dominance of derivatives.

The addresses of "whales" have gradually shifted from anonymous early investors to ETF custody addresses labeled with institutions. While the market has become "boring," it has also become more resilient.

4. Sector Rotation: Seeking the New Holy Grail in Privacy and AI

● As mainstream narratives are "taken over" by institutions and regulators, the market's speculative instincts and innovative capabilities have begun to seek outlets in marginal sectors. The sector rotation in 2025 exhibits strong event-driven and value reassessment characteristics, with privacy and AI becoming the most dazzling twin stars.

● The return of the king in the privacy sector is the most dramatic twist of the year. Zcash (ZEC) has leaped from long-term obscurity to become a market star, with its over 200% monthly increase directly triggered by the U.S. government's lawsuit against the "Prince Group" and its massive Bitcoin confiscation plan in October.

This event was like a lightning bolt, illuminating the "flaw" of complete transparency in Bitcoin and Ethereum ledgers. Overnight, financial privacy transformed from a philosophical demand of libertarians into a tangible fear and rigid need for high-net-worth users and institutions. The market suddenly realized that in an era of comprehensive regulation and on-chain monitoring, protocols that can provide compliant privacy solutions like "selective disclosure" may possess scarce long-term value.

● The integration of AI and blockchain has shifted from concept to infrastructure competition. The focus of speculation has shifted from "tokens with AI concepts" to "decentralized infrastructure essential for AI operations."

Decentralized computing and machine learning protocols represented by Bittensor (TAO) and decentralized rendering networks represented by Render Network (RNDR) have been revalued for addressing practical resource bottlenecks in AI development. The market is beginning to seek blockchain projects that are not merely riding the hype but can capture real demand in the AI value chain.

● At the same time, the differentiation within traditional DeFi and public chain sectors has intensified. Solana continues to capture market share from Ethereum due to lower fees and a more active developer ecosystem. Emerging modular blockchains and Layer 2 solutions are fiercely competing for the throne of "the next Ethereum."

5. Market Analysis: Divergent Patterns and Doomsday Revelry

The price trends of 2025 are not a universally beneficial bull market but a floating world composed of extreme divergence. The following key data reveals how the fates of different asset categories can be worlds apart:

● Bitcoin and Ethereum have emerged as a robust "institutional bull." Their candlestick charts are increasingly correlated with the Nasdaq index and U.S. Treasury yields, with volatility dropping to multi-year lows. This marks their transition from high-risk speculative assets to allocation assets in institutional portfolios, with their pricing logic increasingly resembling that of traditional growth tech stocks.

● In contrast, Zcash and some small-cap AI tokens have staged an extreme "speculative frenzy." The surge of ZEC perfectly illustrates the age-old rule of the cryptocurrency market: "buy on expectations, sell on facts." Its price peaked amid privacy panic and KOL endorsements, but the usage rate of its core privacy trading function did not see a corresponding explosion, highlighting the significant bubble risk of disconnection between price and fundamentals. This extreme surge in a specific sector at the end of a bull market is often referred to by market veterans as the "doomsday chariot," warning that the revelry may be nearing its end.

● Stablecoins are the unique "winners" in this game. Their value lies not in price increases but in scale and ecological dominance. Compliant stablecoins like USDC, bolstered by regulation, have become the absolute bridge connecting traditional dollars with the on-chain world, with annual settlement volumes reaching hundreds of trillions of dollars, defining the entire DeFi pricing unit.

6. Black Swans and the Testing of Market Immunity

Even under the overarching trends of institutionalization and compliance, the inherent fragility of the crypto market underwent several brutal stress tests in 2025. These black swan events acted like earthquakes, testing the "seismic resistance" of this emerging financial system.

● The Bybit hacking incident in February was the first disaster of the year. With losses reaching $1.46 billion, it not only triggered a price collapse but also shook the industry's faith in the "absolute safety" of top exchanges. In the aftermath, exchanges began publicly disclosing the frequency of their "proof of reserves" audits and cold wallet management details, leading to a new surge in demand for insurance and custody services.

● The "perfect storm" in October was even more comprehensive. Beginning with the U.S. government shutdown on October 1, it created sustained macro uncertainty. Subsequently, the U.S. Department of Justice's lawsuit against the "Prince Group" and its request to confiscate 127,000 Bitcoins triggered deep fears of "government market manipulation." Multiple negative factors ultimately exploded on October 11, resulting in a single-day liquidation of $19 billion. This crash cleared a large number of high-leverage positions, acting as a brutal "market chemotherapy" that killed unhealthy cells and laid a healthier foundation for subsequent rises.

● The late October pardon of Binance founder CZ by Trump showcased a deep intertwining of politics and finance. The pardon itself was seen as a signal of regulatory leniency, but the complex political and business relationships behind it made market participants realize that in this emerging industry, policy risks could manifest in a more personalized and unpredictable manner.

The imprint of the "crypto president" has been deeply etched in Washington, with Bitcoin holdings on BlackRock's ETF reports becoming a routine item, while Zcash holders continue to debate whether privacy is a fundamental right or a shield for crime.

As the story of 2025 comes to a close, the old rulebook has been torn apart, but the new order has yet to be fully established. The only certainty is that cryptocurrency is no longer an edge experiment on the internet; it has become a core chapter in the global narrative of power, capital, and technology that can no longer be ignored.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。