Author | Aki Wu on Blockchain

If we were to choose the most representative figure for the bullish narrative on Ethereum in 2025, Tom Lee, Chairman of the Ethereum treasury company BitMine and Co-founder and Chief Investment Officer of Fundstrat, would often be placed in the most prominent position. He has repeatedly emphasized in public speeches that ETH is undervalued, and just recently, on December 4th during Binance Blockchain Week, he stated that Ethereum at $3000 is "severely undervalued," and has given a high target price prediction of "ETH at $15,000 by the end of 2025." As a Wall Street veteran known as the "Wall Street Oracle," and a strategist who has long been active in media and institutional roadshows, Tom Lee's views are often seen as a barometer of market sentiment.

However, when the market shifts its focus from the spotlight to internal documents, the narrative takes a turn: in Fundstrat's latest internal outlook strategy for 2026, created for subscription clients, a contrary viewpoint is presented. Their baseline prediction suggests that significant pullbacks in crypto assets may occur in the first half of 2026, with ETH's target range set at $1800–2000. This discrepancy between the "publicly bullish" and "internally bearish" statements has thrust Tom Lee and his associated institution into the spotlight of public opinion.

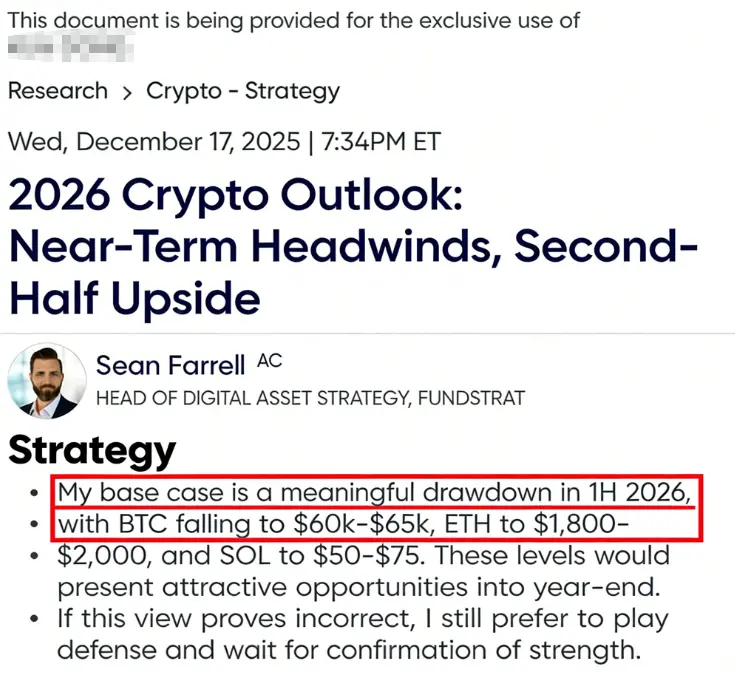

Core Predictions and Views from Fundstrat's "2026 Crypto Outlook"

The report was issued by Sean Farrell, an analyst responsible for crypto asset research at Fundstrat, who currently serves as the Head of Digital Asset Strategy, primarily covering strategy research and viewpoints related to the crypto market and blockchain. The report is mainly aimed at its internal subscription clients, with a monthly subscription fee of $249.

The report presents a short-term market expectation that starkly contrasts with public opinion, predicting a significant market correction in the first half of 2026: Bitcoin may drop to $60,000–65,000, Ethereum may fall to $1800–2000, and Solana may decline to $50–75. It states that these pullback areas will be good opportunities for bullish positioning, and if the market does not experience the expected deep correction, the team also tends to maintain a defensive strategy, waiting for clear trend reinforcement signals before re-entering.

The report explains that the aforementioned pessimistic scenario does not indicate a shift to a long-term bear market, but rather a risk management measure of "strategic reset." Fundstrat points out several short-term headwinds that may suppress the crypto market in early 2026: including the potential government shutdown in the U.S., uncertainty in international trade policies, waning confidence in AI investment returns, and the policy suspense brought about by the change in the Federal Reserve Chair.

These macro factors, combined with high volatility, may trigger valuation pullbacks in crypto assets within a tight liquidity environment. Fundstrat emphasizes that this round of adjustment is a "pullback rather than a crash," believing that sharp declines are often a prelude to a new rally, and after digesting risks in the first half of the year, a rebound in the second half is expected.

The report even provides an optimistic target for the end of 2026: Bitcoin at $115,000 and Ethereum at $4,500, and specifically mentions that Ethereum may show relative strength during this round of adjustment. The report points out that Ethereum has some structural advantages: after transitioning to PoS consensus, there is no selling pressure from miners, unlike Bitcoin, which faces continuous selling pressure from miners; there are also no potential selling pressure factors like large holders such as MicroStrategy. Additionally, compared to Bitcoin, Ethereum faces lower concerns regarding threats from quantum computing.

These factors suggest that Ethereum may better withstand selling pressure in the medium term. It can be seen that the tone of Fundstrat's internal research report is cautious; although they remain bullish in the long term, they advise internal clients to increase cash and stablecoin holdings and patiently wait for better entry points.

Tom Lee's Public Optimistic Predictions for Ethereum in 2025

In stark contrast to Fundstrat's internal report, its co-founder Tom Lee has consistently played the role of "super bull" in public forums throughout 2025, frequently issuing price expectations for Bitcoin and Ethereum that far exceed market realities:

Bullish on Bitcoin at the beginning of the year: According to CoinDesk, Tom Lee set a target for Bitcoin at the end of 2025 at a maximum of about $250,000. In July-August 2025, as Ethereum's price surged close to historical highs, Tom Lee publicly stated that Ethereum is expected to reach $12,000–15,000 by the end of 2025, calling it one of the biggest macro investment opportunities in the next 10–15 years.

In August, during a guest appearance on CNBC, he further raised his target price, stating that Ethereum is entering a critical turning point similar to Bitcoin in 2017. In 2017, Bitcoin started from under $1,000 and surged to $120,000, achieving a 120-fold increase driven by the "digital gold" narrative. With the "Genius Act" greenlighting stablecoins, the crypto industry is experiencing its "ChatGPT moment," and the core advantages of smart contracts do not apply to Bitcoin. He predicts that this is Ethereum's "2017 moment," and a price increase from $3,700 to $30,000 or even higher is not impossible.

Supercycle rhetoric: As the autumn market approached, Tom Lee maintained an extremely optimistic stance. In November 2025, he stated in an interview, "We believe ETH is entering a supercycle similar to Bitcoin from 2017 to 2021," implying that Ethereum has the potential to replicate Bitcoin's trajectory of a hundredfold increase in the coming years.

Speech at the Dubai Summit: At the Binance Blockchain Week in early December 2025, Tom Lee once again made headlines by proclaiming a bull market, predicting that Bitcoin could soar to $250,000 "within months," and bluntly stating that the then approximately $3,000 price of Ethereum is "severely undervalued."

He pointed out through historical data comparisons that if the ETH/BTC ratio returns to the eight-year average level (around 0.07), the price of ETH could reach $12,000; if it returns to the relative high of 2021 (around 0.16), ETH could rise to $22,000; and in extreme cases, if the ETH/BTC ratio rises to 0.25, theoretically, Ethereum's valuation could exceed $60,000.

Short-term new high expectations: Even in the face of market fluctuations at the end of the year, Tom Lee has not tempered his bullish rhetoric. In mid-December 2025, during an interview with CNBC, he stated, "I don't think this rally is over," and bet that Bitcoin and Ethereum will set new historical highs by the end of January next year, at which point Bitcoin had already surpassed its 2021 high, while Ethereum at around $3,000 was still about 40% away from its historical high of $4,954.

The above list of predictions covers almost all major time points in 2025. On the unbias fyi Fundstrat analysis page, Tom Lee is labeled as a "Perma Bull," and every time he speaks, he provides the market with higher target prices and more optimistic timelines. However, these aggressive predictions are far from the actual market trends. This series of facts has led the market to begin questioning the credibility of "Wall Street Oracle" Tom Lee.

Who is Tom Lee?

Thomas Jong Lee, commonly known as Tom Lee, is a well-known stock market strategist, research director, and financial commentator in the United States. He started on Wall Street in the 1990s, having worked at Kidder Peabody and Salomon Smith Barney, and joined JPMorgan in 1999, serving as Chief Equity Strategist from 2007.

In 2014, he co-founded the independent research firm Fundstrat Global Advisors and became its research director, transitioning from an investment banking strategist to the head of an independent research institution. He is regarded as one of the early Wall Street strategists to incorporate Bitcoin into mainstream valuation discussions. In 2017, he published a report titled "A framework for valuing bitcoin as a substitute for gold," which first proposed that Bitcoin has the potential to partially replace gold as a store of value.

Due to the media-centric nature of his research and views, Tom Lee often appears in mainstream financial programs and events as "Fundstrat Research Director" (including references to his title on CNBC-related program/event pages and video content). Since 2025, his influence has further extended to the "Ethereum treasury" narrative: according to Reuters, BitMine has added Fundstrat's Thomas Lee to its board to support its Ethereum-oriented treasury strategy after advancing financing related to the Ethereum treasury strategy. Meanwhile, Fundstrat continues to release market outlooks and viewpoint segments centered around Tom Lee through its own YouTube channel.

Contradiction: Publicly Bullish Calls vs. Internal Cautious Bearishness

The contradictory statements from Tom Lee and his team in different contexts have sparked heated discussions within the community regarding their motives and integrity. In response to recent controversies, Sean Farrell, Head of Digital Asset Strategy at Fundstrat, published a statement clarifying that there is a misunderstanding regarding Fundstrat's research process.

He stated that Fundstrat has multiple analysts, each using independent research frameworks and time horizons to serve the goals of different types of clients; among them, Tom Lee's research is more focused on traditional asset management institutions and "low allocation" investors (who typically allocate only 1%–5% of their assets to BTC/ETH), emphasizing long-term discipline and structural trends, while he himself primarily serves portfolios with a higher allocation to crypto assets (around 20%+). However, Tom Lee did not disclose that he was addressing the group of "1%–5% asset allocation to BTC/ETH" when publicly advocating for ETH.

Farrell further stated that his cautious baseline scenario for the first half of 2026 is a matter of risk management, rather than a bearish turn on the long-term outlook for crypto. He believes the current market pricing is leaning towards "almost perfect," but risks such as government shutdowns, trade volatility, uncertainty in AI capital expenditures, and changes in the Federal Reserve Chair are still present. He also listed historical performance, claiming that his token portfolio has grown about threefold since mid-January 2023, and the crypto stock portfolio has risen about 230% since its inception, outperforming BTC by approximately 40%. In their respective durations, both have likely outperformed most liquidity funds. However, this wording seems more like a cover-up for Bitmine's $3 billion paper loss and the contradictory statements from its founder.

Conclusion: The Contrast is Not the Problem Itself; The Issue Lies in Disclosure and Boundaries

The real controversy in this matter does not lie in the existence of different frameworks within Fundstrat, but rather in the lack of sufficiently clear applicable scope and interest disclosure between the co-founder's public communications and service side.

Sean Farrell explained the contradictory statements by referring to serving different types of clients, which logically holds, but on the communication level, it still revolves around three issues:

When Tom Lee frequently expresses strong optimism about ETH in public videos and media interviews, the audience does not automatically assume this is "only applicable to long-term allocation discussions for low allocation positions," nor will they automatically understand the implied risk premises, time horizons, and probability weights. He has also not publicly clarified this or defined the applicable scope.

The subscription model of FS Insight/Fundstrat essentially represents "monetizing research," with the official website directly presenting subscription prompts like "Start Free Trial" and showcasing Tom Lee as a promotional figure. Tom Lee is a core figure at Fundstrat, and the FS Insight page directly labels him as "Tom Lee, CFA / Head of Research." When traffic and subscription growth largely stem from Tom Lee's public interviews across various media, how can the company convince the public that "this is just expressing personal opinions"?

- Public information shows that Tom Lee also serves as the Chairman of the Board for Ethereum treasury strategy company BitMine Immersion Technologies (BMNR), which positions ETH as one of its core treasury directions. Under this identity structure, his ongoing public "bullish" communication about ETH will naturally be interpreted by the market as being highly aligned with the interests of related parties. For CFA charterholders, professional ethics also emphasize the need for "full and clear disclosure" regarding matters that may affect independence and objectivity.

Such controversies often involve compliance issues: anti-fraud and conflict of interest disclosure. In the context of U.S. securities law, Rule 10b-5 is one of the typical anti-fraud provisions, focusing on prohibiting significant false or misleading statements related to securities transactions.

Moreover, the structural complexity of Fundstrat adds to the controversy: Fundstrat Global Advisors emphasizes in its terms and disclosure documents that it is a research company, "not a registered investment advisor or a broker-dealer," and that subscription research is "for client use only." However, at the same time, Fundstrat Capital LLC explicitly provides advisory services as an "SEC-registered investment advisor (RIA)."

Considering that public interviews and the operation of the Fundstrat YouTube channel effectively serve the function of "customer acquisition/marketing," another question arises: which content belongs to personal research dissemination, and which content belongs to company marketing. If an institution's public video channels continuously release "bullish segments," while the subscription service side publishes "bearish" predictions for the first half of the year without synchronously presenting key limiting conditions and risk frameworks in public communications, it would at least constitute a selective presentation under information asymmetry.

This may not violate the law, but it will continue to erode public trust in the independence and credibility of research, and it will blur the boundaries of "research - marketing - narrative mobilization." For research institutions where reputation is one of the core business elements, such trust costs will ultimately backfire on the brand itself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。