Original Title: The Crypto Theses 2026

Original Author: Messari

Translated by: Peggy, BlockBeats

Editor's Note: Against the backdrop of a gloomy sentiment in 2025 but with institutions accelerating their entry, Messari's report "The Theses 2026" systematically outlines the seven core sectors it believes will continue to exert key influence in the coming years: Cryptomoney, TradFi, Chains, DeFi, AI, DePIN, and consumer applications, focusing on the main narratives and structural trends.

This article is an excerpt from the core content on cryptomoney in "The Theses 2026," highlighting Messari's judgment logic and controversial focal points regarding the monetary attributes of assets like BTC, ETH, and ZEC.

Introduction

Welcome to "The Theses 2026"!

The year 2025 may be the most tumultuous year in the history of the crypto industry. Your final assessment of this year largely depends on where you are and who you are.

If you are reading this report from an office overlooking Wall Street, it may be the best year you have experienced in crypto history; but if you are on the other end of the spectrum, lurking in Telegram and Discord groups for over 12 hours a day as a trench warrior, you might long for the past. One thing is certain: 2025 has once again proven that the volatility of this industry is as intense as the price charts we watch every day.

Looking back at the year:

At the beginning of the year, we witnessed what retrospectively seems to be the most exhilarating token issuance in history: TRUMP. Although sentiment quickly receded, this issuance became an important stress test, validating the extent to which on-chain infrastructure has developed.

The world's largest government officially announced Bitcoin as a unique store of value asset, incorporating it into official reserves and even leaving room for further accumulation under the premise of "budget neutrality" in the future. Just two years ago, this was merely a fantasy.

Ethereum's identity crisis, which had plagued it for two years, finally reached a climax, resulting in Ethereum becoming stronger. Today, Ethereum is solidifying its position as a core hub for institutional adoption.

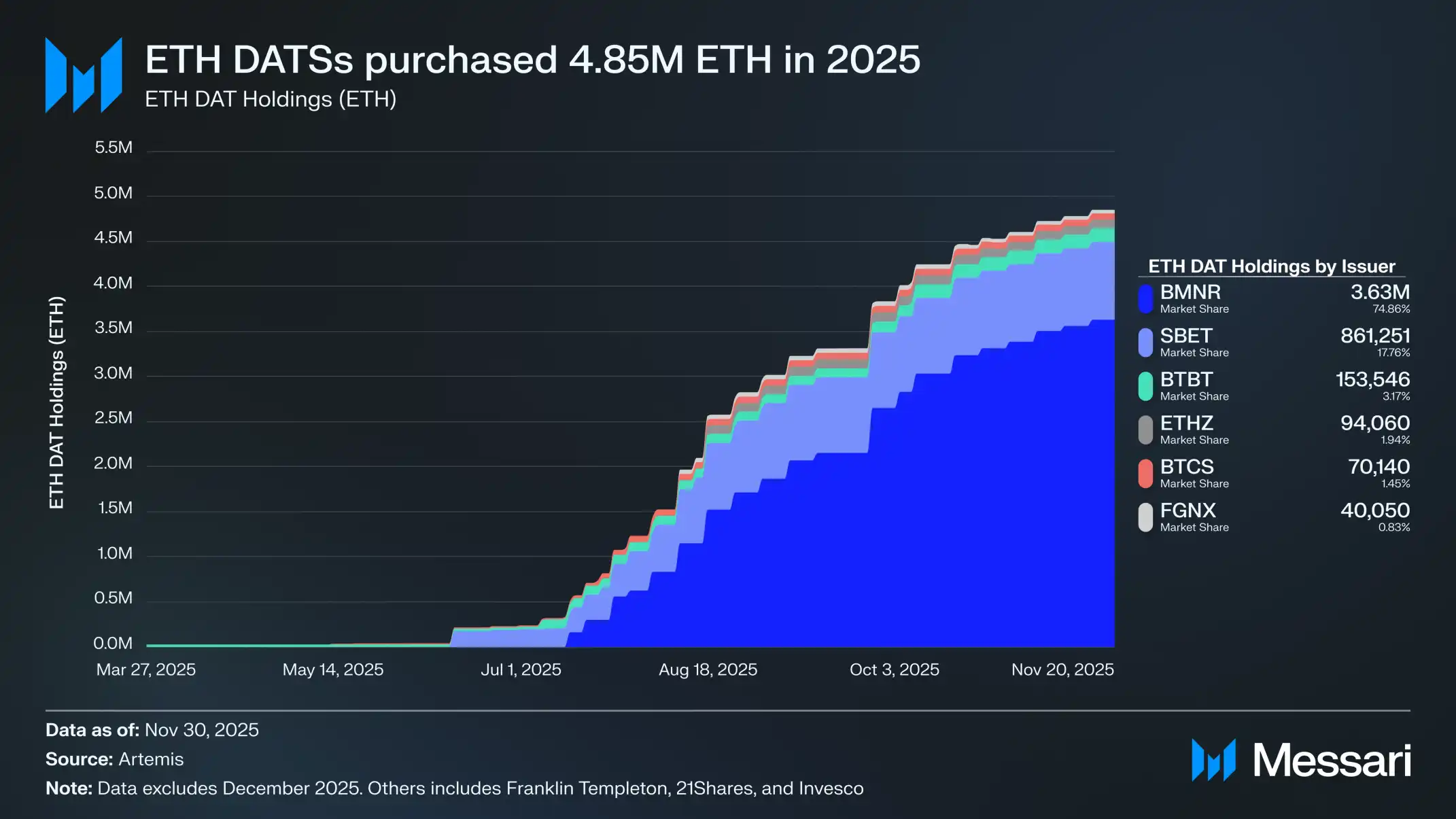

DAT (Digital Asset Treasury) became the buzzword of the year, with its collective buying pushing the entire asset class to historical highs.

The first milestone crypto legislation in the U.S., the "GENIUS Act," was officially signed, laying the groundwork for a stablecoin market that the U.S. Treasury Secretary anticipates could expand to trillions of dollars in the future.

On October 10, the largest crypto deleveraging event in history erupted, with many assets dropping over 50% in minutes, and some assets even trading at zero (literally zero) for a time. Subsequently, crypto assets significantly underperformed compared to asset classes with strong historical correlations (such as gold, silver, and stocks).

Tomorrow's enterprises are being born on-chain. By per capita profit, Hyperliquid and Tether may have entered the ranks of the most profitable companies in history. Applications like Polymarket and pump.fun have successfully "crossed the chasm" into mainstream cultural contexts.

Amid all this, Messari Research has always been with you to grasp the pulse of the industry. We released two major annual core trend reports—stablecoins and AI; our forward-looking judgment on Hyperliquid at the beginning of 2024 was validated, and we continued to track its rise throughout the year. As the industry begins to rethink how crypto assets should be priced, we have released valuation frameworks covering multiple areas, including L1, public chains, DePIN, lending protocols, as well as more segmented asset types like launch platforms and AI hedge funds.

From Trump's tariff policies and their spillover effects on the crypto market to how tokenization is reshaping the collectibles industry, even bringing Pokémon cards on-chain, we have maintained a sufficiently agile research pace. Messari's Protocol Services team has collaborated with over 150 protocols to drive the industry forward with objective insights.

This year's "The Theses" is divided into seven core sections, focusing on: Cryptomoney, TradFi, Chains, DeFi, AI, DePIN, and consumer applications. In these sections, we will delve into the core narratives and themes that we believe will continue to exert key influence in the coming years.

After the seven sections, we also retained popular content such as Messari Analyst Picks and Messari Awards. New this year is Alumni Theses, featuring in-depth articles from several Messari alumni—who are at the forefront of driving the industry forward. Finally, we also previewed a new analytical framework under construction: Disruption Factor.

Cryptomoney is the cornerstone of the industry: Core Themes

Authors: AJC, Drexel Bakker, Youssef Haidar

Bitcoin has completely distinguished itself from other crypto assets and is undoubtedly the most dominant form of cryptomoney today.

The relative underperformance of BTC in the second half of this year is partly due to selling pressure from early large holders. We do not believe this will evolve into a long-term structural issue; BTC's "monetary narrative" will remain solid in the foreseeable future.

L1 valuations are increasingly detached from their fundamentals. L1 revenues have significantly declined year-on-year, and their valuations are increasingly based on the assumption of "monetary premium." With few exceptions, we expect most L1s to underperform BTC.

ETH remains the most controversial asset. Concerns about value capture have not completely dissipated, but the market performance in the second half of 2025 indicates that the market is willing to view it as a form of cryptomoney similar to BTC. If a bull market returns in 2026, Ethereum DAT may experience a "second life."

ZEC is gradually being priced as a privacy-focused cryptomoney rather than just a niche privacy coin. In an era of heightened surveillance, institutional dominance, and financial repression, it may become an important complementary hedge asset to BTC.

An increasing number of applications may choose to build their own monetary systems rather than relying on the native assets of the networks they operate on. Applications with social attributes and strong network effects are most likely to be the first to take this path.

Overview

We begin this year's "The Theses" by focusing on the most fundamental and important element of the crypto revolution: money. This is not a coincidence.

When we started planning this year's Theses in the summer, we had no idea that market sentiment would swing so dramatically negative.

In November 2025, the crypto fear and greed index briefly fell to 10, entering the "extreme fear" zone. Before this, the index had only touched or fallen below 10 a few times in history, occurring during:

The Luna collapse and 3AC contagion in May-June 2022

The massive liquidation waterfall in May 2021

The market crash due to the COVID-19 pandemic in March 2020

Several phases of the bear market in 2018-2019

In the entire history of the crypto industry's development, there have been very few moments of such low market sentiment, and they almost all occurred during times when the industry was truly on the brink of self-collapse, with its future prospects severely questioned. But clearly, today's situation is not like that.

There have been no major exchanges disappearing with users' funds; no obvious Ponzi schemes being hyped to valuations in the hundreds of billions; and the overall market cap has not fallen below the peak of the last cycle.

On the contrary, crypto assets are being recognized and gradually incorporated by the highest levels of global institutional systems. The U.S. SEC has publicly stated that it expects all financial markets in the U.S. to be on-chain within two years; the supply of stablecoins has reached an all-time high; and the adoption narratives we have repeatedly mentioned over the past decade, which "will one day come," are truly materializing.

However, despite this, the sentiment in the crypto industry has rarely been this bad. Almost every week or two, there is a post trending on X: someone is convinced they have wasted their life in the crypto industry; others assert that everything built in this industry will ultimately be replicated, appropriated, or captured by existing institutions.

It is precisely in this stark contrast of continuously collapsing sentiment and rising institutional adoption that now becomes the best time to re-examine the crypto industry from first principles. And that original core principle, which gave birth to this chaotic yet fascinating industry, is actually quite simple: to build a monetary system that is superior and more alternative than the existing fiat currency system.

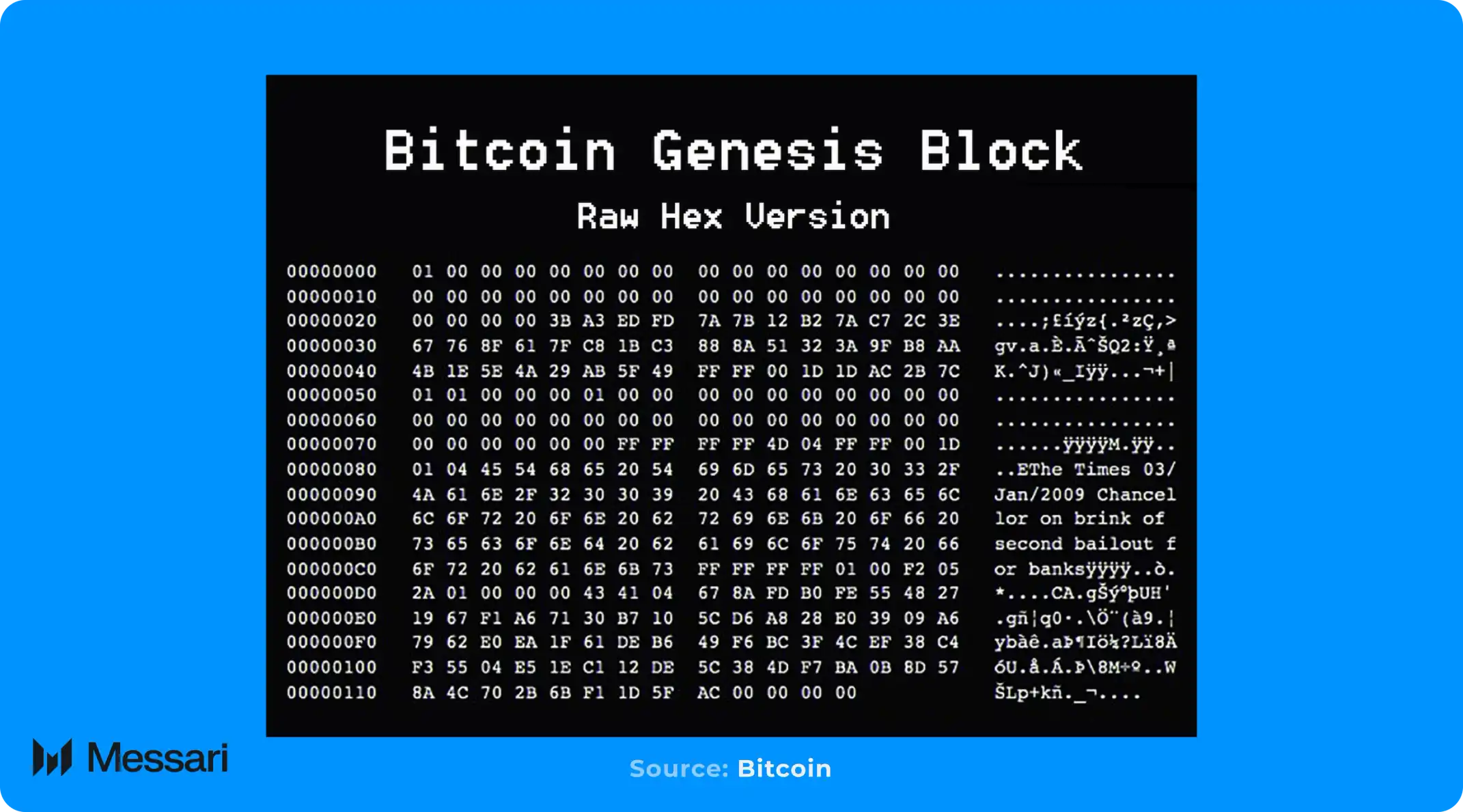

Since the birth of Bitcoin's genesis block, this ideal has been deeply embedded in the industry's DNA. In that block, a line of text was deliberately inscribed, which later became widely known: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

The importance of these starting points lies in the fact that at some unconscious stage, many people have forgotten what problem cryptocurrencies were originally created to solve.

The emergence of Bitcoin was not to provide banks with a more efficient clearing channel; not to save a few basis points in foreign exchange transfers; and certainly not to drive a never-ending "slot machine" that continuously issues speculative tokens.

Its birth was essentially a response to a failing monetary system.

Therefore, if we are to truly understand the position of the crypto industry today, we must return to the core question of the entire industry: why is cryptomoney important?

Why Cryptomoney?

For most of modern history, people have had almost no substantive choice over "what kind of money to use." Under today's fiat-based global monetary system, individuals are effectively bound to their national currency and the decisions of their central banks.

The state decides what currency you earn, what currency you save, and what currency you pay taxes with. Whether this currency is subject to inflation, devaluation, or systematically mismanaged, you can only passively endure it.

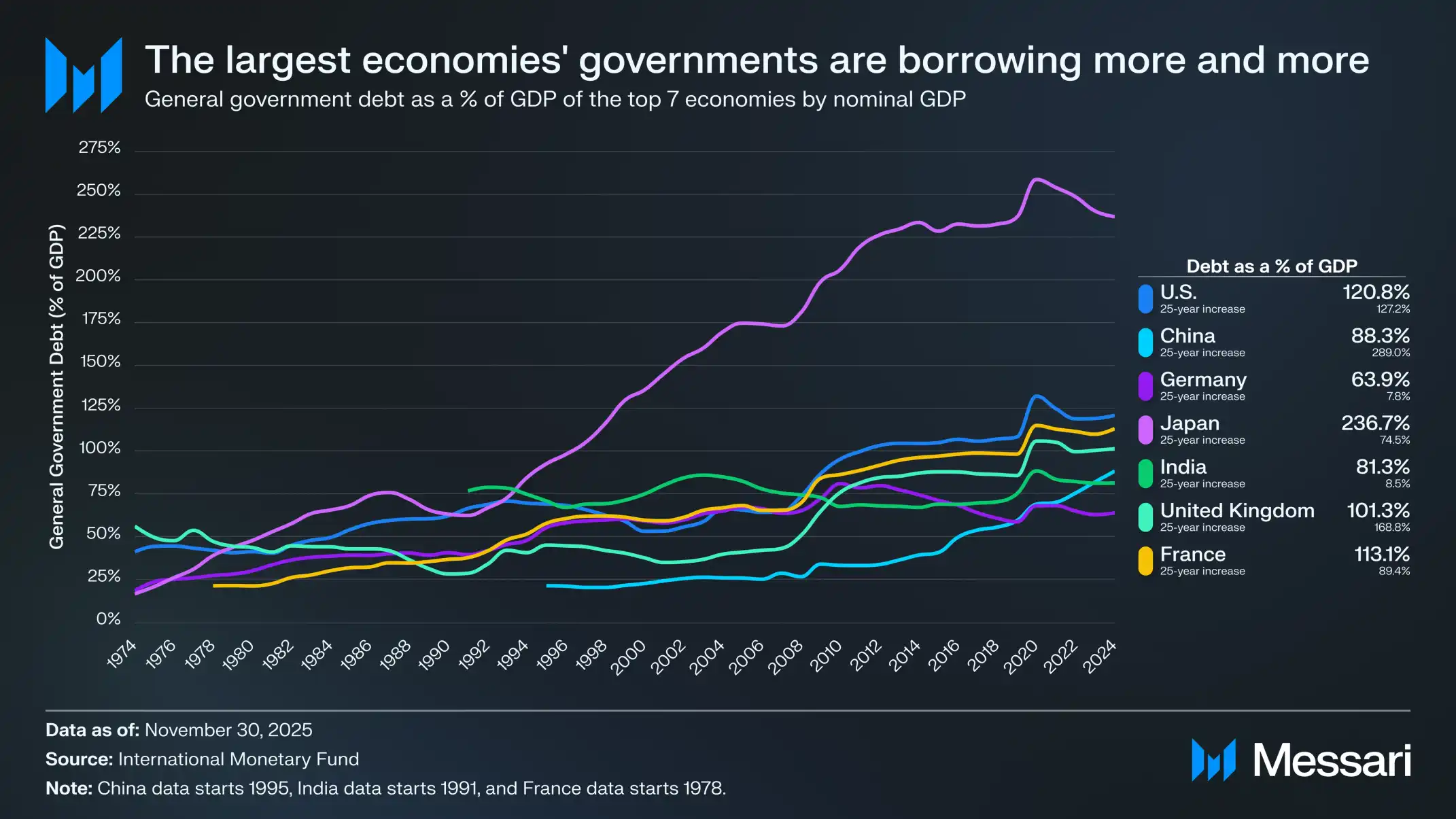

Moreover, this situation does not differ due to political or economic system differences—whether in free markets, authoritarian regimes, or developing economies, almost the same pattern emerges: government debt is a one-way street.

Over the past quarter of a century, the level of government debt relative to GDP in major global economies has generally risen significantly. In the two largest economies in the world, the United States and China, general government debt as a percentage of GDP has increased by 127% and 289%, respectively. Regardless of political systems or changes in growth models, the continuous expansion of government debt has become a structural feature of the global financial system.

When the growth rate of debt consistently outpaces economic output, the costs often fall most directly on savers. Inflation and low real interest rates continuously erode the purchasing power of fiat currency savings, effectively completing a transfer of wealth from individual savers to the state.

Cryptomoney provides an alternative to this system by separating the state from money. Throughout history, when inflation, capital controls, or stricter regulations align with their interests, governments often proactively adjust monetary rules. Cryptomoney returns the governance of money to a decentralized network rather than concentrating it in a single authoritative institution.

In this process, the "choice of currency" re-emerges: savers can choose a monetary asset that better aligns with their values, needs, and preferences, rather than being forced to remain bound to a system that often undermines their long-term financial health.

Of course, the choice itself is only meaningful when "the chosen option truly has advantages." Cryptomoney is just that, with its value foundation stemming from a series of attributes that have never existed simultaneously before.

The first cornerstone of the value of cryptomoney is its predictable, rule-based monetary policy. These rules do not come from the promises of any institution but are inherent properties of software operated by thousands of independent participants. Any change in rules requires broad consensus rather than the discretion of a few, making arbitrary and sudden adjustments to monetary policy extremely difficult.

In stark contrast to fiat systems, where the money supply often passively expands under political or economic pressure, the operational rules of cryptomoney are open, predictable, and enforced through consensus mechanisms, making it impossible to be quietly modified "behind closed doors."

Cryptomoney fundamentally changes the way individuals store wealth. In fiat systems, true self-custody has become impractical, forcing most people to rely on banks or other financial intermediaries to store their savings. Even traditional non-sovereign assets like gold are often concentrated in custodial vaults, reintroducing the same trust-based risks.

In reality, this means that once a custodian or state makes a decision, your assets may be delayed, restricted, or even completely denied access.

Cryptomoney enables direct ownership, allowing individuals to hold and secure their assets without relying on any custodial institution. As various financial restrictions, from cash withdrawal limits to capital controls, become increasingly common worldwide, the importance of this capability continues to rise.

Finally, cryptomoney is designed for a globalized, digital world. It can flow across borders in any amount and instantly without the need for institutional permission. This gives it a significant advantage over gold—gold is difficult to divide, verify, and transport, especially in cross-border scenarios.

In contrast, cryptomoney can complete global transfers in minutes, with no limits on scale and without relying on centralized intermediaries. This ensures that individuals, regardless of their location or political environment, can freely allocate and use their wealth.

Overall, the value logic of cryptomoney is quite clear: it provides individuals with a choice of currency, establishes predictable operational rules, eliminates single points of failure, and allows value to flow globally without restrictions. In a system where government debt continues to rise and savers bear the costs, the value of cryptomoney will only continue to increase.

Bitcoin: The Most Dominant Cryptomoney

Bitcoin created the category of cryptomoney, so it is only natural to start with it. Nearly seventeen years later, BTC remains the largest and most recognized asset in the entire industry.

Since the essence of money ultimately depends on social consensus rather than technical design, the key factor that truly determines whether an asset possesses "monetary status" is whether the market is willing to continuously assign it a long-term premium.

Measured by this standard, BTC's position as the leading cryptomoney is already very clear.

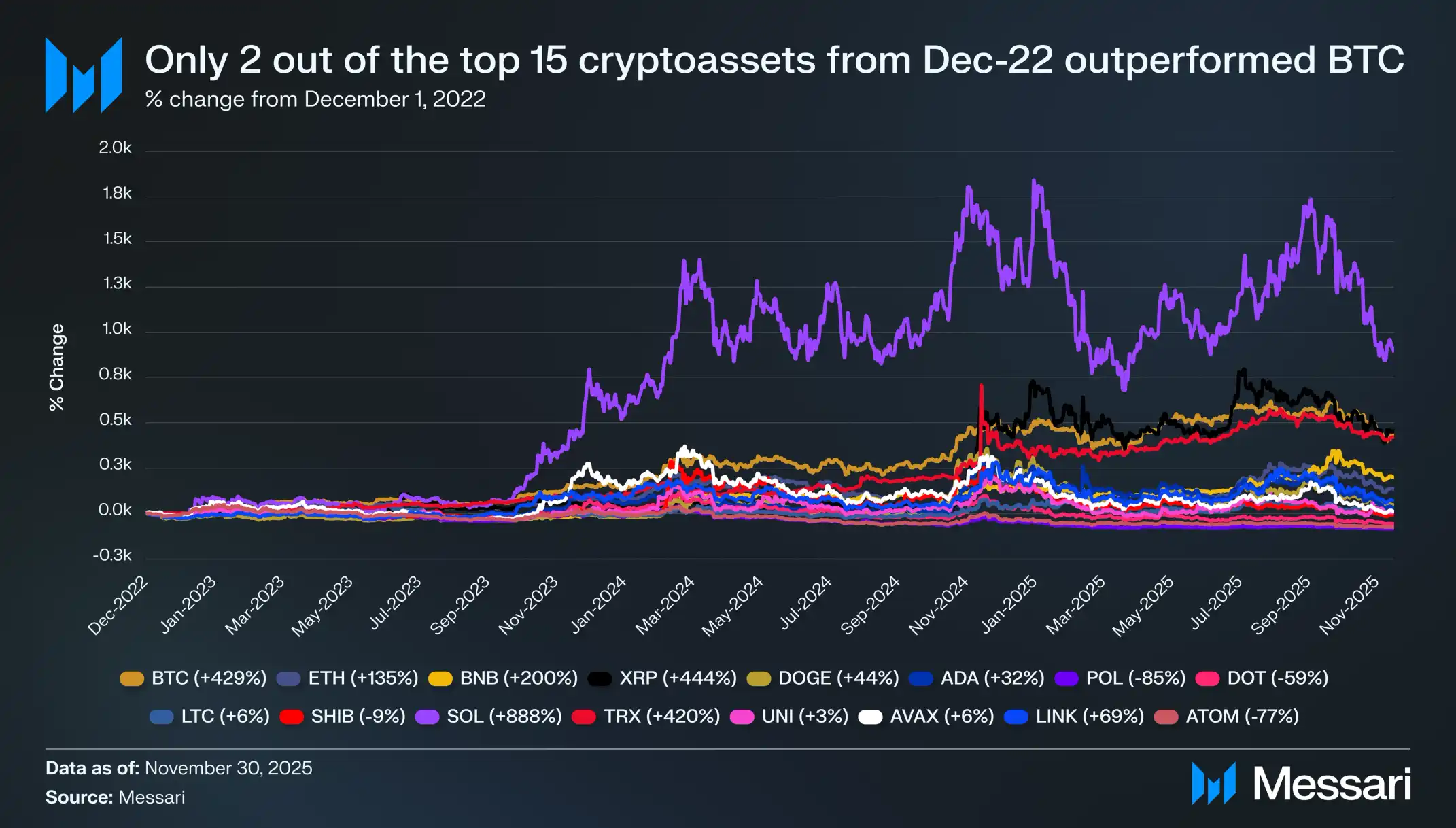

This is most clearly reflected in BTC's market performance over the past three years. Since December 1, 2022, BTC has cumulatively risen by 429%, with its price climbing from $17,200 to $90,400. During this process, Bitcoin has repeatedly set new historical highs, the most recent occurring on October 6, 2025, when the price reached $126,200.

At the beginning of this market cycle, BTC's market capitalization of about $318 billion was not enough to rank among the world's largest assets; now, its market cap has increased to $1.81 trillion, making it the ninth largest asset globally. The market has not only rewarded BTC's monetary attributes with higher prices but has also pushed it into the top tier of the global asset system.

However, what is more indicative is the change in BTC's performance relative to the entire crypto market. Historically, during crypto bull markets, as funds migrate along the risk curve to higher-risk assets, Bitcoin's market dominance (Bitcoin Dominance, BTC.D) typically declines; however, in this BTC-centric bull market, this pattern has been completely reversed.

In the same three-year period, BTC.D rose from 36.6% to 57.3% (including stablecoins). This indicates that BTC is showing a clear divergence from the broader crypto market.

Among the top fifteen crypto assets by market capitalization on December 1, 2022, only two assets (XRP and SOL) outperformed BTC during this period, and only SOL achieved significant excess returns (up 888%, compared to BTC's 429%).

Most other market assets lagged significantly, with many large-cap tokens barely breaking even during the same period, or still in negative return territory. Among them, ETH rose only 135%, BNB rose 200%, and DOGE rose 44%; while assets like POL (-85%), DOT (-59%), and ATOM (-77%) are still deeply retraced.

This phenomenon is particularly noteworthy given BTC's own size. As an asset with a market cap in the trillion-dollar range, it would typically require the most capital to move its price, yet it continues to outperform almost all mainstream tokens. This indicates that there is genuine, sustained buying demand for BTC in the market; while most other assets behave more like "β," only passively rising when BTC drives the entire market upward.

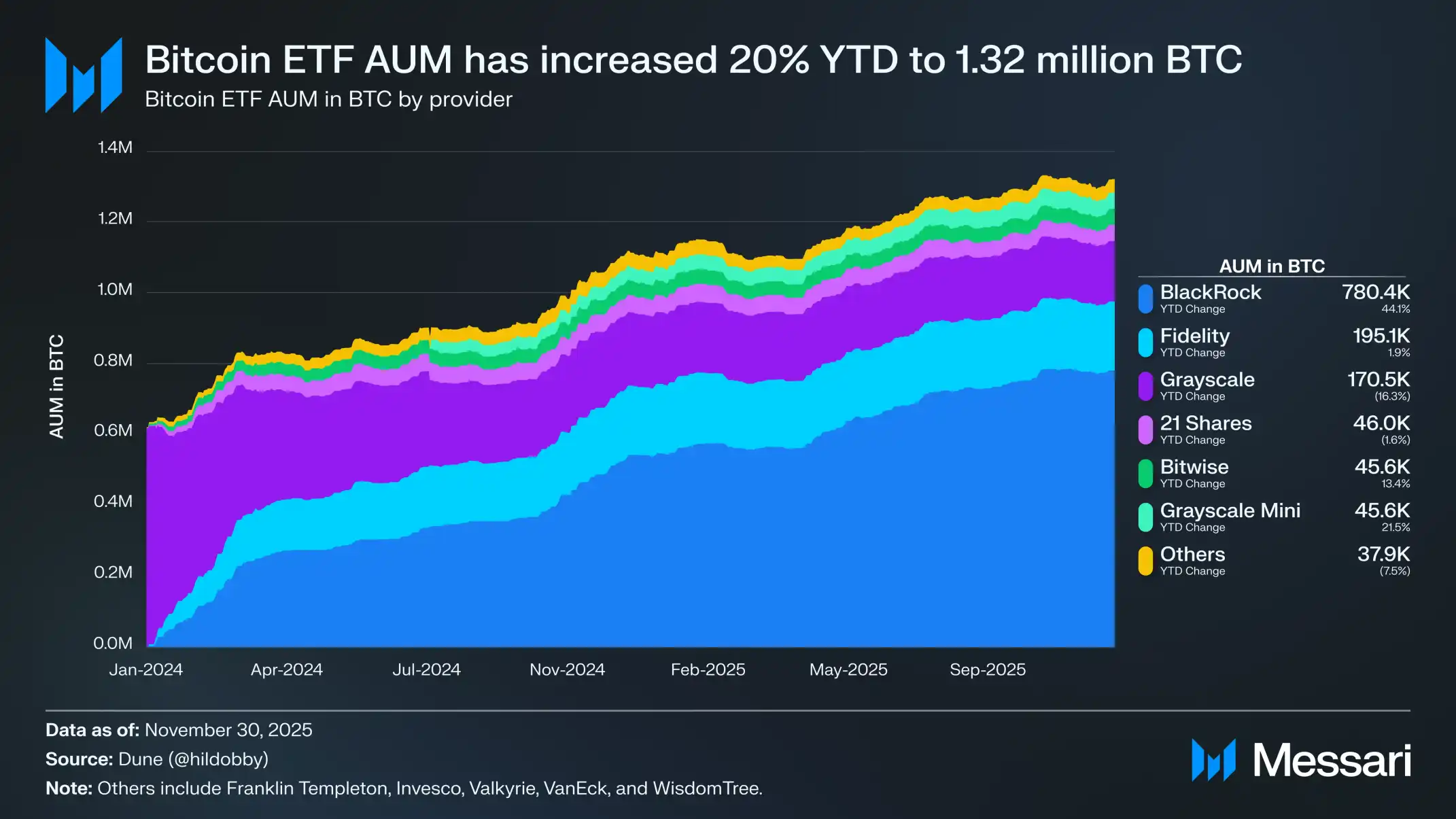

A core driving factor behind the sustained buying of BTC is the accelerated adoption by institutional investors. The most representative form of institutional entry in this round is the spot Bitcoin ETF.

The demand for such products is so strong that it has almost reached a state of supply shortage. BlackRock's iShares Bitcoin Trust (IBIT) has repeatedly broken ETF historical records and is hailed as "the most successful issuance in ETF history."

Just 341 days after its launch, IBIT's assets under management (AUM) reached $70 billion, breaking the previous record set by SPDR Gold Shares (GLD) by a staggering 1,350 days, marking a milestone performance.

The momentum brought by the ETF launch in 2024 has almost seamlessly continued into 2025. As of now, the total assets under management (AUM) of Bitcoin ETFs have grown by about 20% year-to-date, with holdings increasing from approximately 1.1 million BTC to 1.32 million BTC. At current prices, this amounts to over $120 billion worth of Bitcoin held by these products, accounting for more than 6% of BTC's maximum issuance.

Unlike the initial issuance's heat gradually fading, the demand for ETFs has evolved into a continuous source of buying, steadily accumulating BTC regardless of how the market environment changes.

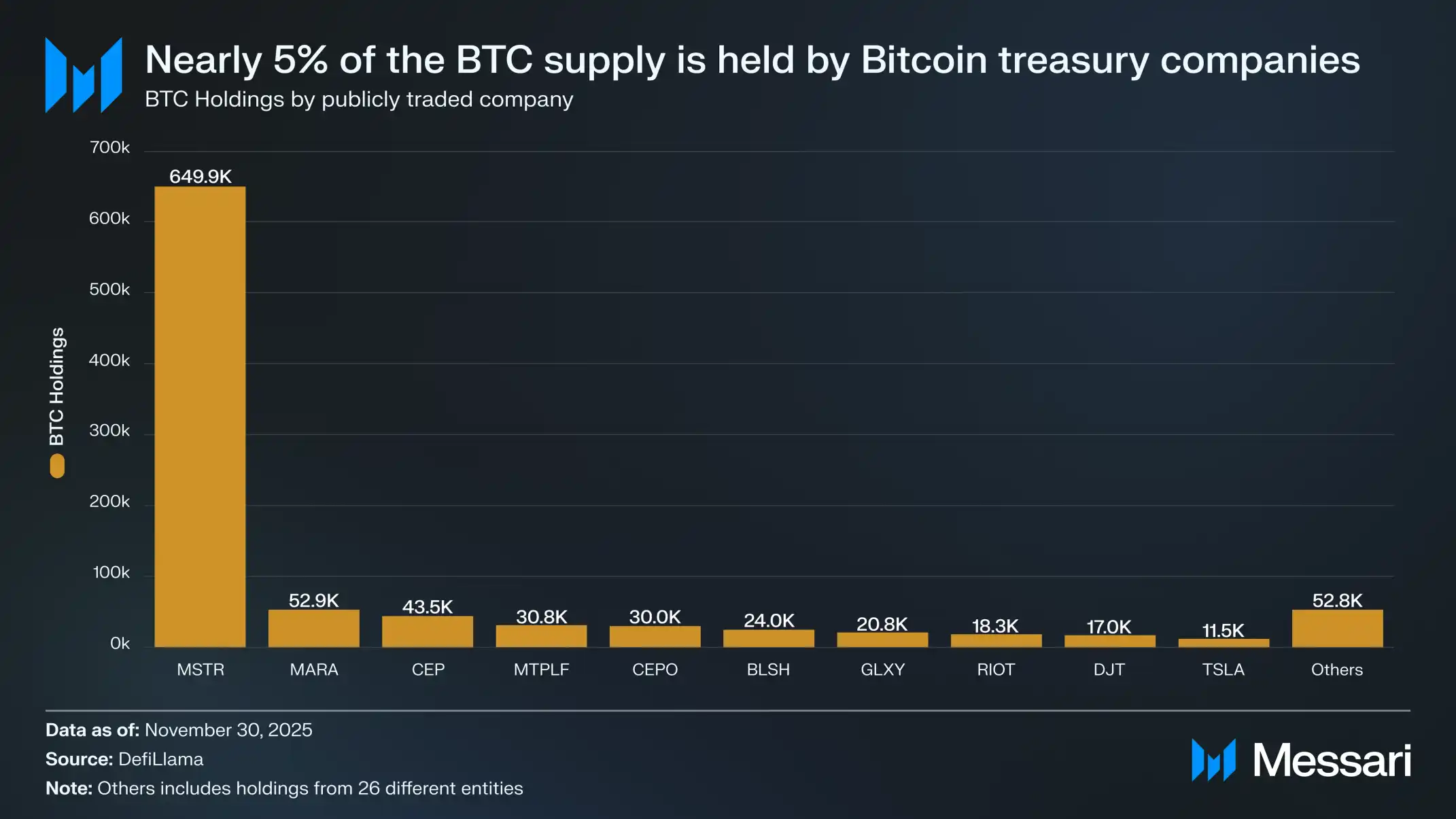

Moreover, institutional participation is no longer limited to ETFs. Digital Asset Treasury companies (DATs) became significant buyers in 2025, further reinforcing BTC's role as a corporate reserve asset. While Michael Saylor's Strategy has long been the most representative case of corporate Bitcoin accumulation, nearly 200 companies worldwide now hold BTC on their balance sheets.

Among publicly traded companies alone, they collectively hold about 1.06 million BTC, accounting for approximately 5% of Bitcoin's total supply; of which Strategy holds 650,000 BTC, leading all companies by a wide margin and occupying the absolute largest share.

Perhaps the most critical and clearest event that distinguished BTC from other crypto assets in 2025 was the formal establishment of the Strategic Bitcoin Reserve (SBR). The SBR institutionalizes the consensus that has long been formed in the market: BTC and other crypto assets do not belong to the same category. Within this framework, BTC is viewed as a strategic monetary commodity, while other digital assets are unified into a separate asset pool, managed in a conventional manner.

In the official announcement, the White House described BTC as a "unique store of value in the global financial system" and likened it to "digital gold." More importantly, the executive order also requires the Treasury to develop potential strategies for increasing BTC holdings in the future. Although no actual purchases have occurred yet, the mere existence of this "policy option" has already sent a clear signal: federal-level policy-making has begun to view BTC from a forward-looking, reserve asset perspective.

Once relevant acquisition plans are implemented in the future, Bitcoin's monetary status will not only be solidified within the realm of crypto assets but will also be further established among all asset classes.

Is BTC "Good Money"?

Although BTC has established a leading position among various cryptomoney, 2025 has sparked a new round of discussions about its monetary attributes. As the largest non-sovereign currency asset currently, gold remains the most important benchmark for evaluating BTC.

Against the backdrop of rising geopolitical tensions and increasing market expectations for future monetary easing, gold has recorded one of its strongest annual performances in decades. In contrast, BTC has not followed this trend in sync.

Although the BTC/XAU ratio reached an all-time high in December 2024, it has since retraced by about 50%. This retracement is particularly noteworthy as it occurred while gold was continuously setting historical highs in USD terms. Year-to-date, gold prices have risen by over 60%, reaching $4,150 per troy ounce.

With gold's total market capitalization approaching $30 trillion, while BTC still occupies only a small portion of that, this divergence naturally raises a reasonable question:

If BTC failed to rise in tandem with gold during one of gold's strongest cycles, how solid is its status as "digital gold"?

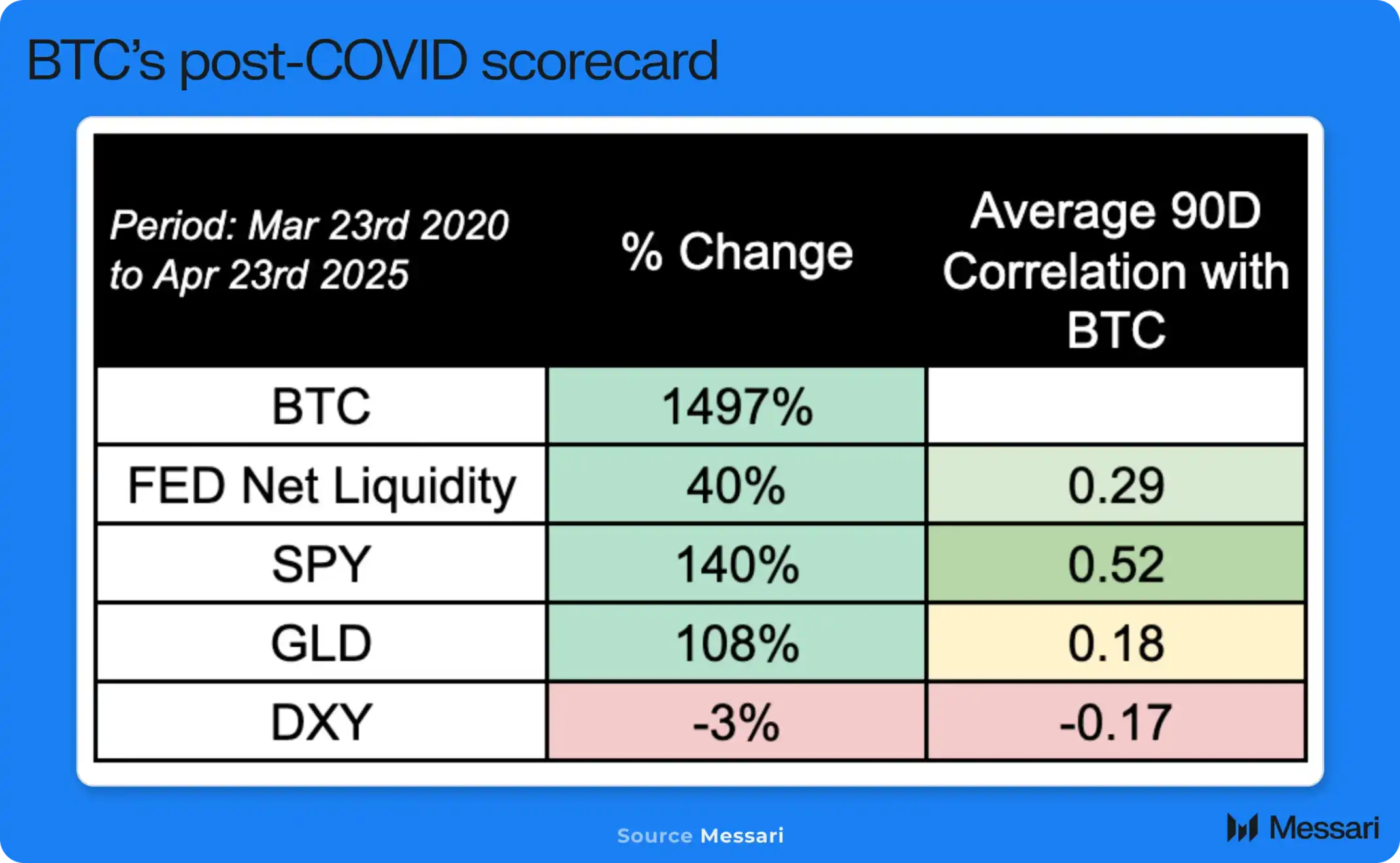

If Bitcoin's performance has not aligned with gold, the next reference point to observe is its performance relative to traditional risk assets. Historically, BTC has shown some correlation with stock indices, including SPY and QQQ, at various stages.

For example, from April 2020 to April 2025, the 90-day rolling correlation coefficient between BTC and SPY averaged about 0.52, while its correlation with gold was relatively weak at only 0.18. Based on this historical characteristic, if the overall stock market weakens, then BTC's lagging performance compared to gold may logically be understandable.

However, this is not the case. Year-to-date, gold (XAU) has risen about 60%, SPY has risen 17.6%, QQQ has risen 21.6%, while BTC has fallen 2.9%. Considering that BTC's market cap is much smaller than that of gold and major stock indices, and its volatility is higher, its significant underperformance relative to these benchmark assets in 2025 inevitably raises reasonable doubts about its monetary narrative.

In the context of gold and stocks continuously setting historical highs, based on BTC's past correlation performance, one might have expected it to exhibit a similar trend, but that has not been the case. Why is this?

It should first be noted that this underperformance is not a long-term phenomenon that has persisted throughout the year, but rather a change that has emerged relatively recently. Just on August 14, 2025, BTC's absolute return year-to-date was still higher than that of XAU, SPY, and QQQ. Its relative weakness only began to gradually manifest in October. What is truly noteworthy is not how long the underperformance lasted, but how significant the extent of the underperformance was.

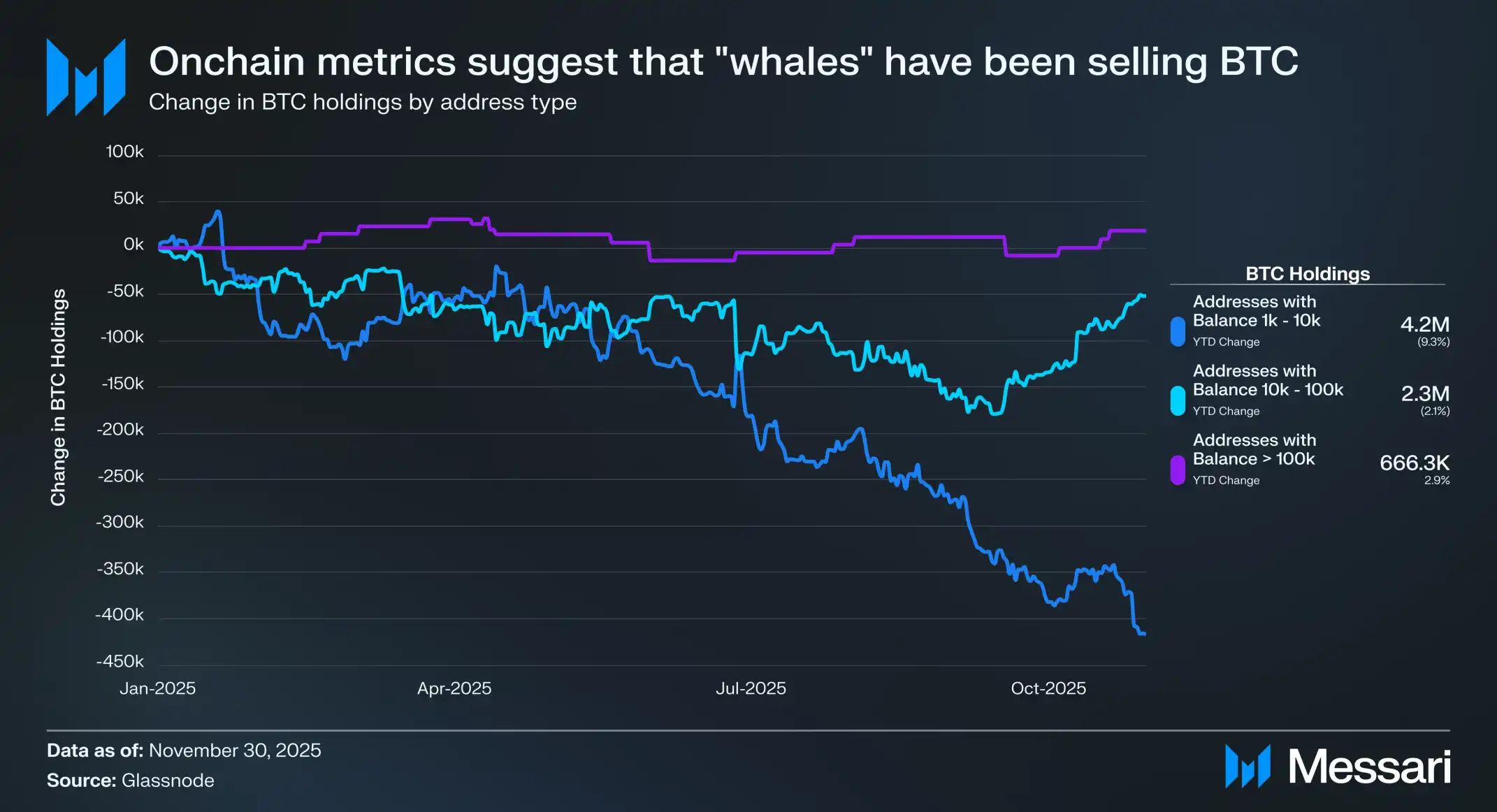

While various factors may have contributed to this outcome, we believe the most critical driving factor is the change in behavior of early, large holders. As the institutionalization of BTC has increased over the past two years, its liquidity structure has undergone substantial changes. The depth and regulated market established through channels like ETFs now allow large holders to sell without causing severe market shocks—something that was nearly impossible in previous cycles.

For many of these holders, this marks the first time they have a realistic window to cash out their profits in an orderly, low-impact manner.

Both from numerous market anecdotes and on-chain data, there is ample evidence that a portion of long-dormant holders are using this window to reduce their exposure.

Earlier this year, Galaxy Digital assisted an investor from the "Satoshi era" in selling 80,000 BTC. This transaction accounted for about 0.38% of Bitcoin's total supply and came entirely from a single entity.

Such a volume is sufficient to exert significant pressure on prices in any market environment.

Bitcoin's on-chain metrics also show a similar trend. Since 2025, some of the largest and longest-held addresses—those holding between 1,000 and 100,000 BTC—have generally been in a net selling state. These addresses collectively held about 6.9 million BTC at the beginning of the year, close to one-third of Bitcoin's circulating total, and have continuously released chips to the market throughout the year.

Specifically, addresses in the 1,000–10,000 BTC range have seen a cumulative net outflow of 417,300 BTC (-9% YTD); while addresses in the 10,000–100,000 BTC range have also experienced an additional net outflow of 51,700 BTC (-2% YTD).

As the institutionalization of Bitcoin deepens and more trading and capital flows shift to off-chain channels, the informational value carried by on-chain data will inevitably decline gradually. Even so, when combining this on-chain data with market examples such as "Satoshi-era investors selling BTC," there is still ample reason to conclude that in 2025, especially in the second half of the year, early large holders were generally in a net selling state.

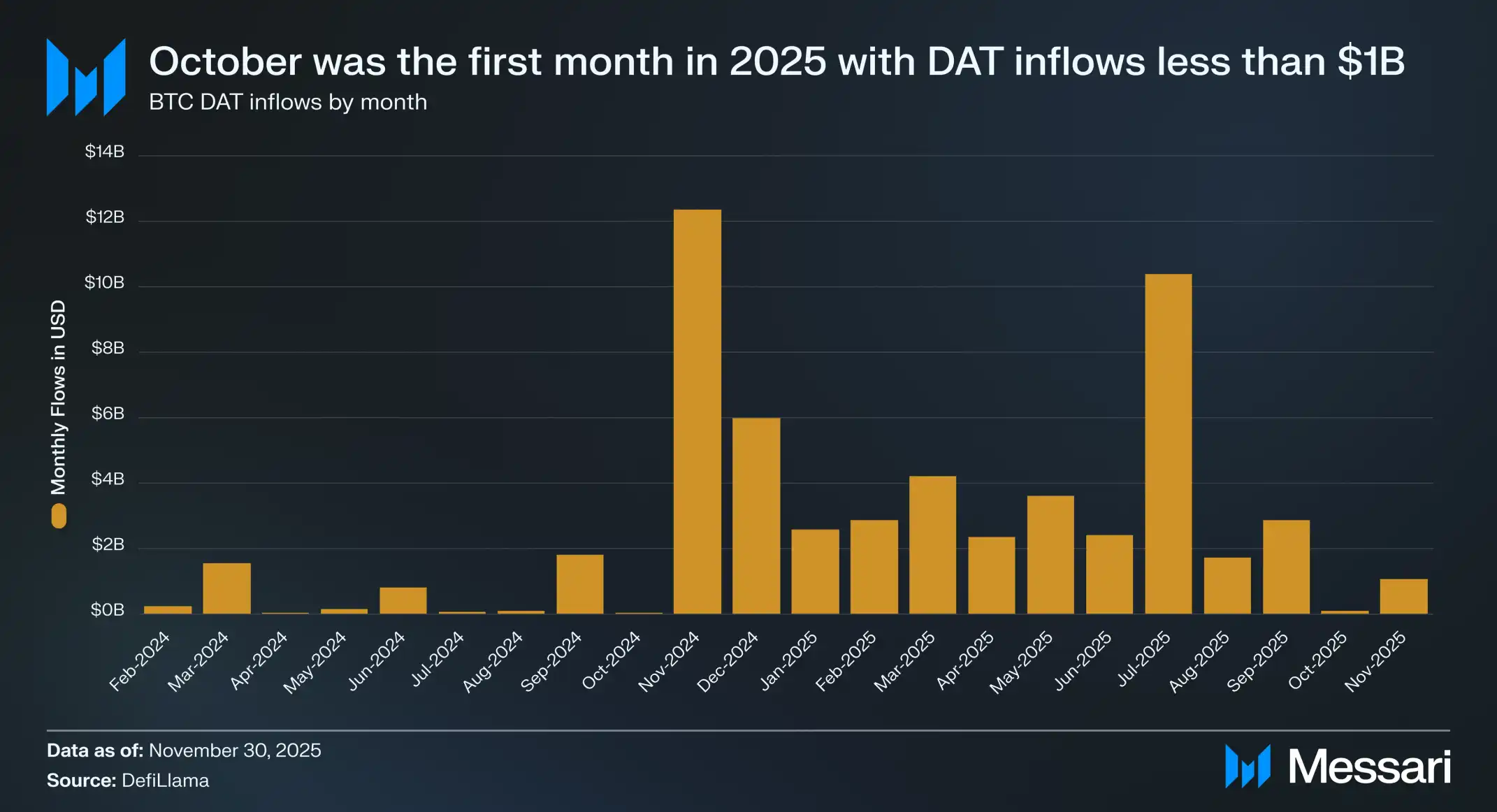

This round of supply release coincides with a significant slowdown in the core buying power that has driven BTC prices up over the past two years. The inflow of funds into DATs dropped sharply in October, marking the first time since 2025 that DAT's monthly net inflow did not exceed $1 billion. Meanwhile, spot Bitcoin ETFs—which had been a net buyer throughout the year—turned into net sellers starting in October.

When both DATs and ETFs, the two major sources of stable demand, show signs of fatigue in the short term, the market must absorb the concentrated selling pressure from early large holders while facing weakened buying. The combination of these two forces naturally exerts significant pressure on prices.

So, is this a cause for concern? Has BTC's "monetary nature" been disproven due to recent underperformance?

In our view, the answer is no. As the old saying goes, "When in doubt, extend the time frame." It is difficult to deny BTC's long-term logic based solely on about three months of weak performance. Historically, BTC has experienced longer periods of relative underperformance, but ultimately rebounded and set new highs in both USD and gold valuations. The current underperformance is certainly a phase setback, but we do not view it as a structural issue.

Looking ahead to 2026, the situation becomes even more complex. As BTC is increasingly viewed as a macro asset, the importance of traditional analytical frameworks (such as the "four-year cycle") is declining. BTC's performance will be shaped more by macro variables, so the truly critical question becomes:

Will central banks continue to increase their gold holdings?

Will AI-driven stock trading continue to accelerate?

Will Trump fire Powell?

If that happens, will Trump push the new Federal Reserve chair to start buying BTC?

These variables are extremely difficult to predict, and we do not claim to provide definitive answers.

But what we are confident in is BTC's long-term monetary trajectory. Over the scale of years or even decades, we expect BTC to continue to appreciate in monetary terms—whether relative to the USD or gold. Ultimately, this judgment can be simplified to one question: "Is cryptomoney a superior form of currency?"

If the answer is yes, then BTC's long-term direction is self-evident.

Beyond BTC: How Should We View L1?

BTC has clearly established its position as the leading cryptomoney, but it is not the only crypto asset with a monetary premium. Some Layer 1 (L1) tokens also reflect a certain degree of monetary attribute premium in their valuations, or at least include expectations of future potential monetary premiums.

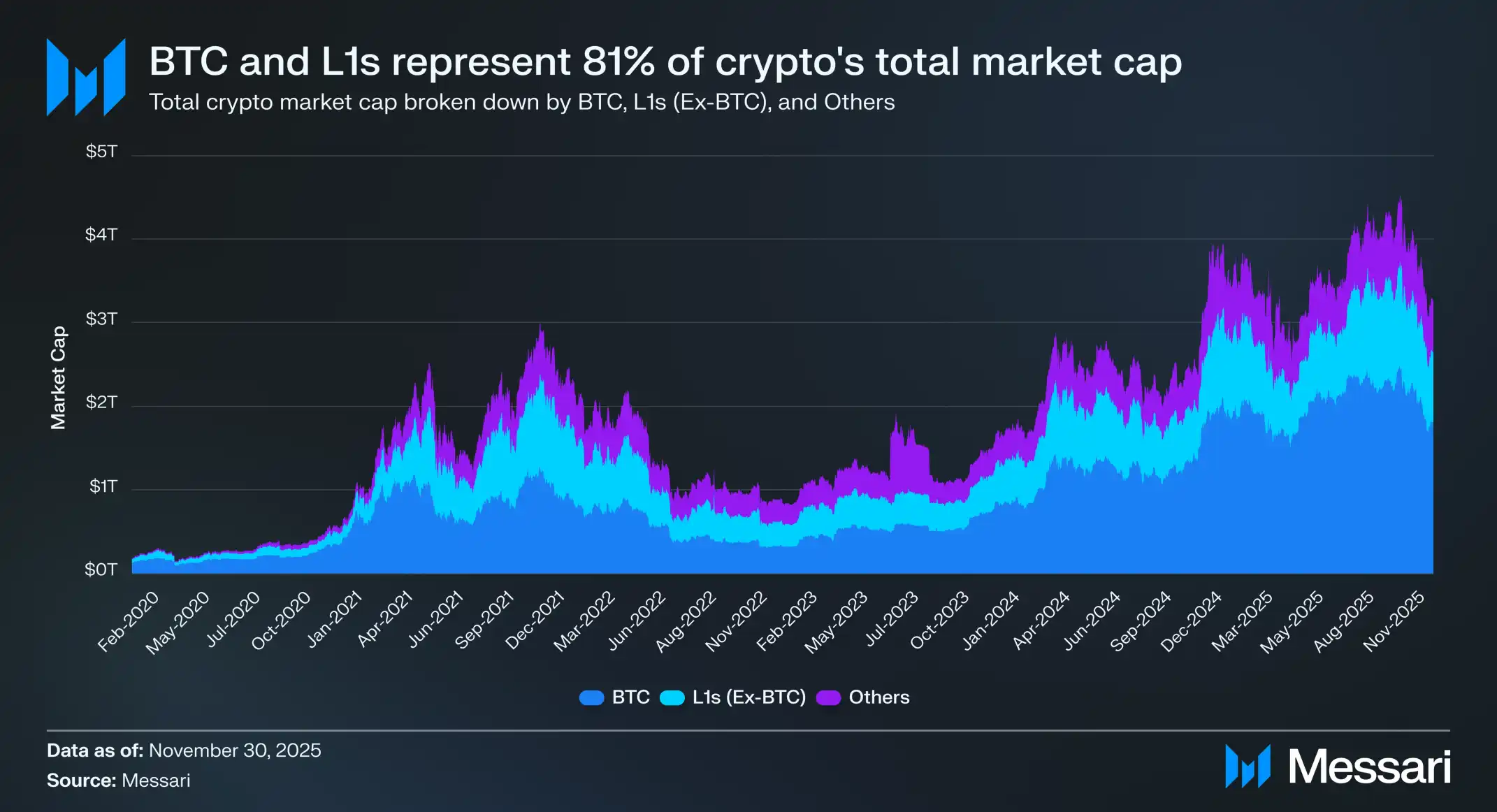

Currently, the total market capitalization of the crypto market is approximately $3.26 trillion. Among this, BTC accounts for about $1.80 trillion; in the remaining $1.45 trillion, about $0.83 trillion is concentrated in various alternative L1s. Overall, about $2.63 trillion, or approximately 81% of the crypto market funds, are allocated to assets that the market has already regarded as currency or believes may gain monetary premiums in the future.

For this reason, whether you are a trader, investor, fund allocator, or builder, understanding how the market assigns or withdraws monetary premiums is crucial. In the crypto industry, no factor influences an asset's valuation level more than whether the market is willing to regard that asset as "money." Therefore, predicting where future monetary premiums will flow is arguably the most important single variable in asset portfolio construction within this industry.

As mentioned earlier, we expect that in the coming years, BTC will continue to capture market share from gold and other non-sovereign stores of value. But this raises the question: What position will L1 occupy?

Will the rising tide lift all boats? Or will some monetary premium be siphoned off from other L1s as BTC "fills the gap" left by gold?

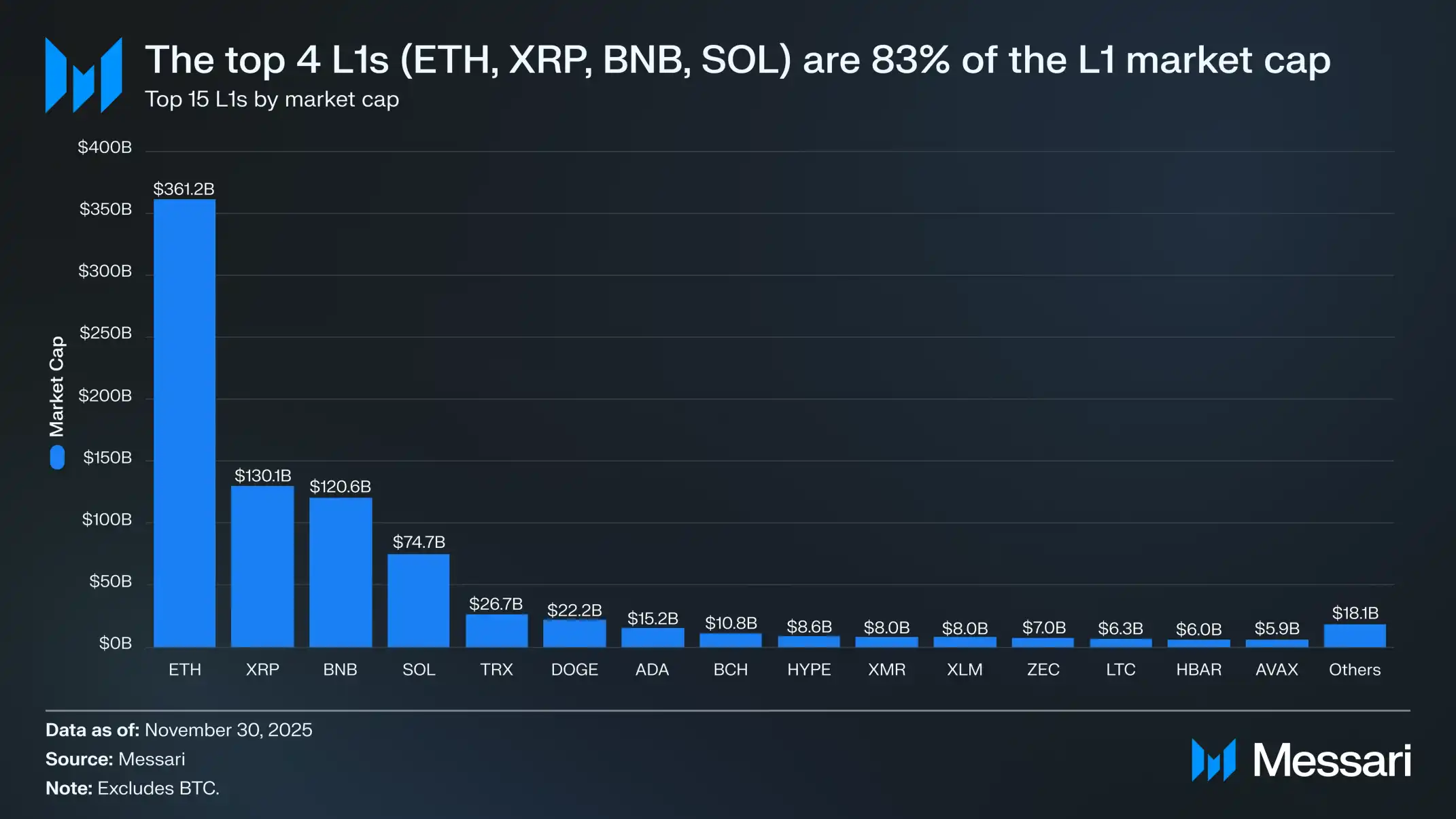

First, it is necessary to clarify the current valuation position of L1. The top four L1s by market capitalization are ETH ($361.15 billion), XRP ($130.11 billion), BNB ($120.64 billion), and SOL ($74.68 billion), with a combined market cap of $686.58 billion, accounting for about 83% of the entire alternative L1 sector.

After the top four, there is a significant valuation gap (for example, TRX has a market cap of about $26.67 billion), but the overall scale is still not to be overlooked. Even the fifteenth-ranked L1—AVAX—still has a valuation exceeding $5 billion.

It is important to emphasize that the market cap of L1 does not equate to its implied monetary premium. The current mainstream valuation logic for L1 can be summarized into three categories:

(i) Monetary Premium,

(ii) Real Economic Value (REV), and

(iii) Demand for Economic Security.

Therefore, a project's market cap is not solely derived from the market viewing it as "money," but rather a result of multiple value logics overlapping.

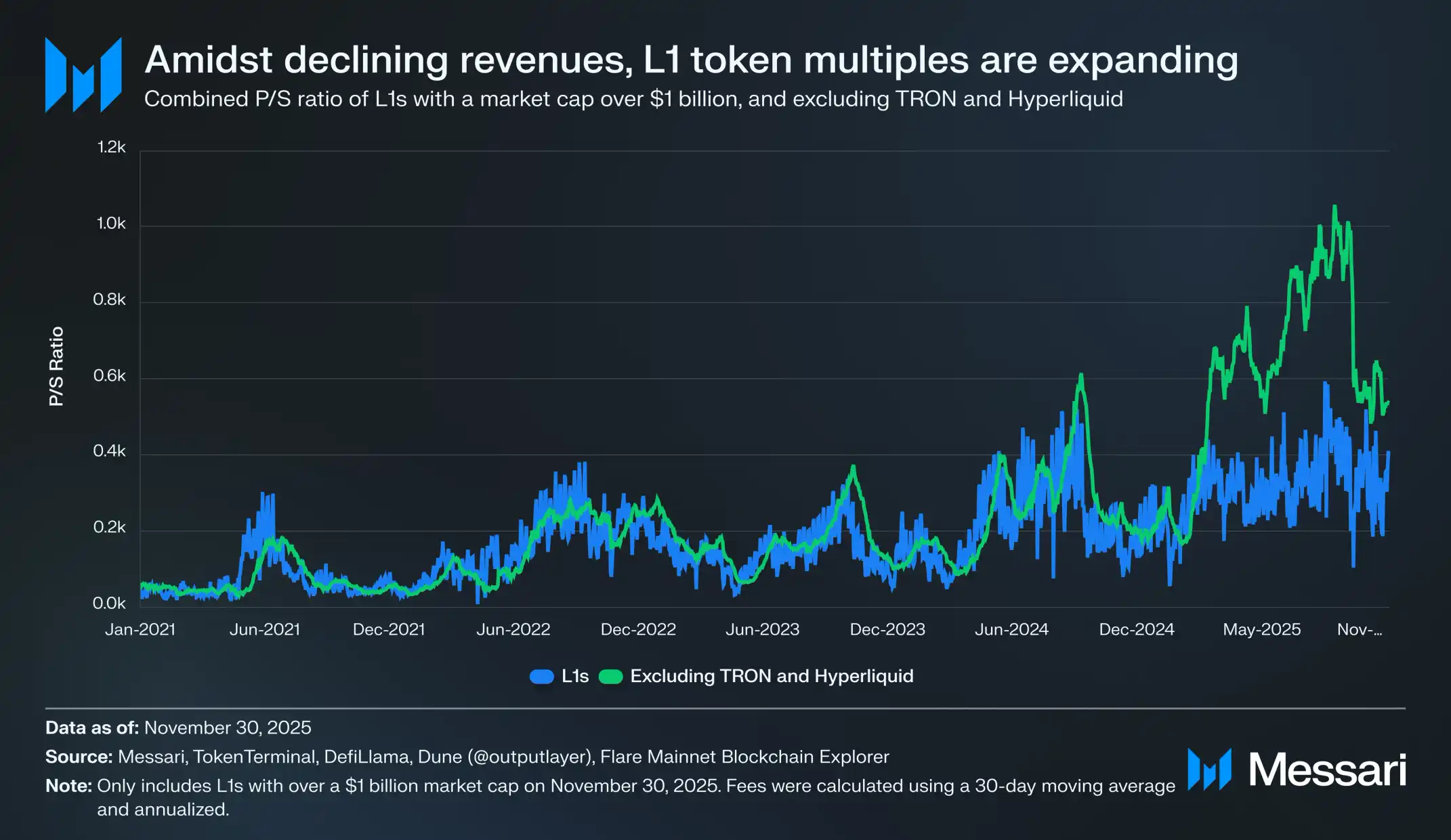

Despite the existence of various competing valuation frameworks, the market is increasingly pricing L1 from a "monetary premium" perspective rather than an "income-driven" one. Over the past few years, the overall price-to-sales ratio (P/S) of all L1s with a market cap exceeding $1 billion has slowly risen from about 200 times to 400 times. However, this surface number is somewhat misleading, as it includes TRON and Hyperliquid.

In the past 30 days, TRX and HYPE contributed 51% of the revenue for this sample, but their combined market cap only accounted for 4%. These two significantly lowered the overall P/S level.

Once these two outliers are excluded, the real situation becomes very clear: while revenue continues to decline, L1 valuations are rising. The adjusted P/S ratio shows a consistent upward trend:

November 30, 2021: 40 times

November 30, 2022: 212 times

November 30, 2023: 137 times

November 30, 2024: 205 times

November 30, 2025: 536 times

From the perspective of REV (Real Economic Value), one explanation could be that the market is pricing in future revenue growth expectations. However, this explanation is difficult to sustain under basic scrutiny. Using the same group of L1s as a sample (continuing to exclude TRON and Hyperliquid), their revenue has almost declined every year, with only one exception:

2021: $12.33 billion

2022: $4.89 billion (a 60% year-on-year decline)

2023: $2.72 billion (a 44% year-on-year decline)

2024: $3.55 billion (a 31% year-on-year increase)

2025: $1.70 billion (annualized, a 52% year-on-year decline)

In our view, the simplest and most direct explanation is that these valuations are primarily driven by monetary premiums rather than current or expected income levels.

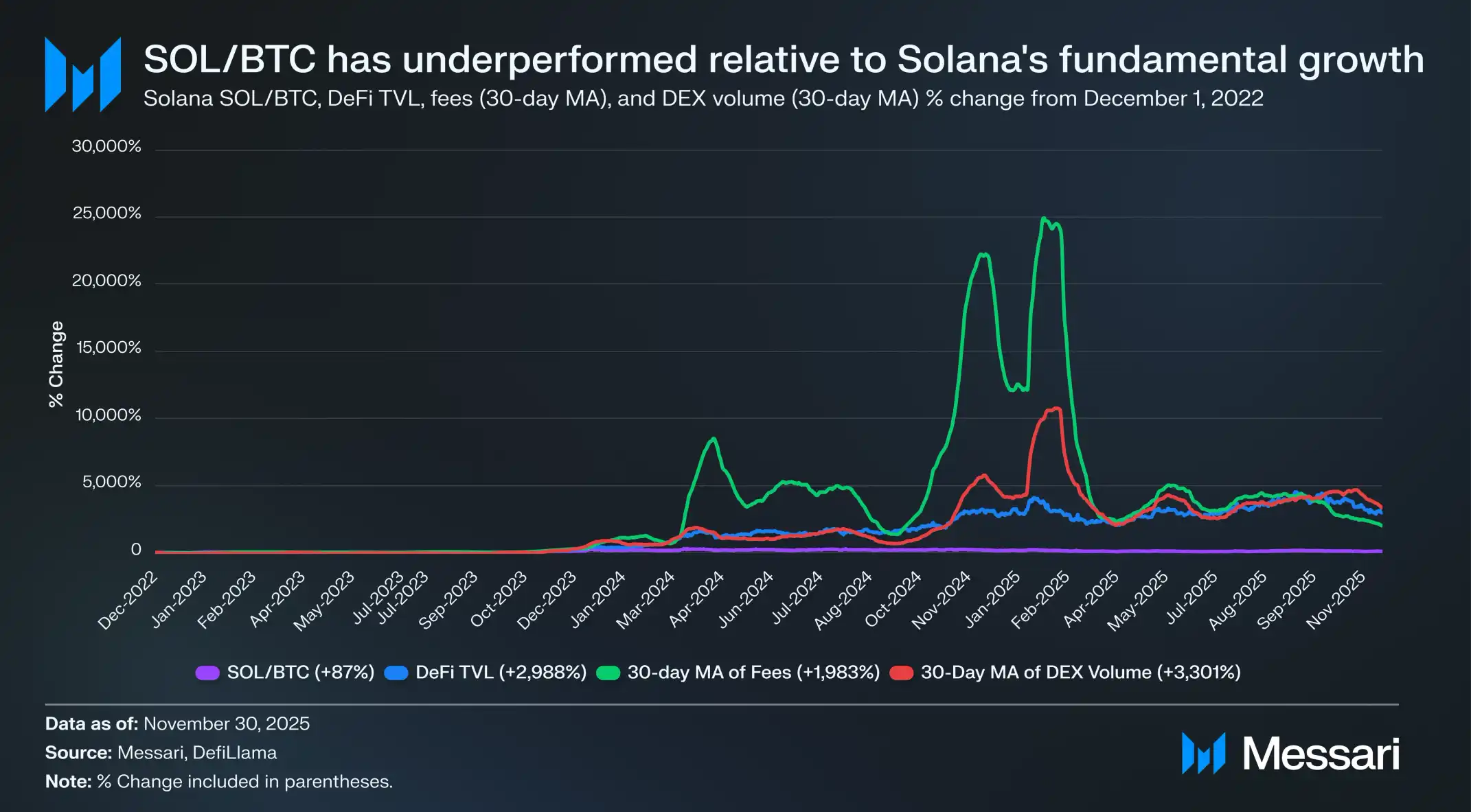

Further examination of SOL's excess performance reveals that its price increase may even be lower than the growth rate of its ecosystem fundamentals. During the same period when SOL outperformed BTC by 87%, Solana's fundamentals experienced explosive growth: DeFi's total value locked (TVL) increased by 2,988%, transaction fees grew by 1,983%, and DEX trading volume surged by 3,301%. By any reasonable measure, since December 1, 2022, the scale of the Solana ecosystem has grown between 20 to 30 times.

However, as the core asset that carries and reflects this growth, SOL has only outperformed BTC by 87%.

Please read that sentence again.

To achieve meaningful excess returns over BTC, an L1 does not just need its ecosystem to grow by 200%–300%; it needs growth of 2,000%–3,000% to achieve high double-digit relative excess performance.

Based on all the above facts, we believe that although L1 valuations are still built on the expectation of "potential future monetary premiums," the market's confidence in these expectations is quietly eroding. Meanwhile, the market's belief in BTC's monetary premium remains unshaken, and it can even be said that BTC's leading advantage is still expanding.

Additionally, although strictly speaking, cryptomoney does not require transaction fees or income to support its valuation, these metrics are crucial for L1. Unlike BTC, the narrative of L1 heavily relies on its ecosystem construction—applications, users, throughput, and economic activity—to "support" token value.

However, if an L1's ecosystem usage shows a year-on-year decline, reflected in a decrease in transaction fees and income, then that token will lose its unique competitive advantage compared to BTC. In the absence of real economic growth, the cryptomoney narrative of these L1s will become increasingly difficult for the market to accept.

Looking ahead, we do not believe this trend will reverse in 2026 or beyond. With very few potential exceptions, we expect alternative L1s to continue ceding market share to BTC. Their valuations are primarily driven by expectations of future monetary premiums, and as the market gradually recognizes that BTC is the most compelling candidate for cryptomoney among all assets, these valuations will continue to be compressed.

Although Bitcoin will still face challenges in the coming years, these issues are either too distant or overly reliant on unknown variables, insufficient to currently support the monetary premiums of other L1s. For L1s, the burden of proof has shifted: when compared to BTC, their narratives are no longer sufficiently persuasive and cannot rely on the overall market's emotional highs for long-term valuation support.

Counter Perspective: Why L1 May Still Compete Against BTC?

While we do not expect L1s to outperform BTC in the short term, it is also a misjudgment to think that their monetary premiums must converge to zero. The market rarely assigns valuations in the hundreds of billions of dollars to assets without underlying logic; the fact that these valuations can persist indicates that investors believe certain L1s may occupy a long-term position within a broader cryptomoney system.

In other words, while BTC has clearly established its position as the dominant monetary asset in the crypto space, if Bitcoin fails to address several structural challenges in the longer term, some L1s may still carve out their own long-term monetary niches.

Quantum Threat

The most pressing potential threat to BTC's monetary status is the so-called "quantum threat." If quantum computers develop to a sufficiently powerful level, they could potentially break the elliptic curve digital signature algorithm (ECDSA) used by Bitcoin, allowing attackers to derive private keys from public keys. Theoretically, this would jeopardize all addresses whose public keys have been exposed on-chain, including reused addresses and old UTXOs generated before best practices became widespread.

According to estimates by Nic Carter, about 4.8 million BTC (approximately 23% of the total supply) are stored in such exposed addresses, theoretically vulnerable to quantum attacks. Among these, about 1.7 million BTC (8% of the total supply) are in early p2pk addresses, which are almost certainly "dead coins"—their holders are no longer alive, inactive, or unable to control the private keys. This portion of assets constitutes the most challenging and unresolved issue currently.

If quantum computing does pose a real risk, Bitcoin must introduce quantum-resistant signature schemes. If this transformation cannot be completed, BTC's monetary value will face collapse, potentially reversing the classic saying to: "Having a key does not guarantee ownership of your coins." Therefore, we believe the Bitcoin network will ultimately need to upgrade to address the quantum threat.

The real challenge is not the upgrade itself, but how to handle these "dead coins." Even if a new quantum-resistant address format is introduced, these coins are likely to remain unmovable forever, thus remaining in a vulnerable state. Currently, the two most commonly discussed paths are:

Do nothing: Eventually, any entity with quantum capabilities could seize these coins, reintroducing up to 8% of the supply into the market, likely falling into the hands of individuals who were not the original holders. This would almost certainly depress BTC prices and undermine market confidence in its monetary attributes.

Directly destroy these coins: After a predetermined block height, make these vulnerable coins unspendable, effectively removing them from the supply permanently. However, this solution also carries significant trade-offs—it violates the long-standing anti-censorship principle of Bitcoin and could set a dangerous precedent: coins could be "voted" on whether they exist.

Fortunately, quantum computing is unlikely to pose a real threat to Bitcoin in the short term. Although predictions vary widely, even the most aggressive estimates typically place the earliest possible risk window around 2030. Based on this timeline, we do not expect substantial progress on quantum issues in 2026. This remains a long-term governance issue rather than an imminent engineering challenge.

The longer-term trajectory is even harder to judge. The biggest unresolved question is: how will the network ultimately handle those dead coins that cannot be migrated to a quantum-resistant address format? We cannot determine which path Bitcoin will choose, but we are confident that the network will ultimately make decisions that favor maintaining and maximizing BTC's monetary value.

Both of these main solutions can actually be seen as serving this goal: the former maintains anti-censorship, but at the cost of introducing potential new supply; the latter sacrifices some anti-censorship narrative but avoids BTC potentially falling into the hands of malicious actors.

Regardless of which path is ultimately chosen, the quantum issue represents a real long-term governance challenge. If quantum computing becomes a real threat and Bitcoin fails to upgrade, BTC's monetary status will cease to exist; and once that happens, alternative cryptomoney with stronger quantum-resistant paths may seize the monetary premium that BTC once monopolized.

Lack of Programmability

One structural limitation of the Bitcoin network is its lack of general programmability. Bitcoin deliberately chose a non-Turing complete design, with its scripting language being strictly limited in functionality, thereby constraining the complexity of on-chain transaction logic.

Unlike other ecosystems where smart contracts can natively verify and execute complex signature conditions, Bitcoin currently cannot directly verify external messages and struggles to achieve low-trust cross-chain collaboration without relying on off-chain infrastructure.

As a result, a whole class of applications, such as DEXs, on-chain derivatives, and privacy tools, can hardly be natively built on Bitcoin L1.

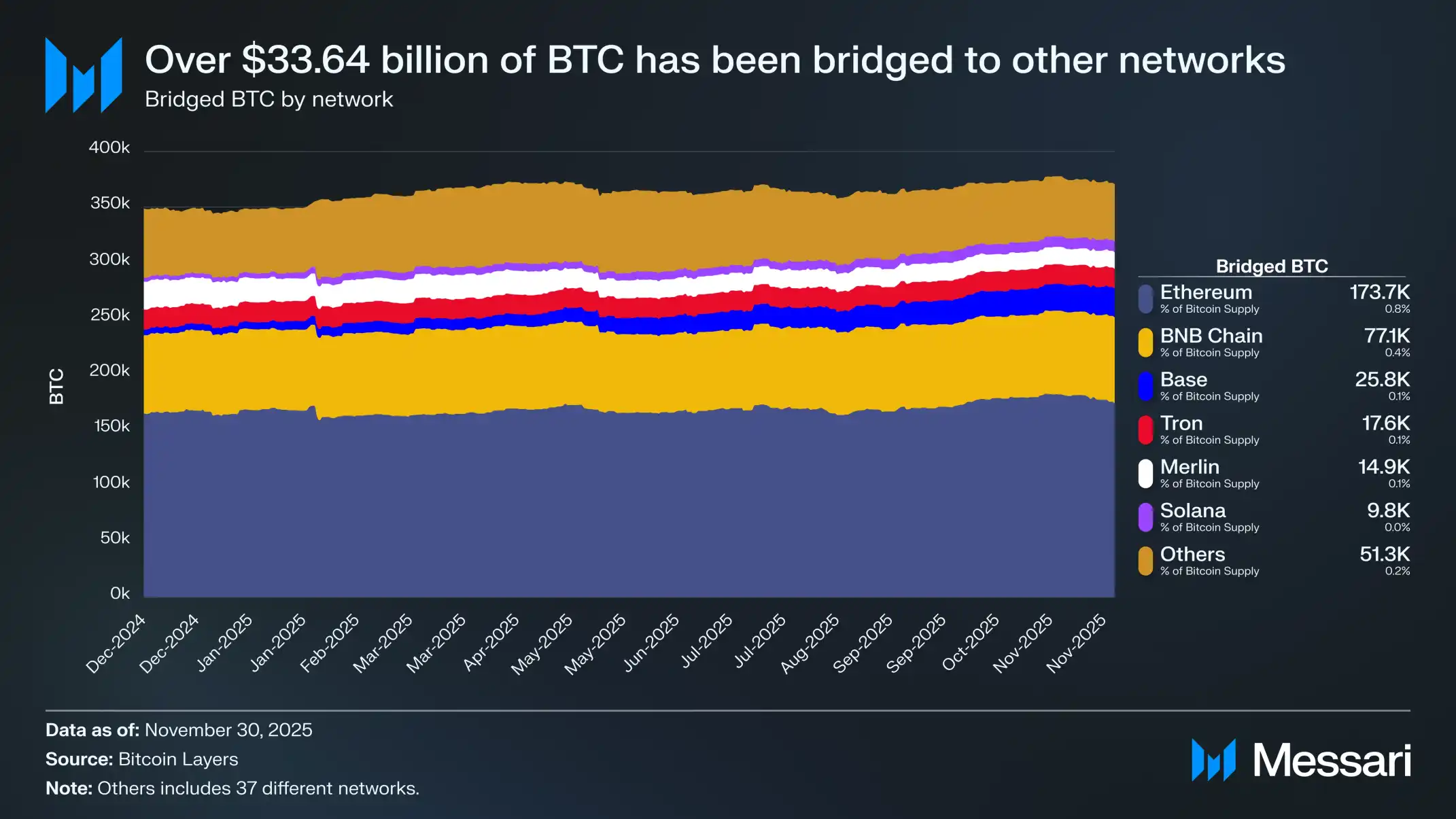

Although some supporters believe that this design helps reduce the attack surface and maintain Bitcoin's simplicity as a currency, it is undeniable that a considerable number of BTC holders wish to enter a programmable environment. As of the writing of this article, 370,300 BTC (approximately $33.64 billion) have been bridged to other networks. Among them, 365,000 BTC (about 99% of all cross-chain BTC) rely on custodial solutions or introduce trust-based assumptions. In other words, to use BTC in a more expressive ecosystem, users have effectively reintroduced the very set of risks that Bitcoin was originally designed to eliminate.

Within the Bitcoin ecosystem, attempts to address this issue—including federated sidechains, early L2 solutions, and low-trust multi-signature mechanisms—have not substantially reduced reliance on critical trust assumptions. Users indeed want to deploy BTC in a more programmable environment, but in the absence of a truly trustless cross-chain method, they often have to settle for centralized custodians.

As the size of BTC continues to grow and increasingly manifests as a macro asset, the demand for "how to efficiently use BTC" will only continue to rise. Whether using BTC as collateral, for lending, exchanging for other assets, or interacting with more expressive and programmable financial systems, users naturally wish not just to hold currency but to be able to use it.

However, under Bitcoin's current design, these use cases introduce significant long-tail risks—because using BTC in a programmable or leveraged environment almost inevitably requires handing over asset custody to centralized intermediaries.

For these reasons, we believe that the Bitcoin network ultimately needs to support these use cases through a fork, achieving trustless and permissionless functionality. We do not think this means Bitcoin needs to transform into a smart contract platform; rather, a more reasonable path may be to introduce new opcodes (opcode), such as OP_CAT, to enable trustless BTC cross-chain and composability.

The attention surrounding OP_CAT lies in its potential to unlock trustless circulation of BTC across different chains with just a small change to the consensus layer. This is not about transforming Bitcoin into a smart contract platform but rather introducing a relatively simple opcode; when combined with Taproot and existing Script primitives, it could allow Bitcoin to directly execute and constrain spending conditions at the base layer.

This capability would make non-custodial BTC cross-chain bridges possible, no longer relying on custodians, federated mechanisms, or external validator sets, thus directly addressing the core risks of the current problem—risks that have led to hundreds of thousands of BTC being wrapped in custodial assets.

Unlike the quantum threat, Bitcoin's lack of programmability does not pose an existential risk to its "monetary nature." However, it does limit the accessible market size for BTC as cryptomoney. The demand for "programmable money" is already evident: over 370,000 BTC (approximately 1.76% of the total supply) are currently held in cross-chain environments, and the asset scale deployed within the DeFi system has exceeded $120 billion.

As the crypto ecosystem continues to expand and more financial activities migrate on-chain, this demand will only grow further. However, the reality is that Bitcoin currently does not provide a trustless path for BTC to safely participate in a programmable ecosystem. If the market ultimately deems the associated risks unacceptable, then L1 assets with programmability, such as ETH and SOL, will become the primary beneficiaries of this demand.

Security Budget

The final structural issue facing Bitcoin is its security budget. This topic has been discussed for over a decade, and although opinions on its severity vary widely, it remains one of the most contentious issues surrounding Bitcoin's long-term monetary integrity.

Essentially, the security budget refers to the total compensation miners receive for maintaining network security, which currently consists mainly of two parts: block subsidies and transaction fees. As block rewards are halved every four years, Bitcoin will ultimately have to rely primarily on transaction fees and, in the more distant future, completely depend on fees to incentivize miners to continue providing security for the network.

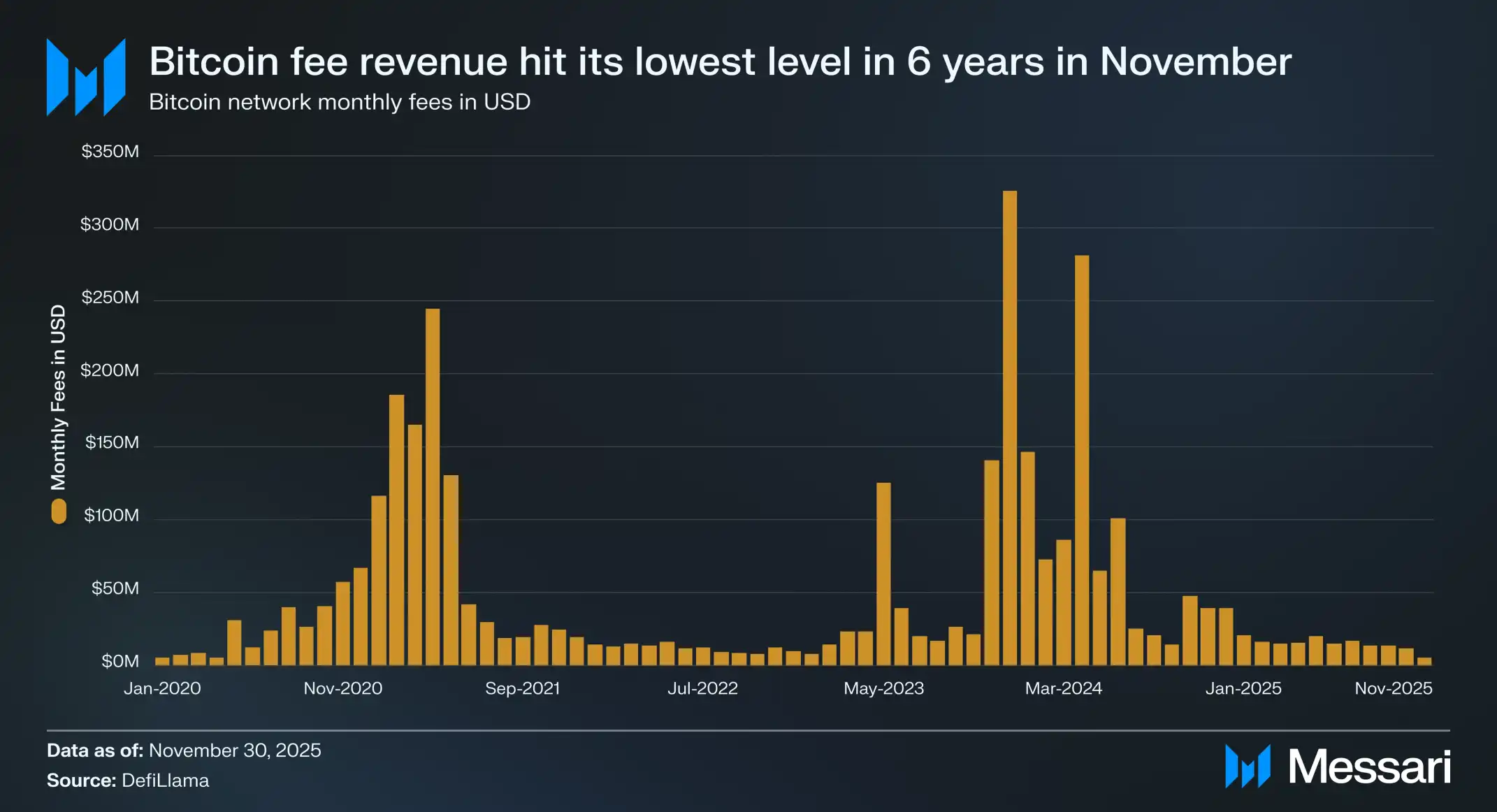

At one point, amid the surge in popularity of Ordinals and Runes, the market seemed to see a possibility: that transaction fees alone might be sufficient to compensate miners and maintain network security. In April 2024, Bitcoin's on-chain fee revenue reached $281.4 million, marking the second-highest monthly level in history. However, just a year and a half later, fee revenue experienced a dramatic decline. In fact, the on-chain fees in November 2025 were only $4.87 million, the lowest monthly level since December 2019.

Although the sharp drop in fees is shocking, it does not necessarily constitute an immediate risk. Bitcoin's block subsidy still provides significant incentives for miners, and it will continue to do so for decades to come. Even by 2050, the network will still add about 50 BTC per week, which remains a non-negligible issuance for miners. As long as block subsidies remain the dominant source of miner income, network security is unlikely to be threatened.

Nevertheless, the possibility of on-chain fees completely replacing block subsidies is becoming increasingly unlikely.

It is important to note that discussions surrounding the security budget are not simply a matter of "can fees completely replace subsidies." Fees do not need to equal the current subsidy level; they only need to exceed the cost of launching a credible attack. However, this cost cannot be precisely calculated and may vary significantly with the evolution of mining technology and energy markets.

If mining costs significantly decrease in the future, the minimum requirement for fees will also drop accordingly. This change could occur under various scenarios: in a mild scenario, gradual improvements in ASICs and lower-cost access to idle renewable energy will reduce miners' marginal costs; in an extreme scenario, breakthroughs in energy sources such as commercial controlled fusion or ultra-low-cost nuclear energy could lead to a dramatic decrease in electricity prices, fundamentally altering the economic structure of maintaining hash power.

Even acknowledging the numerous variables that make it impossible to precisely calculate what level Bitcoin's security budget "needs" to reach, it is still necessary to consider a hypothetical scenario: that miner rewards ultimately prove insufficient to economically guarantee network security. In this case, the incentive mechanisms supporting Bitcoin's "credible neutrality" would begin to weaken, and the assurance of network security would increasingly rely on social expectations rather than enforceable economic constraints.

One possibility is that certain participants—exchanges, custodians, state-level entities, or large holders—might choose to mine at a loss to protect the assets they rely on. However, while this "defensive mining" might technically maintain network security, it could also undermine the social consensus around BTC as a currency. If users begin to believe that BTC relies on the coordinated actions of a few large entities to maintain security, its monetary neutrality, and consequently its monetary premium, could come under pressure.

Another equally possible scenario is that no entity is willing to bear economic losses to maintain the network. In this scenario, Bitcoin could face the risk of a 51% attack. Although a 51% attack would not permanently destroy Bitcoin (Ethereum Classic, Monero, and other PoW chains have continued to survive after experiencing 51% attacks), it would undoubtedly raise serious questions about Bitcoin's security.

With so many uncertainties shaping Bitcoin's long-term security budget, no one can provide definitive answers about the system's evolution decades from now. This uncertainty does not pose a real threat to BTC, but it does create a long-tail risk that needs to be priced by the market. From this perspective, the remaining monetary premium of some L1 assets can also be seen as a hedge against the extremely low-probability event of "Bitcoin's long-term economic security being challenged."

The ETH Debate: Does It Count as Cryptomoney?

Among all major crypto assets, none has sparked long-term, ongoing debate like ETH. BTC's status as the dominant cryptomoney is almost unquestioned, but ETH's role is far from being defined.

Some view ETH as the only asset with credible non-sovereign currency attributes besides BTC; while others see ETH more as a "business" facing declining revenues, shrinking profit margins, and increasingly faster and cheaper L1 competition.

This debate seemed to reach a climax in the first half of this year. In March, XRP briefly surpassed ETH in fully diluted valuation (FDV) (it is important to note that ETH has achieved full circulation, while XRP currently has only about 60% of its supply in circulation).

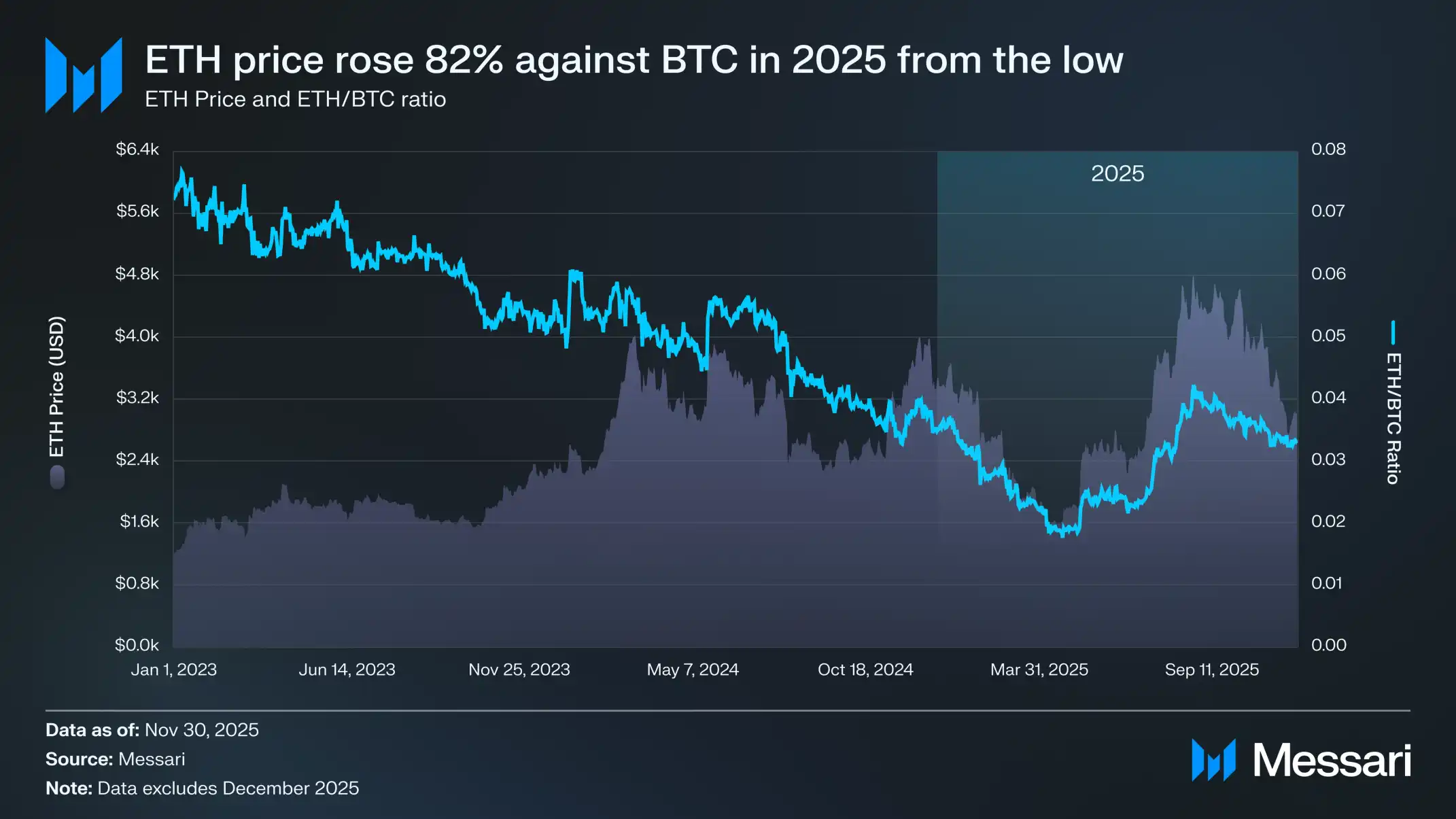

On March 16, ETH's FDV was approximately $227.65 billion, while XRP's FDV reached $239.23 billion—an outcome that almost no one would have thought possible a year ago. Subsequently, on April 8, 2025, the ETH/BTC exchange rate fell below 0.02 for the first time since February 2020. In other words, all the excess performance ETH achieved relative to BTC in the last cycle has been completely reversed.

By that moment, market sentiment surrounding ETH had fallen to its lowest level in years.

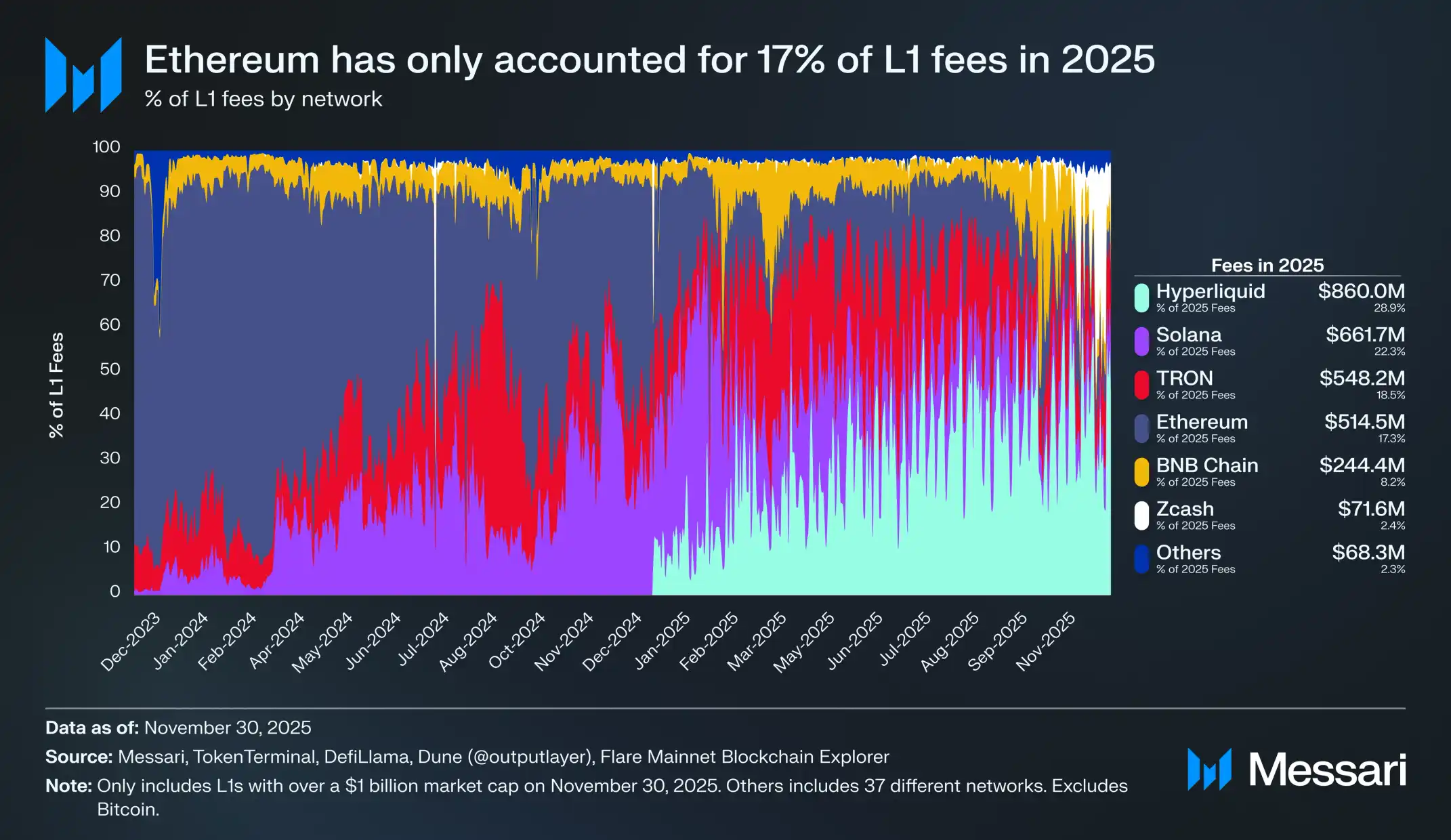

Worse still, price performance is only part of the problem. As the competitive ecosystem continues to grow, Ethereum's share of L1 fees is steadily declining. Solana regained its footing in 2024, and Hyperliquid made breakthroughs in 2025, together compressing Ethereum's fee share to 17%—ranking only fourth among all L1s, a stark contrast to its position as the undisputed leader just a year ago.

Transaction fees are not the only metric that matters, but they are undoubtedly a clear signal of where economic activity is migrating. Currently, the competitive environment facing Ethereum is the most intense in its development history.

However, history repeatedly shows that the most significant reversals in the crypto market often occur during the most pessimistic moments. When ETH is widely regarded as a "failed asset" and abandoned by the market, many of its perceived "problems" have already been fully priced in.

In May 2025, signs of excessive pessimism in the market began to emerge. Since then, both the ETH/BTC ratio and the dollar-denominated price of ETH have started to show a clear reversal. The ETH/BTC ratio rose from a low of 0.017 in April to 0.042 in August, an increase of 139%; at the same time, ETH itself rose from $1,646 to $4,793 during the same period, a cumulative increase of 191%. This momentum ultimately peaked on August 24, when ETH reached a new all-time high of $4,946.

After this repricing, the market gradually realized that the overall trajectory of ETH had turned to strengthen again. The leadership adjustment within the Ethereum Foundation (to be discussed later) and the emergence of Digital Asset Treasuries centered around ETH injected a sense of certainty and confidence that had been noticeably lacking in the previous year.

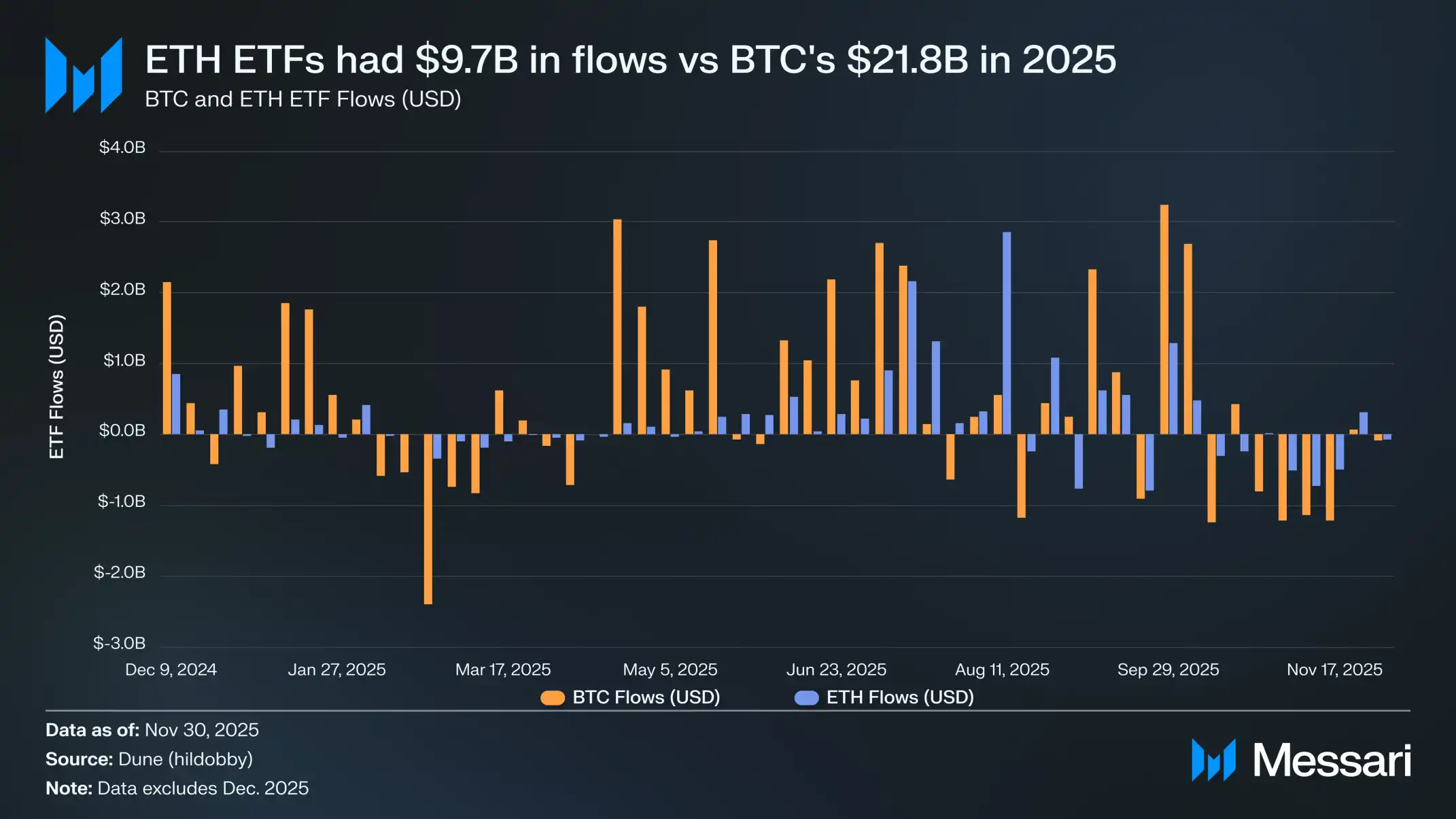

Before this rebound, the contrast between BTC and ETH was particularly evident in their respective ETF markets. When the spot ETH ETF launched in July 2024, the inflow of funds was very weak. In the first six months, its cumulative net inflow was only $2.41 billion, which seemed quite bland compared to the record-breaking performance of the BTC spot ETF.

However, as ETH began to recover, concerns about ETF fund flows were completely reversed. In the following year, the spot ETH ETF attracted a cumulative $9.72 billion, while the BTC ETF saw inflows of $21.78 billion during the same period. Considering that BTC's market capitalization is nearly five times that of ETH, the difference in fund inflows of only 2.2 times is far below market expectations.

In other words, after adjusting for market capitalization, the demand for ETH ETFs is actually higher than that for BTC, which sharply contrasts with the previous narrative that "institutions have no substantial interest in ETH." At certain stages, ETH even outperformed BTC comprehensively.

From May 26 to August 25, the inflow into ETH ETFs reached $10.2 billion, surpassing BTC's $9.79 billion during the same period, marking the first time institutional demand clearly tilted towards ETH.

From the perspective of ETF issuers, BlackRock further solidified its dominant position in the ETF market. By the end of 2025, BlackRock held 3.7 million ETH, accounting for about 60% of the entire spot ETH ETF market. This figure represents a 241% increase from 1.1 million ETH at the end of 2024, the highest annual growth among all issuers.

Overall, the spot ETH ETF held a total of 6.2 million ETH by the end of the year, approximately 5% of the total ETH supply.

Behind ETH's strong rebound, the most critical change is the rise of Digital Asset Treasuries (DATs) centered around ETH. DATs have brought a previously unseen source of stable and repeatable demand for ETH, anchoring asset prices in a way that narratives or speculative funds find difficult to achieve. If ETH's price movements signify a superficial turning point, then the continuous accumulation of DATs represents a deeper structural change that facilitates this turning point.

DATs have had a significant impact on ETH prices. Throughout 2025, DATs collectively increased their holdings by approximately 4.8 million ETH, equivalent to 4% of the total ETH supply. Among them, the most aggressive ETH DAT is Bitmine (BMNR), led by Tom Lee—a company originally engaged in Bitcoin mining, which began shifting its treasury and capital structure towards ETH in July 2025. From July to November, Bitmine accumulated 3.63 million ETH, accounting for 75% of all DAT holdings, making it the undisputed leader in this field.

Despite the powerful reversal of ETH, this market trend ultimately began to cool down. By November 30, ETH had fallen from its August peak to $2,991, significantly below both the recent high and the previous cycle's historical high of $4,878. Compared to April, ETH's overall situation has improved significantly, but this rebound has not eliminated the structural concerns that initially triggered bearish logic. If there has been any change, it is that the debate surrounding ETH has become more intense than ever.

Supporters argue that ETH is exhibiting many similarities to the characteristics BTC displayed during its establishment as a currency: ETF fund inflows are no longer sluggish; digital asset treasuries have become a continuous source of demand; and, more importantly, an increasing number of market participants are beginning to view ETH as a special asset distinct from other L1 tokens—in the eyes of some, it has been incorporated into the same monetary framework as BTC.

However, the core concerns that weighed down ETH at the beginning of the year still persist. Ethereum's fundamentals have not fully repaired; its share of L1 fees continues to be pressured by strong competitors like Solana and Hyperliquid; and the on-chain activity at the base layer remains significantly below the peak levels of the previous cycle. Meanwhile, despite ETH's strong rebound, BTC has firmly established itself above its historical high, while ETH has yet to reclaim its previous highs. Even during the strongest months for ETH, a considerable portion of holders viewed the price increase as an opportunity to exit liquidity rather than a confirmation of a long-term monetary narrative.

The core issue of this debate is not whether Ethereum is "valuable," but rather: how does the asset ETH derive value from the Ethereum network?

In the previous cycle, the market generally assumed that ETH would directly capture value from Ethereum's success. This is a key component of the "Ultrasound Money" narrative: as Ethereum becomes increasingly useful, the network will burn a large amount of ETH, making it a deflationary value carrier.

Today, we can say with considerable confidence that things will not unfold as previously envisioned. Ethereum's fee revenue has significantly declined, with no clear signs of recovery; and its current most important growth sources—RWA and institutional participation—primarily use the dollar as the base currency, rather than ETH.

In this context, the value of ETH will depend on whether it can achieve "indirect" value capture from Ethereum's success. However, compared to direct, mechanical value capture, the uncertainty of indirect value capture is much greater. It relies on an expectation: as Ethereum's importance at the system level continues to rise, more users and capital will choose to view ETH as cryptomoney and a store of value.

However, unlike direct value capture mechanisms, this process offers no guarantees. It entirely depends on social preferences and collective beliefs—this is not a flaw (as previously explained, BTC accumulates value in this way), but it also means that ETH's price performance is no longer directly linked to Ethereum's economic activities in a deterministic manner.

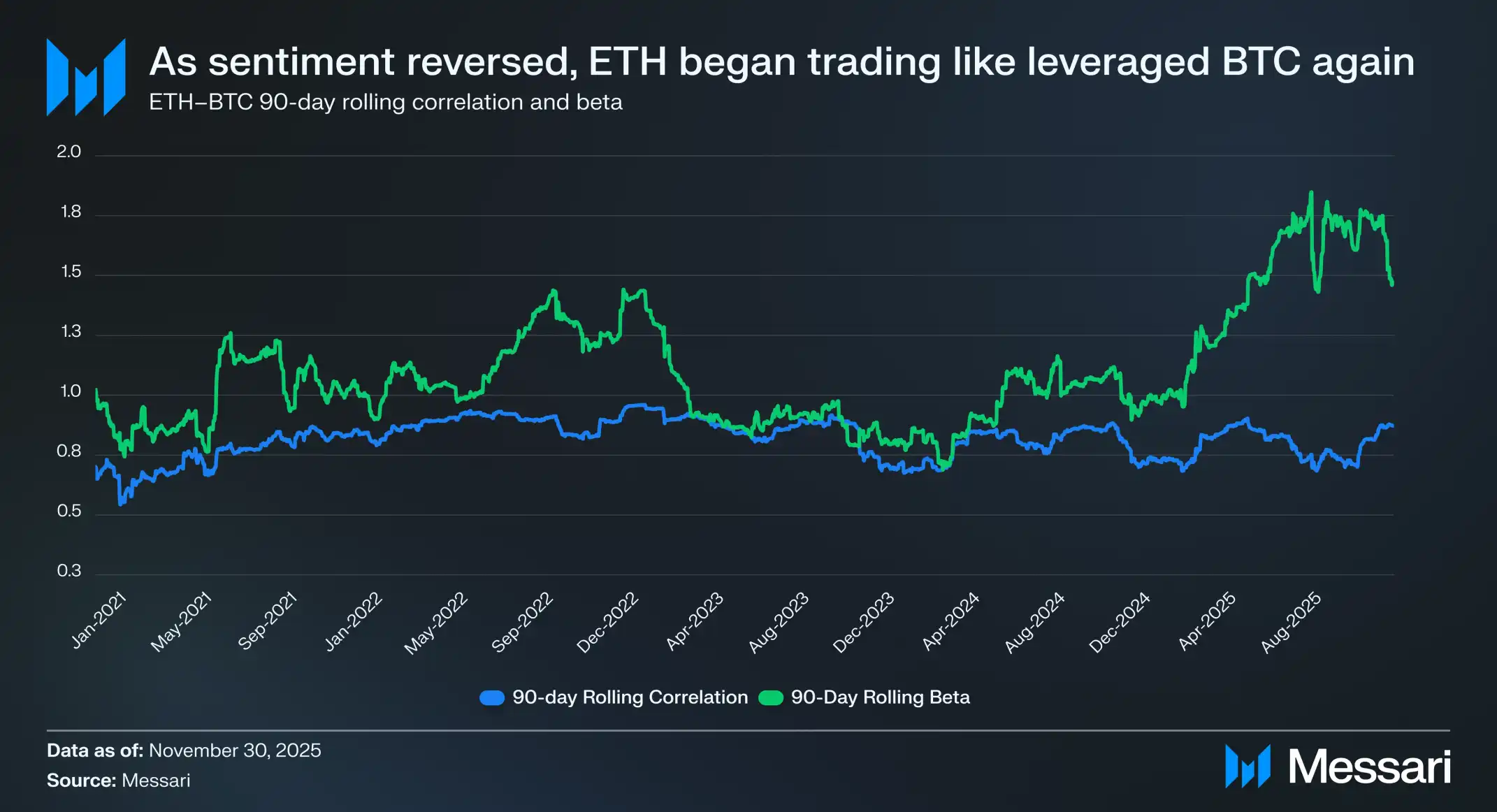

All these factors ultimately bring the debate about ETH back to its core tension. ETH may indeed be accumulating some form of monetary premium, but this premium always lags behind BTC and is subordinate to BTC. The market once again views ETH as a leveraged expression of BTC's monetary narrative rather than an independent monetary asset.

In 2025, the 90-day rolling correlation coefficient between ETH and BTC mostly remained in the range of 0.7 to 0.9, while its rolling beta value soared to multi-year highs, exceeding 1.8 during certain periods. This indicates that ETH's volatility is significantly higher than that of BTC, but its price movements still heavily depend on BTC.

This is a subtle yet extremely important distinction. Currently, the reason ETH's monetary correlation holds is that BTC's monetary narrative remains solid. As long as the market continues to believe in BTC's status as a non-sovereign store of value, a portion of marginal participants will be willing to extend that belief to ETH.

If BTC continues to strengthen in 2026, ETH will also have a relatively clear path to further narrow the gap with BTC.

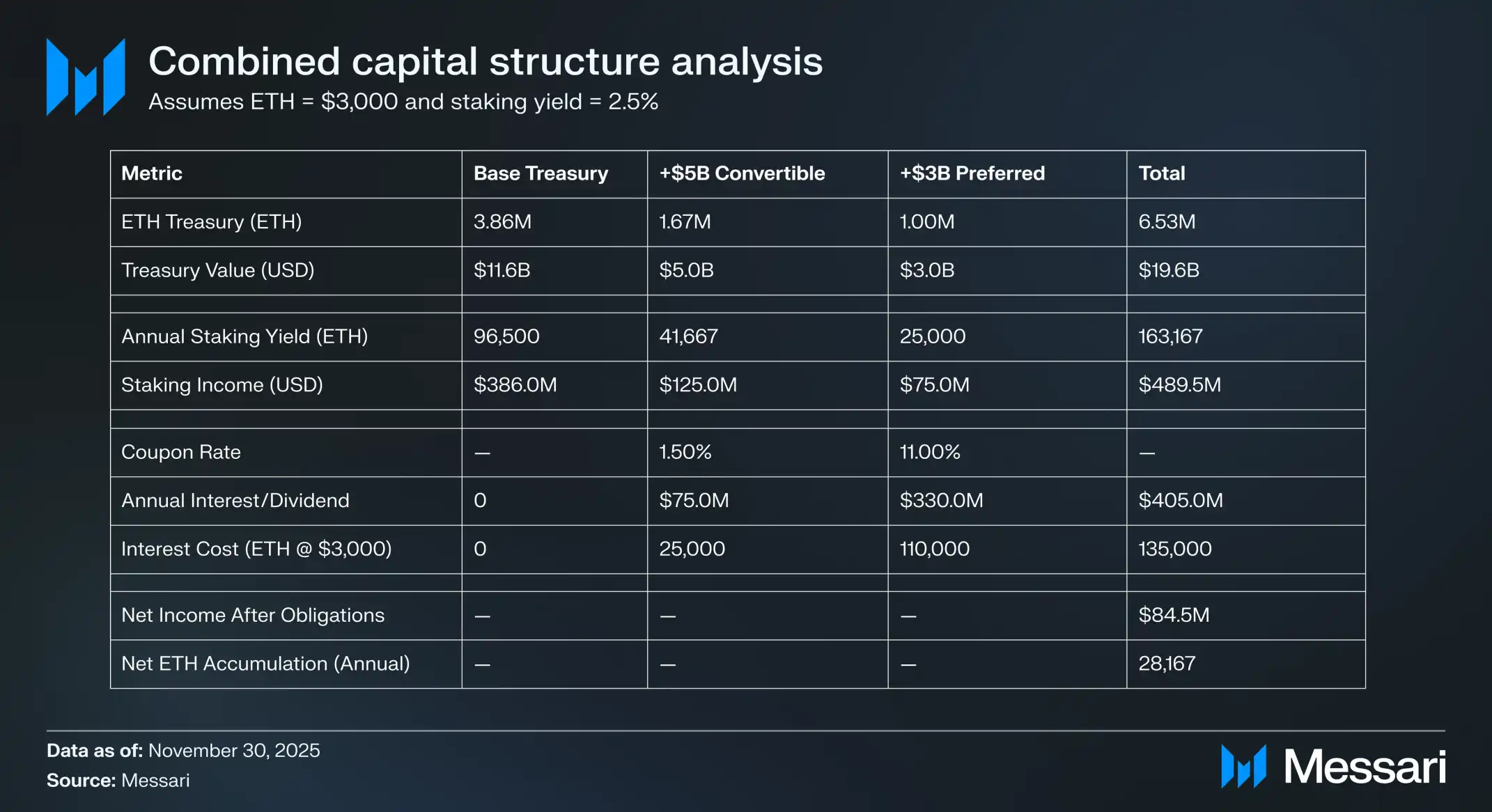

Ethereum DATs are still in the early stages of their lifecycle, and so far, their accumulation of ETH has mainly been achieved through common stock financing. However, in the next round of the crypto bull market, these entities may very well explore more capital structure tools, replicating the path used by Strategy to expand BTC exposure, including convertible bonds and preferred stocks.

For example, DATs like BitMine can issue low-yield convertible debt and higher-yield preferred capital, using the raised funds directly to purchase ETH while staking these ETH for ongoing returns. Under reasonable assumptions, staking income can partially hedge fixed interest and dividend expenses, allowing the treasury to continuously accumulate ETH in favorable market conditions while increasing balance sheet leverage.

This "second life" of Ethereum DATs is expected to become another force maintaining ETH's relatively high beta characteristic compared to BTC in 2026—provided that a broader BTC bull market restarts.

Fundamentally, the market still views ETH's monetary premium as existing in relation to BTC. ETH has not yet become an autonomous monetary asset with an independent macro foundation; it resembles a secondary beneficiary of BTC's monetary consensus. The recent recovery of ETH reflects a small portion of marginal participants who are beginning to view ETH as an asset closer to BTC, rather than just an ordinary L1 token. However, even during relatively strong phases, the market's belief in ETH remains tethered to the ongoing validity of the BTC narrative.

In short, the monetary narrative of ETH is no longer broken, but it is far from settled. Given the current market structure and considering ETH's high beta characteristic relative to BTC, as long as BTC's core logic continues to materialize, ETH has the potential for significant upward movement; the structural demand from DATs and corporate treasuries indeed provides it with upside potential. However, for the foreseeable future, ETH's monetary trajectory will still depend on BTC. Until ETH demonstrates a lower correlation and beta—something that has never occurred over a longer time scale—ETH's premium will always operate in the shadow of BTC.

Zcash: A Hedge Against BTC?

Among all crypto assets outside of BTC and ETH, ZEC has undergone the most significant shift in monetary perception in 2025. For years, ZEC has lingered outside the core tier of cryptomoney, viewed as a niche privacy coin rather than a true monetary asset. However, with increasing concerns about surveillance and the acceleration of Bitcoin's institutionalization, privacy has been re-evaluated as a core monetary attribute, no longer merely a marginalized ideological preference.

Bitcoin has proven that non-sovereign digital currencies can operate on a global scale, but it has failed to retain the privacy attributes we take for granted when using physical cash. Every transaction is broadcast to a completely transparent public ledger, and anyone can track it through a block explorer. This creates an irony: a tool originally intended to weaken state control inadvertently creates a financial panopticon.

Zcash combines Bitcoin's monetary policy with the privacy characteristics of physical cash through zero-knowledge cryptography. No other digital asset can provide such tested and certain privacy guarantees as Zcash's latest shielded pool. In our view, the market's re-evaluation of ZEC's position relative to BTC is based on this—seeing it as a privacy-oriented cryptomoney with ideal attributes and positioning ZEC as a hedge against the rise of surveillance states and the institutionalization of Bitcoin.

Since the beginning of the year, ZEC has risen 666% relative to BTC, with a market capitalization of $7 billion, briefly surpassing XMR in market value to become the most valuable privacy coin. This relative strength indicates that the market is pricing ZEC alongside XMR as a viable privacy-oriented cryptomoney.

Privacy on Bitcoin

It is highly unlikely that Bitcoin will adopt a structure similar to a "shielded pool," so the belief that Bitcoin will ultimately absorb Zcash's value proposition is unfounded. Bitcoin is known for its highly conservative culture, emphasizing the reduction of attack surfaces and the maintenance of monetary integrity through "ossification." Embedding privacy features at the protocol level would require adjustments to Bitcoin's core architecture, introducing risks such as inflation vulnerabilities that could undermine its monetary integrity. Zcash is willing to take on this risk because privacy is its core value proposition.

Implementing zero-knowledge cryptography at the base layer would also impact the scalability of the blockchain: to prevent double spending, nullifiers and hashed notes would need to be introduced, raising long-term concerns about "state bloat." Nullifiers would create a list that only grows over time, potentially increasing the resource costs for running nodes indefinitely. Forcing nodes to store a large, continuously growing collection of nullifiers would weaken Bitcoin's decentralization, as the operational threshold for nodes would increase over time.

As mentioned earlier, before enabling zero-knowledge validation through a soft fork (such as OP_CAT), no Bitcoin L2 can provide Zcash-level privacy while inheriting Bitcoin's security. The realistic options are limited to three:

- Introducing trusted intermediaries (consortium/federated model);

- Accepting lengthy and interactive withdrawal delays (BitVM model);

- Completely outsourcing execution and security to independent systems (sovereign Rollup).

Until these conditions change, there is no realistic path that retains Bitcoin's security while achieving Zcash's privacy. This is precisely where ZEC's value as a privacy-oriented cryptomoney lies.

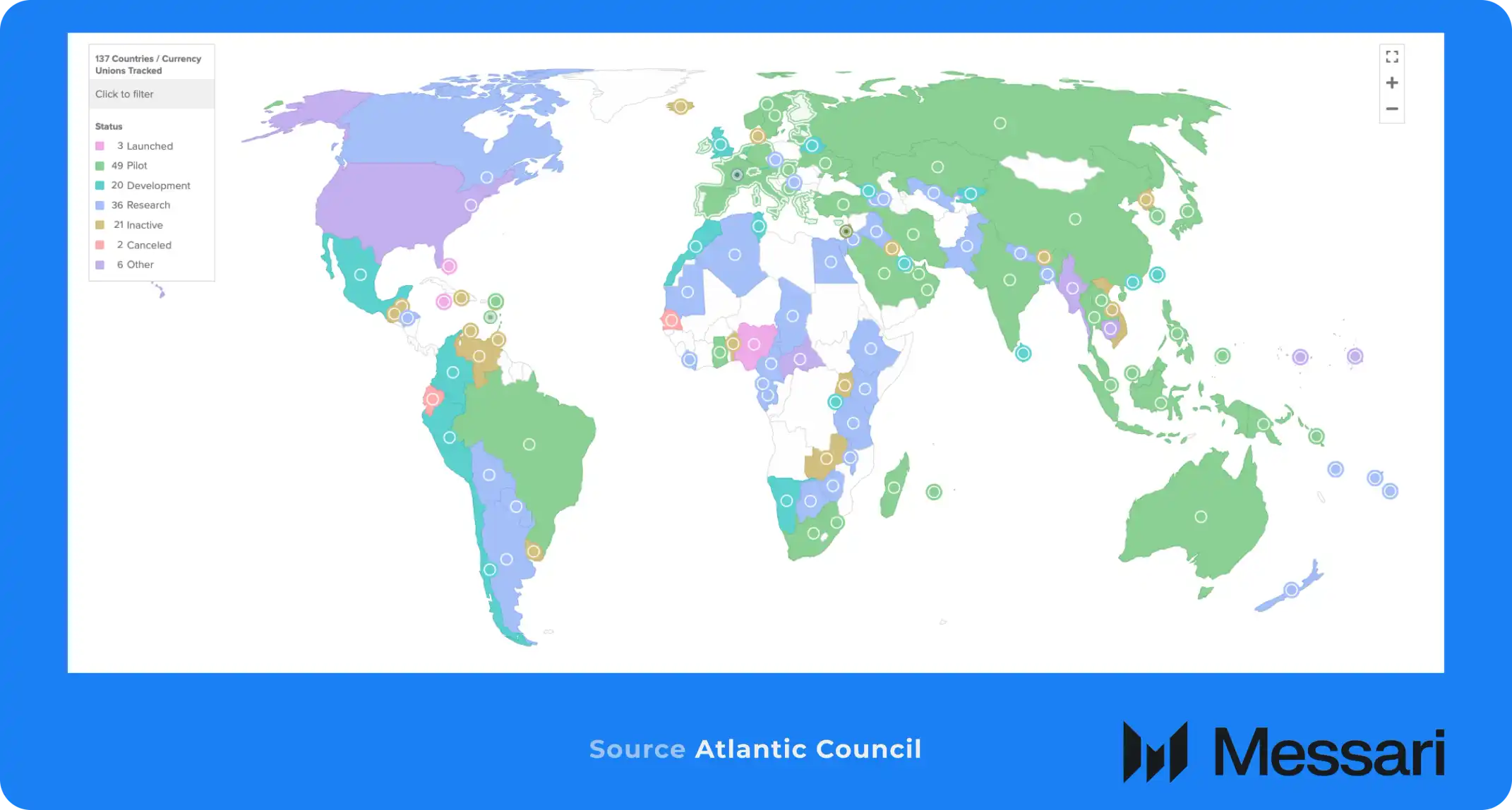

A Hedge Against CBDCs

The importance of privacy is further amplified by the arrival of Central Bank Digital Currencies (CBDCs). Half of the countries globally are either researching or have already launched CBDCs. CBDCs are programmable, meaning that issuers can not only track every transaction but also control how, when, and where funds are used. Funds can even be programmed to be usable only at designated merchants or within specific geographical areas.

This may sound like a dystopian fantasy, but the weaponization of the financial system is not a figment of imagination; it is a reality that has already occurred:

- Nigeria (2020): During the #EndSARS protests against police violence, the Central Bank of Nigeria froze the bank accounts of several key protest organizers and feminist organizations, forcing the movement to rely on cryptocurrency to sustain operations.

- United States (2020–2025): Regulators and large banks implemented de-banking on legitimate but politically unpopular industries under the guise of "reputational risk," rather than based on safety and soundness. This trend became severe enough for the White House to order a review; the Office of the Comptroller of the Currency (OCC) documented systematic restrictions on legitimate industries from oil and gas to firearms, adult content, and the crypto industry in its 2025 de-banking study.

- Canada (2022): During the "Freedom Convoy" protests, the Canadian government invoked the Emergencies Act to freeze the bank and crypto accounts of protesters and small donors without a court order. The Royal Canadian Mounted Police even blacklisted 34 self-custodied crypto wallet addresses, demanding that all regulated exchanges cease providing trading services for them. This incident demonstrates that Western democracies are also willing to use the financial system to suppress political dissent.

In an era where currency can be programmed to constrain individual behavior, ZEC provides a clear "exit option." However, the significance of Zcash extends beyond evading CBDCs; it is increasingly becoming a necessary tool for protecting Bitcoin itself.

A Hedge Against Bitcoin's "Capture"

As influential advocates like Naval Ravikant and Balaji Srinivasan have pointed out, Zcash serves as insurance for maintaining Bitcoin's vision of financial freedom.

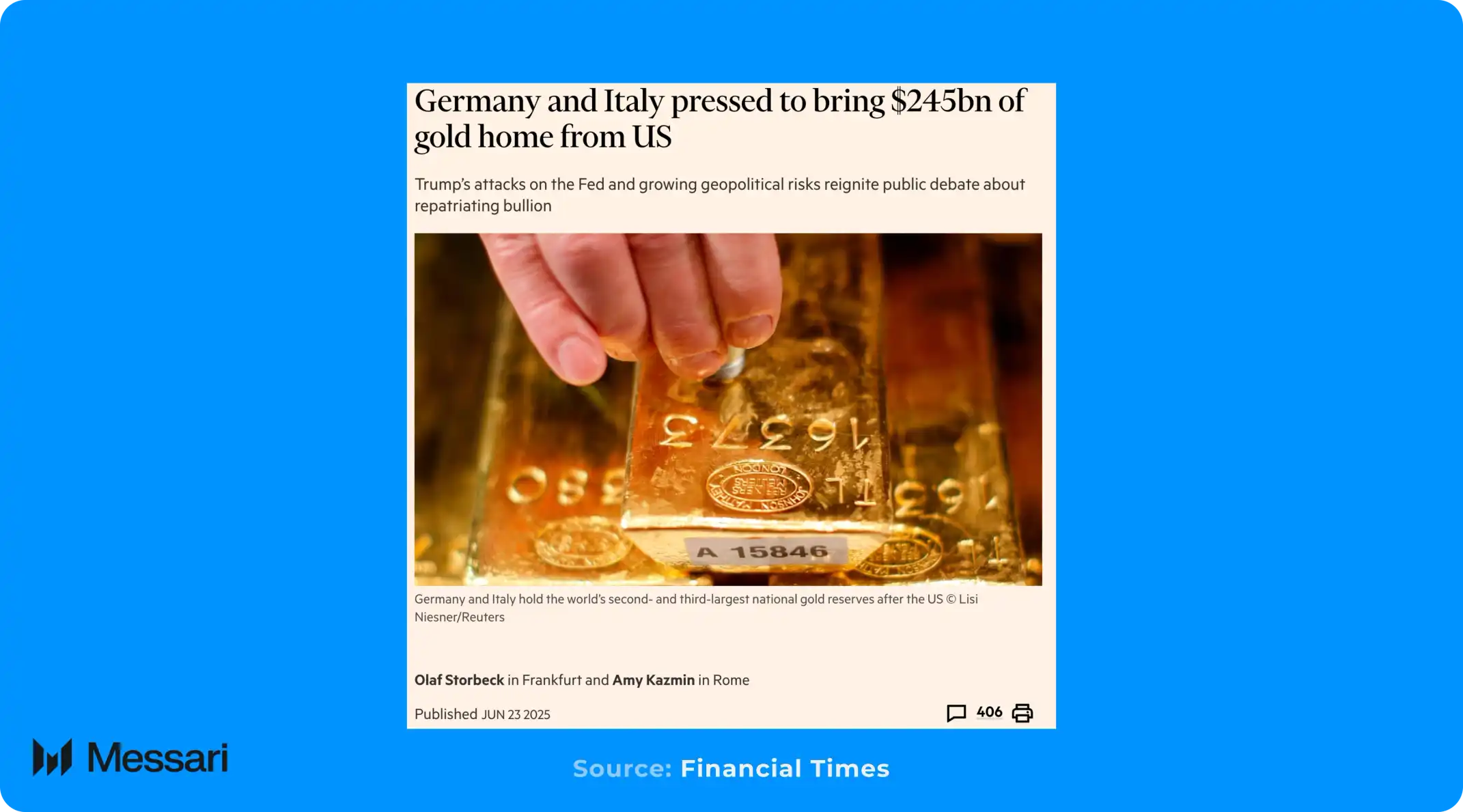

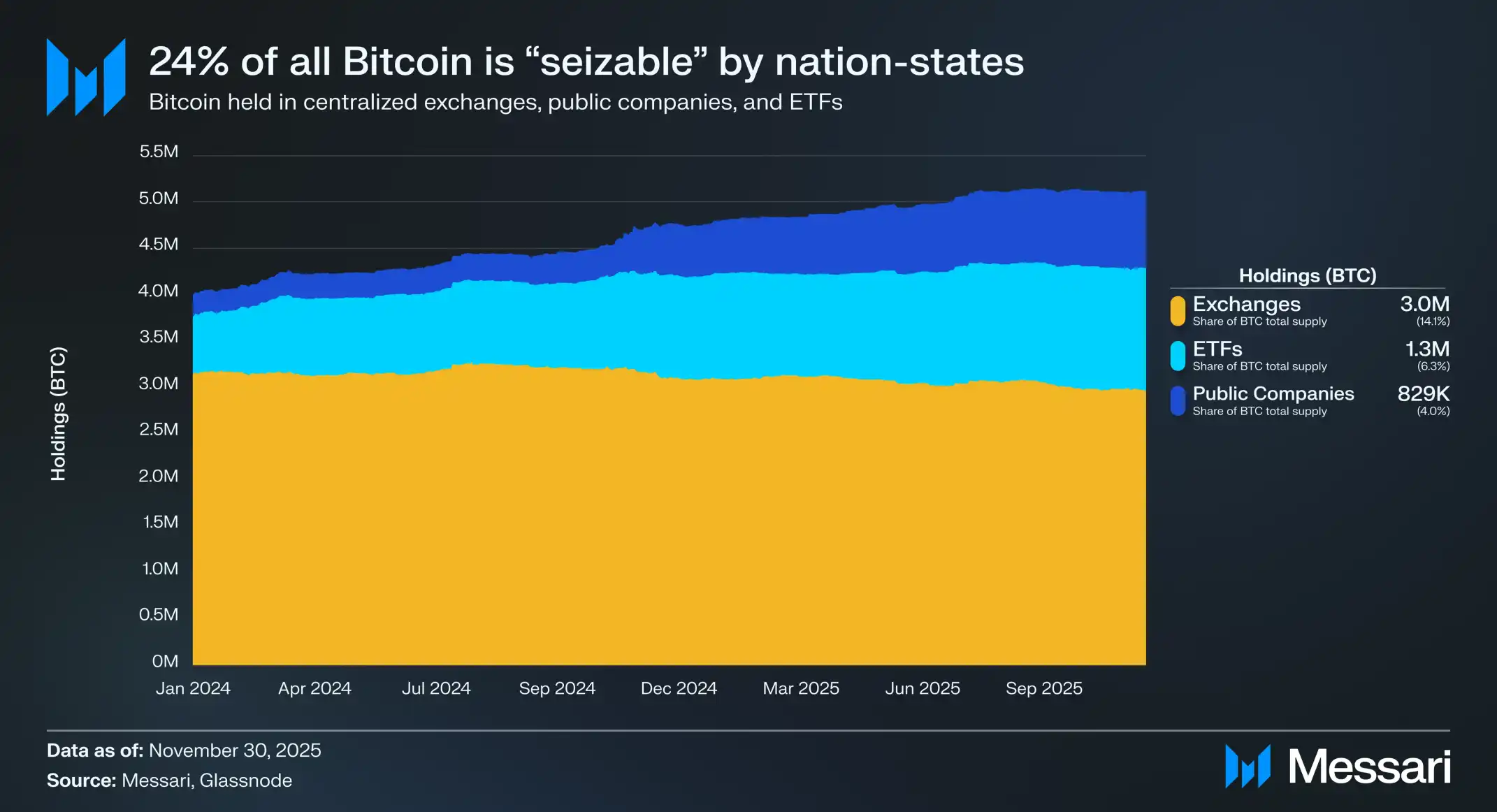

Bitcoin is rapidly centralizing around centralized entities. In total, centralized exchanges (approximately 3 million BTC), ETFs (approximately 1.3 million BTC), and publicly traded companies (829,192 BTC) collectively hold about 5.1 million BTC, accounting for approximately 24% of the total supply, currently held in custody by third parties.

This concentration means that about 24% of the total BTC supply is exposed to the risk of regulatory seizure, a situation highly reminiscent of the centralized conditions relied upon by the U.S. government during the gold confiscation in 1933. At that time, the U.S. enforced Executive Order 6102, compelling citizens to surrender gold exceeding $100 to the Federal Reserve, exchanging it for paper currency at the official price of $20.67 per gold ounce. The execution of this policy did not rely on force but was completed through "choke points" in the banking system.

For Bitcoin, the execution mechanism is almost identical. Regulators do not need to possess your private keys to seize this 24% of the supply; they only need legal jurisdiction over the custodians. In this scenario, the government merely needs to issue enforcement orders to institutions like BlackRock and Coinbase. Legally obligated to comply, these companies would be forced to freeze and hand over the BTC they hold in custody. Overnight, nearly a quarter of the Bitcoin supply could be effectively "nationalized" without the need to alter any code. While this is a fringe scenario, it cannot be entirely ruled out.

Furthermore, the transparency of the blockchain means that mere self-custody is no longer a sufficient defense. Any BTC withdrawn from KYC exchanges or brokerage accounts may face the risk of being reclaimed, as its "paper trail" can ultimately lead the government to the asset's final destination.

BTC holders can sever this custody chain by exchanging for Zcash, achieving "air-gapping" of their assets from the surveillance system. Once funds enter the shielded pool, their final receiving address will appear as a cryptographic "black hole" to external observers. Regulators can track the movement of funds leaving the Bitcoin network but cannot see their final destination, rendering these assets invisible to state actors.

Of course, reintroducing assets to the domestic banking system remains a practical bottleneck, but the assets themselves possess censorship resistance and are difficult to actively track. It is important to emphasize that the strength of this anonymity entirely depends on operational security: address reuse or acquiring assets through KYC exchanges will leave permanent associative traces before entering the shielded pool.

The Path to PMF

The demand for privacy coins has always existed; Zcash's past difficulties stemmed from its failure to meet users where they are. For years, the protocol has been plagued by high memory usage, lengthy proof times, and complex, cumbersome desktop configurations, making privacy transactions slow and full of barriers for most users.

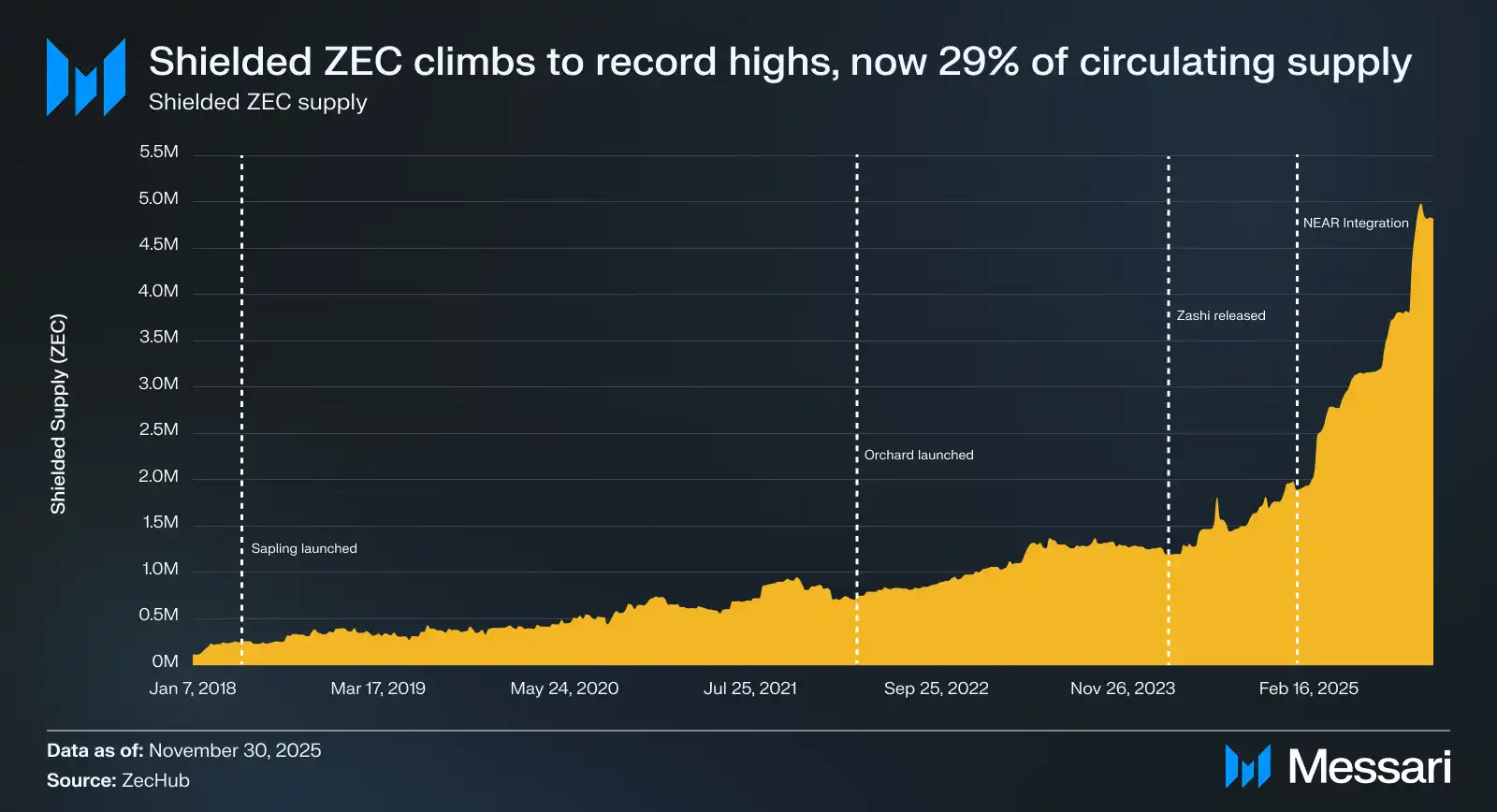

Recently, a series of breakthroughs at the infrastructure level are systematically dismantling these barriers, paving the way for user-level adoption of Zcash.

The Sapling upgrade reduced memory requirements by 97% (to about 40 MB) and shortened the generation time of zero-knowledge proofs by 81% (to about 7 seconds), paving the way for privacy transactions on mobile devices.

While Sapling achieved breakthroughs in transaction speed, the issue of trusted setup has always been a lingering concern in the privacy community. With the introduction of Halo 2, Orchard completely eliminated Zcash's reliance on trusted setup, achieving complete trustlessness in a cryptographic sense. At the same time, Orchard introduced Unified Addresses, integrating the transparent pool and the privacy pool into a single receiving address, so users no longer need to manually choose between different address types.

These architectural improvements will ultimately be reflected in the mobile wallet Zashi, launched by Electric Coin Company in March 2024. With the abstract design of Unified Addresses, Zashi simplifies the previously complex privacy transaction process into just a few clicks on the screen, making "privacy" the default user experience (UX) for the first time, rather than an additional burden.

After the UX barriers have been removed, distribution and acquisition paths remain a significant issue. Previously, users still had to rely on centralized exchanges (CEX) to deposit or withdraw ZEC to their wallets. The integration of NEAR Intents effectively removed this dependency. Through NEAR Intents, Zashi users can directly exchange supported assets like BTC and ETH for privacy-preserving ZEC, all without interacting with any CEX. Meanwhile, NEAR Intents also allows users to use privacy ZEC as a source of funds to make payments to any address on 20 blockchains using any supported asset.

These initiatives work together to enable Zcash to bypass historical friction points and directly connect with global liquidity, truly meeting the market where it is.

Looking Ahead

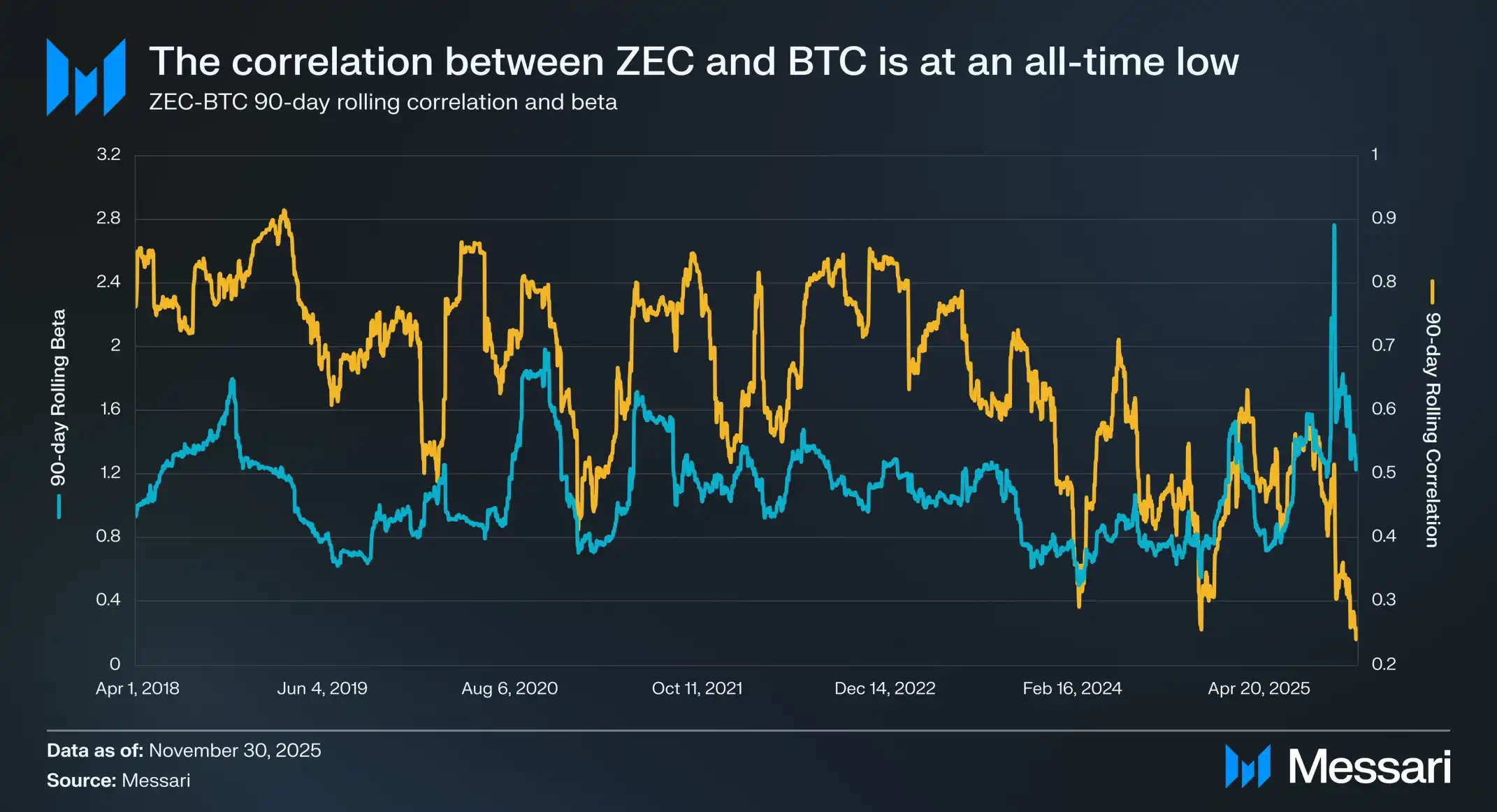

Since 2019, the rolling correlation between ZEC and BTC has shown a clear downward trend, dropping from as high as 0.90 to a recent low of 0.24. Meanwhile, the rolling beta of ZEC relative to BTC has risen to an all-time high, indicating that as the correlation between the two decreases, ZEC is actually amplifying BTC's price volatility. This divergence suggests that the market is beginning to assign an independent, unique premium to Zcash's privacy guarantees.

Looking ahead, we expect ZEC's performance to be primarily driven by this "privacy premium"—the value the market assigns to financial anonymity in the context of increasing surveillance and the growing instrumentalization of the global financial system.

We believe the likelihood of ZEC surpassing BTC is extremely low. Bitcoin has established its position as the most reliable cryptomoney due to its transparent supply mechanism and unquestionable auditability; meanwhile, Zcash, as a privacy coin, inevitably comes with its inherent trade-offs. To achieve privacy, Zcash encrypts its ledger, sacrificing auditability while introducing theoretical inflation vulnerability risks—namely, potential supply inflation in the privacy pool that may occur but is difficult to detect immediately, which is precisely the issue that Bitcoin's transparent ledger explicitly avoids.

Nevertheless, ZEC can still carve out its own niche without relying on BTC. The two do not address the same problem but correspond to different use cases within the cryptomoney ecosystem:

BTC is positioned as a robust cryptomoney emphasizing transparency and security;

ZEC is positioned as a privacy-oriented cryptomoney emphasizing confidentiality and financial privacy.

In this sense, ZEC's success does not hinge on replacing BTC but rather on complementing the attributes that BTC deliberately chooses not to provide.

2026: The Emergence of Application Money

We expect "application money" to continue accelerating its development in 2026. Application money refers to currency assets specifically designed for a particular application scenario, aiming not to serve as a universal currency like BTC or L1 tokens, but to support the economic system within a single application.

To understand why application money is becoming viable in the crypto environment, we need to return to two fundamental principles about "money":

- The value of money comes from the goods and services it can be exchanged for;

- When the cost of switching between different currency systems is high, participants will naturally converge on a common currency standard.

Historically, money emerged as a tool for storing the value created by economic activity. Since most goods and services are perishable or time-limited, money allows people to preserve purchasing power and exchange it in the future. It is important to emphasize that money itself does not inherently possess value; its value depends on what it can purchase in a specific economic environment.

As economies expand and become interconnected, multiple currency systems often follow a power-law distribution, ultimately converging into a single dominant standard. This convergence arises from the high friction costs associated with switching between different currency systems, including slow settlement, insufficient liquidity, information asymmetry, reliance on intermediaries, and the physical difficulty of transferring funds across regions. Under these conditions, the network effects of money continually reinforce the most widely accepted currency, making it increasingly inefficient to maintain an independent currency standard.

The crypto ecosystem fundamentally changes this dynamic. It significantly reduces the aforementioned frictions, making it possible for smaller, application-specific currency systems to thrive in a low-friction environment. Users can seamlessly enter and exit different currency systems without incurring high costs. As a result, applications no longer need to rely on universal currency systems but can build their own application-level currency systems, internalizing and retaining the value generated by their internal economic activities.

2025 has already provided several viable proof-of-concept examples for this application-level currency system, with the most representative cases being Virtuals and Zora.

Due to space limitations, please visit the Messari official website for the rest of the report.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。