Original Author: AJC

Original Translation: Luffy, Foresight News

Among all mainstream cryptocurrency assets, the debate surrounding Ethereum is the most intense. Bitcoin's status as a mainstream cryptocurrency is widely recognized, while Ethereum's positioning remains unresolved. Some view Ethereum as the only credible non-sovereign currency asset besides Bitcoin; others believe that Ethereum is essentially a business facing fierce competition from various public chains that offer faster transaction speeds and lower costs, with declining revenue and tightening profit margins.

This debate seemed to peak in the first half of this year. In March, the fully diluted valuation of Ripple (XRP) briefly surpassed that of Ethereum (notably, all of Ethereum's tokens are in circulation, while only about 60% of Ripple's total supply is circulating).

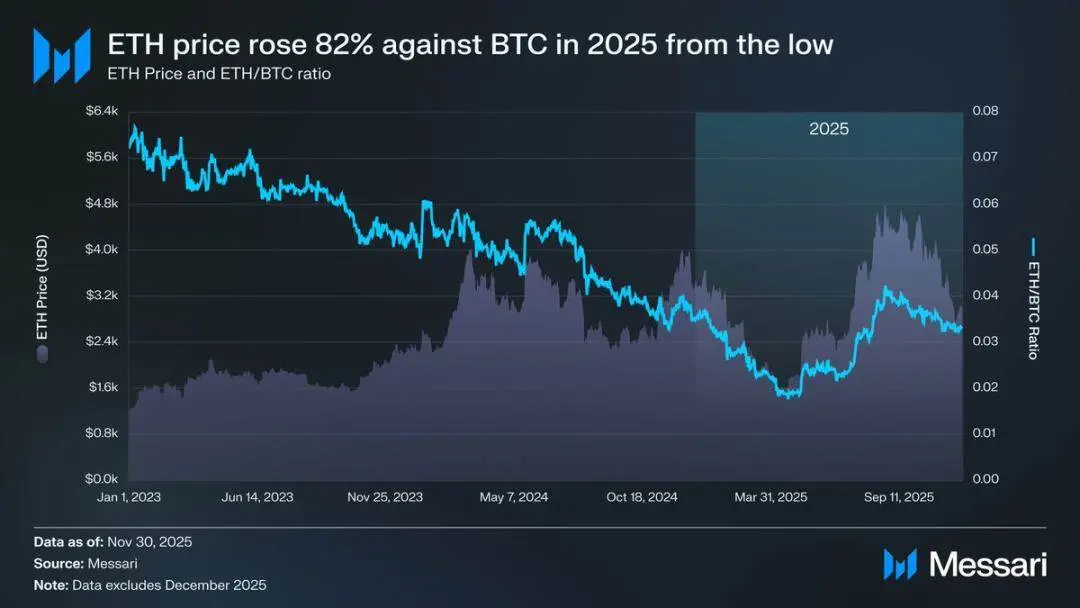

On March 16, Ethereum's fully diluted valuation was $227.65 billion, while Ripple's corresponding valuation reached $239.23 billion. This outcome was nearly unimaginable a year ago. Subsequently, on April 8, 2025, the exchange rate of Ethereum to Bitcoin (ETH/BTC) fell below 0.02, marking the lowest level since February 2020. In other words, Ethereum had completely retraced all its gains relative to Bitcoin from the previous bull market. At that time, market sentiment towards Ethereum had plummeted to a multi-year low.

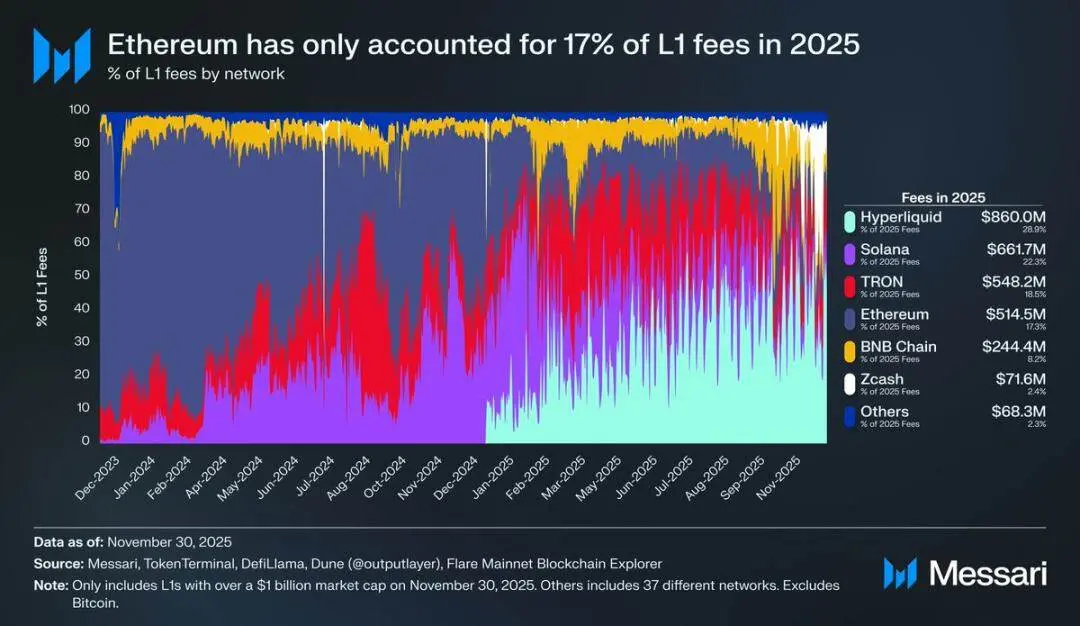

To make matters worse, the price decline was just the tip of the iceberg. With the rise of competing ecosystems, Ethereum's market share in public chain transaction fees continued to shrink. In 2024, Solana made a strong comeback; in 2025, Hyperliquid emerged as a new contender. Together, they reduced Ethereum's market share in transaction fees to 17%, ranking fourth among public chains— a stark drop from its top position a year ago. While transaction fees do not represent everything, they are a clear signal reflecting the flow of economic activity. Today, Ethereum is facing the most severe competitive landscape in its development history.

However, historical experience shows that significant reversals in the cryptocurrency market often begin at the most pessimistic moments. When Ethereum was declared a "failed asset" by outsiders, most of its apparent downturn had already been absorbed by market prices.

In May 2025, signs of excessive bearishness towards Ethereum began to emerge. During this period, both the exchange rate of Ethereum to Bitcoin and its price in USD experienced a strong rebound. The ETH/BTC exchange rate rose from a low of 0.017 in April to 0.042 in August, an increase of 139%; during the same period, Ethereum's price in USD surged from $1,646 to $4,793, a staggering increase of 191%. This upward momentum peaked on August 24, when Ethereum's price reached $4,946, setting a new all-time high. Following this revaluation, Ethereum's overall trend had clearly returned to an upward trajectory. The leadership change at the Ethereum Foundation and the emergence of a number of treasury companies focused on Ethereum injected confidence into the market.

Before this round of increase, the differing circumstances of Ethereum and Bitcoin were vividly reflected in their exchange-traded fund (ETF) markets. In July 2024, Ethereum's spot ETF was launched, but the inflow of funds was very sluggish. In the first six months after its launch, its net inflow was only $2.41 billion, in stark contrast to the record performance of Bitcoin ETFs.

However, with Ethereum's strong recovery, market concerns about its ETF fund inflows dissipated. For the entire year, the net inflow of Ethereum's spot ETF reached $9.72 billion, while Bitcoin's ETF saw $21.78 billion. Considering that Bitcoin's market capitalization is nearly five times that of Ethereum, the inflow scale of the two ETFs differs by only 2.2 times, a gap far below market expectations. In other words, when adjusted for market capitalization, the market demand for Ethereum ETFs actually exceeds that of Bitcoin. This result completely overturned the narrative that "institutions lack genuine interest in Ethereum." Moreover, during specific periods, the fund inflow into Ethereum ETFs even directly outpaced that of Bitcoin. From May 26 to August 25, the net inflow into Ethereum ETFs was $10.2 billion, surpassing the $9.79 billion of Bitcoin ETFs during the same period, marking the first clear tilt of institutional demand towards Ethereum.

From the performance of ETF issuers, BlackRock continues to lead the market. By the end of 2025, BlackRock's Ethereum ETF holdings reached 3.7 million tokens, accounting for 60% of the Ethereum spot ETF market. This represents a staggering increase of 241% compared to the 1.1 million tokens held at the end of 2024, with an annual growth rate far exceeding that of other issuers. Overall, the total holdings of Ethereum spot ETFs by the end of 2025 reached 6.2 million tokens, approximately 5% of its total token supply.

Behind Ethereum's strong rebound, the key driving force is the rise of treasury companies focused on Ethereum. These reserves have created unprecedented stable and continuous demand for Ethereum, providing support that narrative speculation or speculative funds cannot match. If Ethereum's price trend marks a clear turning point, then the continuous accumulation by treasury companies is the deep structural change that facilitated this turning point.

In 2025, Ethereum treasury companies accumulated a total of 4.8 million Ethereum tokens, accounting for 4% of its total supply, significantly impacting Ethereum's price. The standout performer was Bitmine (stock code: BMNR), led by Tom Lee. This company, originally focused on Bitcoin mining, began gradually converting its reserve funds and capital into Ethereum starting in July 2025. From July to November, Bitmine accumulated 3.63 million Ethereum tokens, maintaining a dominant position in the Ethereum treasury company market with a 75% holding ratio.

Despite Ethereum's strong rebound, the upward momentum eventually cooled. As of November 30, Ethereum's price had fallen from the August high to $2,991, even below the previous bull market's historical peak of $4,878. Compared to the low in April, Ethereum's situation has significantly improved, but this round of rebound has not completely eliminated the structural concerns that initially triggered the market's bearish outlook. On the contrary, the debate over Ethereum's positioning has returned to the public eye with even more intensity.

On one hand, Ethereum is exhibiting many characteristics similar to Bitcoin; these characteristics are key to Bitcoin's elevation as a currency asset. Now, the fund inflows into Ethereum ETFs are no longer weak, and Ethereum treasury companies have become a source of its continuous demand. Perhaps most importantly, an increasing number of market participants are beginning to differentiate Ethereum from other public chain tokens, incorporating it into the same currency framework as Bitcoin.

On the other hand, the core issues that dragged Ethereum down in the first half of this year remain unresolved. Ethereum's core fundamentals have not fully recovered: its market share in public chain transaction fees continues to be squeezed by strong competitors like Solana and Hyperliquid; the transaction activity on Ethereum's underlying network is still far below the peak levels of the previous bull market; despite a significant price rebound, Bitcoin has easily surpassed its historical high, while Ethereum still hovers below its historical peak. Even during the strongest months for Ethereum, many holders viewed this round of increase as an opportunity to cash out rather than an acknowledgment of its long-term value.

The core issue of this debate is not whether Ethereum has value, but how the asset ETH can achieve value accumulation from the development of the Ethereum network.

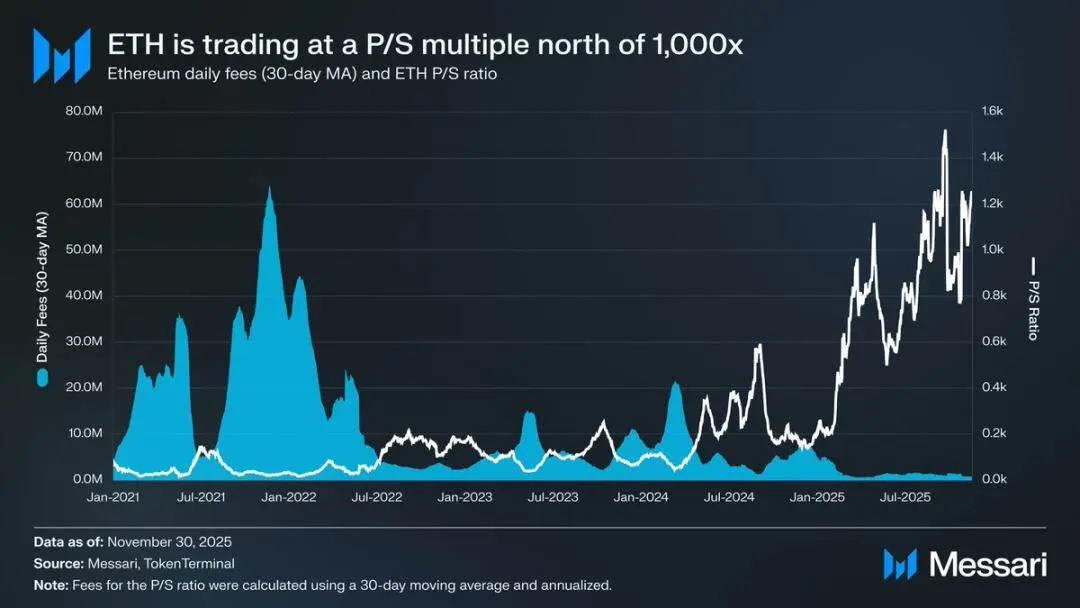

In the previous bull market, the market generally believed that the value of ETH would directly benefit from the success of the Ethereum network. This is the core logic of the "ultrasound money theory": the utility of the Ethereum network would generate significant demand for token destruction, thereby establishing a clear and mechanized value support for Ethereum assets.

Now, we can almost be certain that this logic no longer holds. Ethereum's fee income has plummeted significantly, with no hope of recovery; at the same time, the two core areas driving the growth of the Ethereum network—real-world assets (RWAs) and the institutional market—are both centered around the US dollar as the core settlement currency, rather than Ethereum.

The future value of Ethereum will depend on how it can indirectly benefit from the development of the Ethereum network. However, this indirect value accumulation carries significant uncertainty. Its premise is that as the systemic importance of the Ethereum network continues to rise, more users and capital are willing to view Ethereum as a cryptocurrency and a store of value.

Unlike direct, mechanized value accumulation, this indirect path offers no certainty. It entirely relies on social preferences and collective consensus in the market. Of course, this is not a flaw in itself; but it means that Ethereum's value growth will no longer have a necessary causal relationship with the economic activities of the Ethereum network.

All of this brings the debate surrounding Ethereum back to its core contradiction: Ethereum may indeed be gradually accumulating monetary premium, but this premium always lags behind Bitcoin. The market once again views Ethereum as a "leveraged expression" of Bitcoin's monetary attributes, rather than an independent currency asset. Throughout 2025, the 90-day rolling correlation coefficient between Ethereum and Bitcoin remained between 0.7 and 0.9, with the rolling beta coefficient soaring to multi-year highs, even exceeding 1.8 at one point. This indicates that Ethereum's price volatility far exceeds that of Bitcoin, but it also remains closely tied to Bitcoin's movements.

This is a subtle but crucial distinction. The monetary attributes that Ethereum possesses today are rooted in the market's recognition of Bitcoin's narrative as a non-sovereign store of value. As long as the market firmly believes in Bitcoin's non-sovereign value storage properties, a portion of marginal market participants will be willing to extend that trust to Ethereum. Thus, if Bitcoin continues to strengthen in 2026, Ethereum will also recover more ground accordingly.

Currently, Ethereum treasury companies are still in their early development stages, with their increased holdings of Ethereum primarily funded by common stock issuance. However, if the cryptocurrency market enters a new bull market, these institutions may explore more diversified financing strategies, such as adopting the model used by Strategy to expand Bitcoin holdings, issuing convertible bonds and preferred stocks.

For example, treasury companies like BitMine could finance themselves by issuing low-interest convertible bonds and high-yield preferred stocks, using the raised funds directly to increase their Ethereum holdings while staking these Ethereum to generate continuous income. Under reasonable assumptions, staking returns could partially offset the interest expenses on bonds and dividends on preferred stocks. This model would allow the treasury to continuously increase its Ethereum holdings using financial leverage when market conditions are favorable. If the Bitcoin market enters a full bull market in 2026, this "second growth curve" for Ethereum treasury companies will further strengthen Ethereum's high beta attribute relative to Bitcoin.

Ultimately, the market's current pricing of Ethereum's monetary premium still hinges on Bitcoin's performance. Ethereum has not yet become an autonomous currency asset supported by independent macro fundamentals; it remains a secondary beneficiary of Bitcoin's monetary consensus, and this beneficiary group is gradually expanding. Ethereum's recent strong rebound reflects that some market participants are willing to view it as a peer to Bitcoin, rather than just an ordinary public chain token. However, even in relatively strong phases, market confidence in Ethereum remains closely tied to the ongoing strength of the Bitcoin narrative.

In short, while Ethereum's monetization narrative has emerged from its fractured predicament, it is far from settled. In the current market structure, coupled with Ethereum's high beta attribute relative to Bitcoin, as long as Bitcoin's monetary narrative continues to materialize, Ethereum's price is expected to achieve significant increases; the structural demand from Ethereum treasury companies and corporate funds will provide tangible upward momentum. However, ultimately, in the foreseeable future, Ethereum's monetization process will still depend on Bitcoin. Unless Ethereum can achieve low correlation and low beta coefficients with Bitcoin over a longer period, a goal it has never accomplished, its premium space will always be overshadowed by Bitcoin's halo.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。