Author: Silvio

Translation: Saoirse, Foresight News

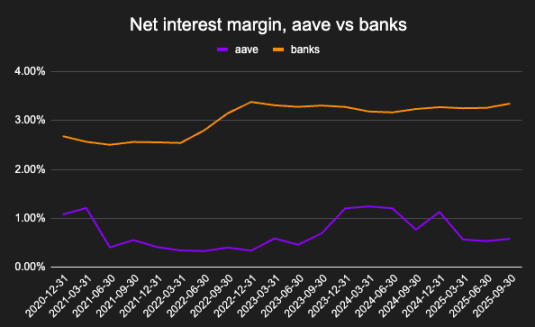

The revenue generated by $1 in bank deposits is ten times that of an equivalent amount of USDC on Aave. This phenomenon seems unfavorable for the DeFi lending sector, but in reality, it reflects more of the structural characteristics of the current cryptocurrency market rather than the long-term potential of on-chain credit.

Net interest margin is an indicator of deposit profitability. Banks under FIDC, Aave under Blockworks.

This article will explore the following questions: how current lending protocols are actually used, why their profit margins are structurally lower than those of banks, and how this situation may change as lending activities gradually detach from the crypto-native leverage cycle.

The Role of On-Chain Credit

My first job involved analyzing bank balance sheets and assessing borrower qualifications. Banks channel credit funds to real enterprises, and their profit margins are directly related to the macroeconomy. Similarly, analyzing the borrower situation in decentralized finance protocols helps understand the role of credit in the on-chain economy.

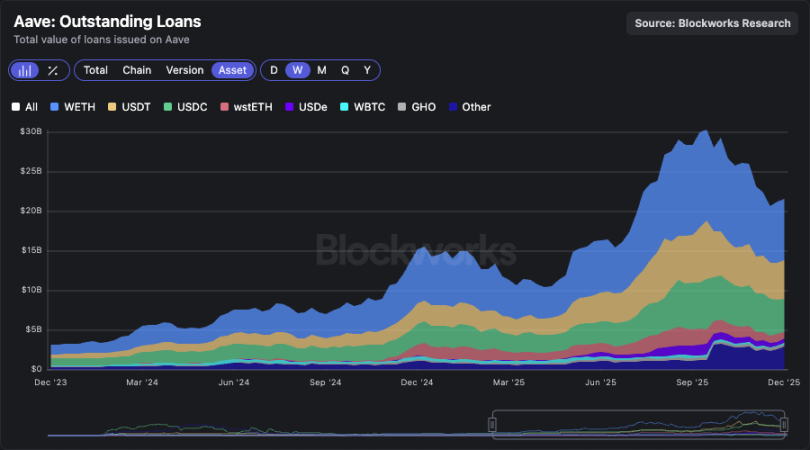

Aave outstanding loan data chart

Aave's outstanding loan amount has surpassed $20 billion, a remarkable achievement — but why do people borrow on-chain?

Actual Uses of Aave Borrowers

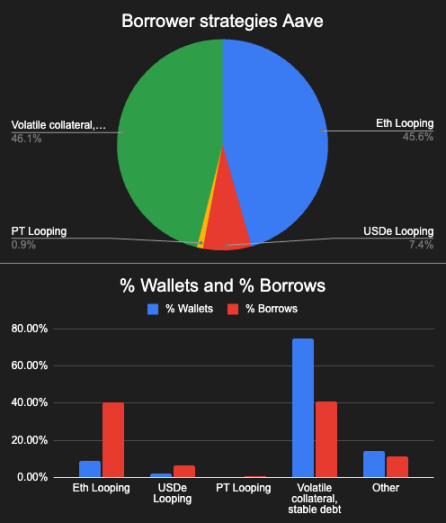

Borrower strategies can be divided into four categories:

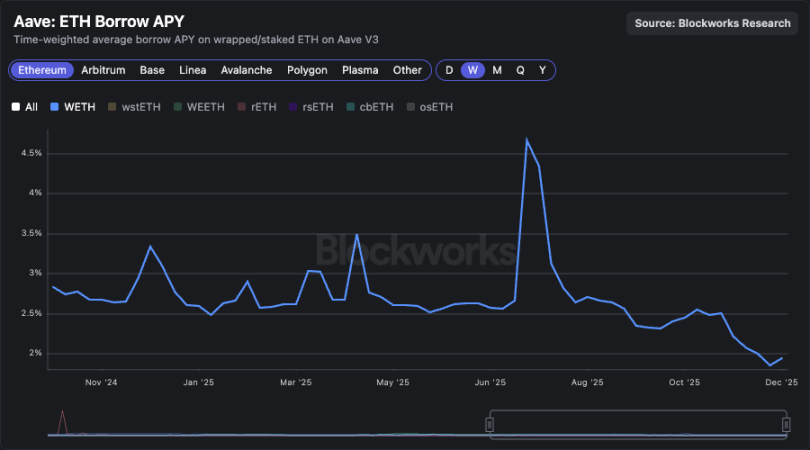

- Using interest-bearing ETH as collateral to borrow WETH: The yield from staking ETH is usually higher than that of WETH, creating a structural basis trade (essentially "borrowing WETH while still earning yield"). Currently, this type of trade accounts for 45% of the total outstanding loans, with most funds coming from a few "whales." These wallet accounts are often associated with ETH staking issuers (such as the EtherFi platform) and other "circular stakers." The risk of this strategy lies in the potential sharp rise in WETH borrowing costs, which can quickly lead to collateral health falling below the liquidation threshold.

Speculated WETH borrowing rate chart: If the rate remains below 2.5%, basis trading can be profitable.

Stablecoins and PT circular stakers: Similar basis trades can also be formed through interest-bearing assets (such as USDe), with yields potentially exceeding the borrowing costs of USDC. Before October 11, this type of holding strategy was very popular. Although structurally attractive, these strategies are highly sensitive to changes in funding rates and protocol incentive policies — which explains why the scale of such trades quickly shrinks when market conditions change.

Volatile collateral + stablecoin debt: This is the most popular strategy among users, suitable for two types of demand: one is to leverage and increase cryptocurrency holdings, and the other is to reinvest borrowed stablecoins into high-yield "liquidity mining" for basis trading. This strategy is directly related to mining yield opportunities and is a major source of stablecoin borrowing demand.

Other residual types: Including "stable collateral + volatile debt" (used for shorting assets) and "volatile collateral + volatile debt" (used for currency pair trading).

1) Aave wallet borrowing strategy weight distribution; 2) Wallet number distribution corresponding to each strategy.

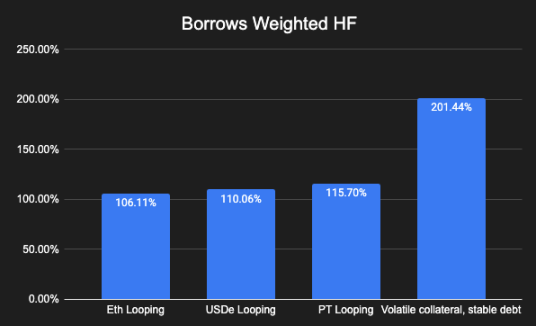

Collateral health chart weighted by borrowing amount.

For each of the above strategies, there exists a value chain composed of multiple protocols: these protocols leverage Aave to integrate trading processes and allocate profits to retail users. Today, this integration capability is the core competitive barrier in the cryptocurrency lending market.

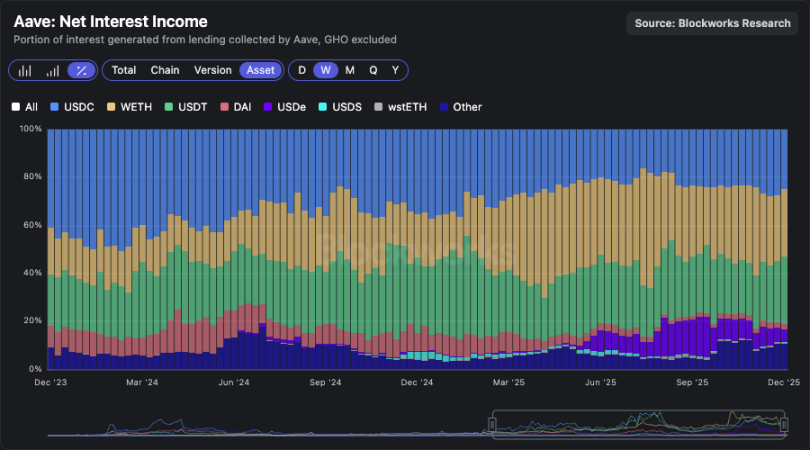

Among them, the "volatile collateral + stablecoin debt" strategy contributes the most to interest income (the borrowing yields of USDC and USDT account for over 50% of total revenue).

Interest income share chart by asset type.

While some enterprises or individuals do use cryptocurrency loans to finance business activities or real-life expenses, the scale of these actual uses is very limited compared to the use of "on-chain leverage/arbitrage of yield differences."

Three core factors driving the growth of lending protocols:

- On-chain yield opportunities: such as new project launches, liquidity mining (e.g., mining activities on the Plasma platform);

- Structurally deep liquidity basis trading: such as ETH/wstETH trading pairs and stablecoin-related trades;

- Collaborations with large issuers: such collaborations can help explore new markets (e.g., the combination of pyUSD stablecoin and RWA).

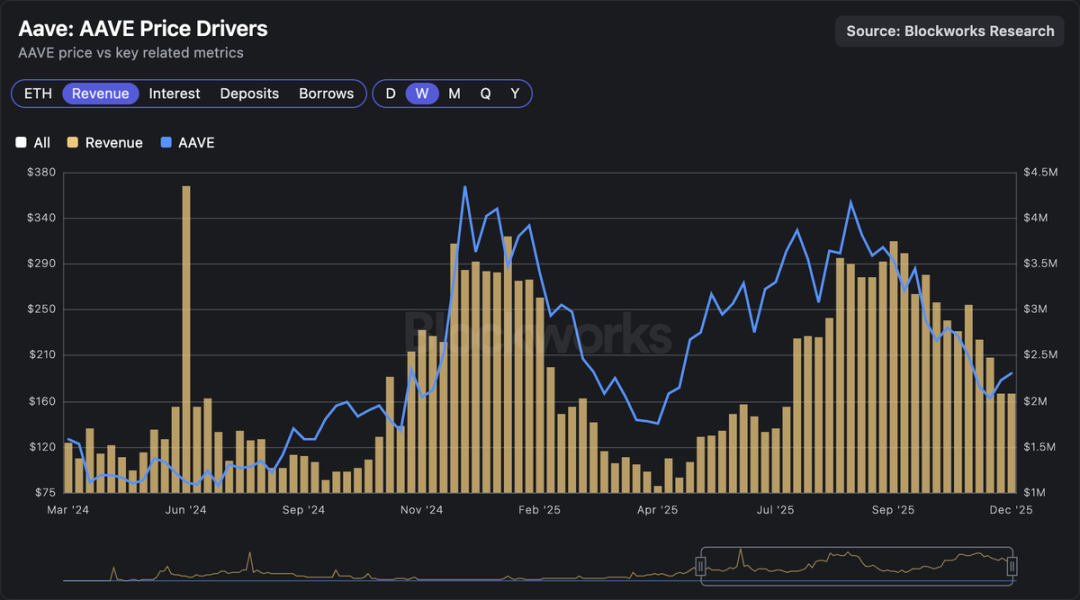

The lending market is mechanically linked to "crypto GDP" (exhibiting Beta correlation), much like banks are essentially a barometer for "real-world GDP." When cryptocurrency prices rise, yield opportunities increase, the scale of interest-bearing stablecoins expands, and issuers adopt more aggressive strategies — ultimately driving revenue growth for lending protocols, increasing token buybacks, and boosting Aave token prices.

Lending market valuation and revenue correlation chart: Lending market valuation is directly related to revenue.

Comparison Between Banks and On-Chain Lending Markets

As mentioned earlier, the revenue efficiency of $1 in banks is ten times that of $1 USDC on Aave. Some view this as a bearish signal for on-chain lending, but in my opinion, it is essentially an inevitable result of market structure, for three reasons:

- The cost of financing in the crypto space is higher: Banks' financing costs are based on the Federal Reserve's benchmark interest rate (below Treasury yield), while the deposit rate for USDC on Aave is usually slightly higher than Treasury yield;

- The risk transformation activities of traditional commercial banks are more complex and should command a higher premium: Large banks need to manage billions of dollars in unsecured loans to enterprises (e.g., financing for data center construction), and this risk management difficulty is far greater than "managing the collateral value of ETH circular staking," thus justifying higher returns;

- Regulatory environment and market dominance: The banking industry is an oligopoly with high user switching costs and industry entry barriers.

Detaching Lending from the "Cycle Binding" of Cryptocurrency

Successful cryptocurrency sectors are gradually detaching from the price cycles of the crypto market itself. For example, the open interest in prediction markets continues to grow even amid price fluctuations; the same goes for stablecoin supply, which exhibits far lower volatility than other crypto market assets.

To align more closely with the operational model of the broader credit market, lending protocols are gradually incorporating new types of risks and collateral, such as:

- Tokenized RWA and stocks;

- On-chain credit from off-chain institutions;

- Using stocks or real-world assets as collateral;

- Achieving structured underwriting through crypto-native credit scoring.

Asset tokenization creates conditions for lending activities to become the "natural endpoint" in the crypto space. When credit activities decouple from price cycles, their profit margins and valuations will also escape the constraints of cycles. I expect this transformation to begin to manifest in 2026.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。