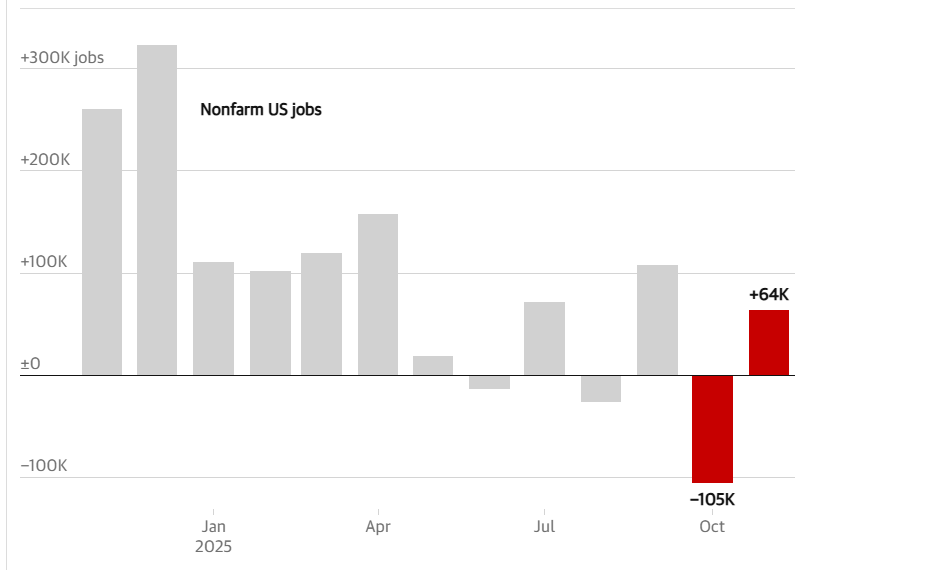

When economists submitted their predictions of unemployment for the past two months, they expected bad news, and on Tuesday, jobs data published by the Bureau of Labor Statistics (BLS) lived up to the gloomy projections. November gained 64,000 jobs, significantly more than the 50,000 experts predicted, but October saw 105,000 job losses, and now, the unemployment rate has crept up to 4.6%, its highest level in four years. Stocks were in the red, but surprisingly, bitcoin, in another counterintuitive move, climbed 2.5%.

(November gained 64,000 jobs but October lost 105,000, according to Tuesday’s jobs report. / Bureau of Labor Statistics via The Guardian)

The recent U.S. government shutdown was the longest ever, and jobs data was not collected during the 43-day impasse. BLS was forced to release November employment figures one week late, but when it finally published the numbers, partial data from October was also included. Roughly 105,000 jobs were lost in October, mostly from the federal government, which lost 162,000 jobs that month, then bled another 6,000 in November. More than 150,000 government employees accepted job buyout offers from the Trump administration, which has been focused on shrinking its 2.25 million federal government civilian workforce.

Read more: Saylor Buys Nearly $1B Worth of Bitcoin, Then It Plunges 4%

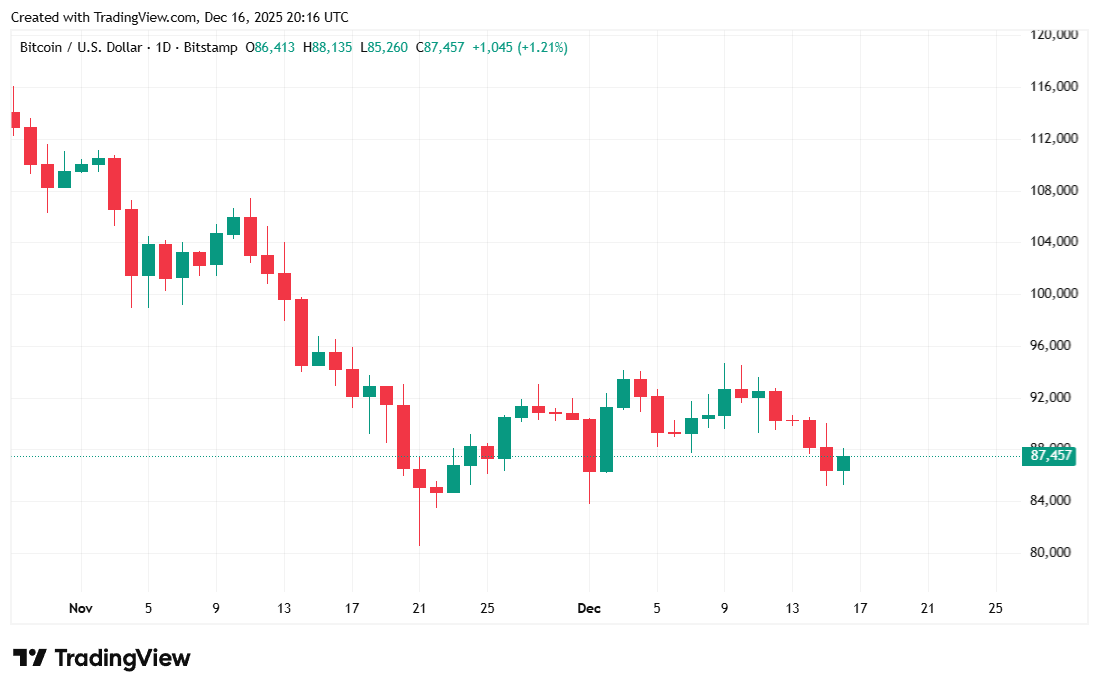

The soft employment scenario has made it increasingly challenging for the Federal Reserve to fulfill its dual mandate of maintaining stable prices and full employment. Headline inflation is already at 3% as of September, a full percentage point above the Fed’s 2% target. But raising rates may worsen the already precarious employment situation, and cutting rates further may trigger runaway inflation. In fact, the probability of a January 2026 rate reduction has now dropped to only 24%. The three major stock indices all fell, but bitcoin remained unbothered, albeit 30% lower than its October record high.

“The November jobs number supports a 25-basis point rate cut, but the data is soft and slightly inaccurate because of the 43-day shutdown,” said finance commentator and Shark Tank investor Kevin O’Leary. “Inflation is still at 3.1%, though, and that puts the Fed in a very difficult position. Every rate cut from here will be heavily scrutinized and debated, and you’re already seeing dissent inside the Fed.”

Bitcoin was priced at $87,561.91 at the time of reporting, representing a 1.8% increase since Monday, but also reflecting a 6.46% decline over the past seven days, Coinmarketcap data shows. The cryptocurrency’s price fluctuated between $85,381.69 and $88,170.10 over the last 24 hours.

( BTC price / Trading View)

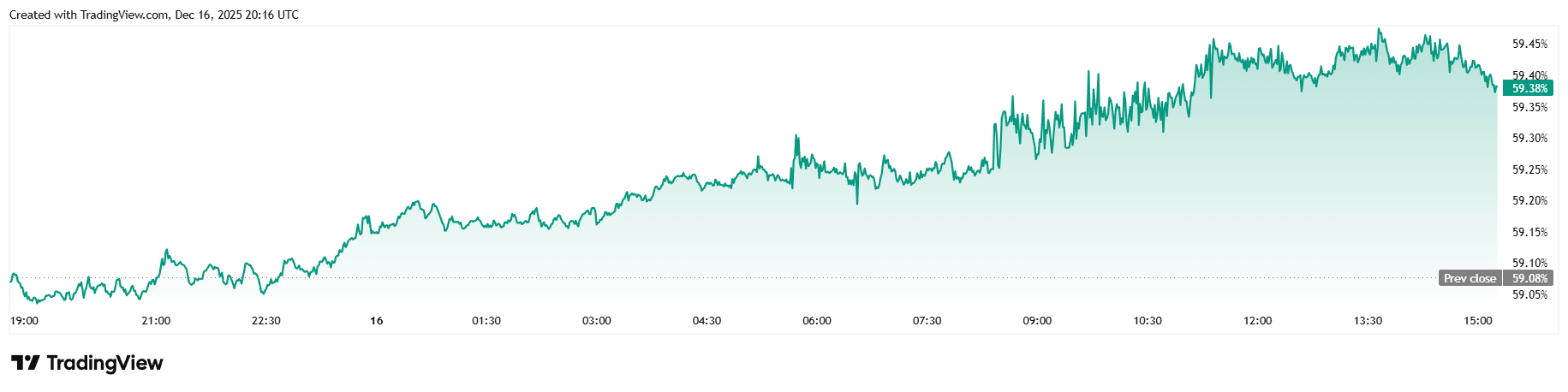

Daily trading volume inched up 3.42% to $44.93 billion and market capitalization climbed to $1.74 trillion. Bitcoin dominance rose by 0.54% to 59.39%.

( BTC dominance / Trading View)

Total bitcoin futures open interest fell 1.25% to $58.58 billion, according to Coinglass data. Liquidations saw an even more dramatic fall, decreasing sharply to $65.83 million. Short sellers lost twice as much as long traders, with total shorts seeing $41.88 million in liquidated margin while longs racked up a smaller $23.95 million in losses.

- What did the shutdown jobs report show?

The BLS reported weak labor data, with October losing about 105,000 jobs and unemployment rising to 4.6%, the highest level in four years. - Why was the jobs data delayed?

A 43-day U.S. government shutdown disrupted data collection, forcing the BLS to release November figures late and include partial October data. - How did markets react to the report?

Stocks fell sharply on the grim employment outlook, while bitcoin unexpectedly rose about 2.5%. - What does this mean for future interest rates?

Soft jobs data and sticky inflation have complicated the Fed’s outlook, pushing the odds of a January 2026 rate cut down to roughly 24%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。