Original text: Binance

Compiled & Organized by: Yuliya, PANews

On December 4, at the Binance Blockchain Week, Wall Street renowned analyst and BitMine Chairman Tom Lee delivered a keynote speech titled "The Cryptocurrency Supercycle Still Exists." He pointed out that the true golden age of cryptocurrency has just begun, providing a target price of $300,000 for Bitcoin and $20,000 for Ethereum by 2026, while elaborating on why Ethereum's value is severely underestimated and why the traditional Bitcoin "four-year cycle" is no longer applicable.

The Golden Age of Cryptocurrency is Not Over; Tokenization is This Year's Core Narrative

At the beginning of his speech, Tom Lee reviewed the investment returns of the past decade, emphasizing the astonishing growth potential of cryptocurrency.

He noted that if you had invested in the S&P 500 index in December 2016, your funds would have grown about three times; investing in gold might have quadrupled; if you were wise enough to invest in Nvidia, the return could reach 65 times. However, if you had invested in Bitcoin ten years ago, the return rate would be an astonishing 112 times. Ethereum outperformed Bitcoin, with a nearly 500 times return over the decade.

Despite the poor price performance of the crypto market from 2025 to now, this year we have witnessed many significant fundamental positive events:

- Shift in Government Attitude: The U.S. government has shown a pro-crypto stance, setting a new standard for the Western world.

- Strategic Bitcoin Reserves: Several U.S. states and the federal government have planned or executed strategic Bitcoin reserves, which is a significant advancement.

- Success of ETFs: BlackRock's Bitcoin ETF has become one of its top five products by fee income, which is unprecedented for a product that has only been launched for a year and a half.

- Entry of Traditional Finance: JPMorgan, a long-time critic of cryptocurrency, is now launching JPM Coin on Ethereum. Tokenization has become a priority for all mainstream financial institutions.

- Breakthroughs in Native Products: The crypto market has seen two to three native products that change the way traditional financial decisions are made. For example, the prediction market PolyMarket provides near "crystal ball" information; Tether has proven itself to be one of the top ten most profitable banks globally.

At the same time, Tom Lee believes that the core narrative for 2025 is tokenization. It all started with stablecoins, which represent Ethereum's "ChatGPT moment," as Wall Street suddenly realized that simply tokenizing the dollar could yield huge profits. Now, financial institutions generally believe that tokenization will transform the entire financial industry, with BlackRock CEO Larry Fink even calling it "the greatest and most exciting invention since self-reconciling accounting."

He further pointed out that the "beginning of the tokenization of all assets," as mentioned by Larry Fink, unlocks value far beyond what people imagine. Tokenization has five major advantages: fractional ownership, reduced costs, 24/7 global trading, higher transparency, and theoretically better liquidity.

This is just the basic element. Most people's understanding of tokenization is merely simple asset fragmentation, but the real revolution lies in the second approach: "factorizing" the future value of a business.

Taking Tesla as an example, we can break it down and tokenize it in multiple dimensions:

- Time Tokenization: Purchasing the net present value of Tesla's profits for a specific year (e.g., 2036).

- Product Tokenization: Purchasing the future value of specific product lines (e.g., electric vehicles, autonomous driving, Optimus robot).

- Geographic Tokenization: Purchasing future profits from specific regions, such as its market in China.

- Financial Statement Tokenization: Purchasing the tokenized portion of its subscription revenue.

- Founder Value Tokenization: It is even possible to strip out the market valuation of Elon Musk himself and trade it.

This approach will create significant value release, and BitMine is actively seeking and promoting projects in this area.

Tom Lee firmly believes that the golden age of cryptocurrency has not passed, and the future growth potential is enormous. He explained that currently, there are only 4.4 million Bitcoin wallets holding more than $10,000 globally. In contrast, there are nearly 900 million retirement accounts worldwide holding over $10,000. If all these accounts allocated Bitcoin, it would mean a 200-fold increase in adoption rate. A Bank of America survey shows that 67% of fund managers still have zero allocation to Bitcoin. Wall Street hopes to tokenize all financial products, and when including real estate, this is a market close to ten trillion dollars. Therefore, the best times for cryptocurrency are still ahead.

The Bitcoin Four-Year Cycle is Invalid; New Highs Expected in January

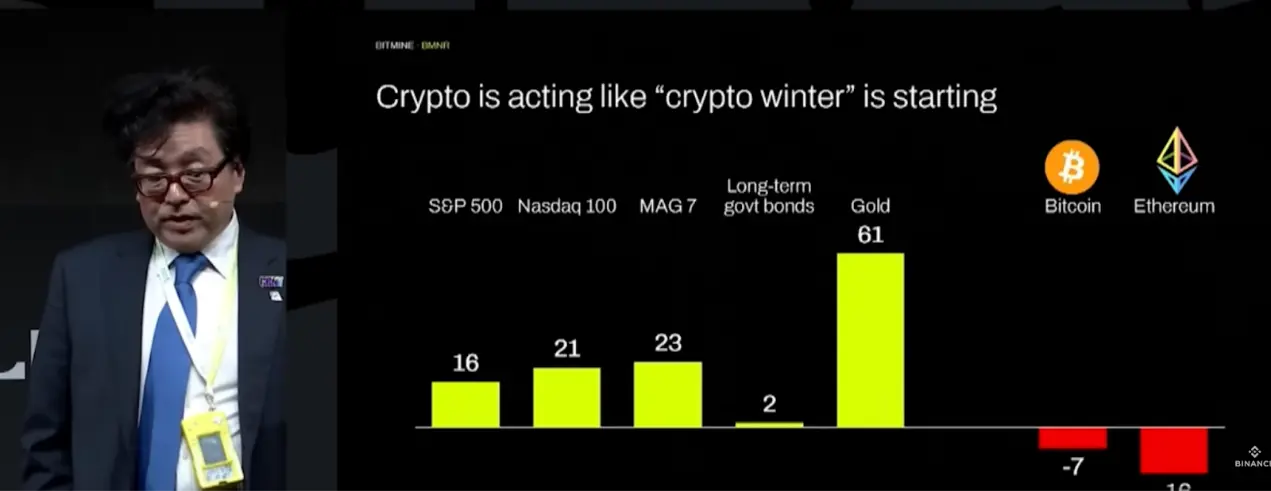

Despite being optimistic about the long-term prospects of cryptocurrency, Tom Lee admitted that the current performance of the crypto market resembles a "winter," in stark contrast to traditional assets, with gold up 61% this year, the S&P 500 index up nearly 20%, while Bitcoin and Ethereum are showing negative returns. Arca's Jeff Dorman wrote a well-titled article: "Unexplainable Sell-off."

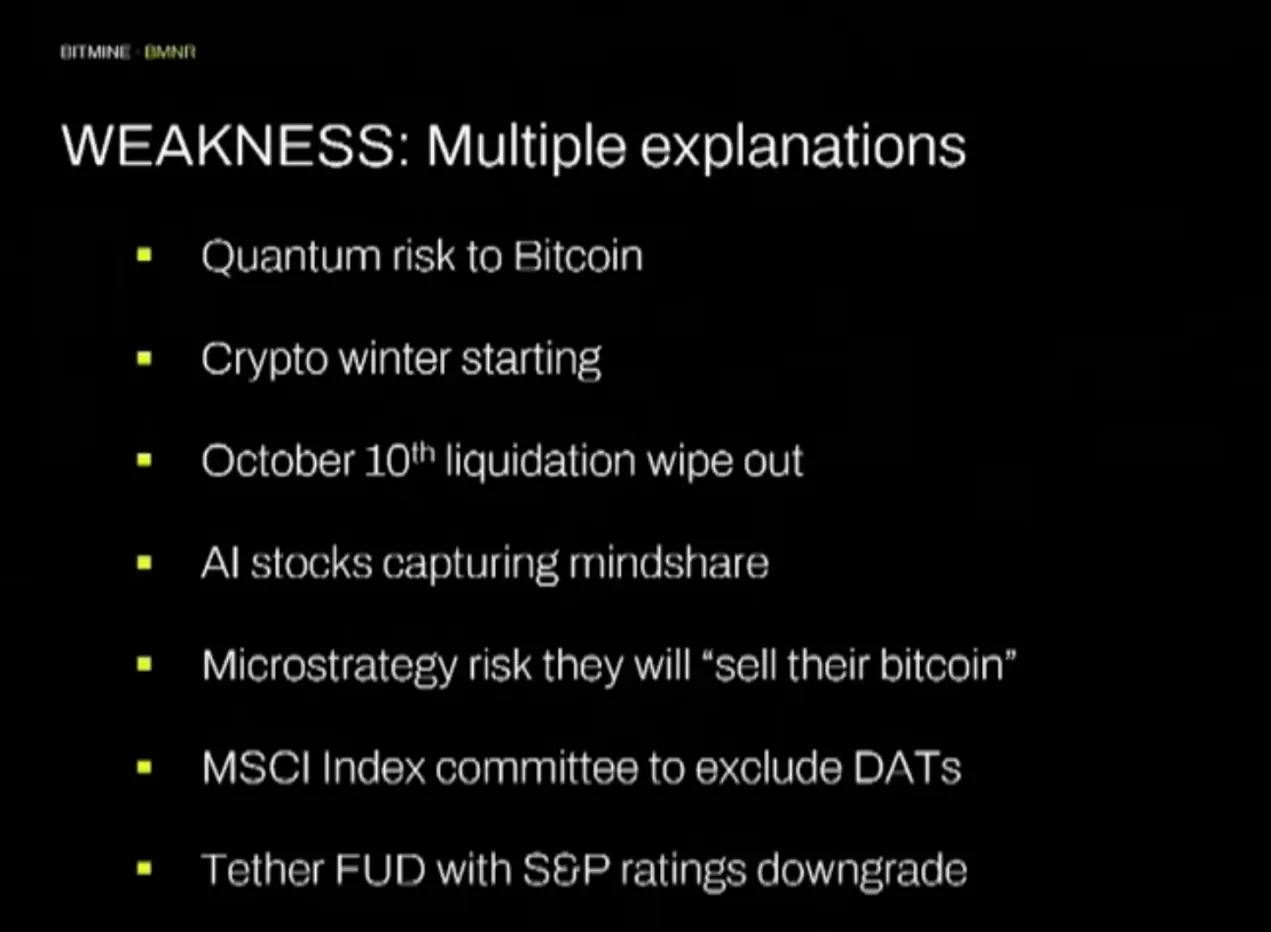

He further pointed out that the turning point for Bitcoin occurred on October 10. Before that, Bitcoin had risen 36% for the year, but then it began to decline. There are many explanations in the market: quantum computing risks, the four-year cycle theory, the historic liquidation event on October 10, AI stocks diverting attention, rumors that Strategy might sell Bitcoin, MSCI possibly excluding digital asset vault companies from the index, and Tether's rating being downgraded, among others.

However, Tom Lee believes this is closely related to deleveraging. After the FTX collapse, the market took eight weeks to restore price discovery. From the liquidation event on October 10 to now, it has been seven and a half weeks, nearing the price recovery period.

To assess the market more accurately, Tom Lee revealed that Fundstrat hired legendary market timing expert Tom DeMark, and based on his advice, significantly slowed down Ethereum purchases, reducing the weekly purchase amount by half to 50,000 coins. However, recently BitMine has resumed increasing its holdings, purchasing nearly 100,000 ETH last week, double that of the previous two weeks. This week's purchase volume is even higher, as they believe Ethereum's price has bottomed.

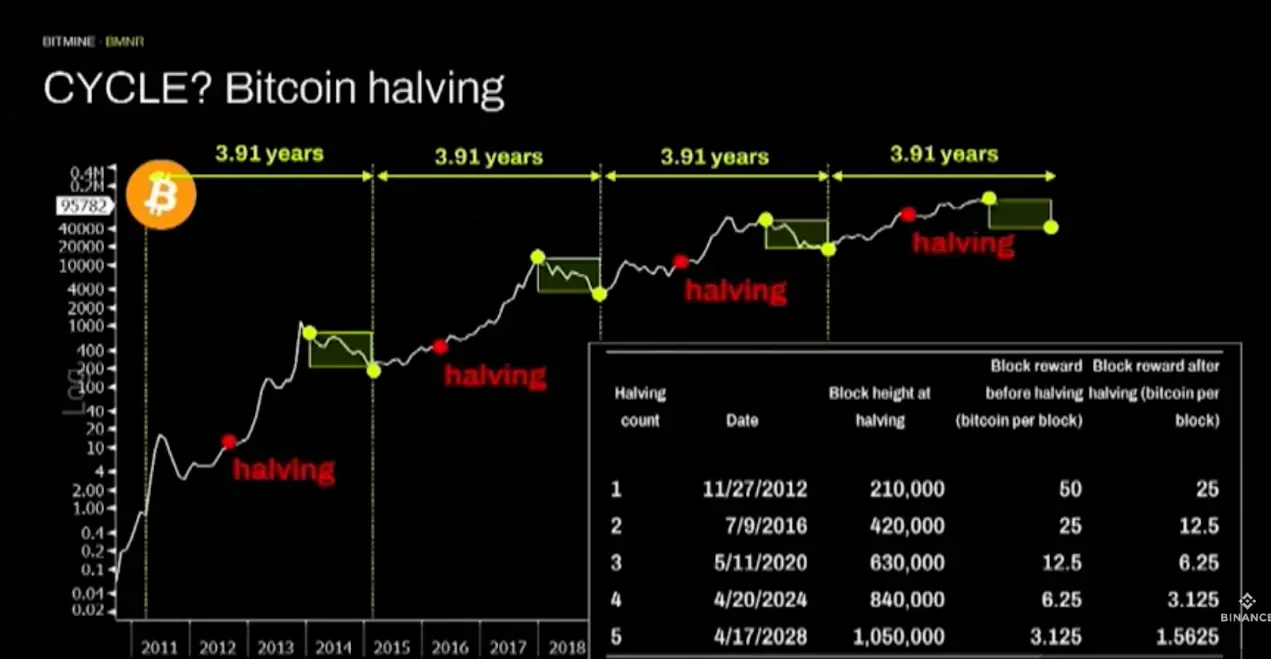

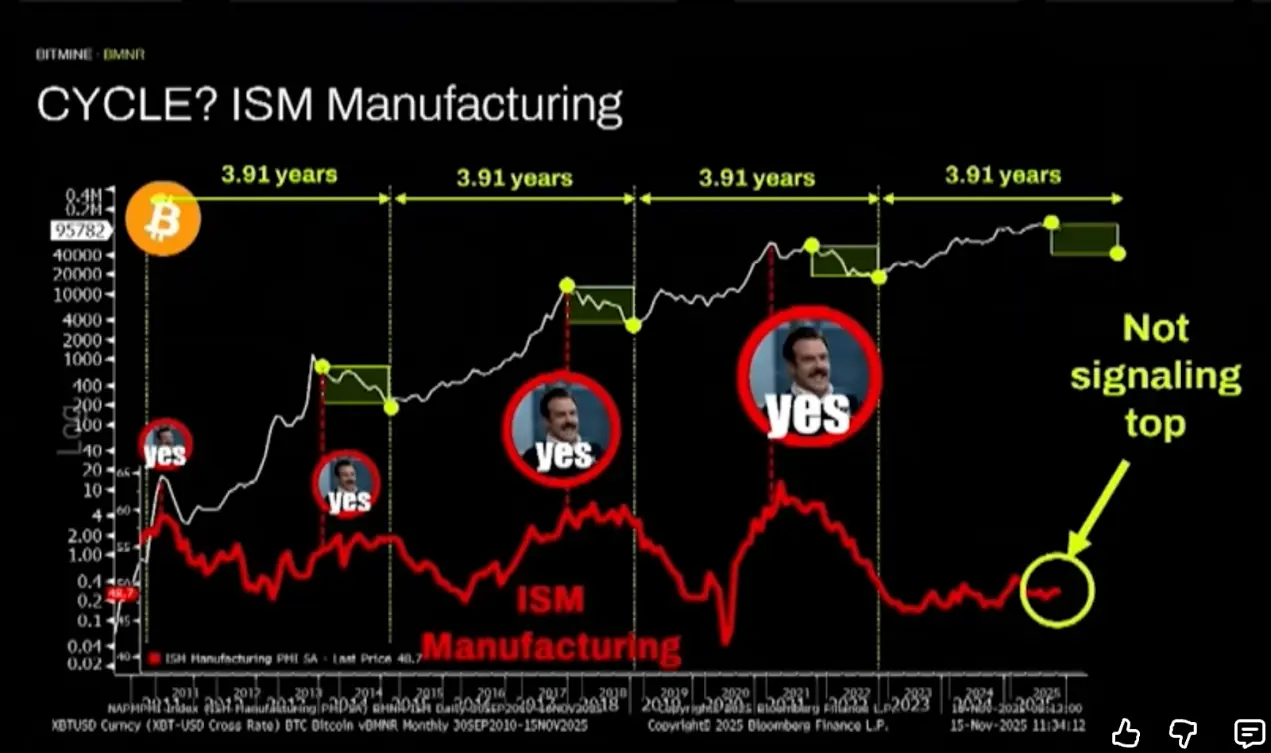

Additionally, Tom Lee discussed the "Bitcoin four-year cycle" that troubles everyone, pointing out that historically, it has accurately predicted tops and bottoms three times, with mainstream explanations usually related to halving cycles, monetary policy, etc. However, the Fundstrat team found that the "copper-gold ratio" and the "ISM manufacturing index" (i.e., traditional economic cycles) have an even stronger correlation with the Bitcoin cycle.

According to Tom Lee, in the past, the copper-gold ratio (which measures the ratio of industrial activity to the monetary base) and the ISM index both exhibited a highly correlated four-year cycle with Bitcoin prices. However, this time, neither of these indicators has followed the four-year cycle. The copper-gold ratio was expected to peak this year but did not; the ISM index has remained below 50 for nearly three and a half years without peaking.

Therefore, he believes that since the industrial cycle driving the Bitcoin cycle and the copper-gold ratio cycle have both failed, we have no reason to believe that Bitcoin itself should still follow the four-year cycle. However, he does not think Bitcoin's price has peaked and dares to bet: Bitcoin will reach a new high in January.

Ethereum is Experiencing its "1971 Moment," Severely Undervalued Core Logic

"Ethereum in 2025 is experiencing its own '1971 moment'." Tom Lee pointed out in his speech that just as Wall Street created countless financial products to maintain the dollar's reserve status back then, today, in the face of the tokenization wave of all assets such as stocks, bonds, and real estate, Ethereum has become Wall Street's preferred platform.

Tom Lee quoted early Bitcoin developer Eric Voorhees, stating that "Ethereum has won the smart contract war." He noted that almost all mainstream financial institutions are building products on Ethereum, with the vast majority of RWA tokenization products appearing on Ethereum. Under the narrative of tokenization, Ethereum's utility value is rapidly increasing. At the same time, Ethereum itself is continuously upgrading, including the recent completion of the Fusaka upgrade. From the price chart, Ethereum has begun to break out after consolidating for five years, and the ETH/BTC exchange rate is also set to break through.

Additionally, as a PoS blockchain, Tom Lee believes that treasury companies are gradually changing the traditional roles on Wall Street. These companies are essentially crypto infrastructure businesses that provide security to the network by staking Ethereum while earning staking rewards as a source of income. At the same time, treasury companies act as a bridge between traditional finance and DeFi, promoting the integration and development of both. The key to measuring the success of such companies is their stock liquidity.

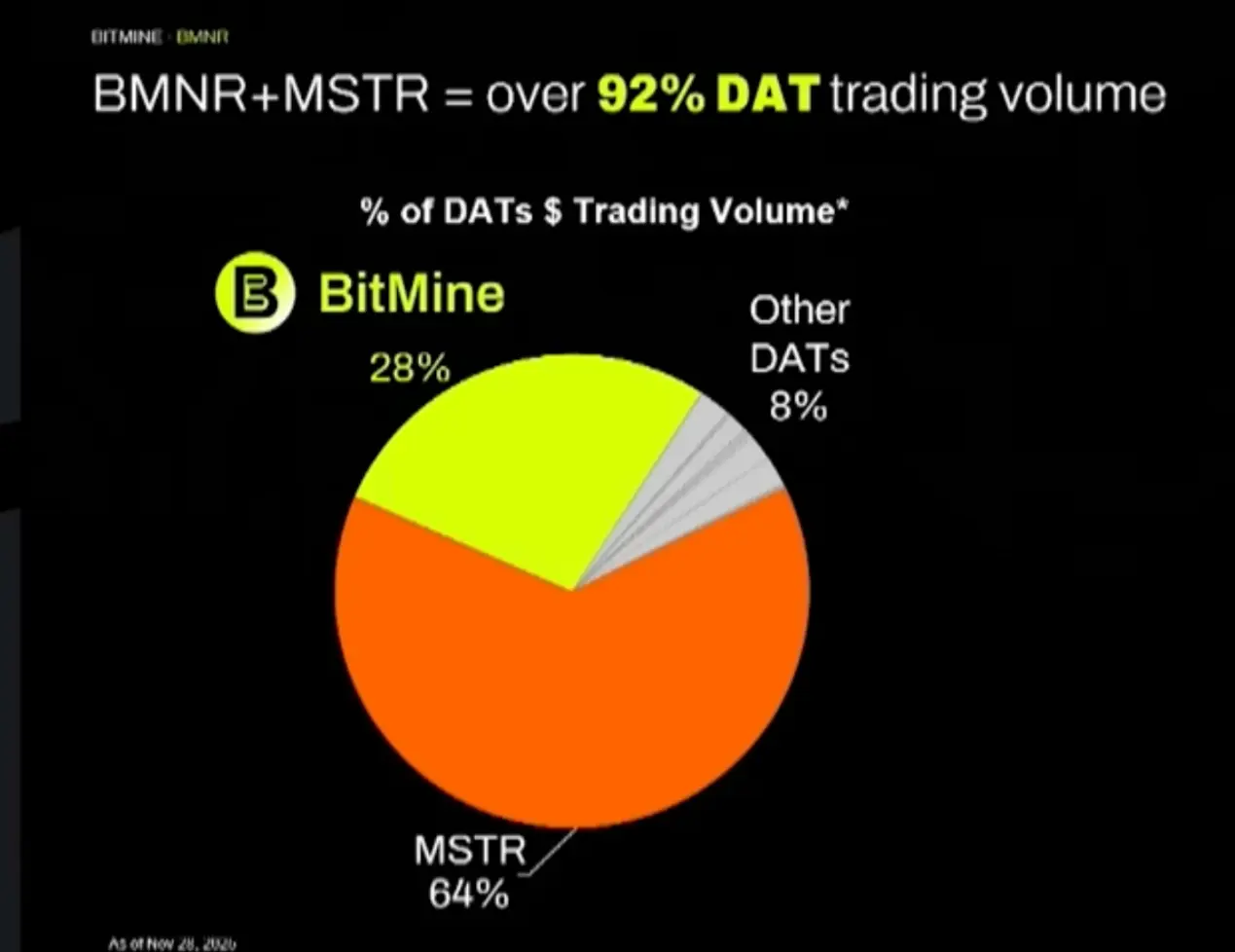

- Strategy is currently the 17th most traded stock in the U.S. stock market, with a daily trading volume of nearly $4 billion, surpassing JPMorgan.

- BitMine, established only three to four months ago, has become the 39th most traded stock in the U.S. stock market, with a daily trading volume reaching $1.5 billion. Its trading volume has exceeded that of General Electric (GE), which has a market cap 30 times larger, and is close to Salesforce, which has a market cap 20 times larger.

Currently, Strategy and BitMine account for 92% of the total trading volume of all crypto treasury companies. Strategy's strategy is to become a "digital credit tool," while BitMine's strategy is to connect Wall Street, Ethereum, and DeFi.

Based on this, Tom Lee provided the following judgments through a price prediction model:

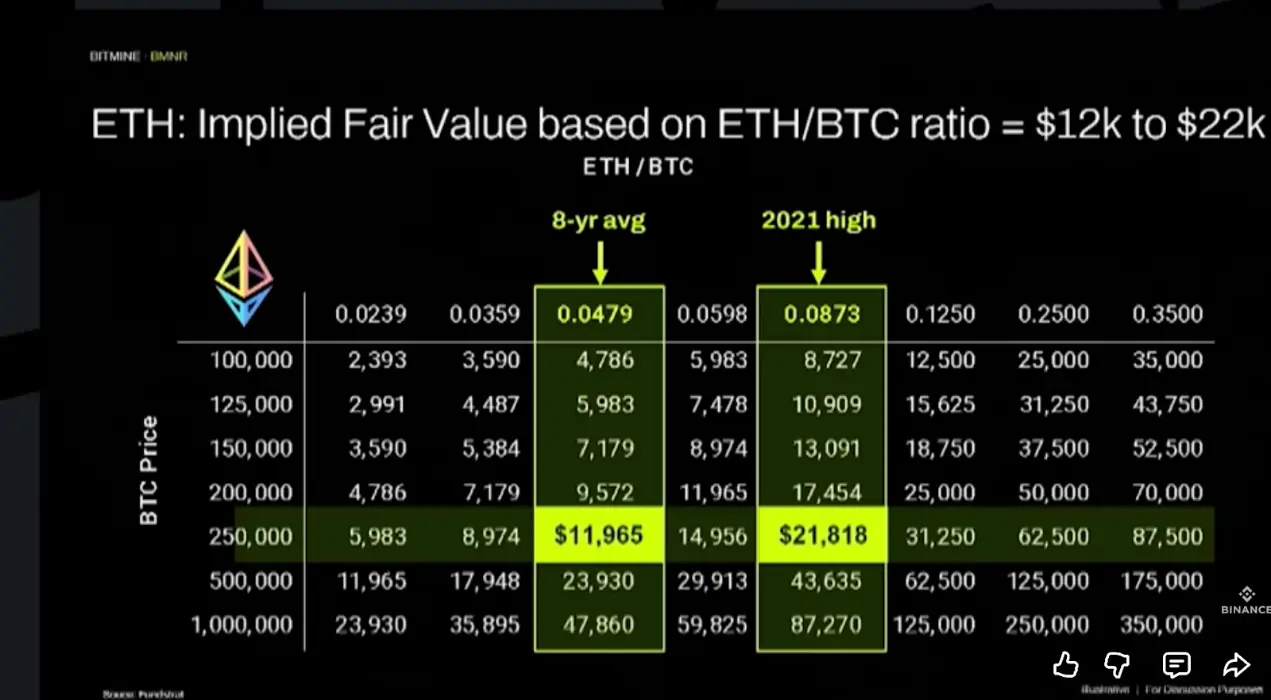

- Assuming Bitcoin reaches $250,000 in the next few months.

- If the ETH/BTC exchange rate returns to the eight-year average, the price of Ethereum will be $12,000.

- If it returns to the 2021 peak, the price will be $22,000.

- If Ethereum truly becomes the future financial payment rail, with an exchange rate of 0.25, then the price of Ethereum could reach $62,000.

Therefore, he believes that the price of Ethereum at $3,000 is severely undervalued.

Community Q&A

In the community Q&A session, Tom Lee discussed the decisive impact of the macro environment on cryptocurrency, the fundamental value of Ethereum in the era of tokenization, and BitMine's role in it, while providing his bold price predictions for the end of 2026.

Host: How do macro factors like monetary policy or regulation really affect the long-term adoption and popularity of cryptocurrency, beyond just influencing prices?

Tom Lee: Macro factors are absolutely crucial. Legendary investor Stan Druckenmiller once said that 80% of an investment's success depends on the macro environment. This means that even if you research a project thoroughly and your judgment is accurate, it only determines 20% of its success or failure.

Why is that? Because cryptocurrency does not exist in a vacuum; it is deeply influenced by the macro environment. For example:

- Regulatory Risk: This is the most direct factor; a policy can determine the life or death of a project or sector.

- Monetary Policy: Whether the Federal Reserve is loose or tight directly affects global liquidity. When liquidity is abundant, assets like gold and Bitcoin naturally find it easier to rise.

- Market Sentiment: Prices themselves drive sentiment. The price drop after October 10 caused the entire market's sentiment to collapse rapidly, with pessimism levels comparable to the deep bear market of 2018.

So, not understanding the macro environment makes it nearly impossible to succeed in the crypto world.

Host: There is a common question in the community: When financial institutions like banks use Ethereum in the future, do they really need to hold ETH? Or will they just utilize Ethereum's technology, similar to how we use the Linux system without needing to hold stock in the Linux company?

Tom Lee: That's a great question and directly touches on a core debate about Ethereum's future. Many people indeed believe that Wall Street will only see Ethereum as a free, useful technology layer (L2) and not care about the ETH token itself.

But I think this view overlooks a fundamental logic in the crypto world, which is the "fat protocol." Simply put, value is captured more at the protocol layer (like Ethereum) than at the application layer.

Let me give a more relatable example: gamers and Nvidia.

Suppose you are a top gamer, proficient in all popular games. You realize that all these cool games rely on Nvidia's graphics card support. At this point, you have two choices:

- Spend money on the games, buying various skins and items.

- Buy Nvidia stock while continuing to play games.

The outcome is obvious; those who choose the latter will become very wealthy because they are investing in the foundation of the entire gaming ecosystem.

Banks will view Ethereum similarly in the future. When they tokenize trillions of assets and place them on Ethereum, **they are essentially betting their entire fortune on this neutral blockchain. What they care about most is whether this foundation is *100%* secure, stable, and reliable.**

Historically, only Ethereum has achieved long-term 100% stable operation among mainstream public chains, and it continues to upgrade. Therefore, to ensure their interests and have a voice in the network's development, they will inevitably participate deeply—whether by staking ETH or directly holding large amounts of ETH. This is akin to how multinational banks must hold dollars. If someone says, "My business settles in dollars, but I don't care about the dollar's value," doesn't that sound absurd? Similarly, when everything operates on Ethereum, everyone will care about the performance of ETH.

Host: If financial institutions really start to adopt Ethereum on a large scale as a financial rail, what changes can we expect in Ethereum's price in the long run? Besides the obvious answer of "price increase," can you analyze it from a deeper perspective?

Tom Lee: To predict Ethereum's future price, I believe the simplest and most effective method is to benchmark it against Bitcoin. Bitcoin is the value anchor in the crypto world; if Bitcoin falls, no project can stand alone.

So, the value of Ethereum ultimately depends on its value ratio relative to Bitcoin. As Ethereum plays an increasingly core role in the financial tokenization process, its total network value should continuously align with Bitcoin. If one day, Ethereum's network value can match Bitcoin's, we will be discussing Ethereum at $200,000.

Host: Since you are so optimistic about Ethereum's long-term value and believe it will become a financial cornerstone, what role do companies like BitMine plan to play in this grand future? What are its long-term business goals?

Tom Lee: We firmly believe that Ethereum will usher in an unprecedented "supercycle." Bitcoin's success lies in its earning the title of "digital gold," becoming a recognized store of value. But the story of the next decade will be about "Wall Street asset tokenization."

A key point in this story is often overlooked: liquidity. If you tokenize an asset but no one trades it, and there is no liquidity, then it is a failed asset. Therefore, Wall Street urgently needs to find partners in the crypto world that can provide liquidity and understand both languages. The Ethereum community is technically strong but not adept at serving Wall Street; Wall Street is large but lacks native crypto understanding. BitMine aims to be the bridge connecting Wall Street and the Ethereum world.

We not only hold a large amount of Ethereum but, more importantly, leverage our macro vision and financial resources to build communication and value channels between traditional finance and DeFi. As the Ethereum ecosystem grows exponentially, as deep participants and builders, we will also reap significant rewards.

Host: You mentioned "translators" and "bridges," and you are one of Wall Street's earliest and most steadfast advocates for cryptocurrency. We are all curious about how you initially entered this field. What opportunity led you to develop such firm beliefs about it?

Tom Lee: This goes back to 2017. At that time, I founded an independent research company, Fundstrat. One day, I happened to see on TV that Bitcoin's price had risen to $1,000. I immediately recalled 2013 when it was only $70, and I had discussed it with colleagues at JPMorgan, but the mainstream view at that time was that it was merely a tool for black market transactions.

My intuition told me that nothing rises from $70 to $1,000 without reason. So, we spent an entire summer researching it. I found that while I didn't understand all the technical details, 97% of the price increase could be explained by the "network effect," which is the growth in the number and activity of wallet addresses. I instantly realized: this is a network value asset!

When I first suggested to clients to allocate Bitcoin, I faced tremendous resistance and even lost several important hedge fund clients. They thought I was crazy to recommend something with "no intrinsic value." During that time, I was filled with passion, but my business was suffering, which was very torturous.

Until I remembered my early experiences. Before becoming a strategist, I researched wireless communications. In the early 1990s, mobile phones were considered "toys for the rich," and no one thought they would become widespread; the mainstream view was that they were merely a supplement to landlines. But at that time, in my twenties, I truly felt how much convenience mobile phones brought to my social life.

At that moment, I realized a truth: only young people truly understand new technologies. The older generation tends to judge new things based on their established ways of life. So, our ability to understand cryptocurrency is not because we are smarter, but because we do not view it through outdated lenses; instead, we try to think from the perspective of young people.

So, if you have been in the crypto world for many years, congratulations, your persistence is remarkable. But at the same time, be cautious not to let your thinking become rigid. What truly matters is what young people in their twenties are doing now, what they care about. They may be more concerned about the social impact of a project; they might want to invest not in the entire Tesla company but in the specific future of "Optimus robot." This is the infinite potential future that cryptocurrency will unlock for us.

Host: Tom, you are known for your bold predictions about the market. Please give us a price prediction for Bitcoin and Ethereum! Let's set the time for the end of 2026, how about that?

Tom Lee: My core judgment is that the Bitcoin four-year cycle will be broken. I believe it will set a historical new high in early 2026. If this judgment holds, then Bitcoin's trajectory will resemble that of the U.S. stock market. I predict that the U.S. stock market will truly take off in the second half of next year.

So, my prediction is that by the end of 2026, the price of Bitcoin will be around $300,000.

If Bitcoin reaches this price, then Ethereum's performance will be phenomenal. I believe that by the end of next year, Ethereum could exceed $20,000.

Host: $300,000 for Bitcoin and $20,000 for Ethereum! We are hearing this first-hand here. Tom, we must invite you back next year to see if your predictions come true!

Tom Lee: If I'm wrong, I might not come back, haha.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。