"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis articles, but they may be hidden among the information flow and trending news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and saving from the content published in the past 7 days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment

The Economic Truth: AI Alone Supports Growth, Cryptocurrency Becomes a Political Asset

The market is no longer driven by fundamentals;

AI capital expenditure is the only pillar to avoid a technical recession; the bottleneck of AI is not GPUs, but energy;

A wave of liquidity will arrive in 2026, yet the market consensus has not even begun to price this in;

The wealth gap has become a macro resistance forcing policy adjustments;

Cryptocurrency is becoming the only asset class with real upside potential for the younger generation, giving it political significance.

2025 Crypto Prediction Review: Which of the Top Ten Institutions Understands the Market Best?

The number of predictions is negatively correlated with accuracy; the more you say, the more you are wrong.

Attempts to predict specific price points and figures generally backfire.

Predictions about policies are very reliable; the improvement of the regulatory environment and the U.S. becoming more crypto-friendly have been correctly predicted by almost all institutions and individuals.

The value of these institutions' predictions each year lies not in "telling you what to buy," but in "telling you what the industry is thinking." We can treat these predictions as indicators of industry sentiment; however, if you use them as investment guides, the results may be disastrous.

Also recommended: 《Tether's Latest Investment Landscape, Crypto Still Dominates》《CZ and Peter Schiff's Full Debate: 300 Million Users Support Not a Ponzi, But a New Generation of Financial Consensus》《Saylor's Full Speech in Dubai: Why Bitcoin Will Become the Underlying Asset of Global Digital Capital》《BitMEX Alpha: "Harvesting" U.S. Stock Perpetual Contracts' Funding Rates on Hyperliquid》。

Entrepreneurship

After the Tide Goes Out: Which Web3 Projects Are Still Making Money?

CEX + on-chain projects (PerpDex, stablecoins, public chains).

Nansen's newly launched 7-day protocol revenue data observation.

Bottom-Fishing Opportunity? In-Depth Analysis of "Real Yield" DeFi Tokens

ENA generated huge fees, but almost all fees are recycled to subsidize and maintain TVL, so the protocol's actual "surplus" is minimal.

PENDLE's fundamentals have deteriorated along with its price. As TVL plummeted to about $3.6 billion, the current sell-off is not a divergence between price and value, but a rational market response to business shrinkage.

HYPE is a massive money-printing machine, with an annual income exceeding $1.2 billion, almost all of which is used for token buybacks—but its price has already reflected winner expectations, and it is currently maintaining growth through fee reductions.

Also recommended: 《From ETH to SOL: Why L1 Will Ultimately Lose to Bitcoin?》。

CeFi

Mass Withdrawal of Crypto ETF Funds, How Are the "BlackRocks" Doing?

The decline in fund flows reflects not only investor sentiment but also directly impacts the fee income of ETF issuers. The larger the issuance scale, the worse the decline. Although issuers cannot prevent investors from redeeming shares during a sell-off, income-generating products can buffer downward risks to some extent.

Tiger Research: The Real Crisis for Strategy is in 2028

The static bankruptcy threshold for Strategy is expected to be around $23,000 in 2025, nearly double the $12,000 level of 2023.

The company will shift its financing model in 2024 from simple cash and small convertible bonds to a diversified mix of convertible bonds, preferred stocks, and ATM issuances.

The call options held by investors allow them to redeem early before expiration. If Bitcoin's price falls, investors are likely to exercise this option, making 2028 a critical risk window.

If refinancing fails in 2028, assuming Bitcoin's price is $90,000, Strategy may need to sell about 71,000 Bitcoins. This is equivalent to 20% to 30% of the daily trading volume, which would put significant pressure on the market.

The reserve fund can temporarily "stop the bleeding," but cannot change the underlying business model; the predicament did not appear suddenly, but is written into Strategy's DNA—long-term reliance on high volatility, high leverage, and high financing.

Risks do not appear suddenly, but market prices can make them seem like sudden explosions.

MSTR's Trial: Short Selling and Palace Intrigue

MSTR's stock price has significantly shrunk in the short term, plummeting over 60%, and there is even a possibility that Strategy could be removed from the MSCI stock index, more profoundly—being caught in a struggle for monetary power.

On one side of the palace intrigue is the old system: the Federal Reserve + Wall Street + commercial banks (led by JPMorgan); on the other side is the emerging new system: the Treasury + stablecoin system + a financial system collateralized by Bitcoin over the long term.

The tactics used to hunt MSTR are systematic. JPMorgan understands these game rules very well because they set the rules. As long as Wall Street tightens one of MSTR's screws, then "price collapse, debt default, premium disappearance, index strangulation" will all lead to MSTR's structure being unbalanced in a short time. Conversely, when the chain operates simultaneously, it may become one of the most explosive targets in the global capital market.

This is MSTR's charm, and also its danger.

Bitwise Chief Investment Officer: Stop Worrying, Strategy Will Not Sell Bitcoin

In the long run, MSTR's value depends on its strategic execution rather than whether index funds are forced to hold its stock. MSTR's stock price falling below net asset value will not trigger its sale of Bitcoin. Similarly, debt conversion is not a recent problem. The company has no maturing debt before 2027, and cash is sufficient to cover foreseeable interest expenses, making extreme situations impossible.

Also recommended: 《Stock Price Halved but Long-Term Capital Bets, Revealing Strategy's "Mysterious Shareholder Group"》《Nasdaq Hits the Gas: From "Drinking Soup" to "Eating Meat," Is U.S. Stock Tokenization Entering the Decisive Stage?》。

Prediction Markets

Why Prediction Markets Are Not Gambling Platforms

The price formation mechanisms of the two are different (market vs. bookmaker), there are differences in use (entertainment consumption vs. economic significance), participant structures differ (speculative gamblers vs. information arbitrageurs), and regulatory logics differ (financial derivatives vs. regional gambling industries).

Regulatory affiliation determines industry scale: the ceiling for gambling is at the state level, which means fragmented regulation, heavy tax burdens, inconsistent compliance, and institutional funds cannot participate, limiting its growth path; the ceiling for prediction markets is at the federal level. Once included in the derivatives framework, it can reuse all the infrastructure of futures and options: globally accepted, scalable, indexable, and institutionalizable. At that point, it will no longer be a "prediction tool," but a complete set of tradable event risk curves.

For capital, the underlying question is not whether prediction markets can grow; but how large they will be allowed to grow.

After the partnership, the most affected will be Polymarket and its "crypto native users," while the biggest beneficiaries will be the Solana ecosystem, and the long-term beneficiaries will be the entire prediction market sector.

Polymarket's counterattack window is only 6–9 months left.

Also recommended: 《The Future Battle of Prediction Markets: Left is a Casino, Right is News》《Facing Lawsuits from Seven States While Valued at $11 Billion: The Ice and Fire Song of Prediction Market Star Kalshi》《From Ballet Dancer, MIT Whiz to 29-Year-Old Female Billionaire, Kalshi Founder Completes Life Turnaround in 6 Years》。

Airdrop Opportunities and Interaction Guide

Interaction Tutorial: 9 High-Funding Hot Projects with Open Testnets

Ethereum

In 3 Days, Ethereum Will Welcome These Major Changes

A detailed explanation of the 9 major EIP proposals in the Fusaka upgrade, requiring a certain technical background. The core changes revolve around scalability, opcode updates, and execution security.

Also recommended: 《Trend Research: From Public Chain Infrastructure to Global Financial Ecosystem, Ethereum's Value Leap》。

Multi-Ecosystem

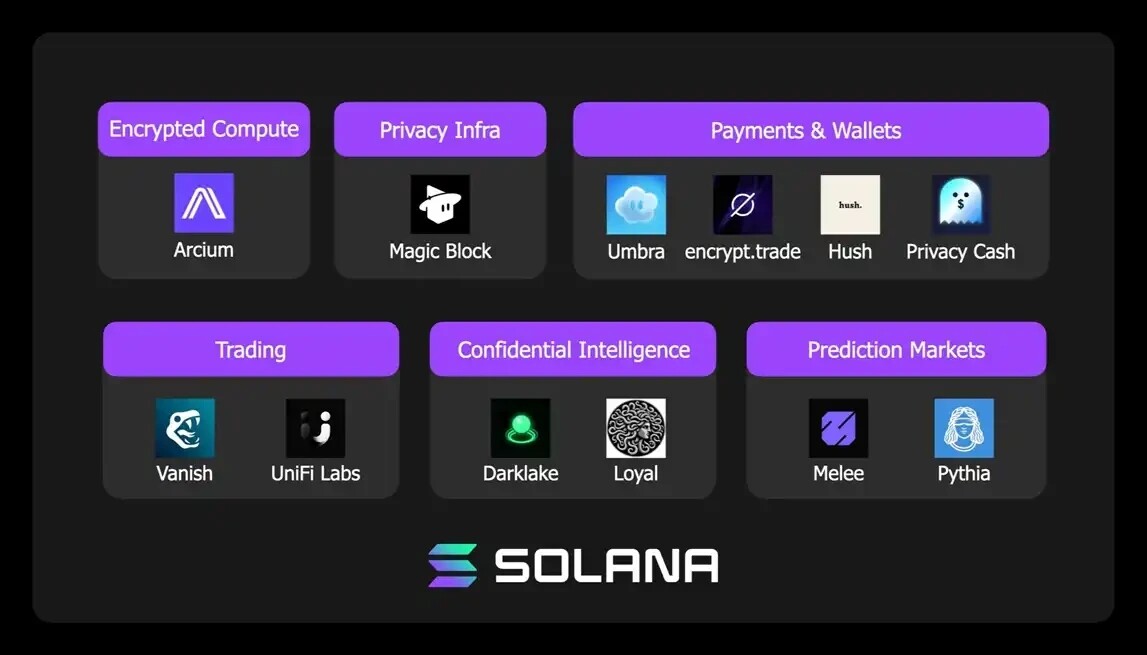

Solana Officially Names 12 New Projects Worth Watching

Security

Leading AI company Anthropic, the developer of the Claude LLM model, announced today a test utilizing AI to autonomously attack smart contracts.

The final test result: Profitable, realistically reusable AI autonomous attacks are technically feasible.

Weekly Hotspot Recap

In the past week, the market dipped again before bouncing back; the central bank held a meeting to combat virtual currency trading speculation, emphasizing stablecoin risks; HashKey Holdings passed the Hong Kong Stock Exchange hearing, officially starting the process for listing in Hong Kong (Interpretation); Ethereum completed the Fusaka upgrade, officially entering a rhythm of hard forks twice a year; SEC Chairman: The cryptocurrency company innovation exemption will take effect in January 2026;

In addition, regarding policies and the macro market, U.S. SEC Chairman: The Cryptocurrency Market Structure Bill is about to pass; Bank of America allows wealth advisors to recommend clients allocate up to 4% of assets in Bitcoin; the UK government will implement new crypto tax regulations starting January 2026, strictly investigating tax evasion; Japan's 20-Year Government Bond Yield Rose by 5.5 Basis Points to 2.88%, the highest level since June 1999; Japan's Interest Rate Anomalies Trigger Global Rebalancing; The Japanese government plans to unify the crypto asset income tax to 20%, with the earliest submission to Congress in 2026;

In terms of opinions and statements, Delphi Digital: The Federal Reserve's liquidity buffer has been exhausted, a key resistance in the crypto market may be fading; Grayscale predicts Bitcoin will reach a new high in 2026, denying the four-year cycle theory; Opinion: Institutional Waves Are Flowing into the Bitcoin Retail Market, with strong growth expected in 2026; WSJ: Investors are worried about a new round of crypto winter approaching, with predictions that Bitcoin's price may drop to $60,000; "Big Short" Michael Burry: Bitcoin is "the Tulip Bulb of Our Time", $100,000 Bitcoin is absurd; Arca's Chief Investment Officer: This is the strangest round of sell-offs in history, native investors are exhausted, and new funds have not been able to enter; Peter Schiff comments on Strategy's launch of a dividend reserve fund: Today marks the beginning of MSTR's doomsday; Strategy CEO: $14 billion in reserves can alleviate selling pressure, and in the future, may consider launching BTC lending services; Strategy CEO: Only when the stock price falls below net asset value and cannot obtain new funds will they consider selling Bitcoin; Michael Saylor publicly disclosed Strategy's financial data, claiming the capital structure is extremely healthy; Nasdaq executives: are fully promoting the stock tokenization plan, with SEC approval listed as the highest priority; He Yi: Taking care of retail investors' interests as much as possible is Binance's fundamental base (first interview after becoming co-CEO of Binance); Arthur Hayes disses Monad, warning that USDT may be insolvent; Alliance DAO co-founder: The fee/revenue ratio is an objective indicator for assessing L1's moat;

In terms of institutions, large companies, and leading projects, Vanguard will open trading for cryptocurrency-related funds including Bitcoin, Solana, and XRP; Binance co-founder He Yi has been appointed co-CEO, with registered users nearing 300 million; Polymarket has launched a U.S. version of its app; the prediction platform predict.fun, incubated by YZi Labs, will soon launch on BNB Chain; CNBC announced the integration of Kalshi prediction market data into its television, digital, and subscription platforms; Sony may launch a dollar stablecoin for payments in gaming and anime ecosystems; Uniswap: has supported Revolut in purchasing cryptocurrencies; Stable has launched its token economic model, with the ecosystem and community accounting for 40% of the total supply; Sahara AI: no unlocking or security incidents have occurred, and an investigation into market anomalies is ongoing; the prediction market platform Kalshi is facing a class-action lawsuit for allegedly conducting sports betting operations without a license; Rayls has announced its token economics; Rayls has launched airdrop claims;

In terms of data, F2Pool: most older Bitcoin mining machines have fallen below the shutdown price;

In terms of security, Huibang Payment has only 990,000 USDT left on-chain and has stopped user withdrawals; Yearn: the yETH pool suffered a complex attack, resulting in a loss of approximately $8.9 million… well, it has been another tumultuous week.

Attached is the Weekly Editor's Picks series.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。