Under the dual pressure of the continuous halving of Bitcoin block rewards and the network fees plunging to a freezing point, this decentralized network that has been running for 15 years is undergoing its most severe test of security budget.

The fees on the Bitcoin network were once almost negligible, but during the Ordinals and Runes craze from 2024 to early 2025, fees accounted for a significant portion of miner income, creating a peculiar "double subsidy" landscape. However, as these trends have faded, the balance between fees and subsidies has tilted once again.

The generation of each block is both a process of security verification and an economic calculation. When the subsidy of BTC is halved and the fees in BTC do not increase correspondingly, this calculation begins to appear precarious.

1. Current State of Security Budget

● The concept of Bitcoin's "security budget" essentially refers to the economic cost that the network must pay to maintain its immutability and decentralization. This cost is directly reflected in miner income, with a simple yet brutal calculation formula:

Miner Income = Block Subsidy + Transaction Fees.

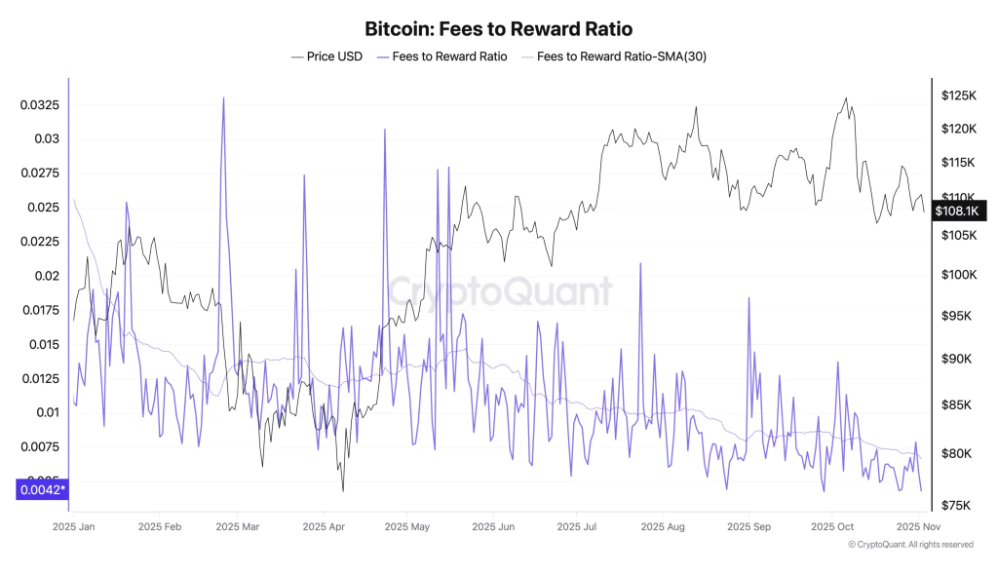

● Real-world data presents a dramatically asymmetric picture. According to the current network state, each new block generates a fixed subsidy of 3.125 BTC, while transaction fees fluctuate only in the 0.02-0.05 BTC range. This means that the proportion of fees in miners' total income has long been below 1%.

● More alarmingly, the value of Bitcoin's security budget is also experiencing severe fluctuations. In 2025, Bitcoin prices saw a significant drop during certain periods, leading to a compression of total miner income in USD terms, even with the network's hash rate remaining high.

This volatility creates greater uncertainty for miners, especially against the backdrop of continuously rising mining difficulty.

2. Structural Changes

● The deterministic nature of halving events poses a fundamental challenge to Bitcoin's security model. This mechanism is a core design of Bitcoin's monetary policy, halving the block subsidy approximately every four years until it ultimately approaches zero.

● To date, Bitcoin has undergone four halving events, reducing the subsidy from the initial 50 BTC to the current 3.125 BTC. Meanwhile, the computational power of the Bitcoin network continues to reach new highs. By 2025, the total network hash rate has surpassed 1100 EH/s (1100 quintillion hashes per second), with the difficulty adjustment mechanism also moving upward.

● This means that the rewards per unit of computational power are continuously diluted, and only those miners who can secure extremely low electricity prices and operate the latest ASIC mining machines can maintain profitability. As older generation mining machines are gradually phased out, small and medium-sized miners are exiting the market due to cost pressures, leading to a capital-intensive centralization of Bitcoin's hash rate distribution.

3. Challenges to the Security Model

● The security of Bitcoin is based on the economic principle that the cost of an attack exceeds the potential rewards. If miner income continues to decline, it may give rise to a negative feedback loop known as a "death spiral":

Price drop → Miner income decreases → Hash rate exits → Network security declines → Market concerns intensify → Price drops further.

● Although the Bitcoin network still maintains an impressive scale of hash power, the trend towards centralization is quietly altering its security foundation. Research from Cambridge University indicates that the Bitcoin mining industry is rapidly transitioning to industrial-scale operations.

● Between August and September 2025, the number of active miners plummeted by about 8,000. This change will not immediately weaken network security, but in the long run, it will slowly alter the network's game structure and decentralization characteristics.

4. Market and Ecology

The structural changes in on-chain activities of Bitcoin directly affect fee income. The Ordinals and Runes protocols, which surged in popularity in 2024, quickly cooled down as they entered 2025.

● A report from Galaxy Digital shows that these data-intensive transactions once accounted for over 60% of daily trading volume at their peak, but by August 2025, this proportion had sharply dropped to around 20%.

● Meanwhile, the explosive growth of Bitcoin ETFs is pushing a large amount of trading activity off-chain. When investors buy and sell Bitcoin ETFs through traditional financial institutions, the actual asset transfer occurs between the issuer and the custodian, usually completed through batch processing or over-the-counter trading.

● Currently, the Bitcoin held by U.S. spot Bitcoin ETFs has exceeded 1.3 million coins, accounting for a significant proportion of the circulating total, but most of these assets remain in a "static" state.

The high concentration of Bitcoin use cases also limits the potential for fee growth. Current network activities primarily revolve around "value transfer," rather than the large-scale on-chain financial applications, asset issuance, and complex contracts commonly seen on platforms like Ethereum.

5. Future Pathways

In the face of security budget challenges, the Bitcoin community is exploring solutions in multiple directions.

● The development of Bitcoin finance (BTCfi) is considered one of the key breakthroughs. Unlike DeFi on Ethereum, BTCfi emphasizes using native Bitcoin as the underlying asset to build financial applications on layer two protocols that interact directly with it.

● Every BTCfi operation requires the transfer of Bitcoin, which will directly drive on-chain computation, occupy block space, and generate fees. Currently, over $7 billion worth of Bitcoin has been earned on-chain through various protocols.

● Technical protocol upgrades are also under ongoing discussion. The upcoming v30 version of Bitcoin Core plans to relax the size limits on OP_RETURN outputs, providing space for more complex on-chain data applications.

● More fundamental solutions, such as introducing opcodes like OPCAT or OPCTV to enable more complex smart contract functionalities, and the "big consensus cleanup" soft fork to fix potential vulnerabilities, are still under research and debate.

As the proportion of fees in miner income has dropped from 1.35% at the beginning of this year to the current 0.78%, this seemingly small percentage change reflects a profound evolution in Bitcoin's security model.

Every halving forces ecological evolution, and every bear market filters out true believers. When the last Bitcoin is mined, what supports this network will no longer be new coin subsidies, but the global collective valuation of the "immutable settlement layer."

Contrary to the concerns of many, the most significant innovations in Bitcoin's history often emerge during the moments of greatest security pressure. Perhaps today's freezing fees and halving pressures are the necessary prelude to the next round of evolution.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。