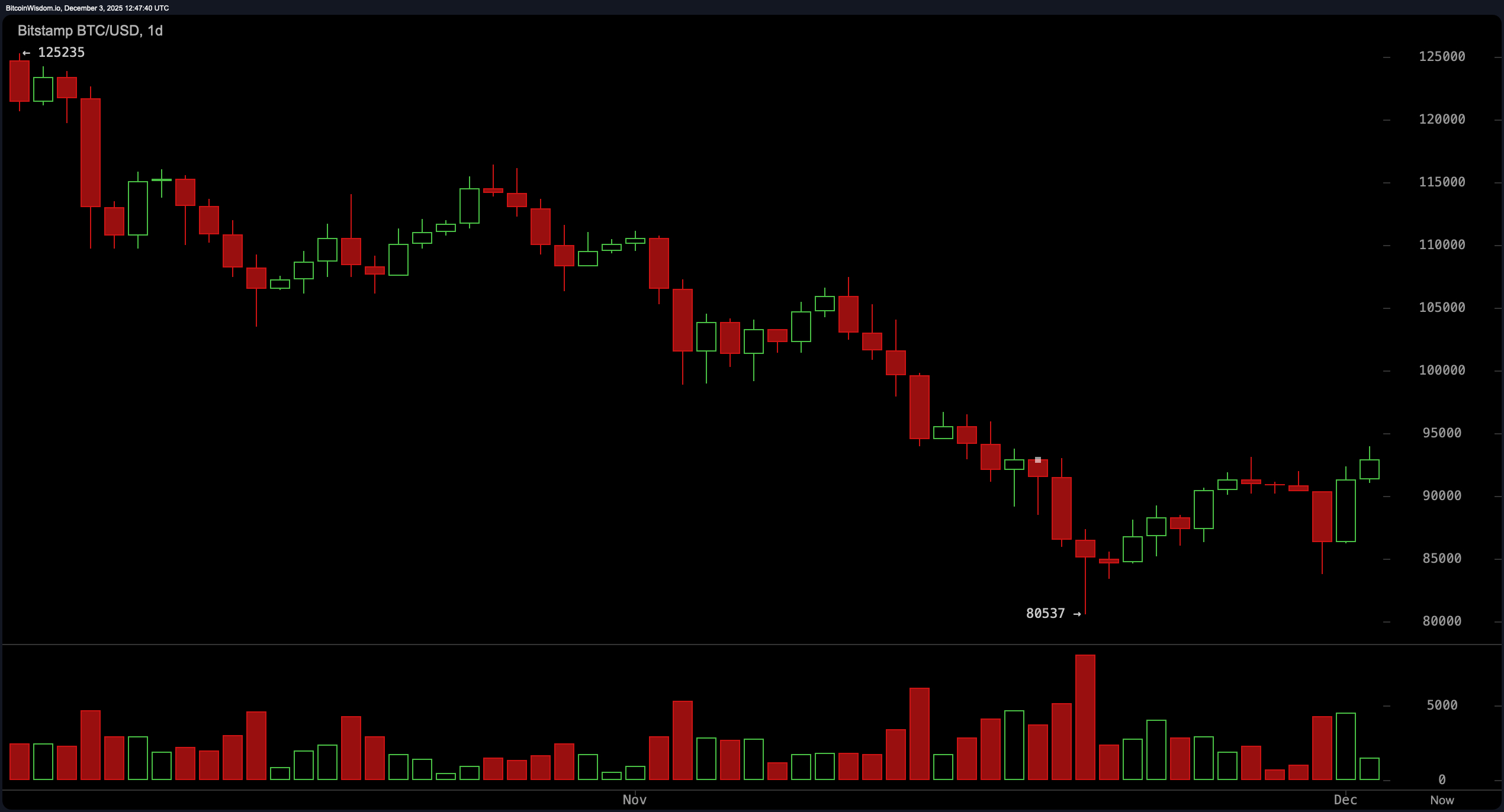

On the daily chart, bitcoin has clawed its way back from a steeper descent, reversing off a $80,537 low in a V-shaped recovery that now tests the $95,000 resistance zone. The recovery comes not just with improved structure but also accompanied by a burst in trading volume, suggesting there’s more conviction than noise behind the price action.

However, the $95,000 mark isn’t giving way easily, making it the current line in the sand. The resistance here is stiff, but if broken with strong volume, it could pave the way for a decisive upside leg. For now, the $87,000–$89,000 support range offers a technical anchor — a retracement to that level would provide an attractive setup for strategic positioning.

BTC/USD 1-day chart via Bitstamp on Dec. 2, 2025.

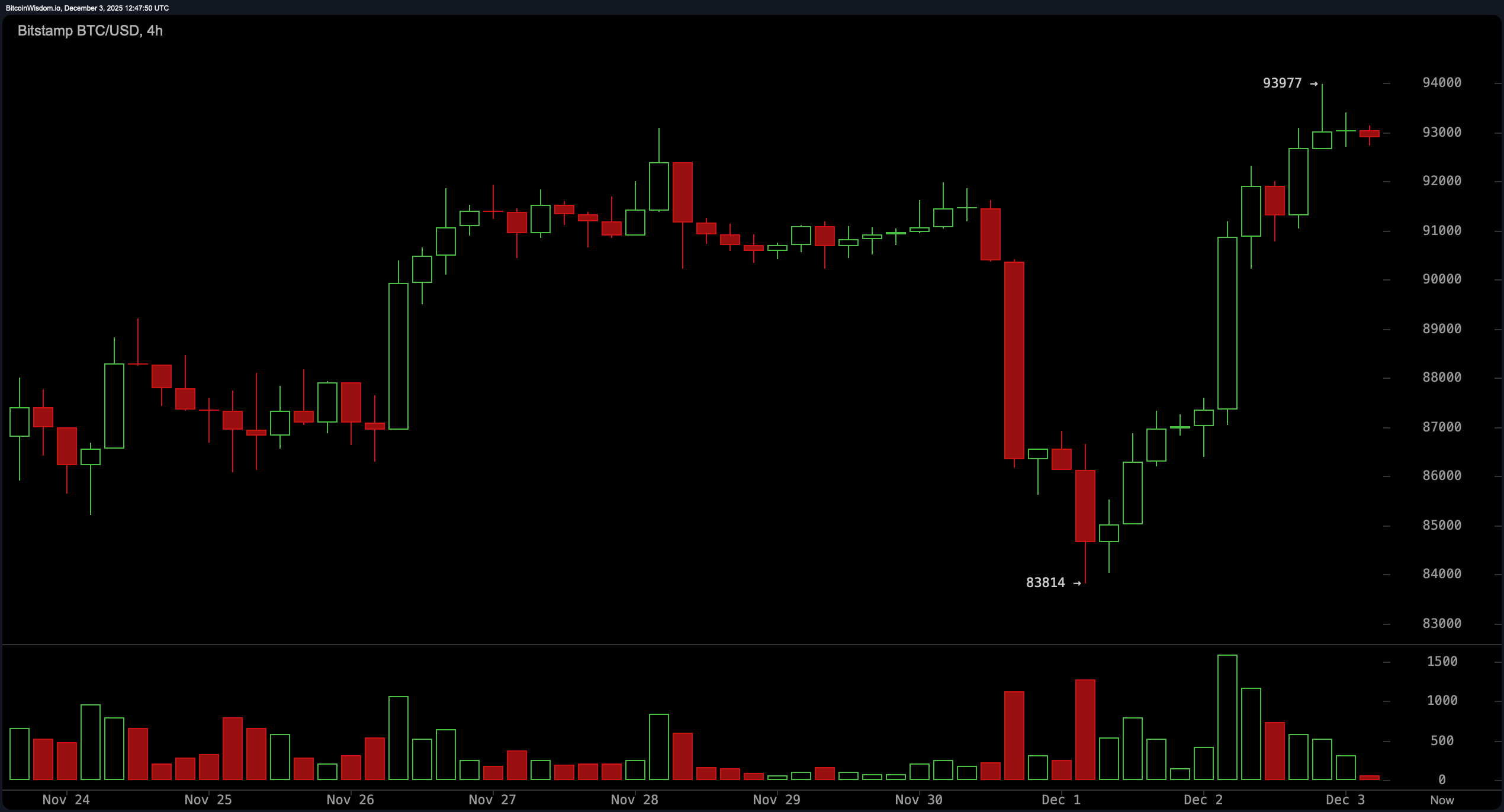

Moving down to the 4-hour chart, bitcoin is catching its breath after a sharp surge from $83,814 to $93,977. The consolidation now seen just below $94,000 suggests a market taking stock of itself — neither overextended nor eager to charge ahead without reinforcements. The falling volume is telling, hinting at either a healthy pause or the beginning of a more meaningful retracement. A push above $94,000 with volume confirmation could unlock continuation potential, while a slip below $88,500 may be the cue that momentum is giving up the ghost — at least for now.

BTC/USD 4-hour chart via Bitstamp on Dec. 2, 2025.

On the 1-hour chart, the tempo remains bullish but measured. The price is coiling beneath its recent high, moving in a narrow band and likely gearing up for a micro-breakout or a tactical pullback. Momentum is waning slightly, evidenced by tapering volume and a relative strength index (RSI) that’s likely tiptoeing into overbought territory. A move above $94,000 with volume follow-through could ignite short-term upside action, while any breach below $91,500 would spoil the party for scalpers banking on this uptrend’s continuation.

BTC/USD 1-hour chart via Bitstamp on Dec. 2, 2025.

From a broader momentum and trend standpoint, the indicators are whispering more than shouting. Oscillators are mostly balanced: the relative strength index (RSI) is at 48, Stochastic at 74, commodity channel index (CCI) at 60, and the average directional index (ADX) stands at 37 — all suggesting neutrality. The Awesome oscillator clocks in at −6,040, remaining indecisive, while momentum at 6,072 shows early signs of exhaustion. Curiously, the moving average convergence divergence (MACD) comes in at −2,972, which points to potential convergence of short-term bullishness amid broader consolidation.

Turning to the moving averages, the short-term outlook leans constructive. Both the 10-period exponential moving average (EMA) and simple moving average (SMA) sit below the current price, at $90,439 and $90,004 respectively. Likewise, the 20-period EMA and SMA show support at $92,104 and $90,191. However, the 30-period and beyond tell a different tale — all the way through the 200-period indicators — with each displaying lower values (ranging from $94,543 to $109,531), signaling overhead resistance and lingering bearish legacy from the recent downtrend. This creates a classic compression scenario: near-term optimism pressing against long-term skepticism, with the next catalyst poised to determine who gets the final word.

Bull Verdict:

Bitcoin is poised at the edge of a technical breakout, with short-term momentum and supportive volume hinting at another leg upward. If price action decisively clears the $95,000 resistance with volume to match, the bulls may well reclaim the throne and drive toward six-figure targets with renewed conviction.

Bear Verdict:

Despite recent recovery, bitcoin’s hesitation beneath key resistance and weakening momentum indicators suggest the rally may be running on fumes. Without a clean break above $94,000–$95,000, the path of least resistance could turn lower, pulling the price back toward the mid-$80,000s as enthusiasm cools and sellers regain leverage.

- What is bitcoin’s current price?

As of December 3, 2025, bitcoin is trading at $92,830. - What is bitcoin’s current market cap?

Bitcoin’s market capitalization stands at $1.852 trillion. - What price range did bitcoin trade in over the past 24 hours?

Bitcoin traded between $87,088 and $93,928 in the last 24 hours. - What does the current bitcoin chart suggest?

Bitcoin is consolidating below resistance with mixed momentum signals across timeframes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。