Bitcoin’s relationship with equities is once again under the microscope, and this time the picture is more lopsided than ever. Despite trading less than 20% below its all-time high, BTC is moving in near-lockstep with the Nasdaq-100, but only when sentiment turns risk-off.

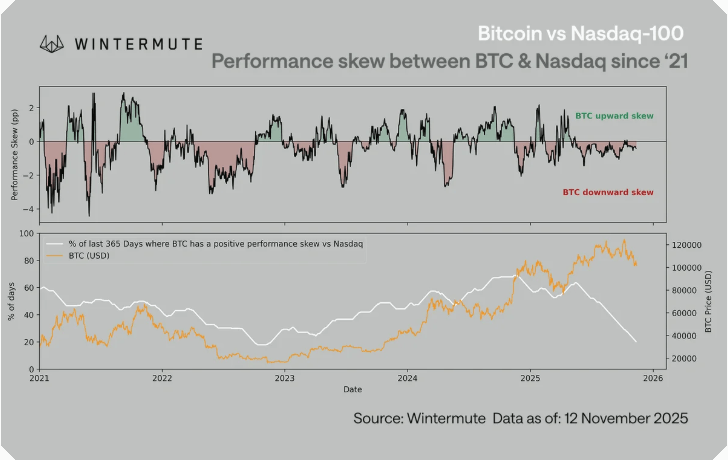

According to a Wintermute report, the crypto market’s biggest asset continues to show a distinctly negative performance skew, falling harder on equity down days while showing muted participation in risk-on rallies.

With the BTC–Nasdaq correlation holding around 0.8, the linkage is intact, but the intensity of bitcoin’s reactions is what stands out. Instead of leading risk sentiment as it often does in bullish phases, bitcoin is behaving more like a high-beta extension of macro fear, absorbing the downside volatility while capturing little of the upside.

This performance skew, measured by how BTC behaves on Nasdaq up days versus down days, has remained negative throughout 2025, a pattern last seen during the late-2022 bear market. Historically, such asymmetry tends to show up at cycle lows, not alongside fresh all-time highs. Yet the current environment tells a different story: BTC is holding its ground despite consistent signs of investor exhaustion.

Source: Wintermute

Two dynamics appear to be driving this divergence. First, market mindshare has shifted decisively toward equities, with megacap tech recapturing both retail and institutional momentum. Much of the speculative capital that fueled crypto markets in 2020–21 is now chasing growth stocks, leaving BTC reactive rather than narrative-driven.

Second, crypto’s liquidity profile remains fragile. Stablecoin supply has stagnated, ETF inflows have slowed, and market depth has not recovered to early-2024 levels. That thin liquidity amplifies BTC’s downside beta whenever equities wobble.

Taken together, bitcoin is still a macro asset, but one currently absorbing more pain than praise. The persistent negative skew doesn’t align with a market overheating at the top of a cycle. Instead, it reflects a stretched and fatigued investor base. And yet, the fact that bitcoin remains near record highs despite this skew may be the strongest testament to its underlying strength.

FAQ📉

- Why is Bitcoin reacting more to Nasdaq declines than to rallies?

BTC shows a negative performance skew, dropping harder on equity down days while barely benefiting from risk-on moves. - How strong is the current BTC–Nasdaq correlation?

The correlation sits near 0.8, with bitcoin behaving like a high-beta macro asset. - What’s causing BTC’s downside sensitivity?

Stagnant liquidity, weaker ETF flows, and flat stablecoin supply are amplifying bitcoin’s reactions to equity volatility. - What does this trend signal for the market?

The skew reflects investor fatigue, even as BTC’s ability to stay near record highs signals underlying resilience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。