Coinbase Global Inc. (Nasdaq: COIN) released its fourth-quarter and full-year 2025 shareholder letter on Feb. 12, 2026, detailing revenue growth, rising market share, and continued product expansion across crypto, derivatives, and equities.

For full year 2025, total revenue reached $7.18 billion, compared with $6.56 billion in 2024. Net revenue rose 9% year over year to $6.88 billion, while net income totaled $1.26 billion. Adjusted EBITDA for the year came in at $2.81 billion.

Fourth-quarter revenue was $1.78 billion, down from $2.27 billion a year earlier. Coinbase reported a Q4 net loss of $667 million, largely driven by a $718 million loss on crypto assets held for investment and a $395 million loss on strategic investments. On an adjusted basis, net income was $178 million and adjusted EBITDA was $566 million.

The company noted that transaction revenue for 2025 totaled $4.06 billion, up 2% from the prior year. Q4 transaction revenue was $983 million, down 6% quarter over quarter. Consumer spot trading volume in Q4 reached $56 billion, while institutional spot trading volume hit $215 billion.

Subscription and services revenue continued to provide ballast. The segment generated $2.83 billion in 2025, including $1.35 billion in stablecoin revenue. In Q4 alone, stablecoin revenue reached $364 million, supported by record average USDC held in Coinbase products of $17.8 billion and average USDC market capitalization of $76.2 billion.

Assets on the platform have tripled over three years, and Coinbase disclosed it now stores roughly 12% of all crypto globally. Metrics from timechainindex.com show the firm safeguards 2.85 million BTC under management on behalf of exchange-traded funds (ETFs), mining operators, and publicly traded companies.

Coinbase’s total trading volume grew 156% year over year to $5.2 trillion in 2025, while its crypto trading market share doubled. Operating expenses for 2025 increased 35% year over year to $5.75 billion, reflecting higher marketing spend, USDC rewards, and acquisition-related costs. Full-time headcount rose 31% to 4,951 employees. Q4 operating expenses totaled $1.51 billion.

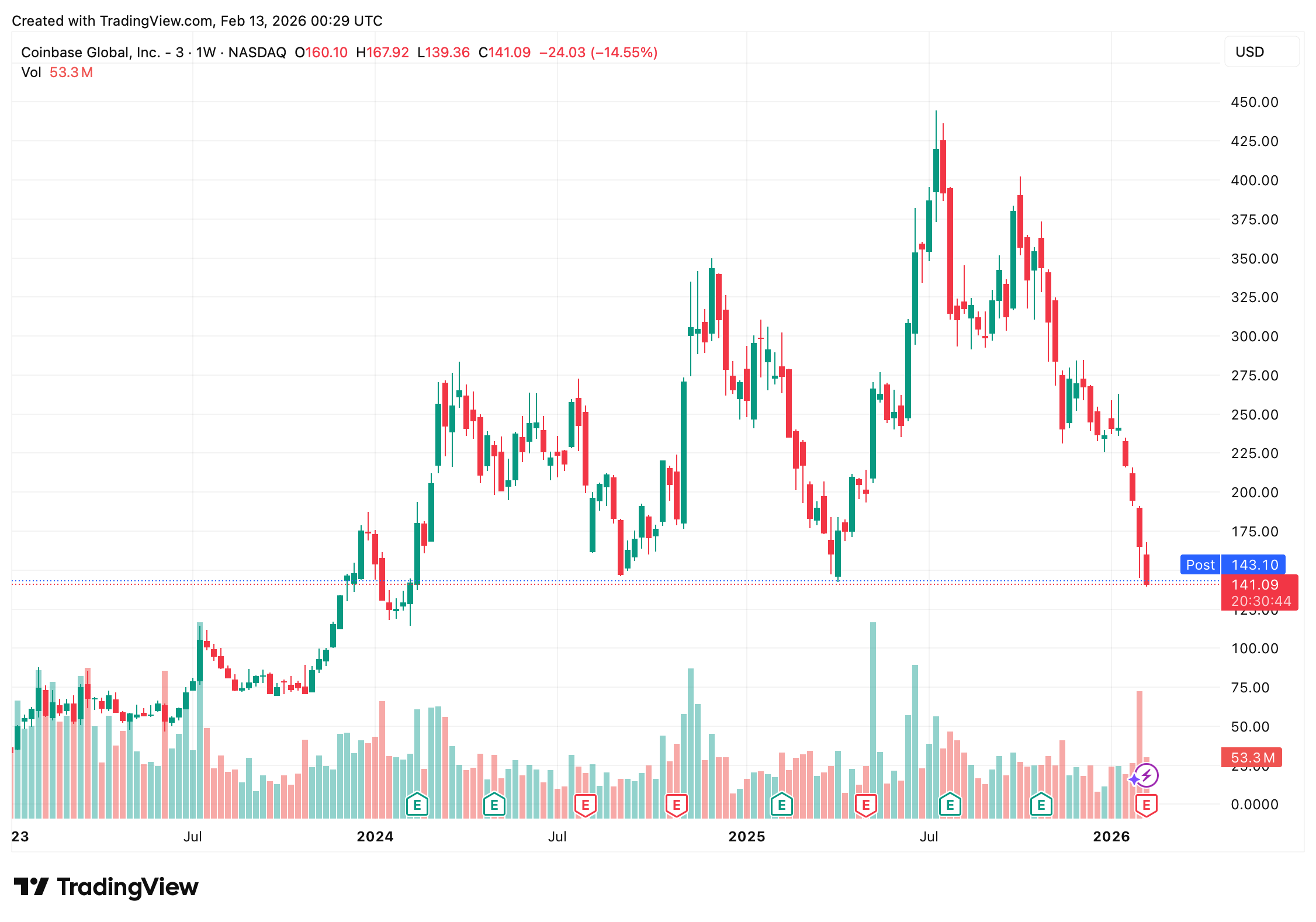

Coinbase shares (COIN) have seen brighter sessions. Following the release of its Q4 earnings, the stock finished Thursday’s trading down 7.9%. Over the past week, COIN has declined 8.71%, is off more than 42% in the last month, and over the previous six months has retreated more than 56%.

Coinbase ended the year with $11.3 billion in cash and cash equivalents. Including crypto assets held for investment and collateral, total available resources reached $14.1 billion.

The company also disclosed that it increased its bitcoin holdings by $39 million in Q4 through weekly purchases for its crypto investment portfolio. As of Dec. 31, 2025, the fair market value of crypto assets held for investment totaled $2.0 billion. While modest relative to its cash position, the move signals Coinbase continues to maintain direct exposure to bitcoin alongside its exchange and infrastructure businesses.

On capital returns, Coinbase repurchased more than $1.7 billion of Class A shares through Feb. 10, 2026, and in January its board authorized an additional $2 billion for share and long-term debt repurchases.

Looking ahead, Coinbase generated approximately $420 million in transaction revenue through Feb. 10, 2026, roughly halfway through the first quarter. The company expects Q1 subscription and services revenue between $550 million and $630 million.

In a note shared with Bitcoin.com News, David Bartosiak of Zacks Investment Research said Coinbase is framing 2025 as the year its “Everything Exchange” vision began evolving from concept into an operational platform. “They claim 12%+ of all crypto globally sat on Coinbase, while total trading volume surged 156% to $5.2T and market share doubled. The business is diversifying fast, with 12 products that now run at $100M+ annualized revenue and with stablecoins and subscriptions acting like the shock absorbers when trading cools.”

Bartosiak added:

“That should help soften the blow that the cryptocurrency market is dealing it right now.”

Bartosiak added that although Q4 generated $1.8 billion in revenue, it also brought higher expenses and a $667 million GAAP loss largely tied to mark-to-market investment losses.

“Underneath, the core engine stayed profitable ($178M adjusted net income, $566M adjusted EBITDA),” Bartosiak said. “They’re leaning into buybacks ($1.7B repurchased through Feb. 10 plus $2B more authorized) and sitting on $11.3 billion in cash. That leaves them optimistic on 2026, but cautioning that lower rates could pressure stablecoin/interest-driven revenue near-term.”

In the release, management outlined three priorities for 2026: expanding the “Everything Exchange” across crypto, derivatives, equities, and prediction markets; scaling stablecoins and payments infrastructure; and driving more activity onchain through DeFi integrations and Base. After a year of record trading volume, deeper product integration and selective bitcoin accumulation, Coinbase enters 2026 with scale, liquidity, and a broader financial footprint than ever.

- Why did Coinbase report a Q4 loss?

The Q4 net loss was largely driven by crypto asset and strategic investment markdowns. - Did Coinbase buy bitcoin in Q4 2025?

Yes, the company increased its bitcoin holdings by $39 million through weekly purchases. - How much revenue did Coinbase generate in 2025?

Total revenue reached $7.18 billion, with $6.88 billion in net revenue. - How strong is Coinbase’s balance sheet entering 2026?

Coinbase ended 2025 with $11.3 billion in cash and $14.1 billion in total available resources.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。