The first full week of November was anything but quiet for U.S. spot crypto exchange-traded funds (ETFs). Bitcoin and ether funds endured a wave of redemptions as investors pulled back following last week’s volatility. But even as the two largest digital assets stumbled, solana ETFs continued their impressive ascent, attracting steady inflows throughout the week.

Bitcoin ETFs recorded a massive $1.22 billion in net outflows, marking their third-largest week of redemptions since launch. The pain was concentrated across the heavyweights. Blackrock’s IBIT led the withdrawals with -$580.98 million, while Fidelity’s FBTC followed with -$438.30 million.

Ark & 21Shares’ ARKB lost -$128.92 million, and Grayscale’s GBTC shed -$64.33 million. Vaneck’s HODL, Valkyrie’s BRRR, and Franklin’s EZBC rounded out the exits with -$13.36 million, -$11.34 million, and -$8.72 million, respectively.

There were modest weekly inflows of $21.61 million for Grayscale’s Bitcoin Mini Trust and $4.69 million for Bitwise’s BITB, but it did little to help the significant outflows. Trading volumes across the group remained high, averaging nearly $5 billion daily, while total net assets fell to $138 billion by week’s end.

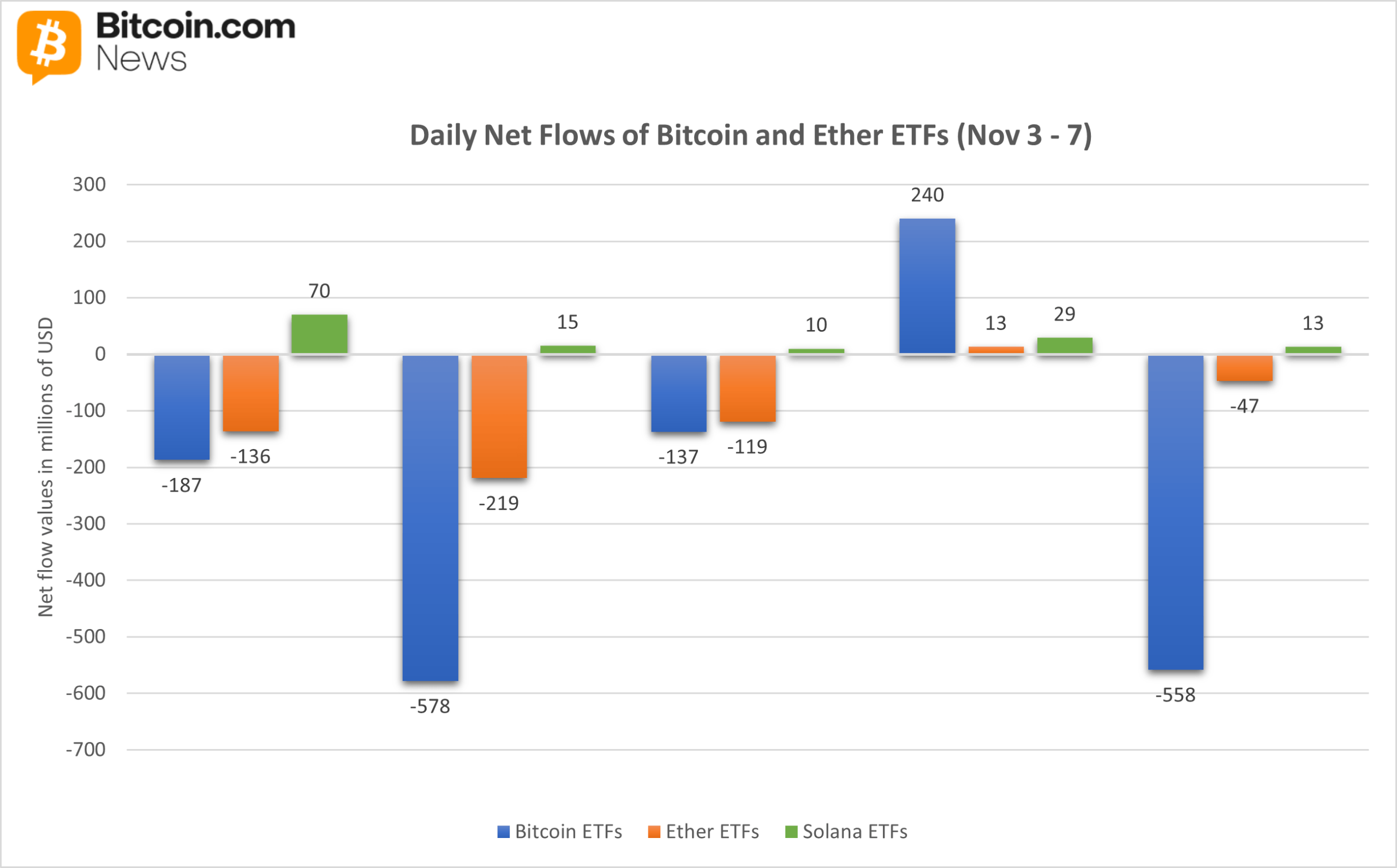

Daily inflow/outflow breakdown for bitcoin, ether, and solana ETFs for the week of Nov 3 – 7.

Ether ETFs weren’t spared either, posting a $507.83 million net outflow, also their third-largest on record. Blackrock’s ETHA led with -$296.95 million in redemptions, followed by Fidelity’s FETH with $108.83 million.

Grayscale’s Ether Mini Trust and ETHE saw exits of $61.07 million and $38.33 million, respectively. Other outflows were seen on Bitwise’s ETHW (-$3.11 million) and Vaneck’s ETHV (-$2.64 million), with the little inflow of $2.59 million on Invesco’s QETH doing little to offset the week’s losses. Net assets slid to $22 billion, and trading activity held at $2 billion per day.

Amid the broader outflow trend, solana ETFs emerged as the clear winner. The pair of funds, Bitwise’s BSOL and Grayscale’s GSOL, drew a combined $136.50 million in inflows. BSOL dominated with $126.74 million, while GSOL added $9.76 million. The group’s net assets climbed to $576 million, as investor interest in solana’s ecosystem continued to build.

While bitcoin and ether ETFs faced a heavy week of selling pressure, solana’s steady inflows offered a contrasting signal that investors may be quietly diversifying their exposure toward the market’s rising star.

FAQ💸

- How much did crypto ETFs lose this week?

Bitcoin and ether ETFs saw a combined $1.73 billion in outflows, marking their third-largest weekly decline on record. - Which funds were hit the hardest?

Blackrock’s IBIT and Fidelity’s FBTC led the redemptions, losing nearly $1 billion in total. - How did solana ETFs perform amid the selloff?

Solana ETFs bucked the trend with $137 million in inflows, reinforcing strong investor confidence. - What does this signal for crypto markets?

The sharp bitcoin and ether outflows contrast with solana’s steady gains, hinting at a gradual shift in investor focus.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。