Original text from haeju.eth

Translation|Odaily Planet Daily Golem (@web 3golem_ )_

Although I was once a top 0.7% trader on Polymarket, I still lost $19,000 on Polymarket on November 9. So, about three hours after the loss, I wrote this article hoping to help other Polymarket traders.

I started trading on Polymarket about a month ago, with two goals:

- Make trades with positive expected value (EV)

Positive EV means that from a mathematical perspective, even if it may not be profitable in the short term, it is a profitable trade or bet in the long run. Each bet has an expected value based on its winning probability and payout. The formula is: EV=(P(win)×Payout)−(P(loss)×Loss)

If the expected value (EV) is positive, then after repeating the operation multiple times, you will ultimately make a profit on average.

For example, if the probability of something happening is 60%, but the prediction market pricing shows 50%, then this is a positive EV opportunity because the actual probability is higher than the implied probability of the price.

- Accumulate trading volume to prepare for the upcoming POLY token airdrop

Polymarket's Chief Marketing Officer Matthew Modabber confirmed last month that Polymarket will have an airdrop. The Polymarket airdrop is expected to be one of the largest airdrops in the crypto space next year, so participating early and accumulating trading volume is the right choice.

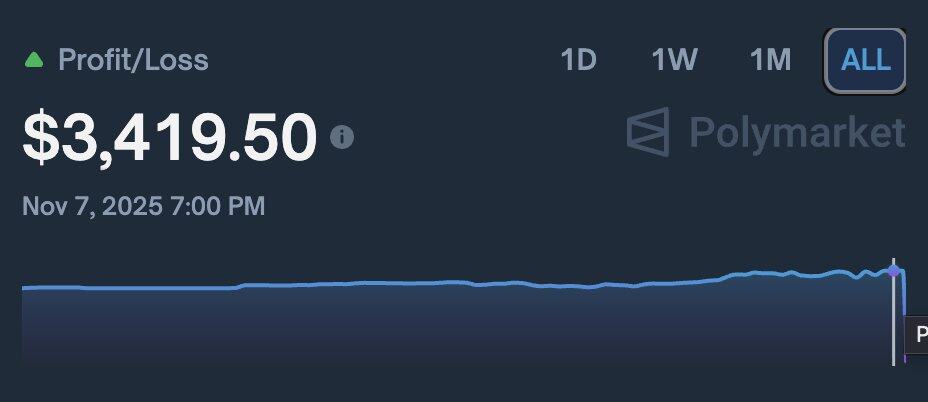

Earn $3,500 through end-of-day strategy

When I first started betting, things did not go smoothly; I lost $600 on the Women's Ballon d'Or. Objectively speaking, the outcome of that match was manipulated, but that's another topic. In any case, over time, I began to find some personal advantages on Polymarket.

I looked for mispriced markets and expired orders, and sometimes even bet on events that had already been decided. For example, buying "winning team" after the match ended could yield a 1% return; the total amount I bet on completed matches reached $6,500.

A daily return of 1% can compound to 365% annually, accumulating over time. Before this loss of $19,000, I had already earned $3,500, with a total trading volume of $200,000, ranking in the top 0.7% of all Polymarket traders.

Lost $19,000 in one minute

Last night, I decided to go big.

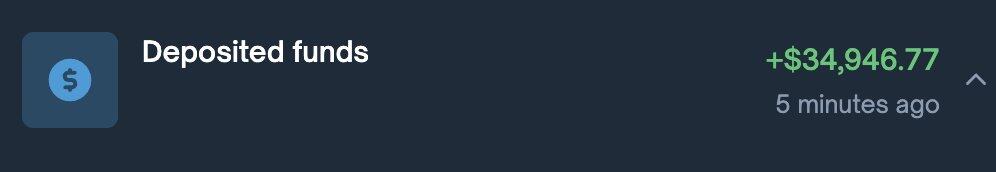

I deposited $35,000 into my account to scale up my capital more quickly, whether for profit or airdrop interaction. I hoped that the time I invested in Polymarket would be worthwhile; rather than just investing $20,000, I could use $55,000 to earn 1%, thus getting a higher return on my invested time.

Then, the match between Manchester United and Tottenham began. I turned on the TV because I am a die-hard Manchester United fan.

With about five minutes left in the match, the situation suddenly reversed from Manchester United leading 1-0 to Tottenham leading 2-1.

At that moment, I checked Polymarket and found a 5-cent spread on the "Tottenham wins" market, which looked like a free positive EV opportunity. So, I placed a $9,000 order at 91 cents, but it didn't execute. I then placed another $9,000 order at 93 cents.

In the end, only 10% of my order executed. I thought everything was fine; I was watching the match, but I made a fatal mistake: I forgot to cancel my previous bid.

A minute later, I looked back at Polymarket to try to close those bids, but just as I hovered my mouse over the close button, my previous order executed.

Seconds later, Manchester United's odds skyrocketed, and 15 seconds later, I saw on the TV (which had a slight delay) that Manchester United scored.

I immediately understood what had happened; I handed over $18,500 to those traders and bots who saw the goal before I did.

The feeling was terrible, a mix of anger, regret, and disbelief. I had initially not wanted to go out, but I had promised my brother and girlfriend to go for a run, so I forced myself to go. This also gave me time to reflect.

The advantage is not with me, but with them

People often post bets with odds as high as 99% claiming "free money" and pretend to have found positive EV, but most of the time, it's just luck.

Just as my bet today seemed to have positive EV, it was actually the opposite, a -1000% EV. I was just paying for those who were faster than me.

The advantage is not with me, but with them.

Another huge mistake I made was leaving my orders hanging there. In a fast-changing market, executing orders can be a trap. Those watching faster streams or running bots can react in milliseconds, while by the time an ordinary person's screen refreshes, they have already taken your money.

Risk tolerance and bet size are crucial

There is a concept in gambling called the quarter Kelly (QK) rule, which is a method for adjusting bet size based on expected value and variance.

I previously did not pay attention to this concept. I did not balance risk and reward, but instead put $18,500 into a low-yield bet. When variance came into play, I lost everything.

Even if the bets you make are positive EV, you cannot always win.

Expected value only manifests after multiple attempts. This is math, not luck, and math requires a large sample size to eliminate variance.

If you flip a coin that has a 55% chance of being in your favor, you could still lose 10 times in a row. This does not mean you were wrong; it just means you haven't flipped the coin enough times.

The same goes for trading or betting. We need to make thousands of bets to truly see if we have a real advantage.

This is also why risk management and controlling bet size are so important.

Even if your expected return (EV) is positive, if you are over-leveraged or let volatility consume your funds before the math is done, you will never gain an advantage.

Long-term winners are not always the smartest; they are simply those who can stick around long enough to let their advantages accumulate.

Expected value (EV) and differentiated advantage (Edge) are the only ways to profit

On Polymarket (or any prediction market), real profits come from differentiated advantages, not beliefs.

Currently, the market efficiency on Polymarket is still relatively low, which is where the opportunities lie. But as trading volume and liquidity increase, these differentiated advantages will also disappear.

You must strive for excess returns (Alpha).

In the end, I am still down $15,000, but I will not give up. I still believe in the process, believe in EV, believe in discipline, and believe in learning faster than others.

One of the best things about Polymarket is that it is publicly on-chain. You cannot fake results or hide losses. My portfolio is also visible to everyone.

My current goal is to achieve over $1 million in total trading volume before the POLY token airdrop and turn my losses into profits.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。