Elon Musk's net worth is expected to reach $1 trillion by 2035, surpassing the combined market capitalization of Ethereum, USDT, XRP, and BNB.

Written by: Liam Akiba Wright

Translated by: Saoirse, Foresight News

When Elon Musk's wealth crosses the trillion-dollar mark, it will not only signify personal success but also herald a new phase in economic history—one where individual influence rivals that of sovereign nations.

As a Bitcoin holder, I view Satoshi Nakamoto's vision of "decentralized wealth" and "financial democratization" as a blueprint for the dispersion of power, a concept that reduces the reliance of value systems on a single entity. However, as capital, artificial intelligence, and policy increasingly converge on Musk's ever-expanding business empire, his rise also reveals the extent to which we have deviated from this ideal.

The ownership of "value" is once again trending towards centralization, but this time, the controllers are not governments or banks, but individuals who transform technology into leverage.

Some argue that Bitcoin is the purest form of private property: non-seizable, borderless, and entirely controlled by individuals. From this perspective, Satoshi might not view the "emergence of trillionaires" as a failure of decentralization, but rather as a logical (if unanticipated) outcome of the decentralization process.

Musk's Carefully Crafted "Feast of Wealth"

So far, Tesla shareholders have approved a compensation plan—if all the milestone targets set by this plan are met, Musk's net worth is expected to rise to $1 trillion.

At the annual Tesla shareholder meeting held on November 6, over 75% of votes supported this multi-year plan centered on stock options. The compensation disbursement of this plan has clear prerequisites: Tesla must surpass a series of operational and valuation thresholds, including achieving a market capitalization of nearly $8.5 trillion and the large-scale deployment of autonomous driving technology and humanoid robots.

The numerical logic behind Tesla's plan creates an unusual contrast: the equity exposure of a single individual could potentially exceed the combined market capitalization of the four major mainstream altcoins (ETH, USDT, XRP, and BNB).

How to Cross the Finish Line: The Game of Wealth, Power, and Policy

If all of Musk's option shares are vested, without considering equity dilution and financing impacts, his actual ownership stake could reach around 25%.

Based on Tesla's $8.5 trillion market capitalization, just 27% of his shares would be worth approximately $2.295 trillion. By mid-2025, SpaceX (the private aerospace manufacturer and space transportation company Musk founded in 2002) is expected to have a private market valuation close to $350 billion, with optimistic public forecasts indicating that by 2030, the company's valuation in defense and broadband sectors will exceed $1 trillion.

Rumors about funding for xAI (the AI company Musk founded in 2023) suggest a valuation range between $75 billion and $200 billion. Overall, the "convexity of returns" in this options plan deeply ties Musk's personal wealth to a few "either-or" outcomes, with the most critical being the commercialization progress of Robotaxis and humanoid robots.

The realization of these goals is not only limited by technology but also constrained by policy. For example, in California, Tesla currently only holds a "safety driver testing permit" issued by the California Department of Motor Vehicles (DMV) and has not yet obtained the "autonomous driving testing and deployment permit" necessary for commercial operations. According to California government records and reports from Reuters, the various stages of ride-hailing services still require separate approval from the California Public Utilities Commission (CPUC).

As previously reported by Ars Technica, the National Highway Traffic Safety Administration (NHTSA) is still reviewing the "Full Self-Driving (FSD) feature," which remains a potential risk point that could attract public scrutiny.

Rationally Viewing the "Trillion-Dollar Challenge" of Cryptocurrency

Currently, Musk's net worth exceeds that of any single altcoin. In the cryptocurrency space, only Bitcoin's market capitalization (over $2 trillion) is higher than his personal wealth—while I hold a fully optimistic view of Bitcoin, believing its performance will continue to outpace any individual's investment portfolio.

Ethereum, the second-largest by market capitalization, has fluctuated between $390 billion and $600 billion in recent months, currently around $400 billion, which is about $100 billion lower than Musk's personal wealth.

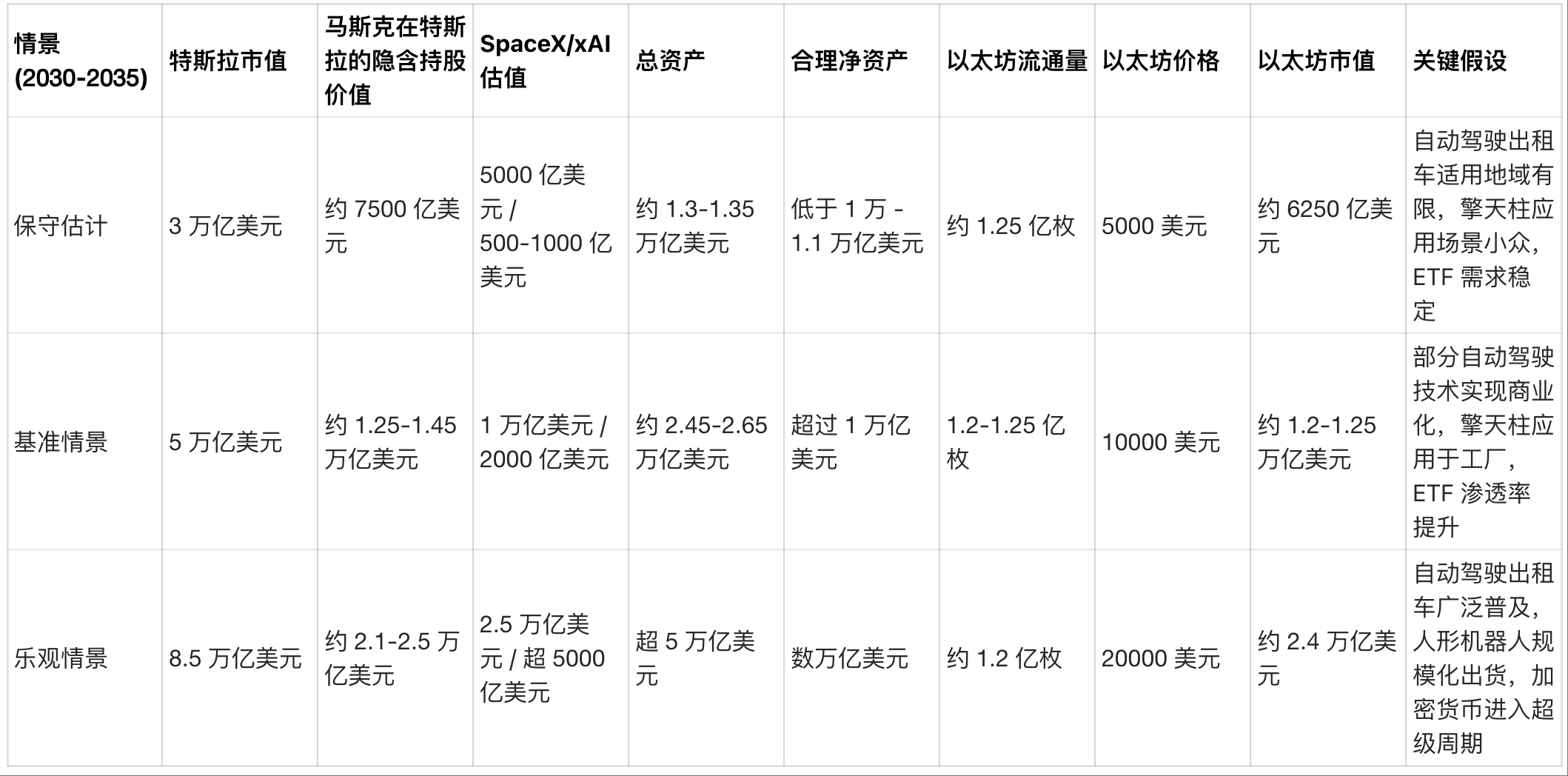

Next, let's conduct some basic forward-looking modeling analysis:

Conservative Scenario:

If the rollout of autonomous driving technology is delayed and the Optimus humanoid robot remains limited to niche scenarios, by 2035, Tesla's valuation may reach $3 trillion. At that point, Musk's 25% stake in Tesla would yield approximately $750 billion, plus SpaceX's $500 billion and xAI's $50-100 billion valuation, bringing his total assets to about $1.3-1.35 trillion. After deducting option exercise costs, taxes, and loans, his net worth would be slightly below $1 trillion, and he might not even break that threshold.

In contrast, if Ethereum's price reaches $5,000 with a circulation of 125 million coins, its market capitalization would only be about $625 billion.

Baseline Scenario:

If Tesla's market capitalization reaches $5 trillion, and Optimus is first deployed in factories while the energy business achieves large-scale expansion, Musk's Tesla shares would be valued at $1.25-1.45 trillion. Adding SpaceX's $1 trillion and xAI's $200 billion valuation, his net worth exceeding $1 trillion would become a "basic outcome."

Even if Ethereum's price approaches $10,000 with a circulation of 120-125 million coins, its total market capitalization would only be around $1.2-1.25 trillion.

Optimistic Scenario:

If Tesla's market capitalization reaches $8.5 trillion, autonomous taxis are widely adopted, and humanoid robots achieve large-scale production; simultaneously, SpaceX's valuation approaches $2.5 trillion and xAI's valuation exceeds $500 billion, Musk's personal wealth would reach the "multi-trillion-dollar" level.

This comparison is not a contest between "personal heroes" and "technical protocols," but rather a competition between "equity option returns" and "network adoption rates."

Therefore, if Ethereum is to surpass Musk (and his assets) and be the first to break the $1 trillion valuation within the next decade, under the premise that Tesla's market capitalization does not exceed $3 trillion, its price must break $10,000.

The Influence of Billionaires and Wealth Politics

However, I believe that the "social narrative framework" surrounding these numbers is equally important.

Research published by Cambridge University Press shows that the worship of super-rich individuals, along with the ensuing notions of "elitism" or "institutional defense," diminishes public support for wealth redistribution and progressive taxation—this effect is also present among low-income groups.

Long-term studies in political science indicate that the responsiveness of policy outcomes to the preferences of the wealthy class is far greater than to those of ordinary citizens. This means that extreme concentration of wealth may translate into lasting political influence.

At the same time, economic research (such as that from the Quarterly Journal of Economics and related literature) finds that exposure to wealthier groups decreases individual life satisfaction while increasing conspicuous consumption and borrowing behavior—this effect is particularly pronounced among lower-income groups.

A 2024 Harris Poll shows that the majority of respondents believe "billionaires contribute insufficiently to society"; related surveys in the UK also indicate that the public is generally concerned about "the excessive political influence of super-rich individuals."

These are not abstract opinions surrounding celebrities but rather the "halo effect" of billionaires and media narratives that directly impact fiscal budgets, electoral voting, and social debt.

Positioning Ethical Boundaries from a Scale Perspective

According to Forbes magazine, the number of billionaires worldwide is expected to reach 3,028 by 2025, a historic high. With a global population of approximately 8.23 billion, this means that only about 1 in every 2.7 million people can become a billionaire.

Currently, there are no trillionaires globally. According to UBS, the total global household wealth is $450 trillion, with $1 trillion accounting for only 0.22% of that. Reuters' interpretation of UBS data shows that the median wealth of adults worldwide is merely "a few thousand dollars," with over 80% of adults having wealth of less than $100,000.

A personal wealth of $1 trillion is roughly equivalent to the total net worth of 100 to 130 million "middle-wealth level adults." The probability of moving from millionaire to billionaire is already extremely low, making the notion of "trillions" a public goal logically untenable on a numerical level.

Policy choices are a key variable affecting the "wealthy elite." Current rules allow top wealth to grow exponentially, and combined with the aforementioned "policy bias towards the wealthy," issues of "affordability" in people's livelihoods (such as housing and healthcare costs) are often resolved belatedly.

As economist Zucman simulated, Oxfam cited, and the Washington Post reported, a targeted annual tax of 2% on billionaire wealth could raise about $250 billion each year. This funding could be used to support public goods or alleviate cost-of-living pressures while moderately narrowing the gap between the wealthy elite and ordinary groups.

In experimental scenarios, if social culture shifts from "personal hero narratives" to "systematic interpretations of progress," public support for progressive taxation would significantly increase—this would create a more moderate counterbalance to the spillover effects of "wealthy worship."

Policy and Public Perception Shape the Trillion-Dollar Race

These measures themselves will not change Tesla's valuation logic or the demand curve for cryptocurrencies, but they can adjust the "external environment" in which massive wealth exists.

Governance issues within Tesla are also worth noting: not only the board of directors but also shareholders have valued and approved the "convexity of returns" of the options—this process responds to certain criticisms while also sparking new controversies.

If state regulatory agencies and safety departments can effectively manage the "cash flow supporting this compensation plan," then the current public regulatory system will play the role of "upstream gatekeeper" in the "trillions of dollars of private wealth options."

According to records from Reuters and the California DMV, Tesla still needs to obtain the "autonomous driving testing and deployment permit" to achieve large-scale operations of autonomous taxis in key markets; meanwhile, the NHTSA's review is still ongoing. The timeline of these approvals, rather than press conferences, will determine whether this compensation plan can be implemented.

We need not cheer for or mock Musk to clearly view this comparison:

For cryptocurrency to reach a scale of $1-2 trillion, it relies on "adoption rates, throughput, and capital flow"; while for a founder to accumulate wealth exceeding $1 trillion, it depends on "a few technological breakthroughs and regulatory approvals."

People can appreciate Musk's execution or technological innovation without venerating "wealthy worship culture"—this culture undermines support for wealth redistribution while amplifying the elite's influence over policy. The logic is evident; whether to worship is a matter of personal choice.

Ultimately, whether the first to break the $1 trillion mark is an individual or a network, the more important question is: what kind of system do we wish to empower? Is it a system built on personal ambition, or one based on collective recognition and participation?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。