On one hand, open regulated leveraged trading, and on the other, tightening the reins on stablecoins, U.S. regulators are drawing a new safety map for the crypto market.

In 2025, the crypto market will reach a regulatory turning point. On one side, the U.S. Commodity Futures Trading Commission (CFTC) is actively promoting regulated leveraged spot cryptocurrency trading, while on the other, the regulatory path for stablecoins as collateral for derivatives is becoming clearer.

These two major trends not only signify the maturation of the crypto market but also highlight the regulatory agencies' wisdom in balancing openness and safety. Regulators are no longer simply prohibiting but are instead establishing safety barriers to bring crypto activities within a controllable range.

1. Shift in Regulatory Thinking: From Blocking to Guiding

The regulatory strategy of the CFTC in 2025 underwent a significant shift. The agency is no longer passively waiting for congressional legislation but is proactively advancing regulation based on existing provisions of the Commodity Exchange Act. The core of this shift is moving from simple enforcement regulation to preventive regulation, guiding crypto activities from the regulatory gray area into a regulated environment.

● CFTC acting chair Caroline Pham has confirmed that negotiations are underway with major exchanges like CME and Cboe, with plans to launch regulated leveraged spot cryptocurrency trading as early as December 2025.

● This initiative aims to address the long-standing regulatory dilemma: guiding crypto retail trading involving margin and leverage from under-regulated offshore platforms into a regulated environment.

2. Safety Framework for Leveraged Trading

The leveraged spot trading promoted by the CFTC establishes a complete safety system, with the core being risk control through regulated platforms.

● Trading venue restrictions become the primary safety measure. According to the Commodity Exchange Act, leveraged or margin commodity trading must occur on regulated exchanges. This regulation confines leveraged trading to regulated platforms like CME and Cboe, creating a safe trading zone that significantly reduces counterparty risk.

● Risk management requirements are stringent. Regulated exchanges must implement appropriate margin requirements and risk disclosures, specifically designed for the high volatility of the crypto market, to prevent excessive leverage from causing systemic risk.

● Transparency improvements are significant. Trading on regulated platforms allows the CFTC to comprehensively monitor market activities, promptly identifying and combating market manipulation. In 2024, CFTC's enforcement actions related to crypto have increased by 59%, indicating a strengthening of regulatory efforts.

3. Regulatory Upgrade for Stablecoins

Alongside leveraged trading, the regulatory framework for stablecoins as collateral for derivatives is also continuously improving, with particularly strict safety measures.

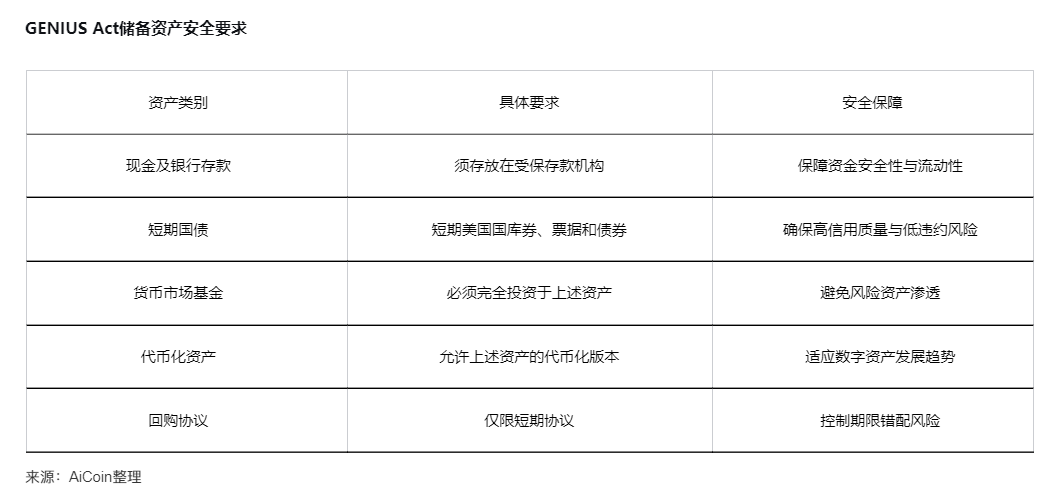

● The passage of the U.S. GENIUS Act establishes a federal-level regulatory framework for stablecoins, clarifying issuer qualifications, reserve asset requirements, and disclosure obligations. This bill was signed into law by the president in July 2025.

This framework lays the foundation for the CFTC's proposal to allow stablecoins as collateral for derivatives. The tokenized collateral policy being developed by the CFTC will permit stablecoins as qualified collateral in the regulated derivatives market, but they must meet strict conditions.

4. Global Regulatory Coordination Trends

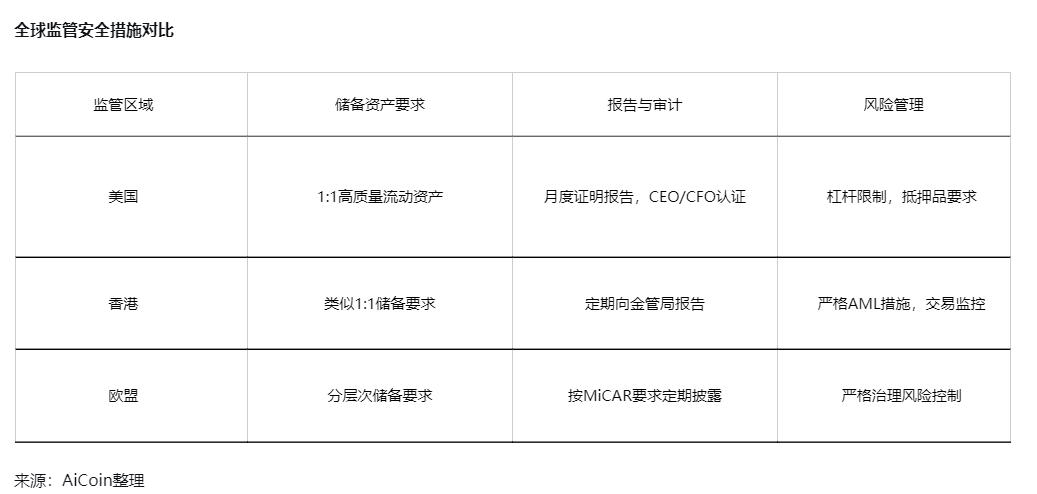

● The U.S. is not the only jurisdiction making strides in crypto regulatory safety. Major global economies are actively building their own crypto regulatory frameworks, showing a clear trend of coordination.

● The Hong Kong Monetary Authority released several guidelines for the regulation of stablecoin issuers in July 2025, constructing a complete regulatory component, including the Guidelines for Licensed Stablecoin Issuers and core regulations such as anti-money laundering guidelines.

● The EU's Markets in Crypto-Assets Regulation (MiCAR) is also gradually advancing, expected to come into wide effect by 2026, setting unified regulatory standards for crypto asset service providers and stablecoin issuers.

UK regulators have also shown a willingness to align with U.S. rules. The Bank of England has initiated a consultation process, with its deputy governor stating that the UK's stablecoin framework will be developed and implemented "as quickly as the U.S."

5. Future Challenges and Responses

Despite the continuous improvement of regulatory safety measures, the crypto market still faces multiple challenges that need to be addressed.

● Stablecoin risk management is a primary concern. Past lessons from stablecoin collapses remind regulators to remain vigilant. The CFTC is expected to launch a pilot project for tokenized collateral in early 2026, which will need to balance innovation and risk management.

● The issue of overlapping regulatory jurisdiction remains. Continuous coordination is needed between the CFTC and SEC regarding overlapping jurisdictions. The proposed Digital Asset Market Clarity Act aims to clearly assign regulatory authority over "digital commodities" to the CFTC, which will help clarify regulatory boundaries.

● Technical complexity poses additional challenges for regulation. The Hong Kong Monetary Authority adopts a "technology neutrality" principle in its regulatory guidelines, encouraging rather than mandating the use of specific tools, balancing regulatory requirements with technical feasibility.

● Cross-border regulatory cooperation is crucial. Differences in regulatory standards across jurisdictions pose challenges for cross-border crypto asset services. International cooperation between regulatory agencies is essential for building an effective global regulatory framework.

Regulatory agencies are laying down new safety tracks in the crypto market. The CFTC's leveraged trading regulations and stablecoin regulatory framework serve as a reliable signaling system for this rapidly evolving market.

With the implementation of these regulatory safety measures, the crypto market is undergoing a critical transition from wild growth to regulated development. The safety barriers of regulation are no longer constraints on innovation but have become the cornerstone of healthy market development.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。