原文标题:《一份 2000 美元的圣诞「劫」:特朗普和他的关税红利》

原文来源:链上启示录

每年圣诞节,孩子们都会收到一份由神秘老人送出的礼物,他们从不追问礼物的成本。如今,唐纳德·特朗普正试图为成年人世界扮演圣诞老人,承诺派发一份从天而降的 2000 美元的「关税红利」,并声称礼物由遥远的「外国工厂」支付。加密市场已经像一群迫不及待拆开礼物的孩子一样兴奋不已。但这场盛大的魔法表演有一个被忽略的细节:在为那只凭空出现的兔子鼓掌前,没人追问,它是用谁的晚餐换来的。以及今晚谁会饿肚子?

一. 当总统宣布全国撒钱:一场献给市场的狂欢

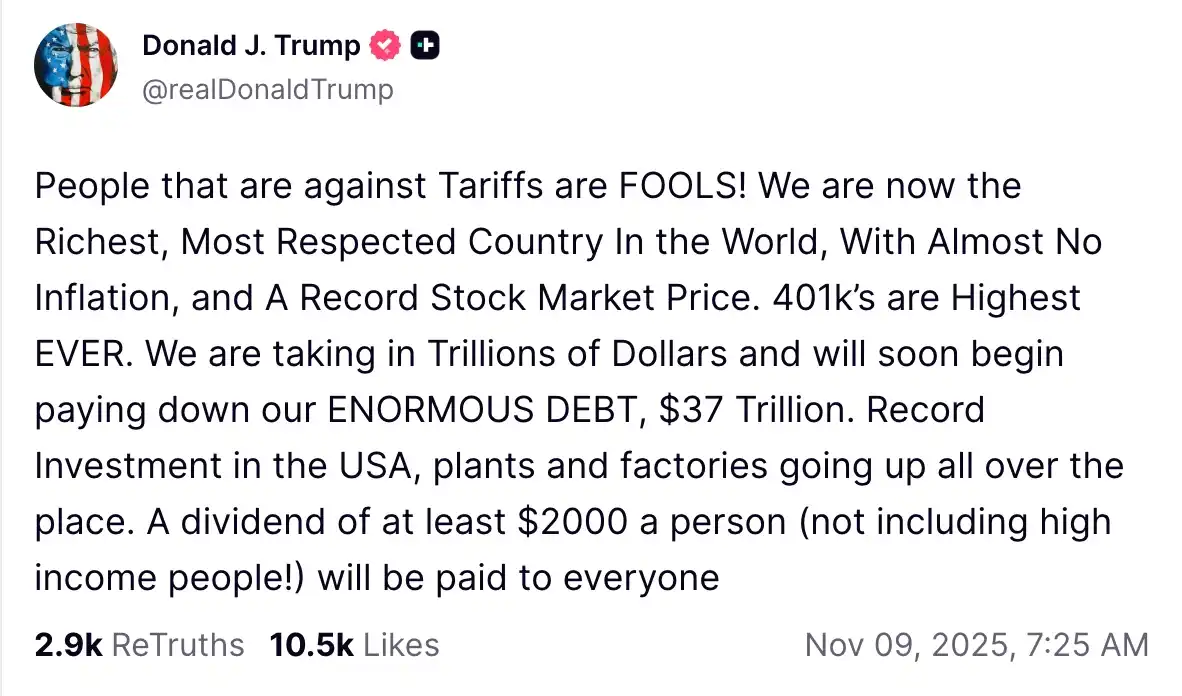

来源:Donald Trump

而加密市场,恰好是那个从不关心晚餐由谁付账、只闻得到香气的食客。

上一次让他们狂欢的,是疫情时的刺激支票;这一次,盛宴的主菜换成了唐纳德·特朗普的新花样——「关税红利」(Tariff Dividend)。这位提前一个多月就匆忙「上岗」的 79 岁「圣诞老人」,于 11 月 9 日在其社交平台 Truth Social 上正式宣布,将为每位中低收入的美国人派发 2000 美元现金。而变出这笔钱的「魔法」,不是传统的印钞机,而是他钟爱的进口关税。

市场的掌声雷动且毫不迟疑。消息公布的几分钟内,比特币应声上涨 1.75%,以太坊上涨 3.32%。对「匿名撒钱」叙事更为敏感的隐私币,如 Zcash 和 Monero,更是录得两位数的疯狂涨幅。加密交易所成交量瞬间飙升,社交媒体上「新刺激牛市」的欢呼声不绝于耳。

显然,对于这群兴奋的「孩子」来说,圣诞老人已经驾着雪橇出发了。

提前打开的礼盒:红利的来源

特朗普对关税的迷恋可追溯到他 2016 年的竞选承诺——「美国优先」。

他坚信高关税能保护美国制造业,并让外国为美国的债务买单。上任后,他迅速发动与中国、欧盟等经济体的贸易战,对进口钢、铝及消费品征收高额的关税。

这一逻辑简单却危险:关税被描述为外国支付的「保护费」,而非美国消费者承担的隐性税收。

到 2025 财年,美国关税收入高达 1950 亿美元。特朗普多次宣称,这些收入可用于偿还美国 37 万亿美元的国债。然而经济学家指出,企业只是将成本转嫁给消费者,结果是通胀上升、购买力下降。

但在特朗普的支持者看来,这是一场胜利——关税让「外国掏钱,美国更富」。这套叙事为他提出「关税红利」埋下了政治伏笔。

红利是如何诞生的?

「关税红利」的概念并非凭空出现, 在上个月的一次电视采访中。特朗普就暗示计划将关税收入的一部分返还给美国人——每人 1000 至 2000 美元不等。他声称,这项政策每年可带来逾 1 万亿美元收入,足以覆盖全民分红。

11 月 9 日,他在 Truth Social 上正式宣布计划:「我们正在收取数万亿美元,并很快开始偿还我们巨大的债务。每个人(不包括高收入人群!)将获得至少 2000 美元的红利。」

财政部长 Scott Bessent 随后暗示,红利可能以减税形式发放。但特朗普并未提供具体细节。

换言而之,这个金光闪闪的礼盒,打开后却空空如也。没有时间表,没有资格标准,更没有国会的点头。

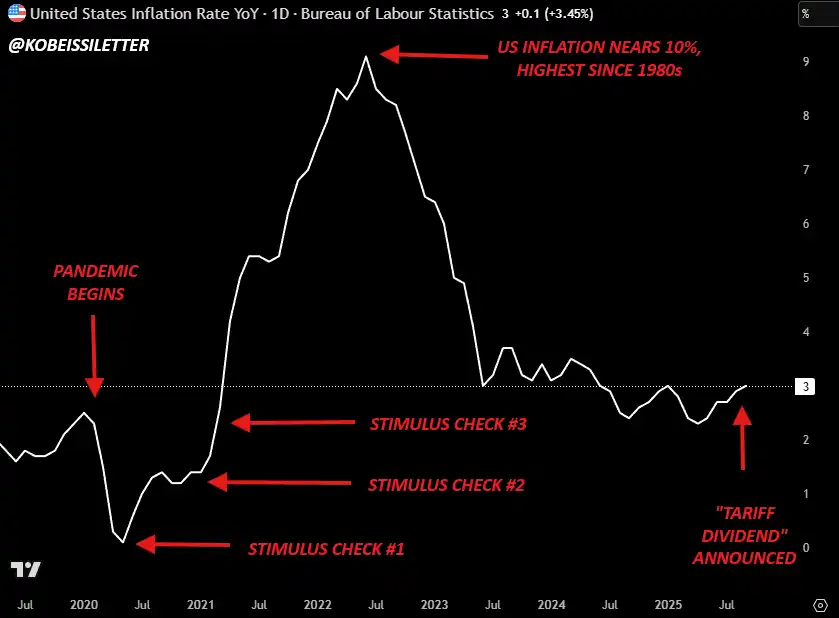

而根据 Kobeissi Letter 的投资分析师的测算,参照过往疫情期间刺激支票的分配模式,目前约有 2.2 亿美国成年人符合领取该刺激支票的领取资格。在形式上,这听起来像一次「财政创新」;在实质上,它是一次政治剧本的重演。先喊口号,刺激市场反映。

在形式上,这听起来像一次「财政创新」;在实质上,它是一次政治剧本的重演。先喊口号,刺激市场反映。

市场拥有肌肉记忆。它清晰地记得 2020 年,美国政府发放的刺激支票曾让比特币从 4000 美元一路飙升至 6.9 万美元,成就了加密史上最狂热的一次牛市。市场自然期待「历史重演」,开启了加密史上最疯狂的派对。如今,熟悉的音乐再次响起,市场自然而然地期待「历史重演」。

但这一次,魔术师的戏法有了破绽:当年的派对,是美联储凭空印出了美酒;而今天的「红利」,只是将一部分客人的酒,倒给了另一部分客人。它并非新的盛宴,只是一场税收的重新摆盘。其规模与可持续性,都充满了问号。

上一轮刺激措施出台后,美国通胀率接近 10%。

二. 预支的狂欢与未付的账单:情绪,狂欢,幻象

市场的短期狂欢:情绪先行,现金未至

加密市场对故事的反应总是迅速。

在消息发布后的 24 小时内,比特币、以太坊、Solana 等主流加密货币全线上扬。

「股票和比特币只会对刺激作出一个反应——上涨。」投资人 Anthony Pompliano 在消息发布后在个人 X 平台写道。

比特币倡导者、西蒙·迪克森(Simon Dixon)则提醒:「如果你不把这 2000 美元投资到资产里,它要么被通胀吞噬,要么用来还债,最后流回银行。」

这番话道出了市场的核心心理:无论刺激是否真实落地,流动性预期才是价格上涨的燃料。

但这波上涨更像是一场心理投机的幻象。

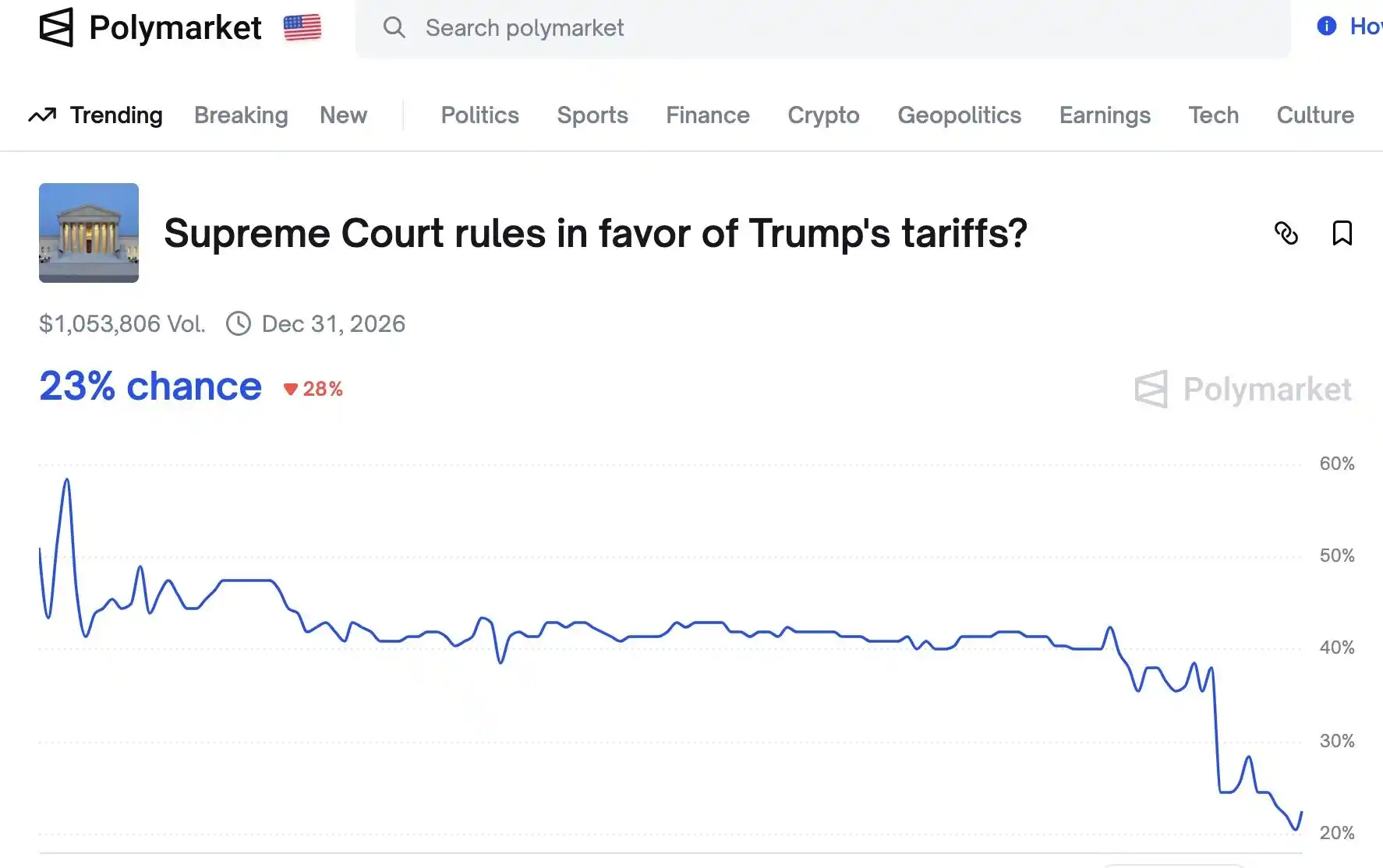

1. 首先,该政策尚未获得任何立法授权。若最高法院裁定相关关税非法,红利计划可能胎死腹中。

2. 其次,即便实施,也意味着财政收入被直接分配,而非用于减债。特朗普承诺的「用外国的钱偿还美国债务」很可能再度落空。

3. 更关键的是,大规模现金发放将推升通胀压力,迫使美联储采取更鹰派的货币政策。届时,流动性收紧,风险资产将首当其冲。

行业投资分析师警告称,虽然部分红利资金将流入市场推高资产价格,但长期看,其后果将是法币通胀与购买力下降。

预测市场的博弈: Kalshi v.s Polymarket

在狂热情绪背后,一场法律角力正在进行。美国最高法院目前正在审理关税合法性的案件。截止 11 月 10 日发稿前,根据去中心化预测市场 Polymarket 的数据,交易者给出最高法院批准的概率仅 23%;在预测平台 Kalshi 上,这一数字更低,仅 22%。换言之,市场多数押注该计划最终将遭司法否决。

来源:Polymarket

但特朗普本人,显然是更出色的「戏剧导演」。他直接在 Truth Social 上反问:

「美国总统被国会授权可以停止与外国的一切贸易——那远比征收关税更严厉——却不能为国家安全目的征税?这算什么逻辑?」

看,他只用一句话,就将一场枯燥的争议,巧妙地重新塑造成一场关于「主权」的政治大戏。

这种戏剧化的策略,对于一个曾在圣诞经典电影《小鬼当家 2》中本色客串、指导过小主角如何找到大堂的「大人物」来说,简直是第二天性。

三. 圣诞糖果背后:一颗叫「通胀」的蛀牙。

换言之,短期狂欢背后,是一个熟悉的剧本,导演没变,只是把问题留给了下一个演员。

「关税红利」被精心包装成一盒圣诞礼物,但它更像一块入口即化的圣诞糖果,甜蜜的滋味(短期刺激)过后,留下的是「通胀」这颗难以根治的蛀牙。

1. 关税带来的 1950 亿美元收入,与 37 万亿美元的国债相比,如同用一个硬币去填满一个游泳池。把这枚硬币直接发掉,无异于用未来的钱来购买当下的喝彩。

2. 短期的政治人气换来的,是长期的财政隐患。经济学家警告,这一政策可能形成「双重通胀」:关税抬高成本,红利刺激需求,如同给一辆本已超速的汽车同时踩下油门和刹车,最终只会导致引擎过热、车毁人亡。

3. 地缘政治层面同样不容忽视。这场喧闹的家庭派对还可能引来邻居(其他国家)的抱怨甚至报复。当贸易战的雪球再次飞舞,全球供应链的窗户将嘎嘎作响,尤其是对依赖全球芯片的加密矿业而言,这无异于一场暴风雪。

换言之,短期狂欢背后,是一个熟悉的剧本。圣诞老人只是把一张写着「通胀」、「赤字」和「贸易战」的账单,塞进了明年的圣诞袜里。

五、最后一个离开餐桌的人

在这场宏大的政治剧中,圣诞老人特朗普不仅为普通民众,也为加密世界准备了一份特殊的礼物。当他宣布将从那只名为「关税」的红色口袋里,为每个美国人掏出 2000 美元时,整个加密市场仿佛提前听到了平安夜的钟声。

如今,历史的雪橇似乎正循着旧日轨迹驶来。市场里的孩子们(散户们)正满怀期待地紧盯烟囱,坚信部分礼物会直接掉进他们的加密钱包,开启又一个「山寨币季节」(altseason)。

然而,每一个相信圣诞老人的孩子,最终都必须面对一个现实问题:礼物的代价是什么?

这一次,圣诞老人的礼物并非在北极的工作坊里凭空变出,他只是豪爽地刷爆了国家的信用卡。这份总额超 4000 亿美元的盛宴,其账单就是「通货膨胀」。当节日的热度让整个房间(经济)变得过热时,大人们(美联储)可能就不得不打开窗户吹入冷风(加息),让这场狂欢提前结束。

所以,摆在每位加密投资者面前的,是一个包装精美的礼盒。短期来看,它闪耀着历史重演的诱人光泽;但长期来看,盒子的背面可能用小字印着一张「通胀」的账单。

这究竟是一份能让整个冬天都温暖的真正馈赠,还是一块入口即化、却会带来蛀牙的圣诞糖果?对于加密世界的信徒们来说,选择相信哪个故事,将决定他们能否在这场盛宴中全身而退。

The last one to leave the party pays the bill.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。