Written by: Will A-Wang

By 2025, spending stablecoins on daily consumption will no longer be a romantic footnote of "global financial equality and inclusiveness," but a grounded reality.

Although the broader cryptocurrency market continues to fluctuate between bull market cycles and regulatory adjustments, most activities remain focused on key infrastructures such as capital flow, remittances, and decentralized finance (DeFi). Stablecoins, however, have carved out a lasting niche market: they are being used for payments and consumption, not just for storage or trading.

Yet, a closer look reveals that less than 10% of these activities are actually tied to real spending—specifically for purchasing goods and services.

However, it is this seemingly insignificant 10% that is expanding at a visible pace, quietly rewriting the rules in the gaps of daily life: from street vendors to cross-border labor remittances, stablecoins are no longer just toys for "crypto geeks," but tangible payment options in consumers' pockets. Businesses are shifting their focus, and capital and products are beginning to align around this "micro fire."

The scenarios in which consumers use stablecoins for daily expenses resemble a grassroots spark. Whether this spark can ignite a larger flame depends on who seizes the opportunity first and ignites a subsequent series of demands. To this end, we have compiled "Where are stablecoins being spent?" and integrated frontline observations, attempting to pinpoint that initial light and sketch the trajectory it is about to illuminate.

1. Overview of the Consumption Market

In the B2B enterprise payment sector, stablecoins have gained significant traction. Companies in logistics, software, and financial services are using stablecoins for cross-border vendor payments, contractor payroll, and treasury operations. It is estimated that the stablecoin B2B economy is operating at a base of $36 billion annually, with its growth momentum accelerating as regulatory transparency increases in major markets such as the U.S. (GENIUS Act), the EU (MiCA), and Hong Kong.

In the B2C consumer spending sector, growth is slower but positive. Over 25,000 merchants worldwide now accept stablecoins for e-commerce transactions, and point-of-sale (POS) pilot projects are being launched in parts of Southeast Asia and Latin America.

Early adopters of stablecoin spending include verticals such as digital commerce, travel, hospitality, and gaming.

Payment infrastructure providers are driving the use of stablecoins in everyday environments, allowing users to spend USDC, USDT, and other tokens without relying on native crypto applications. By 2025, Blue Origin will begin accepting debit cards linked to stablecoins, allowing users to pay for space flight bookings. Uber is reportedly piloting cryptocurrency payments to drivers in Latin America. Web3 native gaming platforms are enabling in-game purchases through stablecoins, supporting chargeback-free microtransactions and facilitating rapid settlements between global users.

Despite these advancements, retail transactions still account for less than 5% of global stablecoin usage, highlighting a significant gap between infrastructure availability and consumer behavior.

For institutions, the conclusion is clear: daily consumption of stablecoins has become a reality, but it is highly unevenly distributed.

Geographically, emerging markets are leading in practical applications. In Latin America, stablecoins are increasingly used in pharmacies, cafes, and local merchants, often as a tool to hedge against inflation or as an alternative to traditional banking services. In sub-Saharan Africa and Southeast Asia, stablecoins are used to access global goods and services that are otherwise unavailable due to fragmented payment channels.

B2B capital flow is growing the fastest, representing the most accessible opportunity for stablecoin infrastructure providers, exchanges, and fintech platforms. Although retail and consumer adoption is small in scale, it is strategically significant, especially in regions where stablecoins effectively address financial pain points.

The infrastructure is ready, and regulation is catching up. Today, the key to competition has shifted to distribution capabilities, user experience, and corporate partnerships. Stablecoins are no longer just "payment channels"; they are entering the checkout process and officially appearing on balance sheets.

2. The Consumer Economy of Stablecoins

The data above tells a clear story: despite the increasing maturity of infrastructure and the expanding scope of real-world usage, the vast majority of stablecoin activities remain at the financial application level—trading, liquidity provision, and remittance channels. Only a small, yet increasingly significant, portion of activities truly touches the consumer economy, and corporate attention is shifting accordingly.

2.1 Use Cases for Stablecoins

Despite the growing momentum, stablecoins are still primarily financial tools. Approximately 67% of global usage is still dominated by decentralized finance (DeFi), liquidity management, and speculative trading; these are not "daily consumption" behaviors but capital flows aimed at efficiency and arbitrage. Another 15% of stablecoin circulation falls under "payment-like" cross-border remittances, but very few enter formal commercial channels such as sales terminals or invoice settlements.

Only about 5% of the global stablecoin volume is directly used at the merchant level—whether in physical retail, e-commerce, or service industries like hospitality and gaming. This figure comes from merchant processor data and on-chain analysis, highlighting that stablecoins are still in their infancy in consumption scenarios, but have significantly increased compared to previous years and continue to rise quarter over quarter. The remaining 10% is used for hedging against inflation and stable value savings.

2.2 Consumption Patterns: Behavior, Timing, and Incentives

In places where stablecoin payments are indeed occurring at the retail level, the data reveals several clear trends.

- Transaction amounts are often slightly higher than local fiat payments, partly due to consumers viewing stablecoins as "more valuable and stable than local currency"; bulk purchases or stockpiling are common in grocery stores and pharmacies.

- There is also a unique rhythm in the timing dimension: in urban areas, more stablecoin transactions occur on weekday mornings and evenings, coinciding with commuting and lunch breaks; weekends see a slight decline, possibly due to leisure spending relying more on cash or mobile banking.

- Incentive programs are becoming key to retention. Many merchants in Latin America and Eastern Europe offer around 1% cashback on stablecoin spending, combined with gamified points in wallets, particularly appealing to younger demographics who already hold crypto assets and value real-time rewards.

Interestingly, some merchants report that stablecoin users are more willing to tip, especially in service industries like food and beauty. This may reflect a psychological disconnect with the consumption scenario or demonstrate consumers' desire to "support" merchants that accept crypto.

Another characteristic of cryptocurrency payments is higher spending. According to the American Automobile Association (AAA), by 2024, the average amount spent using cryptocurrency payments is expected to be 30% higher than traditional payment methods. The travel and hospitality sectors account for 14% of these cryptocurrency transactions. Airlines accepting cryptocurrency payments have seen a 40% increase in bookings.

Travala processed over $100 million in booking revenue last year, with $80 million coming from cryptocurrency, an 80% year-over-year increase. It noted that cryptocurrency users spend 2.5 times more per booking than non-cryptocurrency users, and their lifetime value is three times that of non-cryptocurrency users. Accepting cryptocurrency allows travel suppliers to attract both the growing mass market and ultra-high-end consumers, resembling a "crypto wealth effect," where users profiting from cryptocurrency gains are more willing to spend.

In this regard, cryptocurrency is thriving in two areas: first, in developing markets with severe inflation, many unbanked consumers are starting to book budget travel; second, elite cryptocurrency holders are beginning to book luxury experiences.

2.3 How Stablecoins Can Be Widely Adopted in Daily Consumption

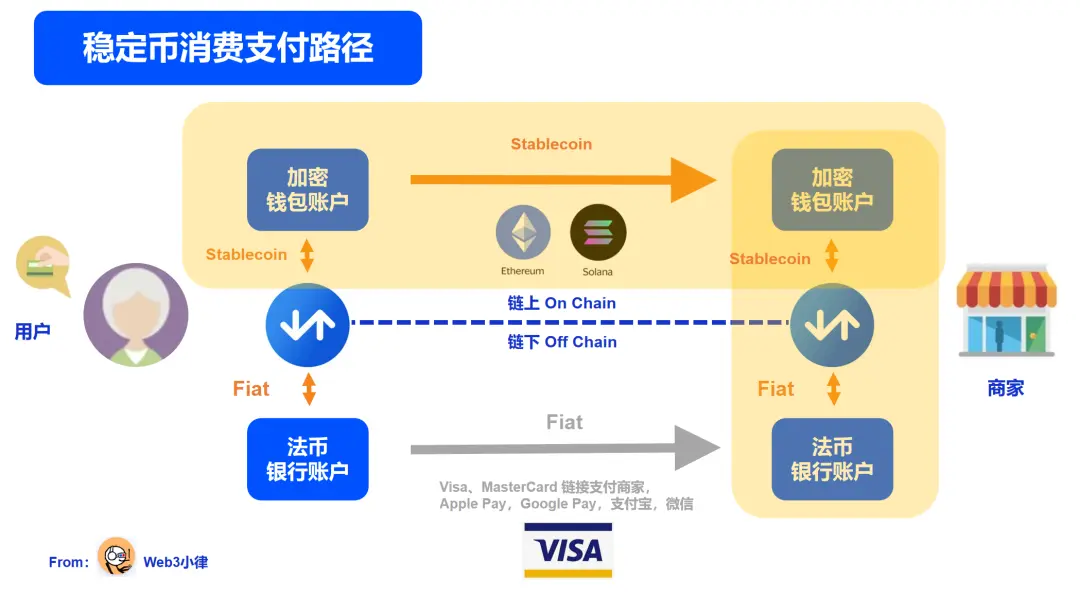

The integration of stablecoin payments into retail POS systems is still fragmented. Although they are all referred to as stablecoin acceptance, the paths currently realized in the market mainly fall into two categories:

A. Independent wallet integration—directly connecting USDC, USDT, or regional stablecoin wallets through a QR code payment system. Such solutions typically do not require new hardware purchases and can be launched within days, making them particularly attractive to small merchants.

This model does not change the merchant's QR code payment system; merchants still receive fiat currency, while the conversion of stablecoins is done on the wallet acceptance side. The advantages are clear, allowing seamless integration into the existing global fiat QR code system, eliminating barriers to promoting stablecoin acceptance on the merchant side. This is also why we see seamless entry of crypto wallets in regions with unified QR codes (such as Vietnam, Brazil, etc.).

Flow of funds: Users pay with stablecoins, wallets/service providers convert to fiat, and settle with merchants in fiat.

B. Gateways and POS directly integrating stablecoin acceptance. Gateways and POS systems integrate stablecoins into platforms like Shopify, WooCommerce, and Magento through plugins and APIs, allowing merchants to accept token payments without restructuring their checkout processes. This approach requires strong market influence and public relations capabilities, typically led by large companies that directly integrate stablecoins into gateways and POS systems. The advantages are clear, capturing merchant-side resources.

Large retailers, especially those with existing payment infrastructure, are beginning to collaborate with native cryptocurrency payment processors. Companies like BitPay, Flexa, Coingate, Circle Pay, and NowPayments provide APIs and merchant backends that can connect stablecoin acceptance with fiat settlements. For example, a merchant can accept USDC at the checkout and receive payments in USD or EUR at the end of the business day, completely avoiding volatility risks. Additionally, several next-generation POS providers are launching hybrid terminals that support both traditional card swipes and digital assets, with early markets including Brazil, Turkey, and Kenya.

Flow of funds: Users pay with stablecoins, and merchants can choose to receive stablecoins or fiat through the payment service provider (dual wallet accounts).

Examples of some POS providers include:

- Brazil: Cielo (integrated with Binance Pay)

- Turkey: PayTR (supported through NOWPayments); Paribu (local cryptocurrency exchange)

- Kenya: M-Pesa (integrated with BitPay); Kopo Kopo (integrated with CoinPayments)

The key to driving adoption lies in customer experience and user guidance, especially for those unfamiliar with operating crypto wallets. Some merchants have begun posting educational prompts in-store or training employees, and some are attempting to attract customers through reward mechanisms. From the backend perspective, merchants still face resistance in areas such as receipt generation, accounting system integration, and tax documentation, which often become bottlenecks for more mature enterprises to further adopt stablecoin payments.

2.4 Payment Infrastructure and Routing Mechanisms

Supporting this transformation is the increasingly mature stablecoin payment infrastructure. Currently, two main technical paths are emerging:

Stablecoin Settlement Models: Stablecoins like USDC are directly credited to crypto wallets;

Hybrid Routing Model: Stablecoins are automatically converted to fiat currency at the moment of payment, ensuring predictable revenue and shielding merchants from volatility risks.

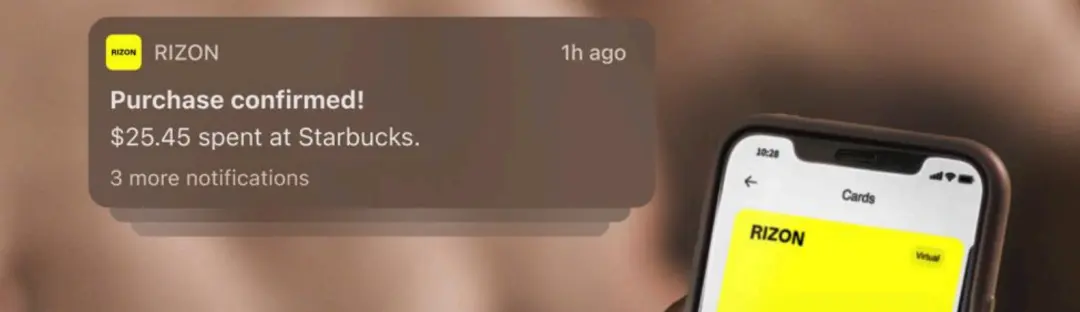

Fintech providers focused on crypto checkout are rapidly expanding; the issuing platform Rizon has launched a stablecoin-backed Visa card that can be used at over 150 million merchants in more than 90 countries, supporting Apple Pay, Google Pay, and the Visa acceptance network. Meanwhile, Fiserv has also partnered with Mastercard to issue the FIUSD stablecoin, aiming to provide small banks and their merchants with real-time access to stablecoin rails.

For e-commerce merchants, they are reaping tangible benefits from stablecoin integration, with key highlights including:

- Recurring payments and subscriptions: Instant, programmable payments eliminate chargebacks and delays from card organizations;

- Smoother cross-border shopping: Stablecoins bypass traditional channels' foreign exchange fees, conversion delays, and counterparty risks;

- Final and irrevocable payments: Significantly reduce fraud and operational burdens caused by chargebacks and disputes.

Data supports this trend. A Fireblocks survey shows that 48% of enterprises list "settlement efficiency" as the primary reason for adopting stablecoins, 30% value "cost savings," and over 86% believe "the infrastructure is ready for immediate implementation." The result is faster customer experiences, lower operational risks, broader global payment reach, and all transactions achieving transparency and traceability at the ledger level.

3. Adoption of Stablecoins Across Industries

In 2024, according to Allium data from Visa, stablecoins facilitated $27.6 trillion in transaction value across 5.6 billion on-chain transfers. However, excluding speculative and DeFi flows, only 5% (approximately $1.3 trillion) pertains to real-world payments, with P2P accounting for 2%, B2C retail for 2%, and B2B commerce for 2%.

A McKinsey report states that the annual transaction volume of stablecoins has surpassed $27 trillion, with payment-related daily throughput estimated between $20 billion and $30 billion, still less than 1% of global fund transfer volume. Although B2B flows have significant operational impacts, the annual average is only about $400 billion to $500 billion, on par with broader merchant and institutional usage.

3.1 Retail Stores as the Early Adopters

Currently, the use of stablecoins in physical retail remains limited, but early adopters have proven that usability in real-world scenarios not only exists but is becoming increasingly practical. Although the adoption rate lags behind e-commerce and B2B sectors, by 2025, small and medium-sized merchants—especially in emerging markets and crypto-friendly urban centers—are expected to show a noticeable increase in acceptance of stablecoin payments.

In the daring physical retail space, several categories stand out. Supermarkets and grocery chains are among the most pragmatic scenarios, particularly in economies with severe currency fluctuations. In Argentina and Venezuela, where inflation continues to erode purchasing power, many local grocery stores are now directly accepting USDC and USDT at the checkout, with customers often using mobile wallets or QR codes for payment. Specific examples include:

- Buenos Aires Central Market: Tether partnered with KriptonMarket to enable merchants in this large fruit and vegetable wholesale market to settle in USDT.

- Several grocery stores in the Villa Crespo district of Buenos Aires: Accepting USDT via QR code through Binance Pay, due to a shortage of cash dollars in the market.

Dining establishments are also beginning to embrace stablecoins, particularly cafes, fast-casual restaurants, and food trucks. In El Salvador, although Bitcoin initially grabbed headlines, stablecoins have quietly become the preferred digital payment method for urban residents. Some examples include:

- McDonald's—supports USDT, USDC (via Strike, Bitfinex)

- Starbucks—supports USDT, USDC (via Chivo, Strike)

- Wendy's—supports USDT, USDC (via payment processors)

- Subway—supports USDT, USDC (via Strike, CoinGate)

- Local restaurants in El Zonte ("Bitcoin Beach")

- Juice bars and vendors in San Salvador and La Libertad

3.2 Current Adoption Status in Retail and E-commerce

Merchant acceptance of stablecoins is on the rise, but distribution is highly uneven. By mid-2025, over 25,000 merchants worldwide are expected to support stablecoins, primarily concentrated online, with a small penetration into physical stores. The most common mainstream assets are USDC, USDT, and PYUSD, typically integrated through native crypto checkout processors or stablecoin-linked Visa and Mastercard channels.

Regarding penetration rates for merchants and users, institutional adoption rates continue to climb. NOWPayments indicates that stablecoins now account for 57% of all merchant crypto payments, significantly up from 7% in 2020. With over 25,000 merchants in retail channels globally, B2C penetration in e-commerce and digital platforms is deepening. User engagement is also expanding: over 150 million blockchain addresses hold stablecoins, with about 10 million addresses conducting stablecoin transactions daily, indicating widespread and active usage. Notably, consumer demand is strongest in emerging markets like Latin America and Africa, where institutional stablecoin payment volumes have increased by over 200% year-on-year.

According to data from Visa's blockchain analytics division, the vast majority of on-chain stablecoin liquidity still pertains to high-value B2B transfers, rather than low-value consumer spending in shopping carts or restaurant receipts. For stablecoins to achieve substantial adoption at the checkout stage, infrastructure must continue to improve, particularly in key areas such as payment user experience, instant fiat conversion, tax reporting, and merchant incentives.

New use cases are still emerging, with some platforms launching cashback rewards to encourage customers to choose stablecoins at checkout, with fees lower than traditional bank cards. In certain markets, compared to traditional payment networks' rates of 2%–4%, merchants accepting stablecoins face almost zero processing costs, thus benefiting directly.

3.3 Travel and Hospitality: Early Trials, Initial Momentum

Consumer-facing travel, hospitality, and digital entertainment spending remains limited, but the entire industry is strategically experimenting with stablecoin payments. However, these use cases are still viewed as niche scenarios, driven more by crypto-native clientele than by mainstream market demand.

A recent travel industry analysis titled "The Rise of Cryptocurrency in Travel" indicates that while cryptocurrency currently accounts for less than 1% of leisure travel spending, this figure is expected to rise to 3%–5% by 2030. With predictable pricing and settlement efficiency advantages, stablecoins are seen as the main force driving this shift.

Cryptorefills states that by 2024, over 80% of users will make at least one cryptocurrency purchase per month. Travel is one of the company's fastest-growing sectors, primarily benefiting from digital nomads and conference travelers who also use the platform to purchase eSIM cards, book travel services, and recharge. Cryptorefills is a B2C platform offering cryptocurrency ticket and hotel booking services.

The crypto-focused online travel agency (OTA) Travala reports, "Our largest customer base currently consists of digital nomads and conference travelers, with bookings typically aimed at mid-range clients. By 2024, approximately 78% of bookings will be completed using cryptocurrency, compared to less than 8% for credit and debit card usage." Cryptocurrency is also attracting high-net-worth individuals. "The luxury market has enormous potential." Travala's concierge service targets this niche market, equipped with personalized high-end travel advisors.

More notably, in the UAE—where luxury experiences and regulatory innovation intersect—43% of five-star hotels now accept crypto payments. The purely digital travel platform Travala shows an even more aggressive usage curve: in September 2024, 77% of orders were paid for with cryptocurrency, the vast majority being stablecoins.

These figures mark a turning point: boutique resorts and forward-thinking chain brands offering stablecoin options are doing so not for gimmicks, but out of competitive differentiation and global appeal considerations. In the broader travel ecosystem, stablecoins are becoming a "full experience payment" tool:

- From June 2024 to June 2025, crypto payments in the travel industry are expected to surge by 38% year-on-year, with over 40% completed using stablecoins.

- Stablecoins are used for booking rooms, flights, spa services, and transfers, with average transaction amounts reaching 2.5 times that of traditional fiat customer transaction values, indicating high-value customer characteristics.

The above figures indicate that consumers are increasingly viewing stablecoins as a reliable medium of exchange, not only for simple bookings but also for comprehensive travel experiences and services.

3.4 About the Gaming Industry

In contrast, the gaming industry is proving to be increasingly fertile ground for stablecoin spending. Several Web3 native games and virtual environments now accept stablecoins for in-game purchases, NFT transactions, and peer-to-peer settlements among players.

For example, Fortnite, developed by Epic Games, is a centralized non-Web3 game, but certain third-party payment solutions have enabled stablecoin-based transactions, allowing players to use stablecoins like USDC to purchase in-game currency (such as V-Bucks). For instance, payment platforms like TransFi have been integrated into the gaming ecosystem to provide players with stablecoin payment channels.

Globally, over 35% of players have made at least one purchase using cryptocurrency, whether for items, tournament entry fees, or subscription fees; of these, as much as 70% of transactions use stablecoins. The blockchain gaming sector is experiencing explosive growth: driven by a 52% compound annual growth rate (CAGR), the global blockchain gaming market is expected to reach $85 billion by the end of 2025.

"Play-to-Earn" (P2E) games leverage stablecoins to distribute rewards, contributing 62% of the market's revenue. On the platform level, 93% of blockchain games have integrated wallet support (such as MetaMask, Phantom), and 37% have introduced metaverse elements, creating more consumption scenarios for character skins, upgrade items, and social interactions.

Similarly, market valuations highlight the scale: tokenized real estate on metaverse platforms has surpassed $112 billion.

Beyond gaming itself, stablecoins are at the core of the high-value economy of virtual goods. By 2025, the total value of the metaverse market is expected to reach $316 billion, with $88 billion of digital goods transactions completed using stablecoins. Transactions involving virtual real estate, virtual avatars, and tokenized assets are rapidly expanding: leading metaverse platform Decentraland is projected to generate over $275 million in revenue by 2025 solely from virtual land and digital asset transactions, with stablecoins being the primary settlement currency.

Behind this value is a surge in user base: 70 million users utilize metaverse financial services monthly, with $2.2 billion in daily transaction volume circulating within these virtual settlement systems. With stable value and rapid settlement, stablecoins have become the natural choice for high-frequency trading in the immersive economy.

By 2025, the gaming and entertainment ecosystem has adopted stablecoins as the primary medium of exchange, significantly accelerating in-game economies, virtual experiences, and hybrid scenarios that blend with the real world.

3.5 Enterprise B2B Payments

A. Cost Reduction and Efficiency Improvement

For enterprises, efficiency rather than cost remains the primary consideration. Fireblocks research shows that 48% of enterprises list settlement efficiency as the greatest benefit of stablecoins, 30% mention cost savings, and 86% claim that existing infrastructure is deployable. The improvement in operational efficiency is also noteworthy: analysis in 2025 shows that stablecoin settlement systems have reduced remittance and settlement fees to about 2.5%, while traditional bank channels can reach up to 5%.

Cryptocurrencies enable direct transactions without banks, thereby lowering costs and increasing profit margins. Travala estimates that the travel industry processes over $11 trillion in transactions annually, and if blockchain-based solutions reduce fees to 0.1%, it could save $270 billion each year. "These advantages are significant; using stablecoins on high-speed networks incurs fees of less than a cent, confirmations are almost instantaneous, and there are no chargebacks, with settlements available 24/7."

B2B transactions can also benefit, achieving real-time settlements, eliminating currency exchange risks, and reducing prepayment requirements. However, not all crypto solutions are the same.

Future adoption trajectory: accelerated merchant penetration—over 57% of crypto merchants now settle in stablecoins; user activity broadens—millions of active wallets and transactions daily. Operational benefits: settlement speed takes precedence over cost savings; readiness of infrastructure and regulatory collaboration are rapidly reducing friction; cost reductions and transparency make stablecoins an efficient alternative for cross-border and digital commerce.

B. Payment Adoption Scenarios

a. Stablecoins for vendor, supplier, and payroll payments

According to PYMNTS data, the annual scale of B2B stablecoin transactions has reached $36 billion, making it the largest segment of stablecoin applications, surpassing P2P and card-linked payments. Artemis Analytics supports this ranking, estimating that B2B stablecoin payments account for 50% of total payment volume. Demand is driven by global manufacturing companies, logistics providers, and service firms, which are increasingly using stablecoins to settle cross-border supplier invoices, pay overseas contractors, and simplify payroll disbursements.

b. Collaboration and Custodial Solutions: Enterprise-Level Infrastructure

Mastercard is incorporating the FIUSD stablecoin into its payment ecosystem, allowing merchants and enterprises within its network of over 150 million merchants to utilize it. Meanwhile, Fiserv plans to launch a digital asset banking platform driven by stablecoins, widely supported by Circle, Paxos, and Solana, bringing regional and community banks into the stablecoin payment system. Major banks like Bank of America, JPMorgan, Standard Chartered, PayPal, and Stripe are actively developing stablecoin issuance and integration strategies, targeting B2B and trade corridors. Enterprises and fintech wallets, SAFE tools, and fund management systems are now being natively designed or upgraded to handle stablecoin flows, enabling businesses to allocate funds with programmable precision, built-in compliance, and integration with legacy systems.

The core value proposition focuses on instant settlements, avoiding exchange rate fluctuations, and near-zero friction channels, particularly benefiting markets underserved by traditional banking services.

c. Liquidity and Cash Management: Internal Fund Allocation for Enterprises

Large enterprises and financial departments are treating stablecoins as programmable liquidity tools. JPMorgan's digital dollar and euro tokens now process over $1 billion in institutional flows daily, indicating their deep integration into automated fund operations. This expanding scale uses stablecoins as real-time funding channels, enabling instantaneous internal transfers, automatic cash pooling across jurisdictions, and seamless movement between fiat and on-chain digital assets through custodial platforms.

"New banks have set the standard for what digital banking should look like, yet they have never touched the core infrastructure. Stablecoins are that upgrade. Together, they unlock everything digital banking should have: instant transfers, low remittance costs, and access to globally stable currencies."

—RIZON

IV. The Rise of New Banks

With digital-first infrastructure, user-friendly interfaces, and global accessibility, new banks have become a bridge between traditional finance and crypto-native economies. Rizon's analysis highlights its potential: by 2025, as regulatory clarity improves and user demand for borderless currencies grows, new banks are uniquely positioned to integrate stablecoins into everyday banking experiences—from payroll disbursement to payments and savings.

By 2025, global new bank users are expected to exceed 600 million, up from 394 million in 2023, with a recent compound growth rate exceeding 30%.

Giants are taking action. Revolut and N26 are expanding crypto services to include stablecoin transfers and payments; Monzo and Wise are exploring instant, zero-forex cross-border remittances through regulated stablecoin channels. In emerging markets, new banks like Nubank (Brazil) and Maya (Philippines) have piloted stablecoin-linked wallets for merchant payments and payroll disbursement. By embedding stablecoins into core products, new banks are becoming the entry point for millions of users to "spend digital dollars, not just transact digital dollars."

4.1 Rizon's Stablecoin New Bank Case

Rizon is a next-generation non-custodial stablecoin application launched in 2025, aimed at making "digital dollars" truly usable. Operating in over 110 countries, users can deposit, transfer, spend, invest, and receive stablecoins like USDC and USDT at low cost and near real-time. Through virtual and physical Visa cards, users can use stablecoins at over 100 million merchants and ATMs worldwide, covering all traditional card swipe scenarios.

The non-custodial architecture ensures users have complete control over their funds and private keys. Rizon now supports tokenized stock trading, 5% cashback on spending, and the RizPoints loyalty program, which can be redeemed for flights, hotels, and gift cards. Rizon's mission is simple: to make stablecoins a real alternative to the outdated banking system. Rizon is not just a crypto wallet; it is a modern financial gateway that allows global users to use secure, stable, and intelligent cross-border financial tools anytime, anywhere.

As the first new bank to fully integrate stablecoin accounts, cards, and APIs into the financial stack, Rizon enables users and businesses to hold, spend, and settle stablecoins as easily as fiat currency. Through direct integration with Visa, Rizon supports stablecoin spending at over 150 million merchants globally, eliminating exchange friction and unlocking real-world utility. With a non-custodial model, anyone with a smartphone and internet connection can use it worldwide.

Rizon's analysis highlights its potential: by 2025, the total global remittance volume is expected to reach $913 billion, with stablecoins saving $39 billion in remittance fees annually, becoming a key driver for everyday cross-border payments.

"The nature of money is changing. While the internet has transformed how we work, communicate, and shop, our financial system remains lagging: slow, expensive, and inaccessible to billions.

The emergence of stablecoins brings a breakthrough: they are digital dollars backed 1:1 by real reserves, enabling instant, borderless, 24/7 transactions without banks or intermediaries. This is not just another crypto trend; it is a fundamental shift in how money flows. But for the average user, stablecoins remain too complex.

At Rizon, we are building the next layer of money: a simple, secure, and intuitive interface that makes it easy for everyone to use stablecoins. Just as new banks did for fiat, we are doing the same for digital dollars—creating financial tools that are inherently global, default fair, and designed for those who need them most."

—Ignas Survila, CEO & Co-founder @ RIZON

4.2 CoinGate's Stablecoin Payment Services

CoinGate is a fintech and crypto payment company founded in 2014 and headquartered in Lithuania, focusing on cryptocurrency payment processing and gateway services. Its platform helps merchants accept Bitcoin, stablecoins, and other digital assets, providing fiat conversion services to mitigate volatility risks. Businesses can integrate CoinGate through APIs and mainstream e-commerce plugins for seamless access to crypto payments globally.

The company also supports crypto fund disbursement, invoicing, and treasury management functions, along with KYC/AML compliance mechanisms. CoinGate serves thousands of merchants, processing hundreds of thousands of crypto transactions annually, aiming to bridge traditional commerce and blockchain payments.

Since 2025, stablecoins have remained the backbone of crypto payments on the CoinGate platform, but their share has changed under regulatory influence. As of this quarter, 31.3% of processed payments were settled in stablecoins. USDT remains the second most frequently used currency, accounting for 19.8% of all transactions; however, this data primarily reflects activity from the first quarter (before the MiCA regulations took effect), after which the platform delisted USDT in compliance with regulations. Meanwhile, USDC's transaction share has risen to 11.5%, ranking fourth. When calculated by amount, the dominance of stablecoins is even more pronounced, accounting for nearly half of the total transaction volume.

The larger narrative is how MiCA is redefining the market landscape. Due to failing to meet MiCA's compliance requirements for stablecoins, USDT has been effectively delisted from many regulated platforms within the EU and EEA. Tether has so far made it clear that it will not cooperate in applying for compliance qualifications, significantly weakening its availability in regulated markets. Therefore, the decline in USDT usage on the platform is not due to reduced demand but rather direct regulatory restrictions on its circulation. In contrast, USDC has experienced explosive growth due to its compliance certification under MiCA and support for multiple public chains: CoinGate's USDC payment volume surged 760% compared to the same period last year; from January to September 2025 alone, usage increased more than sixfold. The observed phenomenon is a clear "substitution effect"—European merchants and consumers who previously used USDT are collectively migrating to USDC.

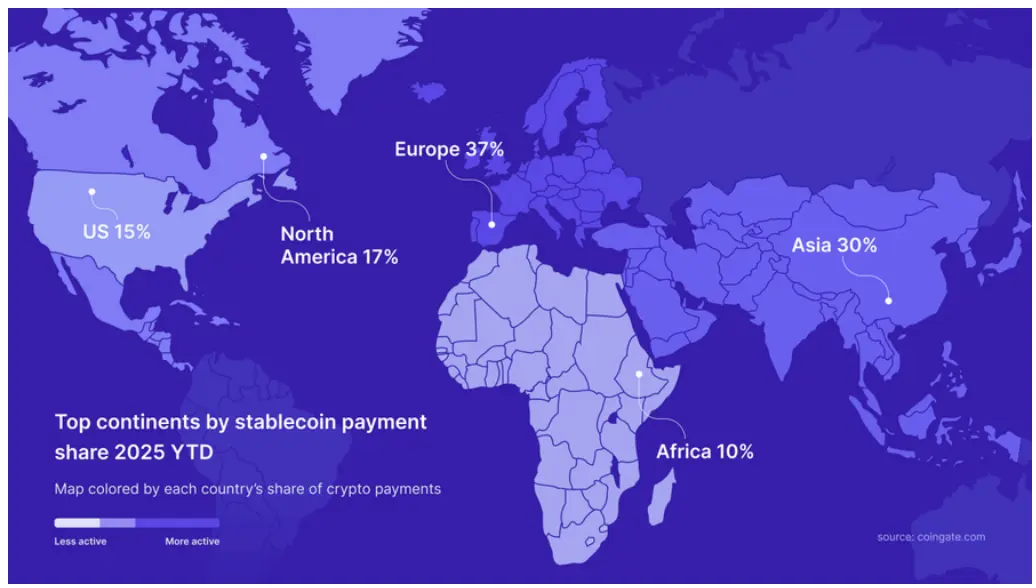

Regionally, the United States remains the largest single market for stablecoin payments, accounting for 15%, but when considering Europe as a whole, its order volume share reaches 37%, ranking first globally. Asia follows closely with a 30% share, primarily driven by India and Hong Kong; in Africa, Nigeria stands out as the most prominent market.

In terms of usage scenarios, stablecoins are most concentrated in digital-native industries, such as adult content, agency services, and hosting; meanwhile, sectors like gaming, gift cards, and consumer e-commerce are also showing steady growth.

On the withdrawal side, the changes are even more significant: by 2025, 85% of merchant settlements on the CoinGate platform chose to disburse in stablecoins. This indicates that for enterprises, stablecoins are no longer just another payment option but the preferred settlement layer for cross-border settlements, remittances, and B2B fund flows.

Overall, the data clearly shows that regulation has become one of the main forces shaping stablecoin adoption. The MiCA regulations in Europe have created a "natural experiment": in a regulated environment, USDT's share is collapsing, while USDC is rapidly becoming the stablecoin of choice for both consumers and merchants.

V. Conclusion

By 2025, stablecoins are no longer theoretical tools; they are being spent, settled, and scaled in the real economy. From institutional liquidity pipelines to retail checkouts, stablecoins are quietly yet decisively changing the way value flows. Although only about 5% (approximately $1.3 trillion) of annual transaction volume is linked to actual goods and services payments, this small portion represents the fastest-growing category in on-chain value transfer. In sectors like B2B, e-commerce, hospitality, gaming, and P2P, stablecoin spending is moving from the margins to mainstream functionality.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。